Freetrade Review

- Freetrade Review – 13 key points quick overview:

- Overview

- At a Glance

- Freetrade Account Types

- How To Open a Freetrade Account

- Freetrade Deposit & Withdrawal Options

- Trading Instruments & Products

- Freetrade Trading Platforms and Software

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- Conclusion

Overall Freetrade is considered a trusted broker, with an overall Trust Score of 85 out of 100. Freetrade is licensed by one Tier-1 Regulator (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk). Freetrade offers three investment accounts: Stocks and Shares ISA, Self-Invested Personal Pension (SIPP), and a General Investment Account.

Freetrade Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Freetrade Account Types

- ☑️How To Open an Freetrade Account

- ☑️Freetrade Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️Freetrade Trading Platforms and Software

- ☑️Freetrade Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Freetrade Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Freetrade, a UK-based fintech company, was established in 2016 to revolutionize the investment industry by offering commission-free trading and a user-friendly mobile app.

In addition, the platform aims to democratize investing by making it accessible and affordable for everyone, regardless of their financial status or experience level.

Moreover, the company’s transparent pricing structure and growing investment options make it a compelling choice for investors in the UK and Europe. Consequently, they have acquired over a million members and are currently managing billions of pounds in assets.

Furthermore, the company’s clear pricing structure and expanding investment options make it an attractive option for investors in the UK and Europe. As a result, today they have over a million members and billions of pounds in assets under control.

Does Freetrade provide tailored investing advice?

The platform does not provide individualized financial advice. However, it offers educational resources and guidance to assist individuals in making informed financial decisions.

Can I invest in cryptocurrencies?

No, Freetrade does not support cryptocurrency trading. It focuses on classic financial products, including equities, exchange-traded funds, and investment trusts.

At a Glance

| 🗓 Established Year | 2016 |

| ⚖️ Regulation and Licenses | FCA |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | Freetrade App, Freetrade Web |

| 🛍 Account Types | Stocks and Shares ISA, Self-Invested Personal Pension (SIPP), General Investment Account |

| 🤝 Base Currencies | GBP |

| 📊 Spreads | None |

| 📈 Leverage | None |

| 💸 Currency Pairs | None |

| 💳 Minimum Deposit | The Basic Plan Starts from 0 GBP |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English, German, French, Japanese, etc. |

| 💰 Fees and Commissions | Commissions from 0.39% on Freetrade Plus |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | United States |

| ✔️ Scalping | No |

| 📉 Hedging | No |

| 🎉 Trading Instruments | Stocks, fractional shares, ETFs, investment trusts, OTC stocks, REITs, SPAC stocks, Cash Investments, UK Treasury Bills |

| 🎖 Open an Account | Open Account |

Freetrade Account Types

Stocks and Shares ISA Self-Invested Personal Pension (SIPP) General Investment Account

✅ Availability All All All

🛍 Markets Stocks, ETFs Stocks, Shares, ETFs, Investment Funds, REITs, etc Fractional shares, ETFs, Investment Trusts, US stocks, EU stocks, UK stocks, etc.

💸 Commissions Commission-Free on most trades. Foreign exchange fee charged between 0.35% - 0.99% Variable Commission-Free on most trades. Foreign exchange fee charged between 0.35% - 0.99%

💻 Platforms Freetrade Platforms Freetrade Platforms Freetrade Platforms

📊 Trade Size Variable Variable Variable

📈 Leverage None None None

💰 Minimum Deposit 2 GBP 2,000 GBP 0 GBP

🎖 Open an Account Open Account Open Account Open Account

Stocks and Shares ISA Account

Moreover, they offer a tax-efficient Stocks and Shares ISA with a minimum monthly fee of £4.99, which is backed by the Financial Services Compensation Scheme (FSCS). This account provides long-term investment strategies and offers tax-free growth on dividends, interest income, or capital gains.

Additionally, with an annual limit of £20,000 for 2023/24, the broker offers diverse investment options such as stocks, ETFs, and REITs, making it a top-rated provider.

Self-Invested Pension (SIPP) Account

The Self-Invested Pension (SIPP) Account is a retirement planning tool that comes with modest fixed fees and tax benefits. Additionally, it allows investors to deposit up to £40,000 annually, offering varying tax advantages based on income.

Furthermore, the plan offers investment option control and merges multiple pensions into one, with HMRC tax exemptions. However, access to the account is restricted until age 55, focusing on long-term benefits.

General Investment Account

Additionally, the General Investment Account (GIA) is a tax-free platform for investors seeking stock and share trading options beyond ISAs and SIPPs.

This means that it offers numerous investment opportunities without limitations, and taxes apply only to gains exceeding set thresholds. Furthermore, Freetrade’s GIA provides straightforward account expenses and fractional shares across global markets.

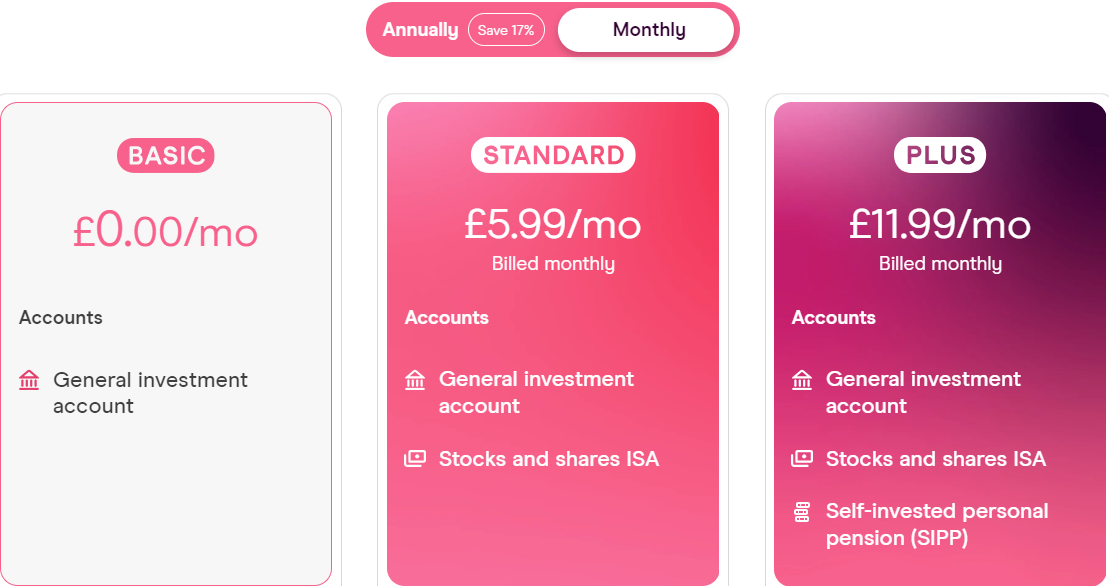

Plan Options

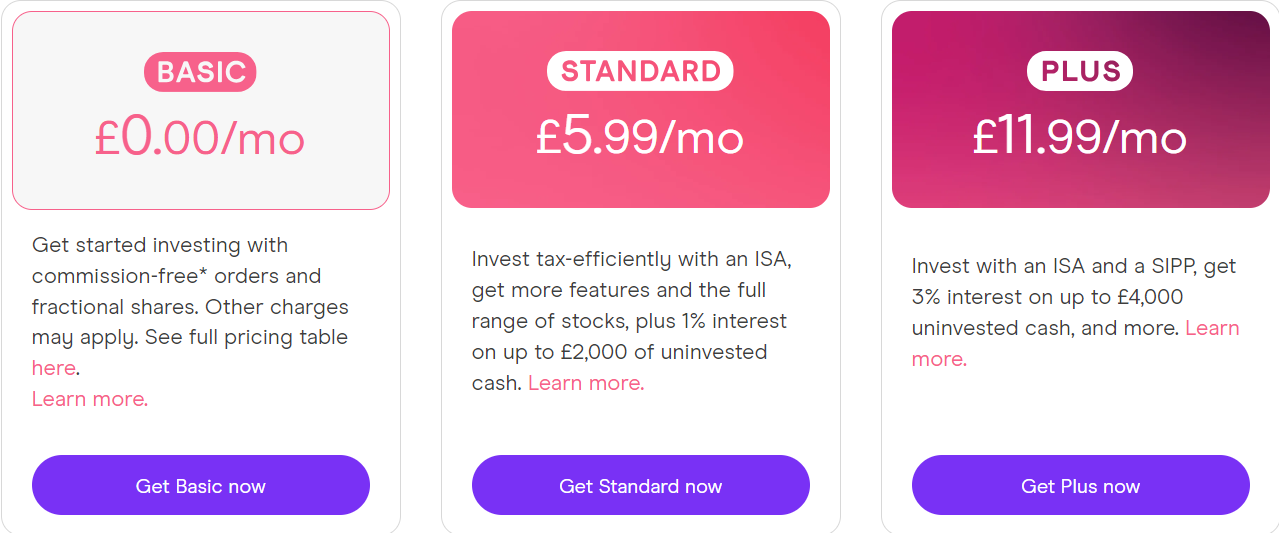

Freetrade Basic

The Basic plan serves as their entry-level option, and it’s entirely free of charge. Additionally, it offers commission-free trading on UK, US, and European equities and ETFs.

Additionally, it’s worth noting that under this plan, the Foreign Exchange (FX) cost for non-GBP equities is somewhat higher. However, basic users may still benefit from features such as limit orders and fractional shares.

Freetrade Standard

Moreover, the Standard plan costs only £3 per month and offers many benefits. For instance, it allows you to access over 6,000 stocks and ETFs.

In addition, this plan provides a cheaper FX cost, automatic recurring investments, and 3% interest on uninvested capital up to £2,000. As a result, it’s a fantastic mid-range alternative for those seeking extra portfolio diversification.

Freetrade Plus

In addition to the Standard features, the Plus service, priced at £9.99 per month, offers a cheaper FX price, priority customer assistance, and access to the Freetrade online beta.

Furthermore, Plus members also have access to a Self-Invested Personal Pension (SIPP), which pays 5% interest on uninvested funds up to £4,000.

Is there a charge to create an account?

No, there is no charge to establish an account. However, some account features may need a monthly membership cost.

Does Freetrade provide paper trading or virtual accounts for practice?

The broker does not provide paper trading or virtual accounts. However, investors might begin with minimal expenditures to obtain real expertise.

How To Open a Freetrade Account

To register an account, follow these steps:

Step 1 – Install the software.

Search for “Freetrade” on the App Store or Google Play and install the software on your mobile device.

Step 2 – Choose a plan.

Freetrade provides three plans: Basic (free), Standard (£3 per month), and (£9.99 per month). Each plan has distinct benefits, so choose one that meets your investing requirements. To begin the account-opening procedure, open the Freetrade app and click “Get started.”

Step 2 – Fill out the form.

Enter your complete name and email address, then create a strong password. Freetrade will send a verification email to the address you enter. Click the link in the email to confirm your account.

Freetrade Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time

Bank Transfer All GBP 2 – 5 days

Debit Card All GBP Instant

Deposit Methods:

Bank Transfer

✅Access the application and navigate to the section labelled “Account”.

✅Then select the “Deposit” choice.

✅After that choose the option of “Bank Transfer” as your preferred payment method.

✅Press “Continue” once you have inputted the deposit amount of your choice.

Debit Card

Freetrade may occasionally activate and turn off debit card deposits to line with their long-term investment strategy. Check the Help Center to discover whether it is currently supported.

✅If enabled, go to the “Account” area of the app and choose “Deposit.”

✅Choose the “Debit Card” as your preferred method of payment.

✅Enter the amount you want to deposit and your debit card information then tap “Deposit” to start the transaction.

Withdrawal Methods:

Bank Transfer

✅In the app, go to the “Account” area.

✅Select the “Withdraw” choice.

✅Withdrawals usually take 2-3 working days but may last up to 5.

Can I withdraw funds from my account at any time?

Yes, you may withdraw funds from your account at any moment. Withdrawals are normally completed within a few business days.

How long does it take for deposits to show in my account?

Deposited funds are normally credited to your account within 2-5 business days, depending on your bank’s processing schedule.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Stocks – Freetrade lets you buy and sell over 6,000 US, UK, and European shares without commission, all through the Freetrade app.

➡️Fractional Shares – Additionally, investors can purchase fractional shares of US equities for as little as £2, which makes investing more accessible for individuals on a budget.

➡️ETFs – Additionally, Freetrade customers can invest in over 400 ETFs across various sectors, commodities, and indexes without paying a fee.

➡️Investment Trusts – Furthermore, Freetrade provides over 150 investment trusts, enabling investors to diversify their portfolios across geographical locations and market sectors.

➡️OTC Stocks – Moreover, Freetrade offers a variety of over-the-counter (OTC) securities, including American Depository Receipts (ADRs) from big, worldwide corporations.

➡️ REITs – With more than 160 REITs accessible, investors may invest in income-producing real estate without acquiring or managing the property directly.

➡️ SPAC Stocks – Moreover, Freetrade members have access to over 200 SPACs. These corporations aim to raise funds through IPOs, offering unique investment opportunities while bringing private enterprises public.

➡️ Cash Investments – Additionally, Freetrade introduces Cash Investments, which is a collection of low-risk ETFs that track overnight interest rates or invest in ultrashort investment-grade bonds.

➡️ UK Treasury Bills – Furthermore, Freetrade will offer 28-day UK Treasury notes, which are a secure and defined investment choice issued by the UK government. These low-risk investments are a great option for those looking to invest safely.

Can you exchange options contracts on Freetrade?

No, Freetrade presently does not provide option trading. However, you can trade stocks, ETFs, investment trusts, and other financial products.

Does Freetrade provide pre-market and after-hours trading?

No, Freetrade presently does not provide pre-market or after-hours trading. Trades are completed during normal market hours per exchange rules.

Freetrade Trading Platforms and Software

Freetrade Web Platform

Additionally, the broker offers a user-friendly trading platform for both beginners and experienced investors. Moreover, it provides a wide range of financial products, such as stocks and ETFs, and real-time market data.

Furthermore, the platform offers extensive portfolio analytics and easy access to over 6,000 US, UK, and European shares.

The platform also includes instructional tools to enhance trading knowledge. Its architecture simplifies investment management, from fractional shares to investment trusts.

Freetrade’s commitment to commission-free trading and transparent pricing not only demonstrates its dedication to affordability and value for its customers but also highlights its unwavering focus on creating a fair and accessible trading platform.

Moreover, by eliminating commissions, Freetrade has made investing accessible to a wider audience, which is likely to increase investment opportunities for many.

Additionally, Freetrade’s transparent pricing policy ensures that customers are well-informed about the costs involved in investing, which builds trust and enhances customer satisfaction.

Freetrade App

The app is a mobile-first solution designed to meet the needs of modern investors. It offers a range of financial instruments, including fractional shares, over 400 ETFs, and 150 investment trusts. The app also provides OTC stocks for Standard and Plan members.

Moreover, the real-time alerts keep users updated on market changes, ensuring they do not miss a beat. In addition, the app is more than just a trading tool; it serves as a portal to a full investing ecosystem. By using this app, users can control their financial destiny while reducing expenses.

Can I use sophisticated charting tools on the Freetrade platform?

No, Freetrade’s charting capabilities are limited, appealing mostly to new investors. However, the platform is constantly updating its features depending on user input.

Does Freetrade provide real-time market data via its platform?

Yes, Freetrade delivers real-time market data, enabling customers to keep informed about price fluctuations and make sound trading choices.

Spreads and Fees

Spreads

Moreover, the broker offers a user-friendly and transparent pricing policy by charging foreign exchange (FX) fees for non-domestic equities transactions. This allows investors to access overseas markets with ease and convenience.

Additionally, this approach is crucial for US, UK, and European investors, as it provides a transparent pricing structure. The FX charge is a modest percentage added to the transaction value, demonstrating Freetrade’s commitment to openness and affordability in trading.

Commissions

Additionally, Freetrade’s commission-free trading structure on stocks and ETFs is a significant advantage for investors of all levels. This policy allows customers to buy and sell shares without incurring fees, making it an attractive platform for optimizing investment returns.

Overnight Fees

Furthermore, the broker does not charge overnight costs, which is another feature of its user-friendly pricing structure.

Deposit and Withdrawal Fees

The broker maintains a user-friendly approach by not charging fees for adding or removing cash from an account.

Inactivity Fees

Additionally, it offers a unique approach to trading by not charging users inactivity fees, which sets it apart from other platforms that impose such fees. This allows investors to take breaks without additional charges, making it a more flexible and user-friendly platform than others.

Currency Conversion Fees

In addition, the broker charges currency conversion fees for foreign currency transactions. This ensures access to worldwide markets and covers currency conversion expenses.

As a result, it keeps trading costs affordable, promoting a cost-effective platform for trading financial products.

Is there a cost for canceling deals on Freetrade?

The broker does not impose fees for canceling deals. However, users should know that canceled transactions may still result in market effect charges.

Does Freetrade provide commission-free trading across all assets?

Freetrade allows you to trade most assets without paying a fee. Please note that if you hold non-GBP assets, there may be foreign currency costs applicable.

Leverage and Margin

Additionally, they are a commission-free trading platform that focuses on providing direct investments without the complexities of leverage and margin trading. This means that you can invest in stocks, ETFs, and trusts without borrowing money.

To further clarify, this approach aligns with Freetrade’s goal to democratize investing and make it more accessible to a wider audience, including novices. Additionally, the broker safeguards investors from losses and margin calls in unfavourable markets by not offering any leveraged products.

Does Freetrade provide leveraged ETFs?

No, Freetrade does not provide leveraged ETFs.

Are there any limits on short-selling using Freetrade?

They do not permit short selling. Users can only purchase and sell assets in long positions.

Educational Resources

The broker offers the following educational resources:

➡️Additionally, on platforms like Freetrade, investment guides play a crucial role in assisting both new and experienced investors in comprehending complex financial products and strategies.

➡️Additionally, staying informed about these events helps investors make informed decisions about their investments and can provide valuable insights into market conditions.

➡️Therefore, keeping an eye on Market News is crucial for investors looking to stay ahead of the curve and make smart investment decisions.

Are there any beginner-friendly materials accessible on Freetrade?

For beginners, Freetrade offers investment guidelines and videos to help them navigate the site and learn how to invest.

Are there any interactive learning resources accessible on Freetrade?

No, Freetrade does not provide interactive learning tools. Investors may utilize the community forum to seek and share information with other investors.

Pros & Cons

✔️ Pros ❌ Cons

You can invest in partial shares, making it more accessible to individuals with lower investment amounts All transactions are subject to FX costs unless the asset is priced in GBP, making investing in non-GBP assets less cost-effective

Tax-advantaged investing accounts for UK citizens provide significant advantages. The Standard and plans include monthly fees for their ISA accounts

The Freetrade mobile app is user-friendly Customer support is mostly provided via in-app chat, which might be delayed during peak hours

The Financial Conduct Authority (FCA) regulates Freetrade, offering investors confidence and safety Their desktop app is currently in development, so professional traders may find the mobile-first strategy restrictive

Their pricing structure is clearly defined, making it simple to grasp the charges involved Compared to some bigger rivals, Freetrade may have a limited variety of asset types

The Basic, Standard, and plans are tailored to various investor profiles Using a debit card for deposits be disabled occasionally

Freetrade provides instructional tools to assist you in learning about investment Freetrade's features and price promote long-term investing strategies

Most UK, US, and European stocks and ETFs can be traded without a commission

A dynamic online forum where you can connect with other people and get information

Security Measures

Additionally, it’s worth noting that they are an FCA-regulated platform that follows strict security measures to protect customers’ assets and personal information.

Furthermore, to ensure maximum security, it maintains client funds separate from the company’s finances. Moreover, stocks are stored in nominee accounts or licensed third-party custodians, further enhancing customers’ safety and protection.

Additionally, the platform has a strong privacy policy to safeguard personal information. Legal agreements preserve investors’ holdings.

Does Freetrade provide two-factor authentication for account security?

Yes, Freetrade provides two-factor authentication as an extra layer of protection for user accounts, preventing unwanted access.

Are users’ funds secure with Freetrade?

Additionally, user payments are maintained in segregated accounts distinct from Freetrade’s operating finances, giving additional security in the event of bankruptcy

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Overall, we found that Freetrade is a highly user-friendly platform for commission-free trading. Moreover, it offers tax-advantaged account choices and a diverse range of investment options such as fractional shares, ETFs, and investment trusts.

Placing mobile devices as a top priority could deter investors due to added costs related to currency exchange and regular fees. Additionally, the lack of desktop software limits the usefulness for experienced traders.

For more information on FXLeaders.

Yes, you can quickly sell your shares using Freetrade’s mobile app.

Withdrawals from Freetrade normally take 2-3 working days to process but can sometimes take up to 5 days.

The platform generates money in various ways, including foreign currency (FX) fees on non-GBP transactions, monthly fees for its plans, interest on uninvested capital, and payment for order flow (compensation from market makers for routing trades).

They do not need a minimum investment, enabling investors to start trading with as little as they like.

Yes, Freetrade is a reputable broker registered by the Financial Conduct Authority (FCA).

Yes, you can easily transfer your current Stocks & Shares ISA from another provider to Freetrade.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |