IFC Markets Review

- IFC Markets Review – 13 key points quick overview:

- Overview

- At a Glance

- IFC Markets Account Types

- How To Open an IFC Markets Account

- IFC Markets Deposit & Withdrawal Options

- Trading Instruments & Products

- Trading Platforms and Software

- IFC Markets Spreads and Fees

- Leverage and Margin

- Educational Resources

- IFC Markets Pros & Cons

- Security Measures

- Conclusion

Overall, IFC Markets is considered an average risk, with an overall Trust Score of 79 out of 100. They are licensed by zero Tier-1 Regulators (high trust), zero Tier-2 Regulators (average trust), and two Tier-3 Regulators (low trust). The broker offers six retail accounts: Standard Account, Beginner Account, MT4/MT5 Standard Account, and MT4/MT5 Micro Account.

IFC Markets Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️IFC Markets Account Types

- ☑️How To Open an IFC Markets Account

- ☑️IFC Markets Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️Trading Platforms and Software

- ☑️IFC Markets Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️IFC Markets Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

In 2006, IFC Markets set out to improve the financial industry by combining trust and innovation. The firm started in Cyprus and quickly developed its worldwide footprint, forming a permitted subsidiary in Malaysia in 2019.

The broker has licenses from reputable regulatory agencies such as the British Virgin Islands Financial Services Commission (BVI FSC) and the Labuan Financial Services Authority (LFSA), demonstrating its dedication to regulatory compliance and providing a safe customer trading environment.

With an ultra-low minimum investment of $1 and an always-available sample account, the broker promotes accessibility, allowing traders to improve their abilities without financial restraints. Additionally, traders can choose from six retail investor account types, including micro and standard variations, allowing for more personalized trading experiences.

IFC Markets’ solid technical infrastructure enables lightning-fast order execution across platforms such as NetTradeX and MetaTrader 4 and the freedom to participate in different trading strategies such as scalping and hedging.

Overall, as a recognized global provider of Forex and CFD trading services, they are committed to its basic principles while embracing innovation to improve the client experience and preserve its market leadership.

What makes IFC Markets unique among brokers?

IFC is well-known for its own NetTradeX trading platform, available alongside established platforms like MetaTrader 4 and MetaTrader 5, as well as its novel Portfolio Quoting Method for constructing and trading Personal Composite Instruments.

What kind of customer support does IFC Markets offer?

The broker provides multilingual customer service via live chat, email, and phone, meeting traders’ requirements around the clock.

At a Glance

| 🗓 Established Year | 2006 |

| ⚖️ Regulation and Licenses | BVI FSC, LFSA |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | Monday – Friday 6 am – 7 pm CET, Weekends 7 am – 15h30 CET |

| 💻 Trading Platforms | NetTradeX, MetaTrader 4, MetaTrader 5 |

| 🛍 Account Types | Standard Account (Fixed and Floating), Beginner Account (Fixed and Floating), MT4 Standard Account (Fixed), MT4 Micro Account (Fixed), MT5 Standard Account (Floating), MT5 Micro Account (Floating) |

| 🤝 Base Currencies | USD, EUR, JPY, uBTC |

| 📊 Spreads | From 0.4 pips |

| 📈 Leverage | Up to 1:400 |

| 💸 Currency Pairs | 49; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 1 USD |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English, Russian, Spanish, German, Korean, French, Italian, Czech, Portuguese, Indonesian, Vietnamese, Taiwanese, Malay, Chinese, Hindi, Arabic, Turkish |

| 💰 Fees and Commissions | Spreads from 0.4 pips, zero commission fees |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Japan, the United States, BVI, Russia |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, Precious Metal CFDs, Indices CFDs, Stock CFDs, Crypto CFDs, Commodity CFDs, Commodity Future CFDs, Gold, ETF CFDs, Crypto Future CFDs, Synthetic Instruments |

| 🎖 Open an Account | Open Account |

IFC Markets Account Types

NTTX Beginner NTTX Standard MT4 Micro MT4 Standard MT5 Micro MT5 Standard

✅ Availability Beginners All Traders Beginners, those with small capital amounts All Traders Beginners, those with small capital amounts All Traders

🛍 Markets All All All All All All

💸 Commissions None; only the spread is charged None; only the spread is charged None; only the spread is charged None; only the spread is charged None; only the spread is charged None; only the spread is charged

💻 Platforms All All All All All All

📊 Trade Size From 0.01 lots – 100 units From 0.01 lots – 10,000 units 0.01 lots 0.01 lots 0.01 lots 0.01 lots

📈 Leverage 1:400 1:200 1:400 1:200 1:400 1:200

💰 Minimum Deposit 1 USD 1,000 USD 1 USD 1,000 USD 1 USD 1,000 USD

🎖 Open an Account Open Account Open Account Open Account Open Account Open Account Open Account

IFC Markets Beginner Account

Overall, the Beginner Account has been created for individuals fresh to trading and provides them with a simple starting point.

Additionally, a minimum investment of only $1 and fixed and floating spreads are required, allowing beginners to grasp the market’s workings without much risk.

By offering micro-lot trading, this account also allows new traders to gain experience through smaller transactions rather than bigger ones, making it a perfect learning platform.

IFC Markets Standard Account

Overall, experienced traders can use the flexible Standard Account, which offers fixed and floating spreads. The account requires a minimum commitment of $1,000 and is suitable for serious investors with access to 1:200 leverage.

Furthermore, with a margin call threshold set at 20%, fifth decimal pricing precision, and comprehensive risk management tools at their disposal, these savvy individuals are empowered by ample flexibility in their balanced trading strategies, allowing them to choose between steady spreads and market-driven prices.

IFC Markets MT4 Micro Account

Overall, traders seeking to enter the market with limited funds can use the MT4 Micro Account.

With a $1 minimum investment requirement and the ability to trade micro-lots, this account provides well-suited fixed spreads for individuals wishing to test strategies or engage in smaller volume trades.

Furthermore, they can do this without exposing themselves to significant risk. In addition, traders can benefit from the powerful features of the MT4 platform while enjoying these advantages.

IFC Markets MT4 Standard Account

Furthermore, the MT4 Standard Account suits customers familiar with the renowned MetaTrader 4 platform and favours a fixed spread format. By making a minimum deposit of $1,000, you can conduct trades across diverse assets with an average fixed spread.

This account category is perfect for traders seeking to calculate their expenses on spreads while possessing knowledge about the advanced features and tools offered by MT4’s platform.

IFC Markets MT5 Micro Account

Individuals with limited funds can still access the advanced features of MetaTrader 5 through the MT5 Micro Account. This alternative allows traders to deposit as low as $1 and take advantage of variable spreads, making it attractive for beginners or those looking to trade in small amounts.

The account also permits micro-lot trading and offers an extensive range of instruments, ideal for cost-saving individuals who want to use the innovative functionalities offered by the MT5 platform.

IFC Markets MT5 Standard Account

For traders needing advanced analytical tools and cutting-edge trading technology to execute complex strategies, the MT5 Standard Account is a great option.

With a minimum deposit requirement of $1,000, this account provides access to several MetaTrader 5 platform features like various timeframes and technical indicators.

Notably inferable from floating spreads options that point towards more dynamic markets suited for ambitious investors who want something extra from their investments.

IFC Markets Demo Account

The broker is proud to present its Demo Account that expertly emulates the rigorous conditions of real trading without any pesky financial hazards.

By utilizing virtual currency provided by this account on sprawling and sophisticated platforms such as MT4, MT5, and NetTradeX- even amateur investors seeking practice or seasoned veterans testing potential strategies can experiment risk-free with no penalty for error.

Moreover, due to an indefinite period complemented by a replenishable balance feature furnished in the said platform, it proves itself an exceptional tool especially useful for instructional purposes targeted at professionals attempting self-improvement or junior traders just starting their trading careers.

IFC Markets Islamic Account

The Islamic Account has been specially designed to cater to the needs of traders who prioritize Sharia compliance in their transactions. This account is completely free from swap charges, ensuring compliance with ethical financial standards prescribed by Islamic law.

It offers all the features and functionality other accounts provide without hidden costs. It guarantees a transparent trading platform for Muslim community members that upholds moral principles at every stage of its operations.

IFC Markets Professional Account

The broker offers a Professional Account tailored for premium traders, featuring a higher minimum deposit criteria that enables bespoke trading conditions.

Clients who exceed $50,000 are entitled to VIP membership status with perks such as dedicated account managers and negotiable trade terms.

Advantages include access to a Virtual Server and utilization of proprietary GeWorko Methodology to construct customized instruments. Therefore, bolstering the distinctiveness of this exclusive offering is ideally suited for astute high-volume traders seeking exemplary accommodations.

What types of trading accounts do IFC offer?

The broker provides a variety of account types, including Standard, Beginner, Micro, Demo, and Islamic accounts, each designed to satisfy the unique needs of traders.

Does IFC Markets offer accounts with different leverage options?

Yes, IFC Markets’ leverage choices vary by account type, with certain account types offering leverage of up to 1:400.

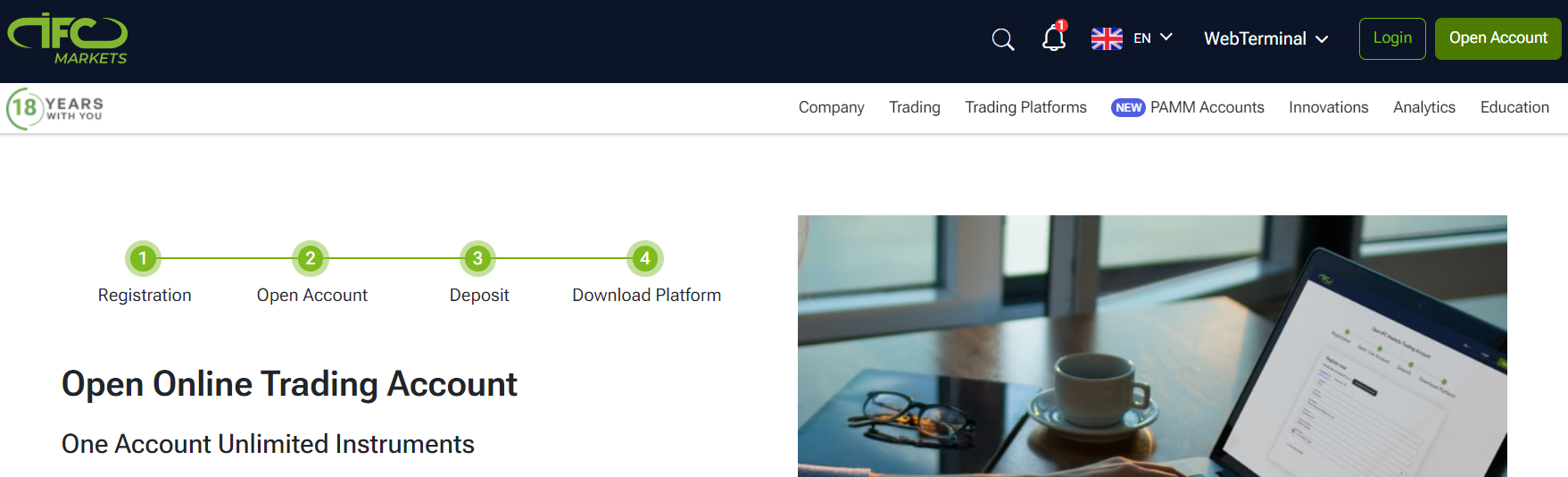

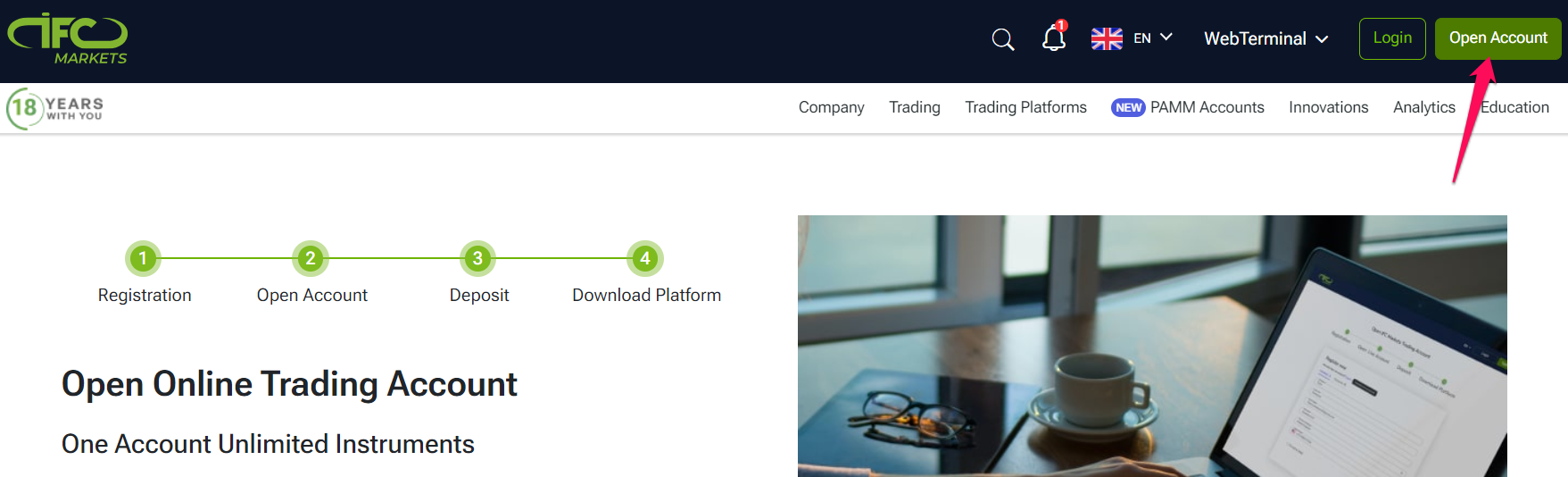

How To Open an IFC Markets Account

To register an account, follow these steps:

Step 1 – Click on the open account button.

Go to the IFC Markets website and click on “Open Account.”

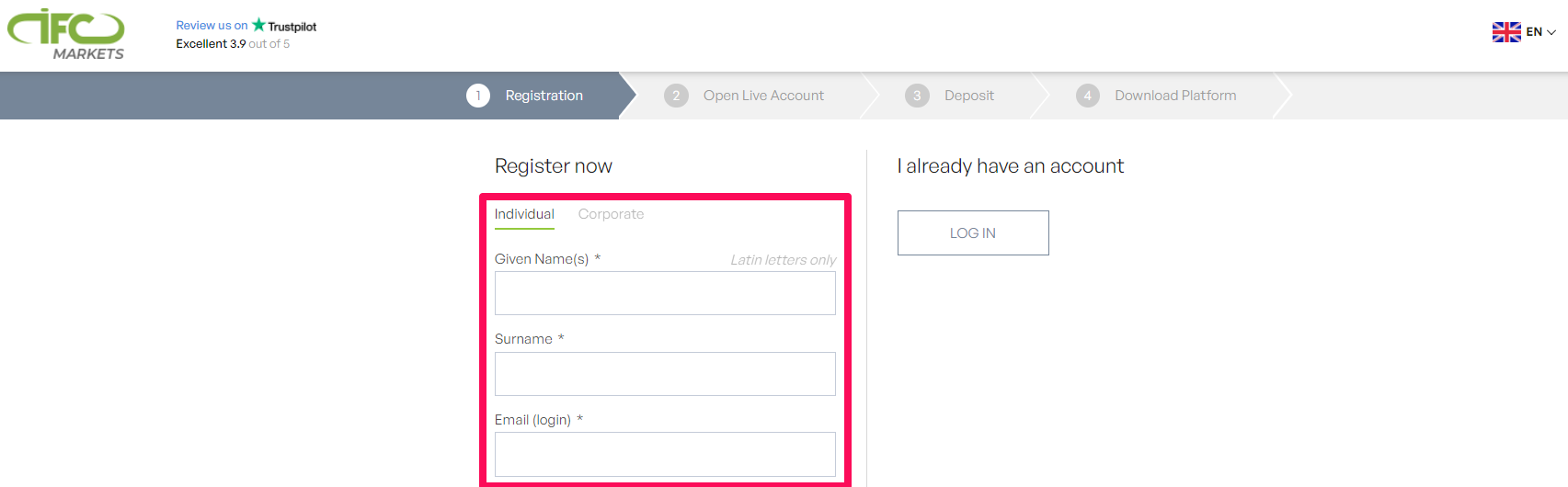

Step 2 – Fill out the form.

Fill out the registration form with basic information like your name, email, and country.

Step 3 – Select a trading platform.

In the “My Accounts” area, select either “Open Live Account” or “Open Demo Account.” Select your favourite trading platform (NetTradeX, MetaTrader 4, or MetaTrader 5) and account type (Beginner, Standard, etc.). Set your account’s currency and leverage (if applicable).

IFC Markets Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time

Bank Transfer All USD, EUR 2 – 3 days

Credit/Debit Card All USD, EUR, JPY Instant – 5 days

Pasargad Novin - USD 1 hour

Mobile Money/M-PESA African countries USD, EUR Instant – less than a day

African Local Bank Transfer African countries USD, EUR Instant – less than a day

Crypto All USD, EUR, JPY, uBTC Instant – less than a day

TopChange All USD Instant

Perfect Money All USD, EUR Instant

BitWallet All USD, EUR, JPY Instant

WebMoney All USD Instant

ADVCash All USD, EUR Instant

Deposit Methods:

Bank Wire

✅To initiate a bank wire transfer, log in to your account and navigate to the “My Money” area.

✅Click “Deposit” and select “Bank Wire Transfer.”

✅Choose your account currency and input your desired deposit amount.

✅Review the transfer details and beneficiary information given by the broker.

✅Start the transfer from your bank, ensuring all details follow the instructions. The deposit usually appears in your account within 2-3 business days.

Credit or Debit Card

✅To use your credit or debit card, log in to your account and navigate to the “My Money” area.

✅Select “Credit/Debit Card” and input your card information securely.

✅Verify the amount and complete the transaction. Funds are normally credited to your account immediately.

Cryptocurrency Wallets

✅Go to “Deposit” for cryptocurrency wallets and choose your favourite cryptocurrency (e.g., Bitcoin, Ethereum).

✅Copy the unique deposit address supplied.

✅Send the specified amount from your cryptocurrency wallet to the copied address. Depending on network confirmation timings, deposits usually reflect within minutes to 24 hours.

e-Wallets or Payment Gateways

✅Select “Deposit” and your favourite e-wallet (e.g., Perfect Money, ADVCash).

✅Log into your e-wallet account and follow the on-screen instructions.

✅Confirm the transaction’s information and amount. Deposits are normally reflected promptly on your account.

Withdrawal Methods:

Bank Wire

✅To initiate a bank wire transfer, navigate to “My Money” and select “Withdraw.”

✅Select “Bank Wire Transfer” and the account you wish to withdraw from.

✅Enter the withdrawal amount and bank account information properly.

✅Review the information and submit your request. Withdrawals usually take 2-3 business days to process and reach your bank account.

Credit or Debit Cards

✅To withdraw funds with a credit or debit card, navigate to “My Money” and select “Withdraw.”

✅Select “Credit/Debit Card” and the card you used to deposit (if applicable).

✅Enter the withdrawal amount and then confirm the transaction. Depending on your card issuer, processing times range from one to five business days.

Cryptocurrency Wallets

✅To withdraw cryptocurrency from your wallet, navigate to “Withdraw” and choose your favourite cryptocurrency.

✅Enter the withdrawal amount and your cryptocurrency wallet address.

✅Please review the details and submit the request.

✅Funds are normally transmitted between minutes to 24 hours, depending on network confirmation timings.

e-Wallets or Payment Gateways

✅Navigate to “Withdraw” and select your favourite e-wallet.

✅Log into your e-wallet account and follow the withdrawal instructions.

✅Confirm the amount and transaction information.

✅Withdrawals are normally reflected promptly in your e-wallet account.

Can I deposit funds in currencies other than USD?

Yes, the broker offers deposits in various currencies, including USD, EUR, and JPY, providing traders with global flexibility.

What is the minimum withdrawal amount?

The minimum withdrawal amount varies based on the withdrawal type used.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – The broker provides 49 currency pairings, allowing traders to engage in the largest financial market with leverage of up to 1:400

➡️Precious Metal CFDs – Traders have access to six precious metal CFDs, which allow them to trade on price changes in metals such as gold and silver without owning the real commodity. These products are commonly used to protect against inflation and market volatility.

➡️Indices CFD – There are 14 indices accessible, providing exposure to a basket of equities spanning diverse industries and economies.

➡️Stock CFDs – With 400 stock CFDs available, traders may trade shares of major firms without owning them.

➡️Crypto CFDs – 15 crypto CFDs are available, allowing traders to participate in the cryptocurrency market.

➡️Commodity CFDs – 26 commodities are accessible for CFD trading, including energy and agricultural items. Trading commodities CFDs may provide insights into global economic patterns and are frequently used for diversification and hedging.

➡️Commodity Future CFDs – Over 50 commodity futures are available, allowing traders to bet on the future price of commodities.

➡️Gold – With a focus on gold, the broker provides three types of gold products, allowing traders to speculate on one of the most traditional safe-haven assets that can be used to mitigate currency risk and inflation.

➡️ETF CFDs – The platform offers four ETF CFDs, allowing traders to invest in a portfolio of assets that track an index, a commodity, bonds, or a basket of assets similar to an index fund, combining the advantages of stock and index trading.

➡️Crypto Future CFDs – Three crypto future CFDs are offered, allowing traders to bet on the long-term price fluctuations of cryptocurrencies without the risks associated with holding the underlying digital assets.

➡️Synthetic Instruments – Over 30 synthetic instruments are available through the Portfolio Quoting Method, which allows traders to construct and trade their composite instruments (PCI).

Can I trade precious metals with IFC Markets?

Yes, trading precious metal instruments such as gold and silver is possible through CFD products.

Are there ETFs available for trading?

Yes, the broker allows you to trade CFDs on various ETFs.

Trading Platforms and Software

MetaTrader 4

The MT4 offered is renowned in the trading community for its resilience and reliability. It boasts diverse technical analysis tools, algorithmic trading capabilities, and expert adviser utilization capacities.

Notably, it is accessible to traders at all levels due to its user-friendly interface with customizable features that facilitate personalization options.

Furthermore, this platform offers potent charting mechanisms and an extensive suite of indicators enabling comprehensive market research, making it highly coveted among forex and CFD traders.

MetaTrader 5

The MT5 platform offered is an advanced tool that enhances the capabilities of its predecessor while simultaneously introducing new and improved features. Among these enhancements are expanded instrument selections comprising equities and commodities.

Moreover, this is a key advantage for those desiring multi-asset trading opportunities. MT5 offers traders added technical indicators alongside numerous graphical elements with diverse timing possibilities to support in-depth market analysis.

Furthermore, it includes upgraded strategy tester functionality tailored to expert advisors and increased order processing capacity to meet professional trader demands seeking innovative functionalities from their chosen trading platforms.

NetTradeX

NetTradeX distinguishes itself through its exceptional trading solutions, which are especially attractive to traders searching for a tailored experience. Developed by IFC Markets, this platform is acclaimed for its intuitive interface that accommodates beginner and seasoned traders.

It streamlines the creation of Personal Composite Instruments (PCIs), enabling investors to craft bespoke investment portfolios while augmenting their analytical capabilities with advanced charting tools and expert technical analysis.

Furthermore, NetTradeX boasts an extensive range of order types, affording traders ample flexibility when it comes time to implement various trading strategies.

Can I trade on mobile devices with IFC Markets?

Yes, the broker offers mobile trading via its NetTradeX, MT4, and MT5 mobile applications.

Does IFC Markets support automated trading?

Yes, automated trading is enabled by both the MetaTrader and NetTradeX platforms provided.

IFC Markets Spreads and Fees

Spreads

Overall, the spreads have been strategically designed to offer a competitive edge for traders of diverse proficiencies. The options available include fixed and variable spreads, with rates varying depending on the type of account selected.

For instance, NetTradeX Standard and Beginner accounts feature floating spread rates as low as 0.4 pip. In contrast, fixed spread rates can go to 1.8 pips – an affordable choice providing consistent pricing transparency that seasoned traders value.

These tight-spread offerings hold potential benefits over time since they reduce transaction expenses, making them especially favourable for frequent buying-and-selling short-term trading practices.

Commissions

The broker has adopted a commission-free trading model that may be particularly attractive to traders with high transaction volumes. This approach simplifies the cost structure, allowing traders to focus on spreads as their primary trading expense.

The broker prioritizes its clients’ interests by eliminating commission fees and establishing a clear and manageable trading environment, especially for busy traders who would otherwise face substantial charges.

Overnight Fees

Overall, the IFC Markets website presents clear and transparent information on the overnight costs associated with each financial instrument.

Additionally, these charges, which may be in a credit or debit format depending upon trade directionality and existing market conditions, are derived from any underlying interest rate disparities between currencies involved in foreign exchange transactions.

Traders must consider these expenses when holding positions overnight since they can prospectively curtail profitability outcomes, especially concerning extended-term exchanges.

Deposit and Withdrawal Fees

Deposits and withdrawals incur costs that are contingent on the chosen method. Notably, Perfect Money transactions attract fees ranging from 0.5% to 1.99%, whereas WebMoney imposes charges up to a maximum of 0.8%.

It is prudent for traders to recognize these fees as undertaking frequent deposits and withdrawals could culminate in substantial expenses over time. Therefore, traders must devise an optimal capital management strategy to minimize transactional expenditures effectively.

Inactivity Fees

One key advantage extended to IFC Markets’ clientele is no inactivity fees. This policy primarily caters to traders who engage in infrequent or passive trading activities.

By not charging penalties for account dormancy, clients are afforded greater flexibility and freedom when executing trades at their convenience without concerns about accruing charges due to prolonged periods of non-activity on their accounts.

Currency Conversion Fees

Traders must factor in currency conversion costs when operating their accounts with a foreign denomination.

Charges are charged on transactions executed using currencies other than the deposit’s base denomination, which may be subject to variation depending on market rates, although not explicitly specified.

Thus, investors who conduct trades involving multiple denominations must account for these probable expenses while evaluating the cost efficiency of their trading techniques.

How can I view the detailed spread and fee structure of IFC Markets?

The IFC Markets website provides detailed information on spreads and fees in the trading conditions section for each financial instrument.

Are there any hidden fees I should know when trading with IFC Markets?

No, the broker is transparent, revealing all potential trading fees upfront, including spreads, overnight fees, and any deposit or withdrawal charges.

Leverage and Margin

Overall, they provide various leverage solutions with varying margin requirements based on account balance and trading techniques. Beginner and Micro accounts have a maximum leverage of 1:400, requiring a minimum margin of 0.25%.

Standard and PAMM accounts have a leverage of 1:200 for deposits under $50,000, requiring a 0.5% margin. Additionally, leverage becomes less accessible as account balance increases, potentially as a risk-reduction tactic.

Furthermore, leverage decreases to 1:100 for deposits between $50,000 and $100,000 and to 1:50 for balances beyond $100,000.

Additionally, the broker has a 10% stop-out level to prevent negative balances and allows traders to request a larger short-margin amount for their NetTradeX accounts.

Moreover, margin requirements are adjusted based on the total amount of active positions, with the maximum leverage lowered to 1:20 if open positions are equal to or above $20,000,000. Margin requirements may fluctuate on weekends and holidays, affecting leverage and forcing traders to adjust their holdings.

In addition, locked positions have a margin equivalent to one position, reducing the required margin for hedges. This, in turn, means that leverage is standardized at 1:20 for MetaTrader 4, MetaTrader 5, and NetTradeX accounts for stock CFDs, aligning with the increased risks in financial markets.

The broker also establishes a preset margin for highly volatile instruments separate from account leverage to protect traders from market changes.

Can I change the leverage on my account?

Traders can seek a change in account leverage by contacting support, subject to approval based on the trader’s experience and risk tolerance.

What is a margin call?

A margin call is a warning when your account equity falls below a specific proportion of the margin necessary to keep open positions, requiring you to deposit more cash or liquidate holdings.

Educational Resources

They offer the following educational resources:

➡️Video Tutorials – Overall, the Video Tutorials are a visual aid for understanding the complexities of trading. From the fundamentals of getting started in trading to more advanced trading techniques and platform-specific instructions, these courses cover a wide range of subjects.

➡️Forex and CFD Trading Books – For individuals who would like to study through a more conventional method, the broker offers Trading Books for CFDs and Forex. These written resources explore the core concepts of forex and CFD trading, giving readers a strong knowledge base to make logical and successful trading decisions.

➡️The Trader’s Glossary provides precise explanations of the many terminology and jargon used in the trading environment and is a vital resource for both novice and experienced traders. This tool facilitates understanding technical jargon frequently used in trading-related transactions.

➡️Overall, IFCM Trading Academy offers a thorough learning route with a sequence of steps intended to develop a trader from the first stages of trading to more complex ones. This methodical technique guarantees that a trader may acquire information gradually and use it wisely in the markets.

Is there a trading academy or course available?

Yes, the broker offers access to an online trading academy where traders may learn about forex and CFD trading from the basic to intermediate levels.

Does IFC Markets offer analysis and research tools as part of their educational resources?

Yes, they offer several analysis and research tools, such as market projections, technical analysis, and financial news, to assist traders in making educated decisions.

IFC Markets Pros & Cons

✔️ Pros ❌ Cons

The Portfolio Quoting Method gives traders the ability to design custom instruments or synthetic pairings, adding a fresh perspective to individual trading plans A few traders have complained about bad customer support, delayed withdrawals, or unfavorable bonus terms

The broker offers quick and dedicated support to clients globally through multilingual customer service that is available by phone, email, and live chat Although IFC Markets is subject to regulation, risk-averse traders may be concerned about the lack of strict regulatory control compared to other brokers governed by organizations such as the FCA or ASIC

Beginners can benefit from IFC Markets' demo account Certain withdrawal methods have costs attached to them

IFC Markets provides attractive spreads on a range of products, particularly on fixed-spread accounts, which can lower trading expenses IFC Markets has fewer options for deposits and withdrawals than some brokers

IFC Markets offers a range of account types to accommodate varying trading philosophies and degrees of expertise Certain bonuses include stringent requirements that make it difficult to take withdrawals of the bonus money or any associated gains

Flexible leverage options are available from IFC Markets (up to 400:1 for some securities) IFC Markets has a lower range of cryptocurrencies available for trading than certain dedicated cryptocurrency brokers

IFC Markets provides instructional resources to assist traders in advancing their knowledge and abilities, including webinars, articles, and tutorials IFC Markets' worldwide reach is limited since it does not provide its services to citizens of some nations, including the USA

IFC Markets gives traders freedom and choice with well-known platforms, including MetaTrader 4, MetaTrader 5, and their own NetTradeX Spreads can be competitive, but for some instruments or account types, they can also be greater

IFC Markets offers chances for diversification by enabling trading in cryptocurrencies, equities, indices, commodities, Forex, and CFDs, among other markets

Security Measures

Overall, the broker has implemented numerous security measures to safeguard its clients’ funds and mitigate trading risks.

Furthermore, the regulatory oversight provided by the British Virgin Islands Financial Services Commission (BVI FSC) serves as a crucial element of their safety infrastructure. This phrasing emphasizes the additional benefit of the BVI FSC’s oversight.

IFC Markets has implemented a margin call mechanism beyond merely complying with regulations.

This technique alerts traders if their account equity falls below a predetermined threshold, enabling them to undertake appropriate actions such as depositing additional funds or closing positions to avoid future losses.

Furthermore, accompanying this is a stop-out level which facilitates automatic liquidation of open positions by brokers if the account hits specific loss levels, thereby preventing negative balance situations for traders.

Moreover, it has been noted that the broker offers negative balance protection to its clients.

This valuable feature effectively safeguards clients from losing more than their initial investment and precludes them from incurring a debt with the broker during periods of substantial market instability.

Such an approach is advantageous as it protects traders against unforeseen market fluctuations.

What security measures does IFC Markets implement to protect traders’ funds?

The broker employs segregated accounts to isolate client funds from the company’s operating finances and SSL encryption for data security.

Are IFC Markets regulated?

Yes, the BVI Financial Services Commission regulates the broker to ensure financial rules and procedures compliance.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Overall IFC Markets provide a more detailed picture of its Forex and CFD trading services and products. Furthermore, the Portfolio Quoting Method is a novel tool that allows traders to design unique instruments, which may benefit those looking to modify their trading strategy.

For more information on FXLeaders.

Yes, you can trade several cryptocurrency CFDs. However, the selection may be limited compared to professional crypto brokers.

Withdrawal timeframes vary depending on the method. However, they typically range from immediate to five working days.

The minimum deposit to trade is $1, making it an accessible starting point for traders of all experience levels.

Yes, leverage is available for various instruments, but more leverage magnifies both possible profits and losses, raising risk.

IFC Markets is a safe broker, licensed by the BVI FSC and LFSA, and uses a variety of safeguards, including segregated accounts and indemnity insurance.

Yes, incentives are offered but be aware of the rigorous requirements before joining.

The broker allows traders to trade various assets, including forex, precious metals, index and stock CFDs, cryptocurrency CFDs, and synthetic instruments.

The broker provides educational tools, including webinars, articles, and tutorials, and you can also visit their official website and contact customer service for more information.

IFC Markets is based in Cyprus and has global offices, including one in the British Virgin Islands, demonstrating its international presence in the trading community.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |