Firstrade Securities Review

- Firstrade Securities Review – 13 key points quick overview:

- Overview

- At a Glance

- Firstrade Securities Account Types

- How to open a Firstrade Trading Account – Step by Step

- Firstrade Securities Deposit & Withdrawal

- Trading Instruments & Products

- Firstrade Securities Trading Platforms and Software

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- 🏆 10 Best Forex Brokers

- Conclusion

“Overall, Firstrade Securities is considered low risk, with an overall Trust Score of 95 out of 100. Additionally, Firstrade Securities is licensed by two Tier-1 Regulators (highly trusted), with zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk).”

Firstrade Securities Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Firstrade Securities Account Types

- ☑️How to Open A Firstrade Securities Account

- ☑️Firstrade Securities Deposit and Withdrawal

- ☑️Trading Instruments & Products

- ☑️Firstrade Securities Trading Platforms and Software

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros and Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

“John Liu created the bargain brokerage business Firstrade in 1985. Initially known as First Flushing Securities, the firm aspired to make investment in the stock market more accessible and cheap to ordinary investors.

In 1997, the business relaunched as Firstrade Securities Inc. and launched Firstrade.com, an online trading platform.

Throughout its existence, Firstrade has maintained a commitment to low-cost investment. In 2010, Firstrade removed commission costs for stock and ETF trading, becoming a pioneer in the zero-commission brokerage industry.

Moreover, this decision, coupled with the user-friendly design of its trading platform, helped it establish a big and devoted client base.

Today, Firstrade is a top supplier of online trading services, including commission-free transactions on stocks, ETFs, and options. The organization also offers several account options, instructional materials, and investment research tools to meet the demands of investors of all skill levels.”

Does Firstrade provide investment advice or financial planning services?

No, Firstrade provides educational information and tools to assist investors in making educated choices, but it does not provide individualized investment advice or financial planning services.

Are there any limitations on how many transactions I can make using Firstrade?

“No, Firstrade has no limitations on the amount of transactions you can make; therefore, you have the freedom to execute as many transactions as needed.”

At a Glance

| 🗓 Established Year | 1985 |

| ⚖️ Regulation and Licenses | FINRA, SEC |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | Firstrade Web, Firstrade Navigator, Firstrade App, Firstrade Options Wizard |

| 🛍 Account Types | General Investing Brokerage Account |

| 🤝 Base Currencies | USD |

| 📊 Spreads | Firstrade does not charge traditional spreads |

| 📈 Leverage | 1:2 |

| 💸 Currency Pairs | Does not offer Forex |

| 💳 Minimum Deposit | 0 USD |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English, Chinese |

| 💰 Fees and Commissions | Commissions from $0 |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | No published list; Firstrade mainly serves the United States and its territories |

| ✔️ Scalping | Not explicitly prohibited |

| 📉 Hedging | Allowed |

| 🎉 Trading Instruments | Stocks, ETFs, options, mutual funds, fixed income |

| 🎖 Open an Account | 👉 Open Account |

Firstrade Securities Account Types

| General Investing Brokerage Account | |

| ✅ Availability | Long and short-term investors |

| 🛍 Markets | All |

| 💸 Commissions | From $0 |

| 💻 Platforms | Firstrade Web, Firstrade Navigator, Firstrade App, Firstrade Options Wizard |

| 📊 Trade Size | Depends on the market |

| 📈 Leverage | 1:2 |

| 💰 Minimum Deposit | 0 USD |

| 🎖 Open an Account | 👉 Open Account |

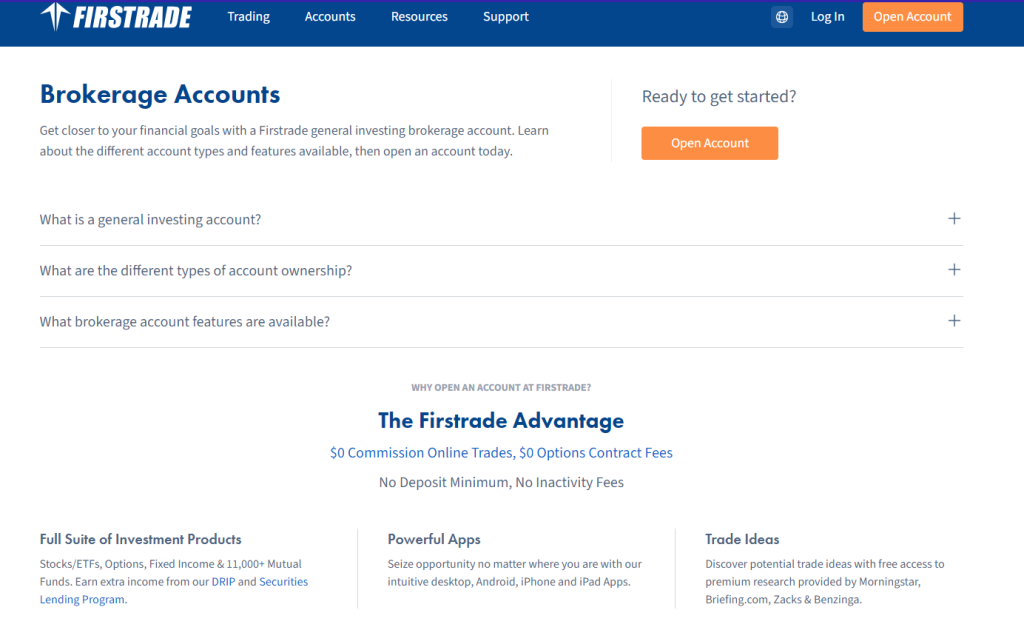

General Investing Brokerage Account

“Firstrade’s investment brokerage account presents itself as a compelling option for new and seasoned investors because of its commission-free trading structure encompassing an array of assets, including but not limited to stocks, ETFs, options, and mutual funds. Additionally,

Its noteworthy absence of trading fees can be viewed as a key attraction since it permits aggressive traders to undertake multiple transactions without incurring supplemental expenses, thereby bolstering profitability. Moreover,

In addition, the platform’s accessibility is notably heightened through its minimal entry requirement. This encompasses a lack of mandatory deposit and provisions for obtaining fractional shares. As such, individuals with limited financial resources can participate in the market. Furthermore,

Firstrade exhibits exceptional performance in the field of user experience, presenting an uncomplicated web-based and mobile trading platform that accommodates traders possessing varying levels of expertise. The facility in which users can navigate this system, coupled with margin trading options, serves to diversify investment opportunities by allowing individuals access to capital borrowed to amplify market exposure. However,

It is noteworthy that while such leverage may yield greater profits, it concurrently heightens susceptibility to losses – hence, caution must be exercised when engaging in these transactions. Despite this,

Firstrade further distinguishes itself by emphasizing investor education and support. Providing comprehensive research tools and instructional resources aids investors in making informed decisions. Additionally,

In addition, customer service is available through multiple channels such as phone, email, and live chat to ensure clients can seek assistance promptly whenever required.”

What account kinds may be opened with Firstrade?

Firstrade provides a General Investing Brokerage Account for both long and short-term investors.

Can I create a joint account with Firstrade?

Yes, Firstrade enables users to form joint accounts, which allow numerous people to invest together.

How to open a Firstrade Trading Account – Step by Step

Applying for an account with Firstrade will consist of the following steps:

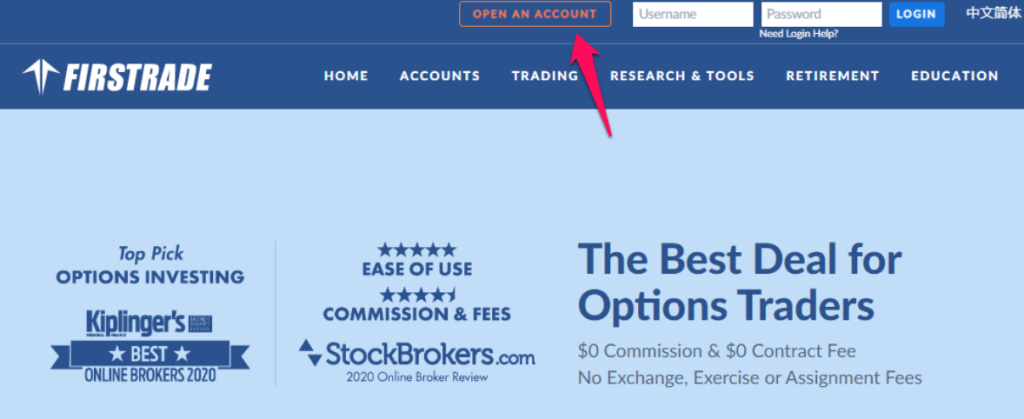

Step 1 – Navigate to the Firstrade website and click on ‘Open an account”

Navigate to the account registration area on the Firstrade website. This can be accessed by clicking on the Open an account tab at the top of the landing page

Step 2 – Fill out the Firstrade account registration form

Fill out the short online registration form to request a live account. You will need to provide your contact number and proceed through the verification process.

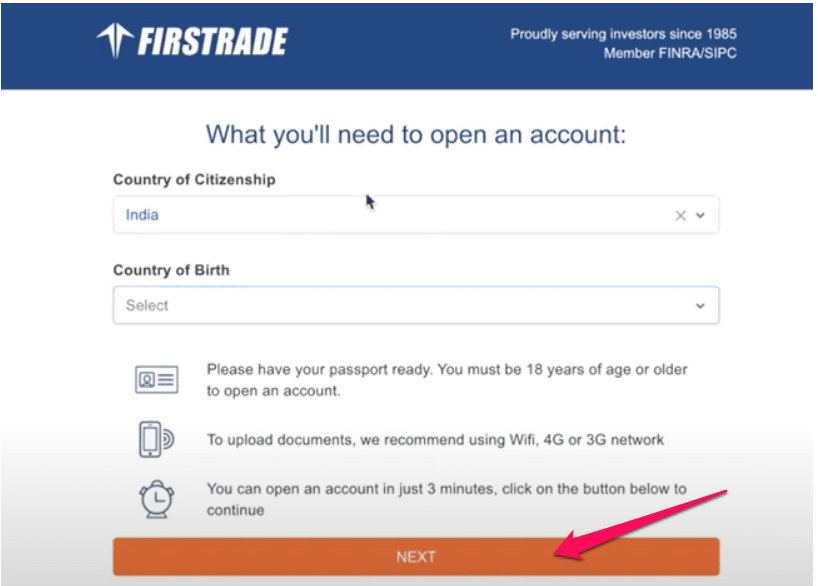

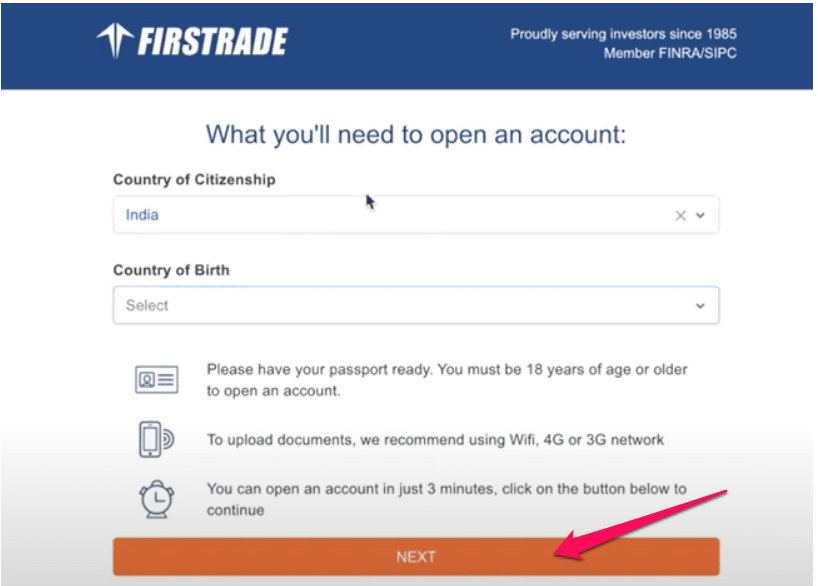

Step 3 – Provide Country of residence

Once the registration form is submitted, you will be redirected through the KYC process whereby the Country of Citizenship and Birth need to be provided, click “next” to continue.

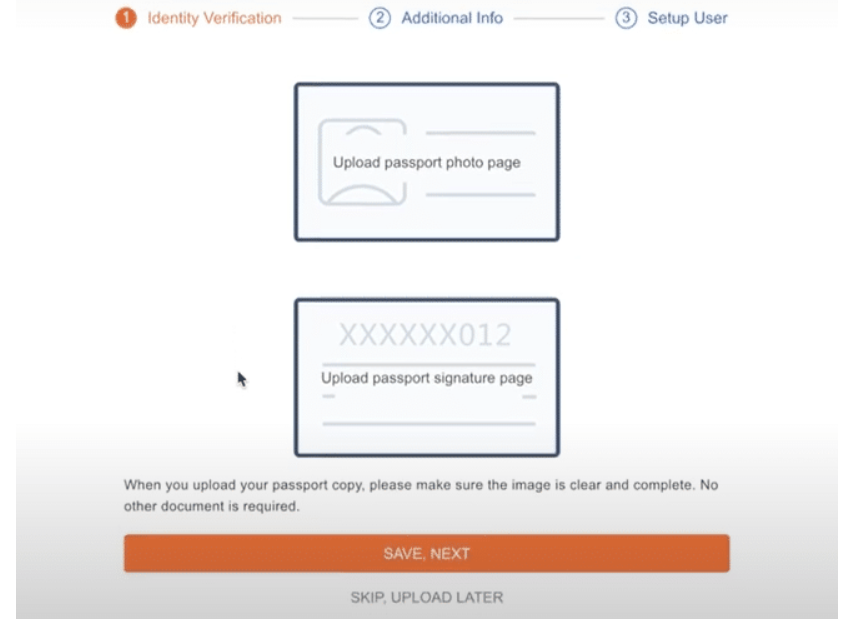

Step 4 – Upload the Passport image.

The fourth step in the account registration process requires proof of passport as well as the passport signature page

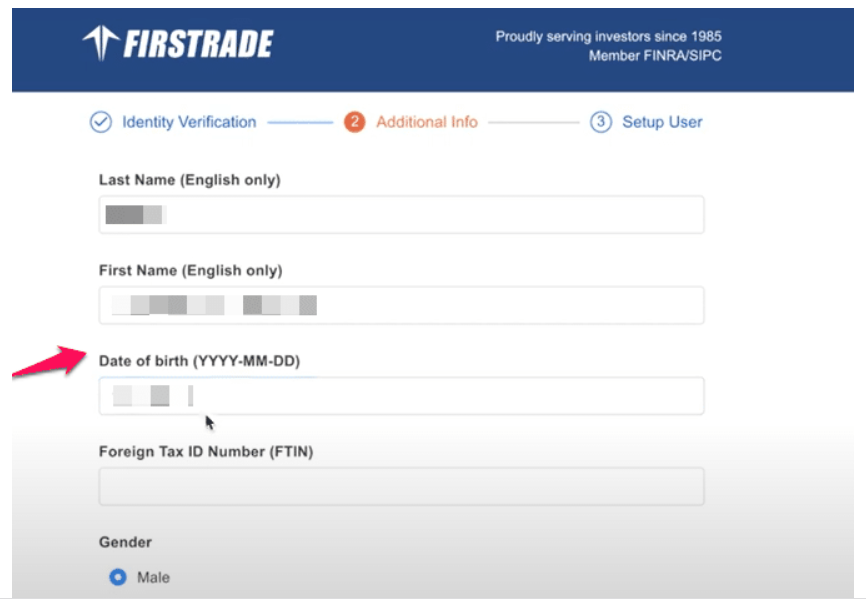

Step 5 – Firstrade Identity Verification Process

Proceed through the Firstrade account verification process by providing personal information: First name, Last name, Date of birth, tax number, gender, and address.

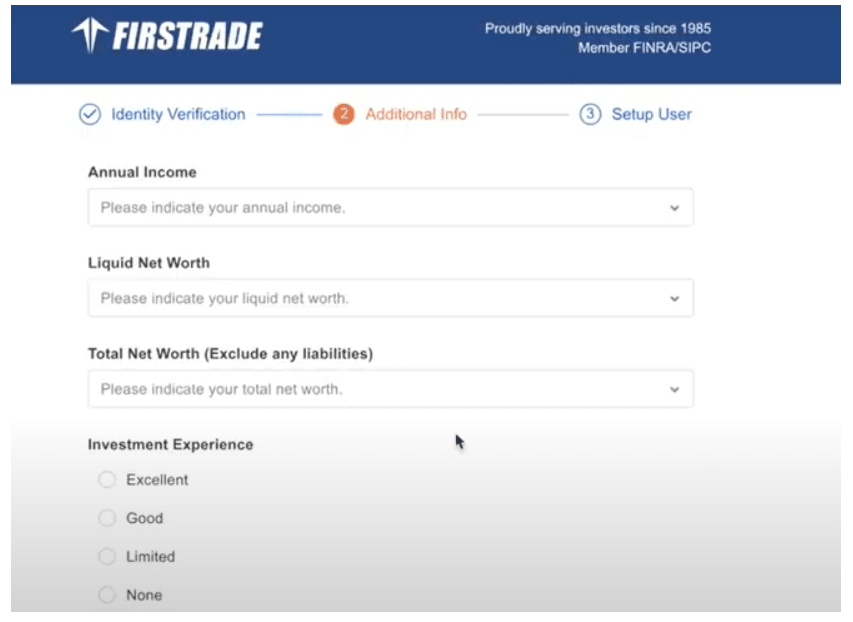

Step 6 – Provide Additional Information

The next step in the account registration process requires traders to provide annual income, liquid net worth, and total net worth, as well as trading experience acquired.

Step 7 – Firstrade User ID Set-Up

Set up the Firstrade User profile by creating an ID and password.

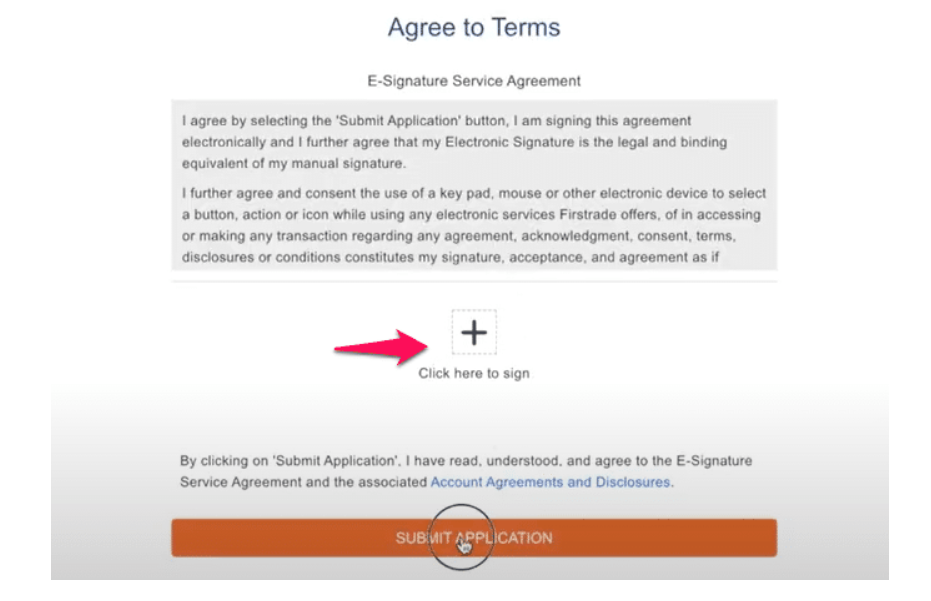

Step 8 – Provide E – Signature & Agree to the Terms and Conditions

The last step of the account registration process requires traders to provide their e-signature as well as accept Firstrades terms and conditions to submit the account registration application

Can I fund my Firstrade account using a credit card?

No, Firstrade does not accept credit card deposits. However, you may fill your account using ACH transfers, wire transfers, or check deposits.

Is the account opening procedure at Firstrade secure?

Yes, Firstrade uses strong encryption technology to protect client information throughout the account opening process.

Firstrade Securities Deposit & Withdrawal

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| ACH Transfers | All | Multi-currency | A few businesses days |

| Bank Wire Transfers | All | Multi-currency | A few businesses days |

| Check Deposits | All | Multi-currency | A few businesses days |

| Brokerage Account Transfers (ACAT) | All | Multi-currency | A few businesses days |

Deposit Methods:

Bank Wire

✅Locate the “Deposit” option in your Firstrade account.

✅Choose “Wire Transfer” as your deposit method.

✅Examine Firstrade’s wire transfer instructions, including bank information and any reference codes necessary.

✅Start the wire transfer from your bank, ensuring all information meets Firstrade’s instructions.

ACH Transfers Card

✅Navigate to the “Deposit” area of your Firstrade account.

✅Firstrade Securities Deposits

✅How to Deposit using Bank Wire Step by Step

✅Locate the “Deposit” option in your Firstrade account.

✅Choose “Wire Transfer” as your deposit method.

✅Examine Firstrade’s wire transfer instructions, including bank information and any reference codes necessary.

✅Start the wire transfer from your bank, ensuring all information meets Firstrade’s instructions.

✅How to Deposit Using ACH Transfers Card Step by Step

✅Navigate to the “Deposit” area of your Firstrade account.

Is there a withdrawal charge with Firstrade?

Firstrade provides free normal withdrawals, although wire withdrawals include costs, such as $25 for domestic and international wire transfers.

Can I move equities across Firstrade accounts or to a different brokerage?

Yes, Firstrade enables brokerage account transfers (ACAT), which enable you to move stocks between Firstrade accounts or to another brokerage.

Trading Instruments & Products

Firstrade Securities offers the following trading instruments and products:

➡️Stocks – Firstrade enables clients to trade equities listed on the NYSE, AMEX, Nasdaq, or Over the Counter (OTC) exchanges, which include firms ranging from penny stocks to large-caps.

➡️ETFs – Firstrade provides over 2,200 ETFs, giving investors flexibility, liquidity, and the option to invest globally via a diversified portfolio. ETFs at Firstrade benefit from cheaper costs, transparency, and tax efficiency.

➡️Options – Firstrade offers options traders a $0 commission, no contract cost, exchange, exercise, or assignment fees, enabling them to generate income from stock/ETF portfolios, take directional positions, and hedge portfolios.

➡️Mutual Funds – Firstrade offers over 11,000 mutual funds, allowing investors to diversify portfolios across industries and risk levels with sophisticated screening tools, fund commentary, and dollar cost-averaging participation.

➡️Fixed Income – Firstrade provides a range of fixed-income investing options, including municipal and corporate bonds, CDs, and other securities, offering a low-risk, portfolio diversification solution.

Does Firstrade provide option trading?

Yes, Firstrade provides options trading with $0 commission and no contract cost, exchange, exercise, or assignment fees.

Are there any limitations on trading ETFs with Firstrade?

No, Firstrade offers a wide selection of over 2,200 ETFs for trading, providing investors with flexibility and diversification options.

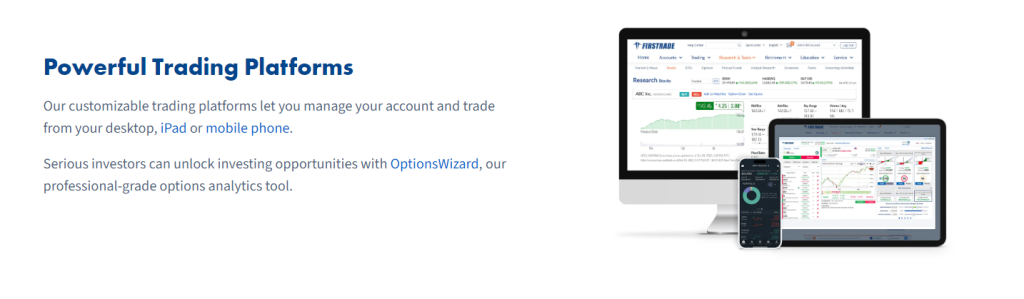

Firstrade Securities Trading Platforms and Software

Web

Firstrade Web is an online trading platform designed for new and experienced investors, offering access to various financial instruments like equities, ETFs, options, mutual funds, and fixed-income products. Moreover, its $0 commission structure ensures cost and accessibility, making it an attractive option for investors of all levels.

Additionally, features like dividend reinvestment programs, extended trading hours, and conditional orders make it easier for traders to make informed decisions. Overall, Firstrade Web combines accessibility, affordability, and advanced features to cater to the diverse needs of investors.”

Navigator

Firstrade Navigator is a sophisticated platform for aggressive traders seeking a dynamic environment. It offers real-time data, extensive charting features, and a configurable interface.

It is particularly useful for ETF and options trading customers, providing analytical tools and rapid execution of complex strategies. Combining Firstrade’s $0 commission model and research resources it maximizes investment potential while reducing expenses.

App

The Firstrade App offers a comprehensive trading experience for mobile users, allowing them to access all financial instruments offered by Firstrade.

It features mobile-optimized charting, real-time notifications, and fast trade execution, making it ideal for investors who value flexibility and convenience. The app also features sophisticated portfolio management and market research capabilities.

Options Wizard

Firstrade Options Wizard is designed to simplify options trading by providing analytical tools and instructional materials. It helps traders identify potential trades based on market perspective, risk tolerance, and investing objectives. In other words, the tool tailors its recommendations to your specific trading goals and risk comfort level.

Furthermore, the tool integrates with Firstrade’s $0 commission options trading and evaluates various tactics, providing clear, actionable conclusions. This demonstrates Firstrade’s commitment to providing investors with the necessary resources to succeed in the options market.

Does Firstrade offer a desktop trading platform?

“Firstrade is a brokerage business authorized by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC), ensuring the safety of its customers’ capital and personal information. Additionally, this regulatory oversight goes hand-in-hand with Firstrade’s commitment to security.”

Can I access my Firstrade account from multiple devices simultaneously?

Yes, you can access your Firstrade account from multiple devices simultaneously, including desktop computers, smartphones, and tablets.

Spreads and Fees

Securities Spreads

Firstrade Securities offers thin spreads, which translates to allowing traders to trade at market rates. This advantage reduces trading costs and ultimately increases investor income. Building on this commitment to affordability, they maintain competitive pricing across various financial products like stocks, ETFs, and options, further ensuring fair pricing for customers.

Commissions

“In a move designed to broaden investor participation, Firstrade Securities has introduced a zero-commission model across various financial instruments. Consequently, this means that investors can now trade without incurring any commission fees.

This new approach aligns with Firstrade’s commitment to democratizing access to the financial markets and empowering investors of all levels. Furthermore, by eliminating commission fees, Firstrade aims to make investing more accessible and cost-effective for its clients. In essence, this initiative marks a significant step forward in Firstrade’s mission to provide inclusive and affordable investment solutions.”

Overnight Fees

Firstrade’s overnight costs are influenced by interest rate differentials, which determine whether a trader receives a small interest credit or incurs a fee.

The cost is determined by factors such as the currency pair being exchanged, the trader’s position, and Firstrade’s current rates at the time of the transaction. Understanding the fee structure is crucial before pursuing leveraged situations, as it influences the trader’s interest credit and fee structure.

Deposit and Withdrawal Fees

Firstrade Securities offers a cost-effective trading platform with free deposits and standard withdrawals, ensuring a hassle-free investing experience. However, some activities, like wire withdrawals, are subject to fees, such as $25 for domestic and international wire transfers.

Inactivity Fees

“Firstrade Securities prioritizes investor-friendly procedures by avoiding inactivity fees, a practice distinguishing it from other brokers penalizing accounts for inactivity. Moreover, this approach aligns with Firstrade’s commitment to fostering a supportive environment for investors, ensuring their satisfaction and financial well-being.”

Currency Conversion Fees

Firstrade does not impose explicit or separate currency conversion fees. Instead, they benefit from the difference between the purchase (ask) and sell (bid) prices they give for a currency pair. This implies that the currency conversion fee is included in the exchange rate.

Does Firstrade offer fee discounts for high-volume traders?

No, Firstrade does not currently offer fee discounts for high-volume traders, but furthermore its competitive pricing and zero-commission model make it cost-effective for all investors.

Can I negotiate fees with Firstrade?

No, Firstrade’s fee structure is standardized and not subject to negotiation, ensuring fairness and consistency for all clients.

Leverage and Margin

However, there are some important points to consider before using margin trading with Firstrade Securities. While it offers margin trading, a financial technique that allows customers to borrow funds from Firstrade and use their current securities as collateral to buy more assets, it’s important to remember this method increases investment risks as well as profits.

For example, with a 50% gain for an initial cash investment of $10,000, you could also experience a 50% loss. On the other hand, Firstrade’s low-margin interest rates can make it an attractive option for individuals seeking to maximize returns without high borrowing expenses. Additionally, margin trading allows for portfolio diversification and can be a practical financing option for personal needs, as long as the risks are carefully considered.

It also offers greater cash dividends and tax deductibility of margin loan interest. First, investors must accept risks, have at least $2,000 in assets, complete the Margin Application & Agreement, and gain approval.

Are there any margin interest rates with Firstrade?

“Yes, Firstrade charges margin interest rates for borrowed funds used in margin trading; moreover, these rates are subject to change based on market conditions.”

Can I increase my margin limit with Firstrade?

“Yes, Firstrade may offer margin limit increases based on account history, trading experience, and financial standing, consequently providing the potential for greater trading flexibility for qualified investors.”

Educational Resources

Firstrade Securities offers the following educational resources:

“Investment and Options Webinars – Firstrade presents a series of webinars that concentrate on investing techniques and using options to navigate current markets. Additionally, these webinars provide valuable insights for investors seeking to enhance their trading strategies.

Investment Glossary – Firstrade’s Investment Glossary is a valuable resource for comprehending financial terminology, thereby aiding in informed trading and investment decisions. Moreover, it serves as a helpful reference for investors looking to expand their knowledge of financial terms and concepts.

Investment Education Videos—Firstrade provides a library of instructional films covering various investing subjects. These videos offer accessible and practical guidance for investors at all levels of experience.

Are there any fees for accessing Firstrade’s educational materials?

No, Firstrade’s educational resources, including webinars, investment glossaries, and videos, are available to all clients free of charge, thus promoting financial literacy and empowerment.”

Are there any interactive tools available for learning on Firstrade?

Yes, Firstrade offers interactive tools such as stock screeners, options wizards, and portfolio analysis tools to help investors apply their knowledge and make informed investment decisions.

Pros & Cons

| ✔️ Pros | ❌ Cons |

| There is no minimum deposit necessary | The absence of a demo trading environment for practice and testing |

| Market news, research reports, and instructional tools can all assist you in making better financial choices | Some full-service brokers can offer more thorough research tools than Firstrade |

| Opening and funding a new account is a straightforward procedure | The platform and tools might not be fully suited to complex active trading techniques |

| You can easily leverage your assets for possibly bigger profits by using margin trading | Firstrade does not provide direct access to the Forex market or CFDs |

| Phone, email, and live chat help available | Exchange rates may not always be the best available |

| Stocks, ETFs, options, mutual funds, bonds, and even a spot Bitcoin ETF provide diversification | Telephonic support is only accessible during office hours |

| Fractional share investing enables you to buy sections of stocks | The market maker strategy may result in less competitive pricing than brokers who have direct market access |

| The web-based platform and mobile app are user-friendly | Holding leveraged transactions overnight results in rollover costs |

| There is no penalty for periods of inactivity on your account | |

| There are no fees on stock, ETF, and option trading |

Security Measures

“Firstrade is a brokerage business authorized by the Financial Industry Regulatory Authority (FINRA) and the Securities and Exchange Commission (SEC), ensuring the safety of its customers’ capital and personal information. Furthermore, this regulatory oversight goes hand-in-hand with Firstrade’s commitment to security.”

Additionally, the platform uses advanced encryption technology to protect data communications and offers an Online Protection Guarantee against illegal account activity. Furthermore, Firstrade’s privacy policies clearly explain the processing of personally identifiable information, ensuring compliance with statutory standards.”

Does Firstrade offer two-factor authentication for account security?

“Yes, Firstrade provides two-factor authentication options, consequently adding an extra layer of security to account logins and transactions.”

Are Firstrade’s regulatory licenses up to date?

Yes, Firstrade is regulated by reputable authorities such as FINRA and the SEC, ensuring compliance with industry standards and regulations.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

According to our research, while Firstrade is an appealing alternative for traders interested in equities, ETFs, options, mutual funds, and fixed-income products, its lack of forex and CFD trading services may frustrate those seeking exposure to these markets.

However, according to our findings, the platform’s user-friendly design, zero-commission approach, and focus on investor education make it an appealing option for both new and seasoned investors.

No, the broker does not provide conventional paper trading (demo) accounts.

Yes, the broker provides a variety of retirement accounts, including regular, Roth, and rollover IRAs. You may benefit from tax-advantaged retirement investing via Firstrade.

The broker normally processes withdrawals within a few business days. However, the time can vary based on the withdrawal type and any extra verification procedures.

The broker does not need a minimum deposit, enabling traders to begin trading without prior financial commitment.

Yes, Firstrade is a renowned broker regulated in the United States that uses modern encryption technologies to secure client data and assets.

Yes, the broker enables margin trading on qualified accounts.

The broker offers various financial products, including equities, ETFs, options, mutual funds, and fixed-income instruments.

The brokers mainly serve the people of the United States. Eligibility limits may apply depending on your country of residence and citizenship.

The broker is founded in the United States and mainly serves customers in the United States and its territories, with headquarters in Flushing, New York.

Yes, the broker lets you buy fractional shares of equities and ETFs. This allows you to invest in even high-priced companies in modest sums.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |