Exclusive Markets Review

- Exclusive Markets Review – 13 key points quick overview:

- Overview

- At a Glance

- Exclusive Markets Account Types

- How To Open an Exclusive Markets Account

- Exclusive Markets Deposit & Withdrawal

- Trading Instruments and Products

- Exclusive Markets Trading Platforms and Software

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- 🏆 10 Best Forex Brokers

- Conclusion

Exclusive Markets Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Exclusive Markets Account Types

- ☑️How to Open An Exclusive Markets Account

- ☑️Exclusive Markets Deposit & Withdrawal

- ☑️Trading Instruments & Products

- ☑️Exclusive Markets Trading Platforms

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Established in 2020, the broker is a financial investment services firm specializing in CFD and Forex trading. Furthermore, the company uses the popular MetaTrader 4 and 5 platforms, known for their powerful charting capabilities and algorithmic trading support, to help traders navigate volatile markets.

Despite its young start, they are regulated by the Seychelles Financial Services Authority (FSA), providing traders with comfort. In addition, the company’s commitment to openness and client satisfaction is reflected in its extensive instructional materials and multilingual customer support.

Today, the broker is a competitive global broker offering narrow spreads, fast execution times, and a wide range of trading products, including Forex, commodities, and indices.

How long has Exclusive Markets been operating?

They were founded in 2020 to provide financial investment services focusing on CFD and Forex trading. Despite its young age, it has swiftly established itself as a competitive worldwide broker.

Does Exclusive Markets provide individualized customer service?

Yes, they offer 24/7 multilingual customer support.

At a Glance

| 🗓 Established Year | 2020 |

| ⚖️ Regulation and Licenses | LFSA, BVI FSC, VFSC, MFSA |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | 24/7 |

| 💻 Trading Platforms | MetaTrader 4, MetaTrader 5 |

| 🛍 Account Types | Cent, Standard, Standard Plus, Exclusive, Shares |

| 🤝 Base Currencies | USD, EUR, GBP, JPY |

| 📊 Spreads | 0.0 pips |

| 📈 Leverage | 1:2000 |

| 💸 Currency Pairs | 70+; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 200 USD |

| 🚫 Inactivity Fee | Yes, 10 USD after 3 months of inactivity |

| 🗣 Website Languages | English, Spanish, Portuguese, Indonesian, Thai, Malay, Turkish, Italian, Hindi, Greek, Arabic |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $2.5 on the Shares Account |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | United States, Canada, Cuba, Iraq, Iran, North Korea, Sudan, Syria, Russia, Belarus |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, metals, indices, commodities, crypto, stocks, ETFs |

| 🎖 Open an Account | 👉 Open Account |

Exclusive Markets Account Types

| Cent | Standard | Standard Plus | Exclusive | Exclusive | |

| ✅ Availability | All; ideal for beginners | All; ideal for casual traders | All; ideal for more experienced traders | All; ideal for professionals, scalpers, and day traders | Ideal for investors with short and long-term investment strategies |

| 🛍 Markets | Forex and Metals | All | All | All | Shares and Share CFDs |

| 💸 Commissions | None; only the spread is charged | None; only the spread is charged | None; only the spread is charged | $7 per lot traded | From $2.5 per share |

| 💻 Platforms | All | All | All | All | All |

| 📊 Trade Size | From 0.01 – 100 cent lots | From 0.01 – 100 cent lots | From 0.01 – 100 cent lots | From 0.01 – 100 cent lots | 10,000 shares |

| 📈 Leverage | 1:500 (fixed) | 1:2000 (dynamic) | 1:2000 (dynamic) | 1:2000 (dynamic | 1:1 |

| 💰 Minimum Deposit | 200 USD | 500 USD | 1,000 USD | 2,000 USD | 5,000 USD |

| 🎖 Open an Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Cent Account

The Cent Account is a great beginner’s option because it offers micro-trading with base currencies in cents. With a minimum deposit of only $200, it provides a safe environment for Forex and Metals trading. Additionally, it features fixed leverage up to 1:500 and spreads starting at 1.6 pips.

Standard Account

The typical account requires a $500 investment, offering leverage up to 1:2000 and competitive spreads at 1.6 pips. In addition, it caters to a wide range of trading assets, including FX, metals, indices, commodities, cryptos, stocks, and ETFs. Furthermore, it boasts no commission fees per lot and negative balance protection for added security.

Standard Plus Account

The Standard Plus Account offers improved trading conditions, including a $1,000 minimum deposit, tighter spreads, and advanced trading capabilities. Additionally, it provides negative balance protection and offers a wide set of trading instruments.

Exclusive Account

The Exclusive Account is designed for experienced traders with a minimum investment of $2000. Accordingly, it offers sophisticated trading conditions and larger leverage. In addition, the account offers a wide range of products with no maximum volume limits, for a $7 charge per lot.

Shares Account

The Shares Account is a platform designed for active traders. It allows users to trade equities directly with a minimum investment of $5,000 and a 1:1 leverage ratio. In addition, it offers several features that can be beneficial for active traders, including:

- Fractional shares: This allows users to purchase a portion of a share, which can help them invest in high-priced stocks.

- Limitless open orders: This allows users to place an unlimited number of orders, which can help implement complex trading strategies.

- Raw spreads: This provides users with direct access to the market data, which can help make informed trading decisions.

- Minimum cost of $2.5 per lot: This makes the platform competitive with other active trading platforms.

Demo Account

The broker provides a demo account for both new and experienced traders. It offers a risk-free environment for beginners to practice trading and improve their skills.

In addition, advanced traders can learn about their services, examine trading platforms (MetaTrader 4 and MetaTrader 5), and try different trading techniques. The demo account helps traders understand market dynamics and broker features, enabling informed decisions in real trading conditions.

Islamic Account

The broker offers an Islamic account for Muslim traders, providing a swap-free option with no overnight position costs. This adheres to Islamic financial principles, allowing Muslim customers to trade without jeopardizing their religious convictions.

Specifically, the account is a stand-alone option with a special application process subject to approval. For more information and to expedite the application process, customers can contact customer service.

Do all account types on Exclusive Markets provide negative balance protection?

Yes, all account types have negative balance protection, which protects traders from possible losses by preventing their account balance from dropping below zero.

Can I create numerous accounts of the same kind on Exclusive Markets?

Yes, traders may establish numerous accounts of the same kind, enabling them to test alternative trading methods or allocate funds for particular trading reasons.

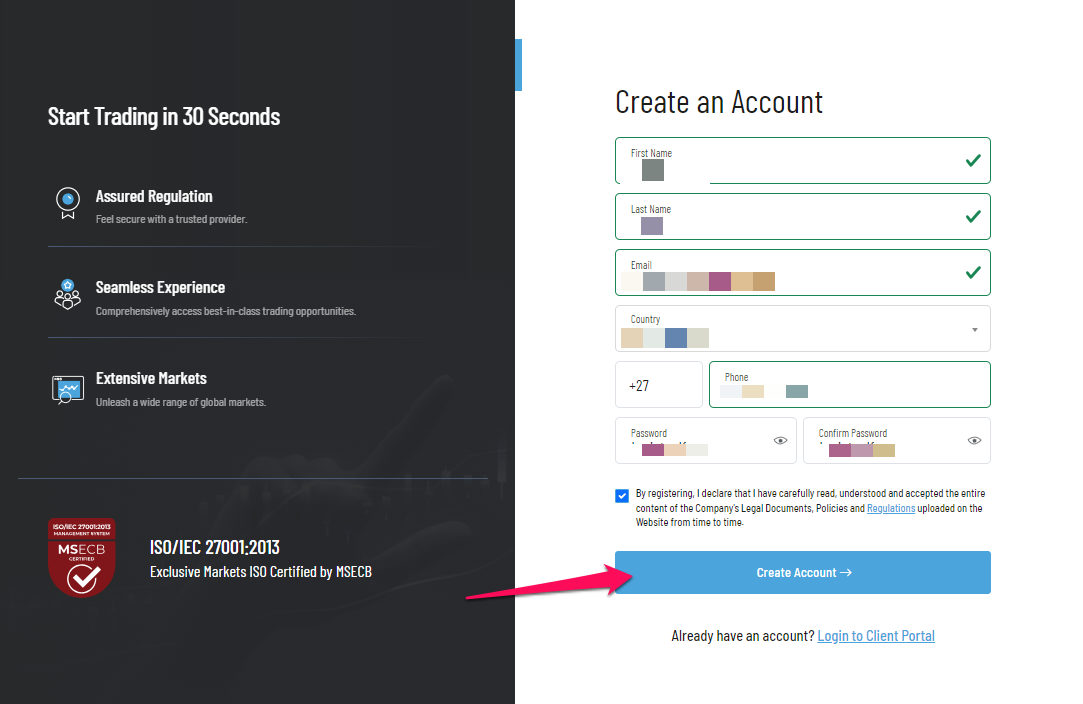

How To Open an Exclusive Markets Account

To register an account with Exclusive Markets, follow these steps:

Step 1 – Open Your Account

- Navigate to the Moneta Markets homepage

- Click on the account button on the top right corner of the page

Step 2 – Fill out the form

- Complete the simple online registration form. Provide your full name, email address, and phone number, and create a password for your demo account

- Read and accept the terms and conditions

- Click “Start Trading” to immediately launch your account

Can I begin trading immediately after registering an account with Exclusive Markets?

Once enrolled, traders must complete a questionnaire and provide the relevant papers for account verification before they can begin trading, subject to clearance personnel.

How long does it take Exclusive Markets to authenticate a new account?

Account verification usually takes a few business days, depending on the number of applications and the documents’ correctness.

Exclusive Markets Deposit & Withdrawal

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Another Lane | Japan | JPY | 1 – 5 days |

| Beeteller | Brazil | BRL | Instant – 24 hours |

| BerryPay | Malaysia | MYR | Instant – 24 hours |

| BitWallet | All | USD, JPY | Instant – 24 hours |

| Dragonpay | Philippines | PHP | Instant – 24 hours |

| Fasapay | Indonesia | USD, IDR | Instant – 24 hours |

| PayTrust | Indonesia, Malaysia, Vietnam | IDR, MYR, VND | Instant – 24 hours |

| Perfect Funds | All | USD | Instant – 24 hours |

| Nuvei | All | EUR, USD, GBP | Instant – 24 hours |

| Skrill | All | EUR, USD | Instant – 24 hours |

| Sticpay | Japan | JPY | Instant – 24 hours |

| Xpay | Indonesia, Thailand, Malaysia, Vietnam | IDR, THB, MYR, VND | Instant – 24 hours |

| Neteller | All | EUR, USD | Instant – 24 hours |

| B2B | All | Cryptocurrencies | Instant – 24 hours |

| Binance Pay | All | Cryptocurrencies | 10 minutes – 24 hours |

| LetKnowPay | All | Cryptocurrencies | Instant – 24 hours |

| Local Deposit | All | USD | Instant – 24 hours |

Deposit Methods:

Bank Wire

✅Log in to your client dashboard.

✅Go to the “Funds” or “Deposits” section.

✅Select “Bank Wire” as your deposit method.

✅Obtain bank account information (beneficiary name, account number, bank name, SWIFT code, etc.).

✅Make a wire transfer from your bank, including all of the data supplied.

Cryptocurrency

✅Go to your client dashboard and choose a cryptocurrency deposit option (e.g., Bitcoin, Ethereum).

✅A unique deposit wallet address for your preferred coin will be produced.

✅Start a transfer from your external cryptocurrency wallet to the specified deposit address, copy the address, and use the relevant cryptocurrency network.

e-Wallets or Payment Gateways

✅Choose your preferred e-wallet or payment channel among the ones accessible (Skrill, Neteller, Perfect Funds, etc.).

✅Enter the amount you want to deposit and other information about your e-wallet account.

✅To finish the transaction, you will be routed to the e-wallet/payment gateway platform.

Withdrawal Methods:

Bank Wire

✅Find the “Funds” or “Withdrawals” section on your client dashboard.

✅Choose “Bank Wire” as your withdrawal method.

✅Please include your bank account information (account holder name, account number, IBAN, SWIFT code, etc.).

✅Enter the amount you want to withdraw and submit the withdrawal request.

Cryptocurrency

✅Locate the coin withdrawal button on your dashboard and pick whatever cryptocurrency you want to withdraw.

✅Provide the external wallet address where you want to receive the funds.

✅Enter the amount to withdraw and submit your request.

e-Wallets or Payment Gateways

✅Navigate to the withdrawal area and choose your favorite e-wallet or payment channel.

✅Enter your e-wallet account information and the amount you want to withdraw.

✅Submit a withdrawal request.

Which payment methods are accepted for deposits on Exclusive Markets?

The broker accepts various deposit methods, including bank wire transfers, cryptocurrencies, and e-wallets like Skrill and Neteller.

Do Exclusive Markets set any withdrawal limitations?

The broker does not impose stringent withdrawal limitations on traders, letting them withdraw funds based on their account balance and available funds.

Trading Instruments and Products

Forex: Offering over 70 currency pairings, Exclusive Markets boasts minimal commission costs, competitive spreads, and leverage up to 1:2000. Additionally, their lightning-fast order execution ensures swift decision-making and trade execution.

Moving on to precious metals, they provide gold and silver trading opportunities with real-time data, attractive spreads, and fast order execution on industry-standard platforms like MT4, MT5, and WebTrader. This combination equips traders with a competitive edge in the volatile spot metals market.

For those interested in commodities, Exclusive Markets offers advantages in three key areas: fast execution times, narrow spreads, and user-friendly systems. They even incorporate Trading Central’s technical analysis, providing valuable insights for effective trading strategies and portfolio diversification.

When it comes to indices, Exclusive Markets grants access to CFDs on 30 key global indexes. This, coupled with low margins, quick order execution, and competitive fees, empowers traders using platforms like MT4, MT5, or WebTrader.

The broker doesn’t stop there. They also offer Share CFDs, encompassing 290 global CFD stocks with no commission fees, adjustable leverage up to 1:10, and a user-friendly interface, fostering confident trading experiences.

For crypto enthusiasts, provides access to over 20 CFD Cryptos, enabling round-the-clock trading opportunities with powerful tools, narrow spreads, quick execution, and award-winning platforms for efficient trading.

Beyond individual stocks and cryptocurrencies, Exclusive Markets offers a wide range of equities exceeding 3,000 stocks, along with powerful trading platforms. They cater to both experienced and new traders by providing knowledge and tools, including over 40 ETF CFDs for investment diversification.

Does Exclusive Markets provide trading chances for spot metals?

Yes, Exclusive Markets provides gold and silver trading possibilities with real-time data, attractive spreads, and quick order execution, giving traders access to the volatile spot metal markets.

How many currency pairs are available to trade on Exclusive Markets?

Traders on Exclusive Markets have access to over 70 currency pairs, including major, minor, and exotic pairings, providing plenty of chances for forex trading and diversification.

Exclusive Markets Trading Platforms and Software

Exclusive Markets provides traders with top-tier trading platforms like MetaTrader 4 and MT5, allowing them to explore financial markets easily. MT4 is known for its resilience and allows for unlimited complexity strategy development. It offers a smooth trading experience with Market and Pending Orders, Instant Execution, and trading right from charts.

MT5 expands on MT4 with 21 timeframes, additional technical indicators, and analytical objects. It also features a built-in economic calendar for informed trading decisions. The MQL5 programming language allows for the creation of custom indicators and automated trading algorithms.

To access these platforms, traders must open a live account on the Exclusive Markets website, create a real MT4 or MT5 account using the My Exclusive dashboard, install the chosen platform on their device, and log in with their Exclusive credentials.

Does Exclusive Markets provide web-based trading platforms?

Yes, Exclusive Markets offers web-based trading platforms with all major web browsers, enabling traders to access their accounts and trade without software downloads or installs.

Can I use my Exclusive Markets account from many devices at once?

Yes, traders may access their Exclusive Markets accounts from numerous devices simultaneously, allowing for more flexibility and convenience when monitoring positions and executing trades across different platforms.

Spreads and Fees

Spreads

Exclusive Markets charges competitive spreads for trading accounts, catering to traders of various tastes and methods. In particular, Cent and Standard accounts start at 1.6 pips, while Standard Plus accounts start at 0.8 pips. For even tighter spreads, Exclusive accounts offer raw spreads at 0.0 pips, reducing trading expenses and providing direct access to interbank pricing.

Commissions

Exclusive Markets charge varying commissions based on account type and traded instrument. For instance, Shares account members pay $2.5 per share for transparency, while Exclusive account members pay $7 per lot for the benefits of the Exclusive Account. In contrast, other accounts have embedded broker costs into their spreads.

Overnight Fees

Rollover interest applies to positions kept open overnight, varying based on the chosen instrument and position.

Forex instruments have a 3-day rollover fee on Wednesdays for interest computations during weekends. Stocks and indexes may incur overnight costs, and the official website provides detailed information on overnight costs for all financial instruments.

Deposit and Withdrawal Fees

Exclusive Markets offers customers a transparent and fair deposit and withdrawal experience, with most payment methods benefitting from free deposit fees. However, traders using Local Depositors to deposit and withdraw funds should be aware that they could face fees depending on the depositor used.

Inactivity Fees

Exclusive Markets accounts charge inactivity fees to encourage frequent trading and account involvement, while dormant accounts face a $10 fee after three months of inactivity, promoting proper account utilization.

Currency Conversion Fees

Exclusive Markets offers easy and quick currency conversion services for clients. In other words, clients can deposit funds in their chosen currency and the platform will automatically convert the amount into their trading account without any additional fees.

Are there any hidden costs while trading on Exclusive Markets?

Exclusive Markets’ pricing structure is straightforward, with spreads beginning at 0.0 pips and fees as low as $2.5 per share for Shares accounts, ensuring that traders are informed of all expenses associated with their transactions.

Does Exclusive Markets provide spread or commission savings for high-volume traders?

Yes, Exclusive Markets may give spread or fee savings to high-volume traders to encourage active trading and reward customer loyalty.

Leverage and Margin

Exclusive Markets offers leverage solutions tailored to different trading account types:

- Standard, Standard Plus, and Exclusive accounts provide a maximum leverage of 1:2000, allowing traders to control a larger position size with a smaller initial deposit. This can be beneficial for experienced traders who are comfortable with taking on more risk.

- The Cent account, on the other hand, offers a fixed leverage of 1:500, which can be suitable for new traders or those practicing with smaller trade sizes. This lower leverage helps to limit potential losses while still allowing traders to gain experience in the markets.

It’s important to remember that higher leverage can amplify both your earnings and potential losses. Therefore, careful risk management is crucial when trading with leverage.

Margin, calculated as the formula ‘lot size x contract size/leverage,’ ensures traders have sufficient funds in their account to cover potential losses and maintain their position during market fluctuations. This helps maintain stability during volatile market conditions.

Does Exclusive Markets provide various leverage choices for different account types?

Yes, Exclusive Markets provides varied leverage possibilities based on the account type, with the Cent account giving fixed leverage up to 1:500 and other accounts allowing dynamic leverage up to 1:2000 to accommodate traders’ risk preferences and tactics.

How do Exclusive Markets determine margin requirements?

Exclusive Markets determines margin needs depending on the position size, contract size, and leverage ratio.

Educational Resources

Exclusive Markets offers a variety of educational resources to help traders of all experience levels learn about the financial markets and improve their trading skills. Here are some of the resources available:

Exclusive Markets offers a variety of educational resources to help traders of all experience levels learn about the financial markets and improve their trading skills. Here are some of the resources available:

- FAQ: Exclusive Markets offers a comprehensive FAQ section that covers a wide range of topics, including account verification, trading, deposits, withdrawals, platform use, funds protection, licensing, account types, leverage choices, VPS, copy trading, and PAMM services. This is a great resource for getting started with Exclusive Markets and learning about the basics of trading.

In addition to the FAQ, Exclusive Markets also offers a variety of other educational resources, such as:

- Educational articles and webinars

- Video tutorials

- Glossaries of financial terms

- Practice accounts

Can traders access instructional resources using the Exclusive Markets mobile app?

No, the FAQ section for Exclusive Markets is only available on the official website.

Is Exclusive Markets hosting any live webinars or seminars?

No, Exclusive Markets does not offer any live webinars or seminars.

Pros & Cons

| ✔️ Pros | ❌ Cons |

| Exclusive Markets offers professional insights and market research papers to keep traders informed | Exclusive Markets has received mixed online reviews, with some traders claiming great experiences and others raising concerns |

| The negative Balance Protection protections feature helps avoid possible losses by preventing your account balance from falling below 0 | Certain countries, such as the United States and Canada, impose restrictions on services |

| Exclusive Markets charges narrow spreads, especially for major forex pairs like EUR/USD | The high minimum deposit requirements could pose a hurdle for some new traders |

| Traders can set leverage levels (up to a limit) to possibly increase their trading capital | If your account is idle for more than three months, it will accrue monthly costs |

| Support is accessible 24 hours a day, seven days a week | Trading incentives might come with stringent terms and withdrawal restrictions |

| Exclusive Markets provides access to Forex pairings, commodities, indices, cryptocurrencies, and several other markets | While they claim quick withdrawals, several reviews indicate delays in processing |

| Exclusive Markets operate with some regulation | |

| Traders can use systems such as MetaTrader 4 and MetaTrader 5 |

Security Measures

Exclusive Markets is a platform that has ISO/IEC 27001:2013 certification, demonstrating its commitment to international data management and protection. Furthermore, the Seychelles Financial Services Authority (FSA) oversees the platform, which requires adherence to financial conduct rules and solvency levels. This accreditation further emphasizes Exclusive Markets’ commitment to providing a safe trading environment for its customers.

Are Exclusive Markets in line with international data handling standards?

Yes, Exclusive Markets complies with international data management standards and has ISO/IEC 27001:2013 accreditation.

How do Exclusive Markets safeguard the security of trader funds?

Exclusive Markets uses stringent security measures, such as segregated accounts and encryption.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Exclusive Markets portrays itself as a competitive choice in the forex and CFD brokerage industry, offering various account types to accommodate traders of all skill levels.

Additionally, it caters to both novices and seasoned professionals by providing tight spreads, varied trading products, and powerful platforms such as MetaTrader 4 and 5. However, our research reveals that the mixed online reviews and substantial minimum deposit requirements may deter some potential traders.

Yes, the broker provides over 20 cryptocurrency CFDs for trading.

The broker withdrawal processing time normally varies from 1 to 5 days, depending on the withdrawal method selected and the current processing queue.

The brokers minimum deposit requirement varies by account type, ranging from $200 for the Cent account to $5,000 for the Shares account.

The broker mainly supports MetaTrader 4 and MetaTrader 5.

Yes, they are licensed by the Seychelles Financial Services Authority (FSA) and has ISO/IEC 27001:2013 accreditation, confirming its dedication to data security and financial conduct standards and strengthening its reputation as a trustworthy broker.

Yes, the broker provides swap-free Islamic accounts that follow Sharia law guidelines.

They offer diverse trading instruments, including currency pairs, metals, commodities, indices, cryptocurrencies, stocks, ETFs, and more.

They’re headquartered in Seychelles.

Yes, they offer demo accounts where customers may practice trading with virtual funds.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |