FXDD Review

- FXDD Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Leverage and Margin

- Which Markets Can You Trade?

- FXDD Deposit and Withdrawals

- Educational Resources

- Pros and Cons

- In Conclusion

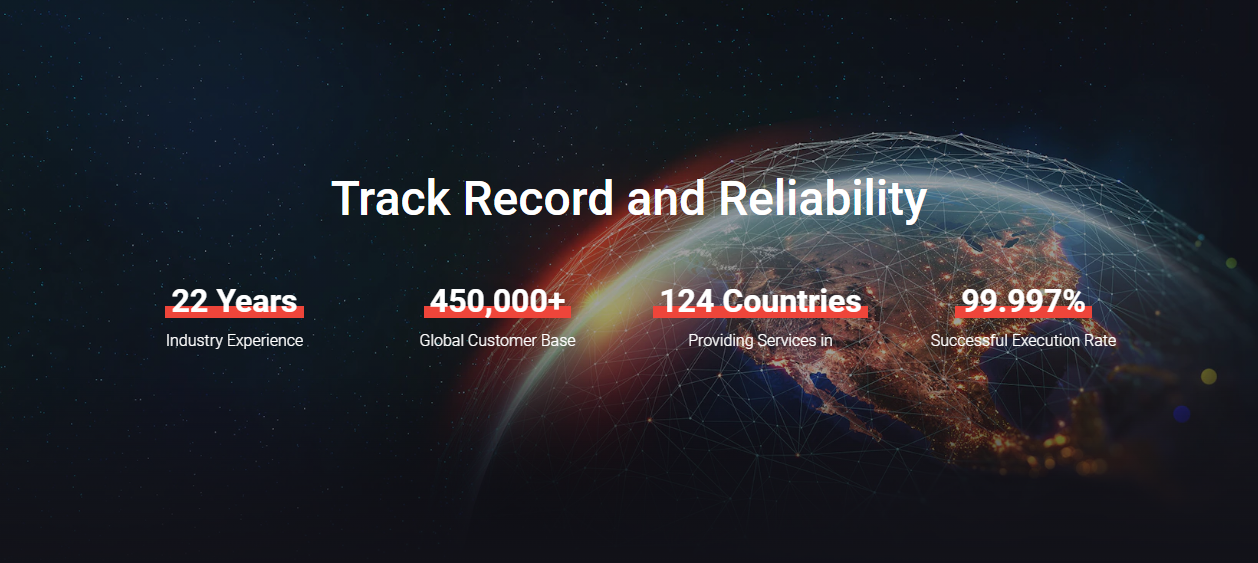

Overall, FXDD can be summarised as a trustworthy Forex Broker with a strong regulatory structure plus access to segregated accounts and negative balance protection measures. FXDD has over two decades of experience serving a diverse customer base and has a trust score of 80 out of 99.

| 🔎 Broker | 🥇 FXDD |

| 📈 Regulation and Licenses | MFSA, FSC Mauritius, LFSA, FINTRAC |

| 5️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, FXDD Mobile, FXDD WebTrader |

| 📉 Account Types | Standard, Premium |

| 🪙 Base Currencies | USD, JPY, EUR, GBP, CNY |

| 📊 Spreads | From 0.4 pips |

| 💹 Leverage | 1:500 |

| 💰 Currency Pairs | 55; major, minor, and exotic pairs |

| 💴 Minimum Deposit | 200 USD |

| 💵 Inactivity Fee | ✅Yes |

| 🥰 Website Languages | English, Spanish, Italian, Portuguese, Chinese, Arabic, Vietnamese |

| 💶 Fees and Commissions | Spreads from 0.4 pips, commissions from $0.0299 per 1,000 orders |

| 🫶 Affiliate Program | ✅Yes |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, stocks, indices, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

FXDD Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Which Markets Can You Trade?

- ☑️ Deposit and Withdrawals

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

- ☑️ Frequently Asked Questions

Overview

FXDD, a leading online trading broker, is based in Malta and has over two decades of experience serving a diverse customer base.

Established in 2002, the broker has a strong regulatory structure monitored by the Malta Financial Services Authority, the Financial Services Commission in Mauritius, FINTRAC in Canada, and the Labuan Financial Services Authority (LFSA).

FXDD offers diverse asset classes, including forex, precious metals, energy, indexes, stocks, and cryptocurrencies, to meet individual traders’ needs. The broker’s commitment to customer fund security is evident through segregated accounts and negative balance protection measures.

FXDD’s tight spreads and support for trading tactics like scalping and hedging provide a competitive and flexible trading environment. The broker’s free statistics, online tools, training resources, and market research benefit new and seasoned traders by providing the necessary skills and expertise.

Is an Islamic Account on Offer?

Yes, FXDD provides Islamic accounts to traders who need them for religious reasons.

Are Bonuses or promotions available?

FXDD does not provide bonuses or promotions to its traders.

Detailed Summary

| 🔎 Broker | 🥇 FXDD |

| 📈 Regulation and Licenses | MFSA, FSC Mauritius, LFSA, FINTRAC |

| 5️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/7 |

| 🖱️ Trading Platforms | MetaTrader 4, MetaTrader 5, FXDD Mobile, FXDD WebTrader |

| 📉 Account Types | Standard, Premium |

| 🪙 Base Currencies | USD, JPY, EUR, GBP, CNY |

| 📊 Spreads | From 0.4 pips |

| 💹 Leverage | 1:500 |

| 💰 Currency Pairs | 55; major, minor, and exotic pairs |

| 💴 Minimum Deposit | 200 USD |

| 💵 Inactivity Fee | ✅Yes |

| 🥰 Website Languages | English, Spanish, Italian, Portuguese, Chinese, Arabic, Vietnamese |

| 💶 Fees and Commissions | Spreads from 0.4 pips, commissions from $0.0299 per 1,000 orders |

| 🫶 Affiliate Program | ✅Yes |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, stocks, indices, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

FXDD ensures customer funds and trading activity security through various procedures, including separating trader deposits from business funds, providing negative balance protection, and an investor compensation fund.

The broker’s operating architecture is supported by regulatory scrutiny in multiple jurisdictions, ensuring adherence to strict financial standards and regulations.

Is two-factor authentication offered for account security?

Yes, FXDD provides two-factor authentication (2FA) as an added layer of protection for account access.

Is a privacy policy in place?

Yes, FXDD has a privacy policy in place to protect the personal information of its clients.

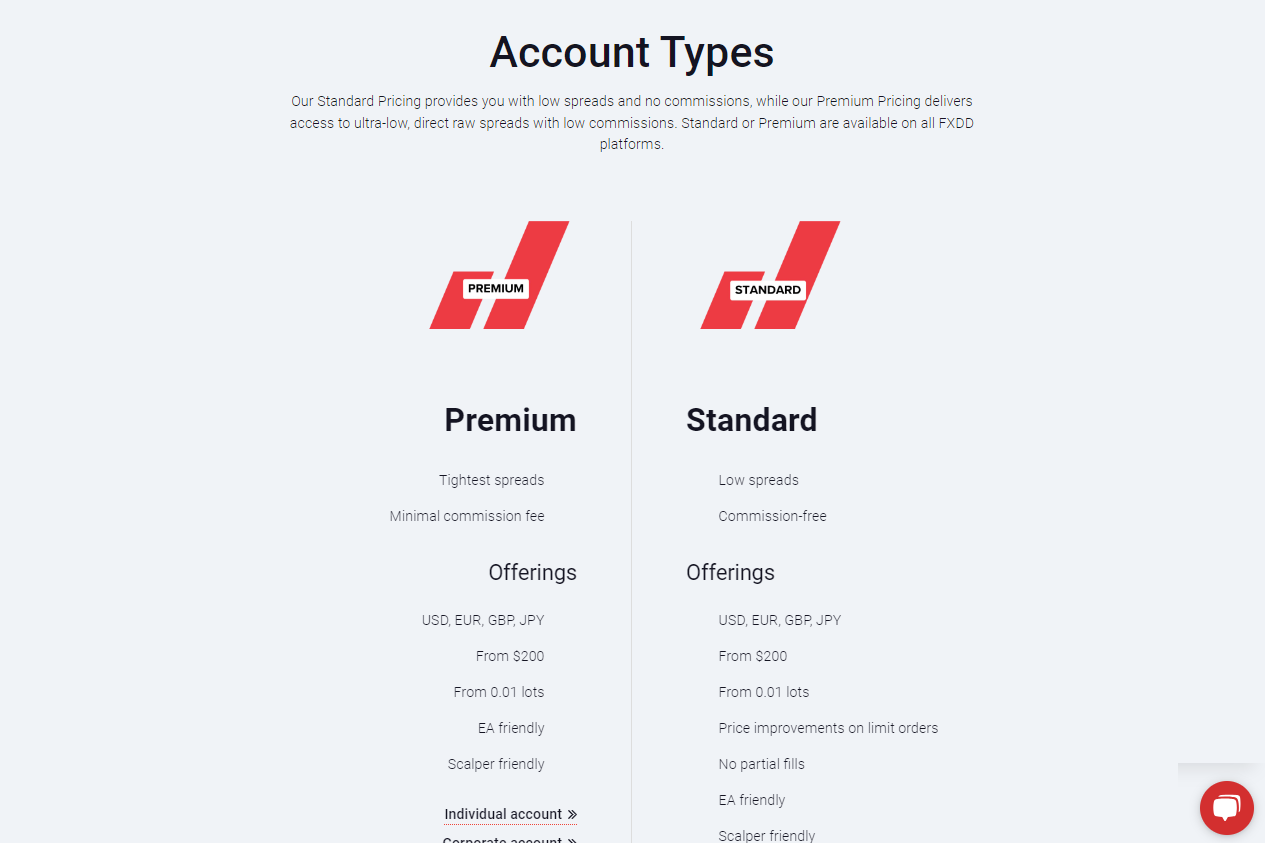

Account Types

| 🔎 Account Type | 🥇 Premium | 🥈 Standard |

| 🩷 Best Suited | Ideal for experienced traders | Ideal for beginners and casual traders |

| 📈 Markets | All | All |

| 💴 Commissions | From $0.0299 | None; only the spread is charged |

| 📉 Platforms | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:500 | 1:500 |

| 💵 Minimum Deposit | 200 USD | 200 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here |

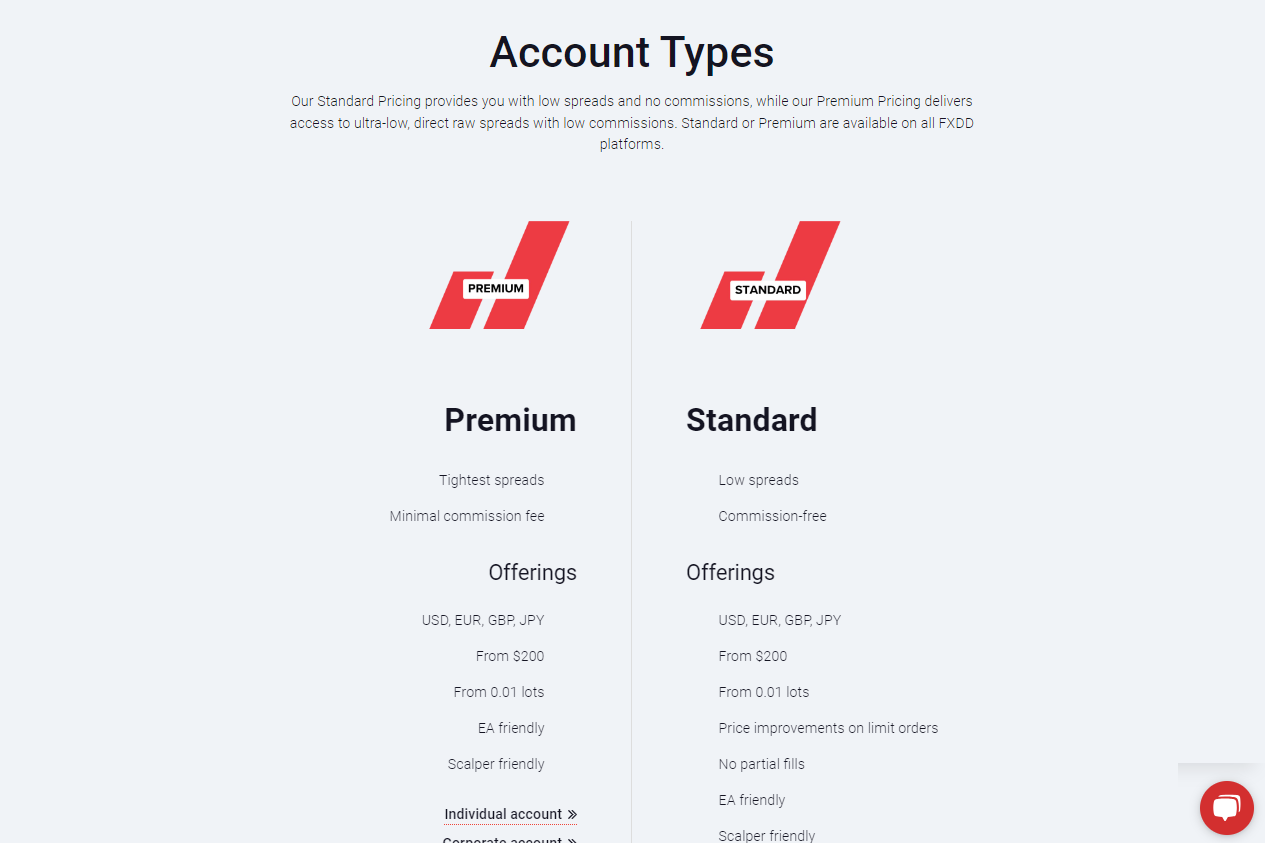

Premium Account

FXDD’s Premium (ECN) account caters to professional traders seeking competitive pricing and raw spreads through electronic communications networks.

It charges 0.4 pips spread and minimal commission costs, enabling quick transactions and enhancing transparency. It also allows scalping and using Expert Advisors for automated trading methods.

Standard Account

FXDD’s Standard account is designed for new forex traders with a simple structure and no commissions.

It offers spreads on popular currency pairings at 2.1 pips and includes broker fees. A suggested first deposit of $200 offers access to FXDD’s tradable assets and leverage up to 1:30 on key currency pairs.

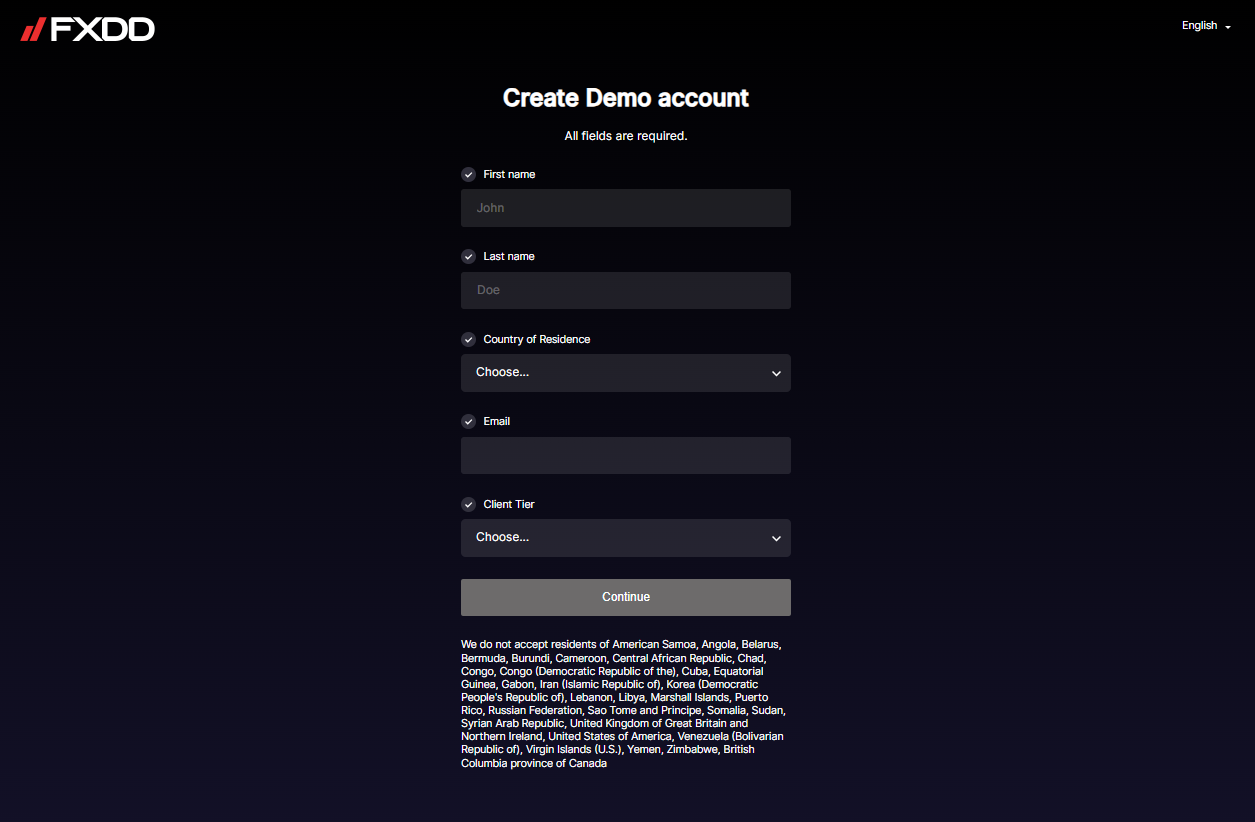

Demo Account

FXDD’s demo account offers a risk-free, 90-day trial period for new and experienced traders to learn about FXDD’s platforms, develop trading methods, and gain confidence using virtual funds. This risk-free environment is crucial for honing trading skills and information.

Islamic Account

FXDD’s Islamic account caters to traders adhering to Sharia law by avoiding swap fees for overnight holdings, thereby avoiding Riba (interest), while maintaining the same trading conditions and benefits as FXDD’s other account types.

What is the minimum deposit required to open a Standard account?

The minimum deposit for a Standard account at FXDD is $200.

Can traders on the Standard account use leverage?

Yes, the Standard account allows traders to leverage up to 1:500 on popular currency pairings.

How To Open an Account

- Begin the procedure by going to FXDD’s official website to access the registration portal.

- Locate and click the “Open an Account” button.

- Select an account type.

- Complete the account application.

- Submit the required identifying papers for verification.

- Choose a trading platform.

- Choose a base currency.

- Review FXDD’s terms and conditions.

- Submit your application to FXDD for approval.

- Once your account has been accepted, you can fund it using the method of your choice.

Is there a specific trading experience required to open an account?

FXDD does not have a minimum trading experience requirement for creating an account, making it available to traders of all skill levels.

Can traders choose their preferred trading platform when opening an account?

When creating an account, traders may choose between MetaTrader 4, MetaTrader 5, and FXDD Web as their trading platform.

Trading Platforms and Software

MetaTrader 4

FXDD’s MetaTrader 4 is a popular platform for traders seeking a reliable and varied trading environment. It offers powerful charting, over 50 pre-installed technical indicators, and extensive back-testing options.

FXDD’s connection with MetaTrader 4 allows customers to access tight spreads and a wide range of products. The platform also supports Expert Advisors for automating trading tactics, aligning with FXDD’s goal of providing sophisticated trading tools.

MetaTrader 5

MetaTrader 5 is a trading platform that offers advanced features like more timeframes, technical indicators, and wider asset classes.

Its comprehensive financial trading operations, technical and fundamental research tools, economic calendar integration, and upgraded strategy tester for EAs make it an ideal choice for traders seeking a sophisticated trading environment.

Mobile App

FXDD Mobile is a smartphone trading interface designed for traders who need to maintain accounts and trade on the go. It offers a streamlined interface with features like chart analysis, trade management, and real-time market data updates.

Although not as comprehensive as MetaTrader platforms, FXDD Mobile aims to provide flexible and accessible trading solutions.

Web Platform

FXDD Web is a web-based trading solution that allows traders to access their accounts and markets from any internet-connected device without downloading software.

It offers advanced charting capabilities and one-click trading, making it ideal for those who do not want to install software or use devices that do not allow downloading.

Is a proprietary trading platform available?

Yes, FXDD offers its unique trading platform, FXDD Mobile, which allows traders to access markets with greater flexibility and convenience.

Can traders use expert advisors (EAs)?

Yes, FXDD’s trading platforms enable using expert advisors (EAs) for automated trading methods.

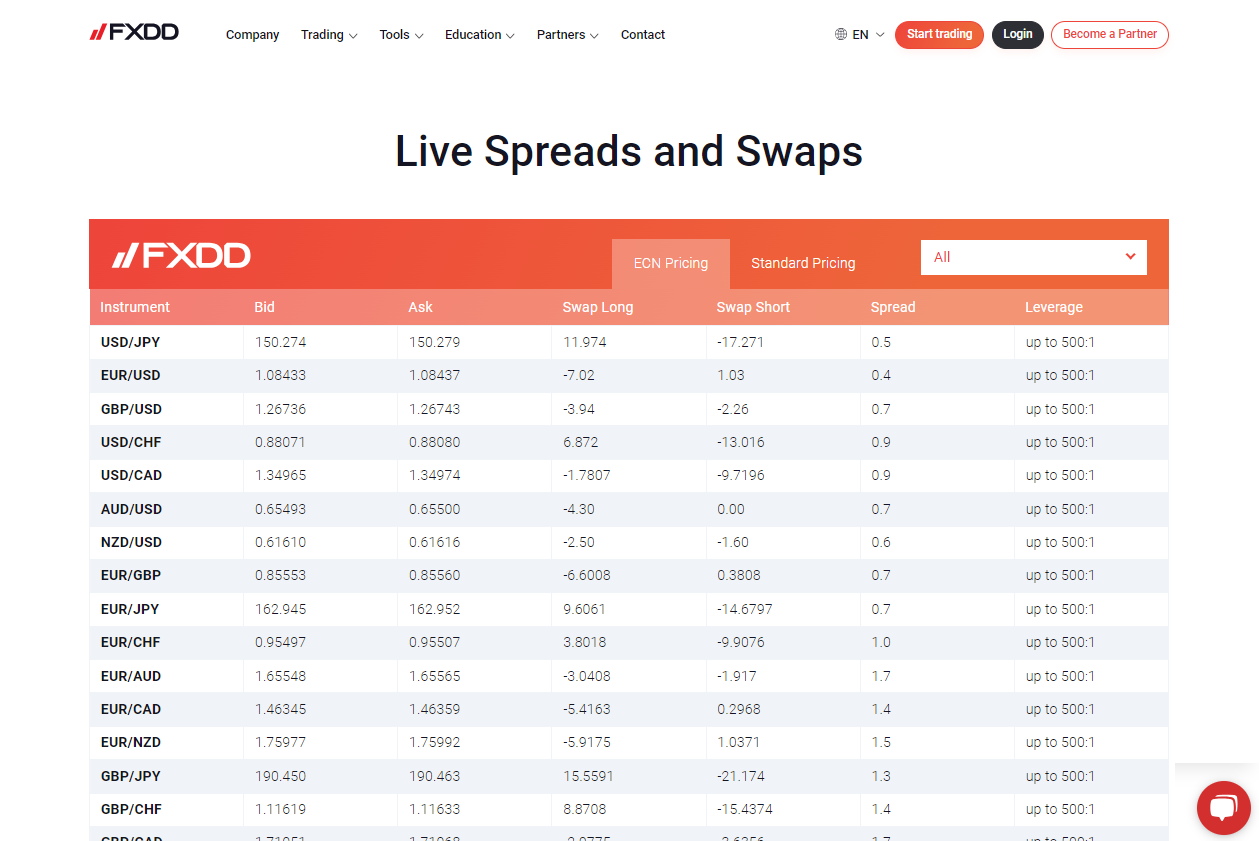

Fees, Spreads, and, Commissions

Spreads

FXDD’s spread structure is competitive, catering to traders seeking cost reduction. ECN accounts offer flexible spreads from 0.4 pips, while standard accounts start from 2.1.

This allows traders to choose the account that suits their trading style and cost preferences, ranging from lower upfront expenses to tighter spreads.

Commissions

FXDD’s ECN accounts offer a straightforward commission plan, charging $0.0299 per 1,000 currency units transacted. This pricing structure ensures traders can accurately determine their trading expenses and is competitive, especially for active traders dealing in large quantities.

Overnight Fees

FXDD charges overnight fees, or rollover rates, for forex trading positions that remain open overnight. These costs are determined by the interest rate difference between the two currencies.

FXDD provides transparency in these costs, which can be paid or debited based on position direction and current interest rates.

Deposit and Withdrawal Fees

FXDD offers no deposit fees, making it easier for traders to open accounts. However, a $40 fee is imposed for withdrawals under $100, which traders should consider when planning their money management, especially for frequent or modest withdrawals.

Inactivity Fees

FXDD charges accounts dormant for over 90 days a $30 inactivity fee to encourage active trading. Infrequent traders should be aware of this cost, which could impact their profitability if not managed properly.

Currency Conversion Fees

FXDD charges currency conversion fees for transactions involving a different currency than the trader’s account base. These fees affect the net amount received from a positive deal or the real cost of a trade if the trader’s account currency differs from their native currency.

Leverage and Margin

FXDD offers varying leverage levels based on the trader’s category and instrument. Forex trading has a maximum leverage of 1:30 for retail accounts, while professional accounts can reach 1:500. Other products have lower leverage levels, with individual equities at 1:5.

Leverage can compound gains and losses, and negative balance protection prevents losses beyond deposits.

Are there any restrictions on leverage imposed?

Yes, FXDD applies leverage controls per regulatory standards to guarantee safe trading behavior.

What is the margin call level?

FXDD sets the margin call level to 100%, requiring traders to contribute additional funds to retain their holdings.

Which Markets Can You Trade?

FXDD offers the following trading instruments and products:

- 55 currency pairs

- 7 precious metal assets

- 3 energy instruments

- 11 global indices

- 51 stocks

With FXDD, traders can access four cryptocurrencies that can be traded against USD and EUR, with leverage of up to 1:4.

Are there any restrictions on trading certain assets?

FXDD does not impose limits on trading certain assets, offering traders greater flexibility in their investing decisions.

FXDD Deposit and Withdrawals

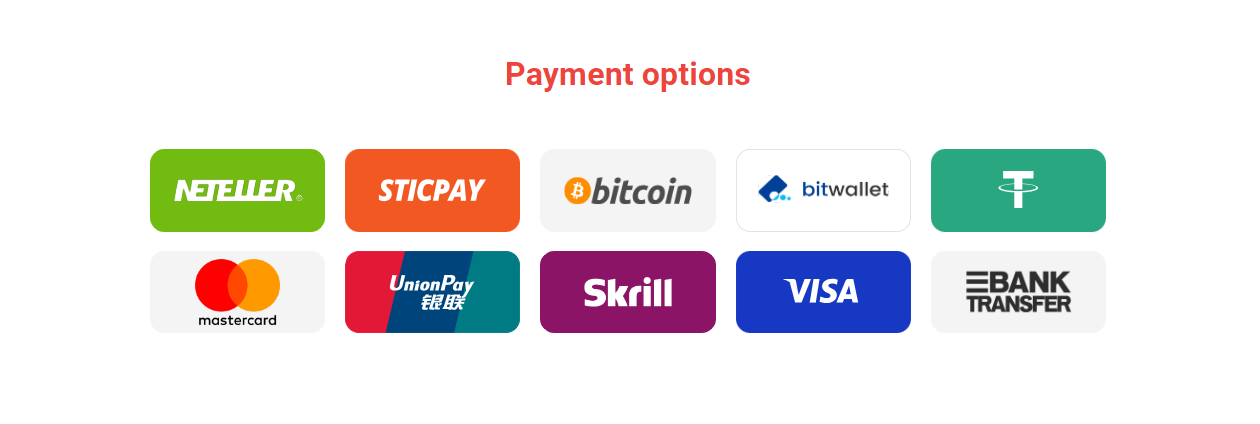

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💰 Credit/Debit Card | All | Multi-currency | Instant – a few days |

| 💴 Sticpay | All | Multi-currency | Instant – a few hours |

| 💵 BitWallet | All | Multi-currency | Instant – a few hours |

| 💶 Crypto Wallets | All | Multi-currency | Instant – a few hours |

| 💷 UnionPay | All | Multi-currency | Instant – a few hours |

| 💰 Neteller | All | Multi-currency | Instant – a few hours |

| 💴 Skrill | All | Multi-currency | Instant – a few hours |

| 💵 Bank Wire | All | Multi-currency | Instant – a few days |

Deposit Options

Bank Wire

- Log in to your FXDD trading account and go to the ‘Funds Management‘ or ‘Deposits‘ area.

- Choose ‘Bank Wire’ as your deposit method.

- Obtain the bank wire information supplied by FXDD.

- Use these data to begin a bank wire transfer from your account.

- Enter the amount you’d like to deposit into your FXDD account.

- Complete your transaction and keep the receipt or confirmation number for your records.

- If applicable, notify FXDD of the transfer by emailing a copy of the receipt or confirmation.

Credit or Debit Card

- Access your FXDD account and navigate to the ‘Deposit’ area.

- Select “Credit or Debit Card” from the list of deposit methods.

- Enter your card information.

- Please specify the amount you wish to deposit.

- Your card issuer may require you to complete a verification process.

- Confirm and submit the payment; the funds should be deposited to your FXDD account immediately after authorizing the transaction.

Cryptocurrency Wallets

- Log onto your FXDD account and navigate to the deposit area.

- Select ‘Cryptocurrency Wallet‘ from the available ways.

- Choose the coin you will use to make the deposit.

- FXDD will issue you a unique wallet address to which you may send your coin.

- Log into your crypto wallet and select sending or transferring funds.

- Enter FXDD’s wallet address carefully, making sure it matches perfectly.

- Enter the amount of crypto you want to send.

- Confirm the transaction in your crypto wallet; the corresponding amounts will be put into your FXDD trading account.

e-wallets or Payment Gateways

- Log in to your FXDD trading account and pick the ‘Deposit’ option.

- Select your favorite e-wallet or Payment Gateway service

- Enter the relevant information, including your e-Wallet account number or login credentials.

- Specify the deposit amount.

- You will be forwarded to your e-Wallet’s website or the payment gateway portal to confirm the payment.

- Follow the steps to confirm the purchase.

- Once the transaction is validated, the deposit will be processed, and the funds should be available in your FXDD account.

Withdrawal Options

Bank Wire

- Sign into your FXDD account and navigate to the ‘Withdraw’ option.

- Choose ‘Bank Wire‘ as your withdrawal method.

- Enter your banking information.

- Determine the withdrawal amount.

- Submit a withdrawal request.

- FXDD may require extra paperwork for verification purposes.

- FXDD will execute the withdrawal and transmit the funds to your bank account.

Credit or Debit Cards

- Access your FXDD account and select the ‘Withdraw’ option.

- Select ‘Credit or Debit Card‘ from the withdrawal options.

- If appropriate, choose the card previously used for deposits.

- Enter the withdrawal amount.

- Confirm the withdrawal information.

- When FXDD confirms the withdrawal, the funds will be paid back to the card used.

Cryptocurrency Wallets

- Log in to your FXDD account and proceed to the ‘Withdrawal’ section.

- Choose the ‘Cryptocurrency Wallet‘ withdrawal option.

- Choose the coin you want to withdraw.

- Provide your crypto wallet address.

- Enter the withdrawal amount in the coin of your choosing.

- Confirm the data and submit your withdrawal request.

- After FXDD processes the withdrawal, the cryptocurrency will be sent to your wallet.

e-wallets or Payment Gateways

- Enter your FXDD account and navigate to the ‘Withdrawal‘ option.

- Choose your e-wallet or Payment Gateway service.

- Input the required e-Wallet account information.

- Specify the amount you intend to withdraw.

- Confirm the withdrawal details and submit your request.

Are withdrawal fees charged?

Yes, FXDD imposes a withdrawal fee of $40 for withdrawals under $100 for each transaction.

Is there a maximum estimated withdrawal time?

FXDD estimates withdrawal processing times to be between 3 and 5 business days.

Educational Resources

FXDD offers its traders the AutoChartist tool, a recognized technical analysis tool that gives real-time trading information. This program helps traders find prospective opportunities using chart patterns and critical levels.

FXDD uses TraderMade to get complete market information for daily FX research, and it provides several trade ideas every day. These insights are a valuable instructional resource for traders seeking to understand market patterns and create trading techniques.

Are there any webinars or training sessions available?

No, FXDD does not provide webinars or training sessions as part of its educational materials.

Can traders access third-party research tools?

Yes, FXDD offers third-party research tools like AutoChartist for technical analysis.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| FXDD provides both MetaTrader 4 (MT4) and MetaTrader 5 (MT5), along with its proprietary trading software | FXDD's premium account levies a fee for each trade, which can build up for active traders |

| FXDD is multi-regulated in several regions, including by FINTRAC in Canada | If your account is inactive for an extended length of time, FXDD will charge you an inactivity fee |

| FXDD provides relatively competitive spreads on major currency pairings, particularly through their Premium account | While the Premium account offers superb spreads, the Standard account's spreads are larger and less competitive |

| Negative Balance Protection ensures that traders cannot lose more than what they have placed | FXDD has a smaller selection of deposit and withdrawal methods than some other brokers |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

In Conclusion

FXDD is a renowned forex and CFD broker with a diverse portfolio of tradable assets. It offers competitive trading conditions on modern platforms like MetaTrader 4 and focuses on trader education through tools like AutoChartist and daily FX analysis.

FXDD provides trading on the MetaTrader 4, MetaTrader 5, FXDD Mobile, and FXDD Web platforms.

Withdrawals at FXDD are normally processed within one business day, with a maximum predicted withdrawal time of three to five business days.

Yes, you can trade 4 cryptocurrency pairs with FXDD.

FXDD’s minimum deposit is 200 USD on the Premium and Standard Accounts.

Yes, FXDD is a safe broker with average trust based on its regulations and licenses.

FXDD offers traders access to diverse products, including forex, precious metals, energy, indexes, cryptocurrencies, and stocks.

While FXDD includes tools such as AutoChartist and daily market analysis, it prioritizes resources for experienced traders over specific training materials for beginners.

FXDD is based in Malta and has other offices in Mauritius.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |