- KVB Prime Review - Analysis of Brokers' Main Features

- Overview

- KVB Prime Detailed Summary

- KVB Prime Safety and Security

- KVB Prime Account Types

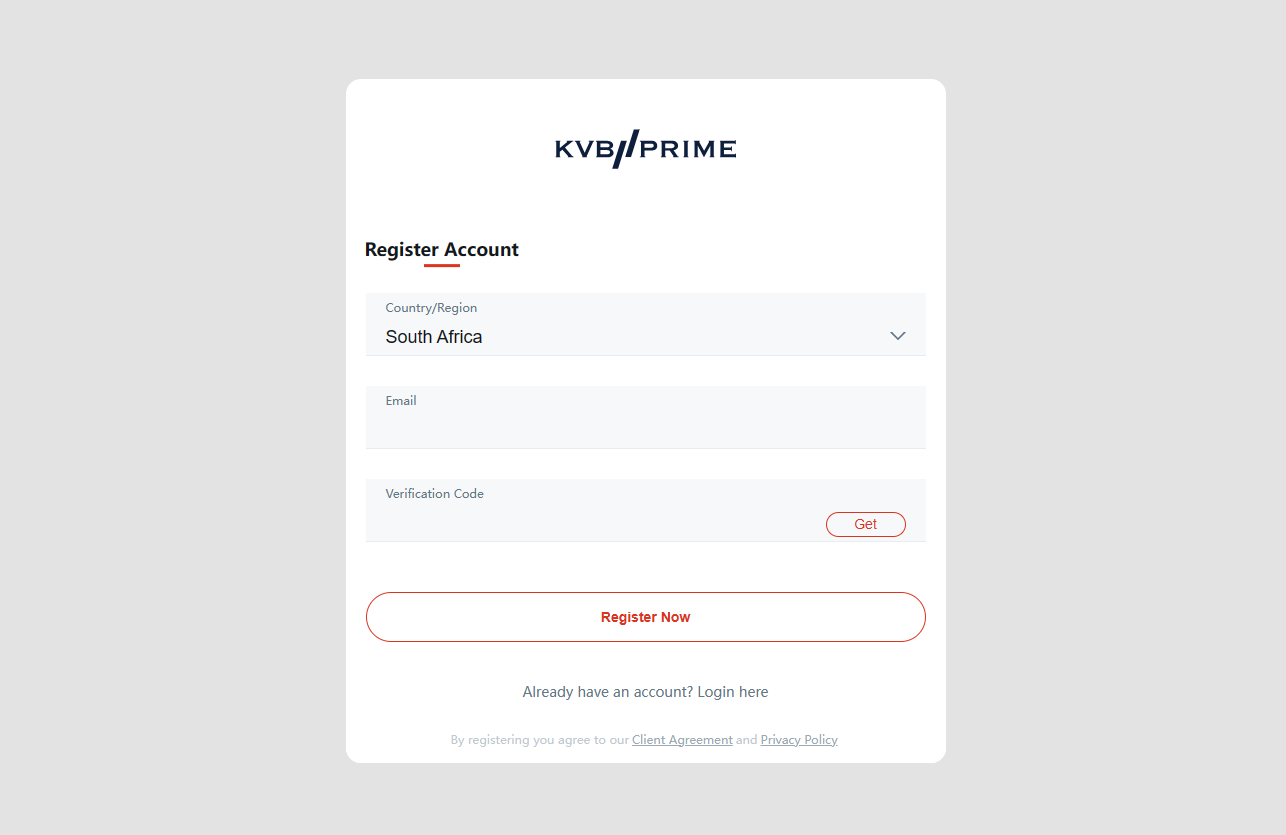

- How To Open a KVB Prime Account

- KVB Prime Trading Platforms and Software

- KVB Prime Fees, Spreads, and, Commissions

- KVB Prime Leverage and Margin

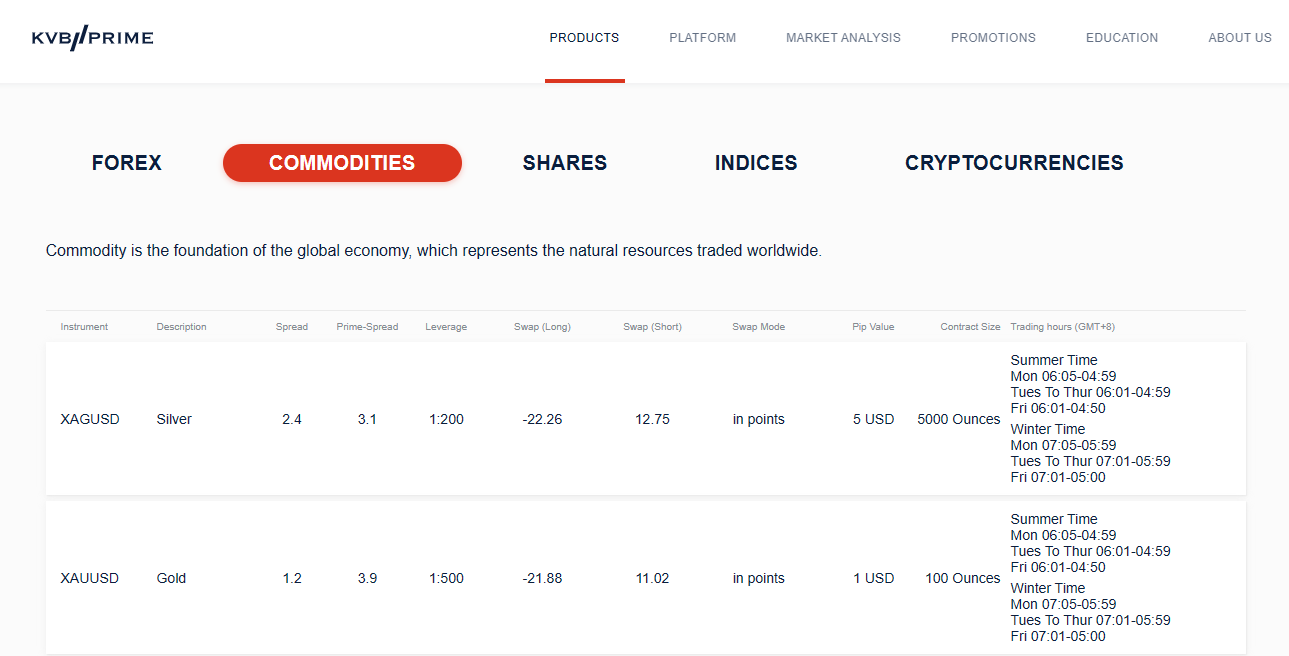

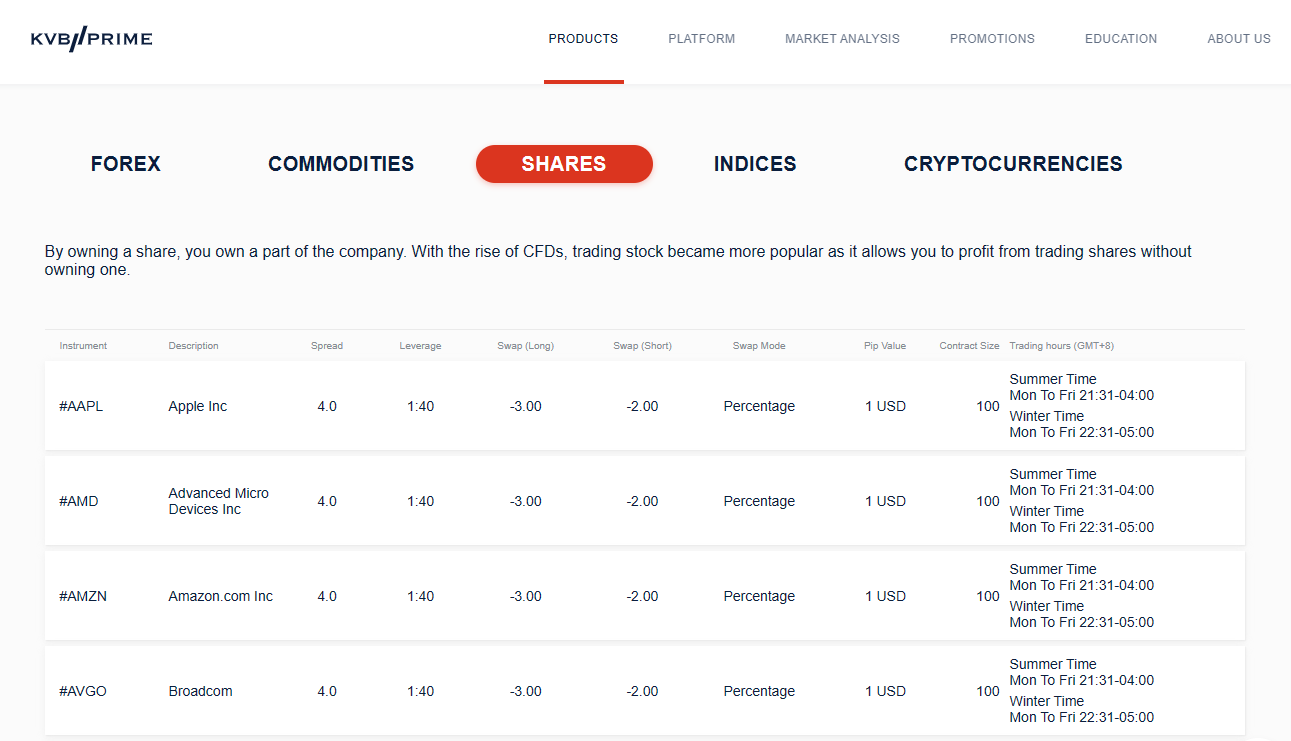

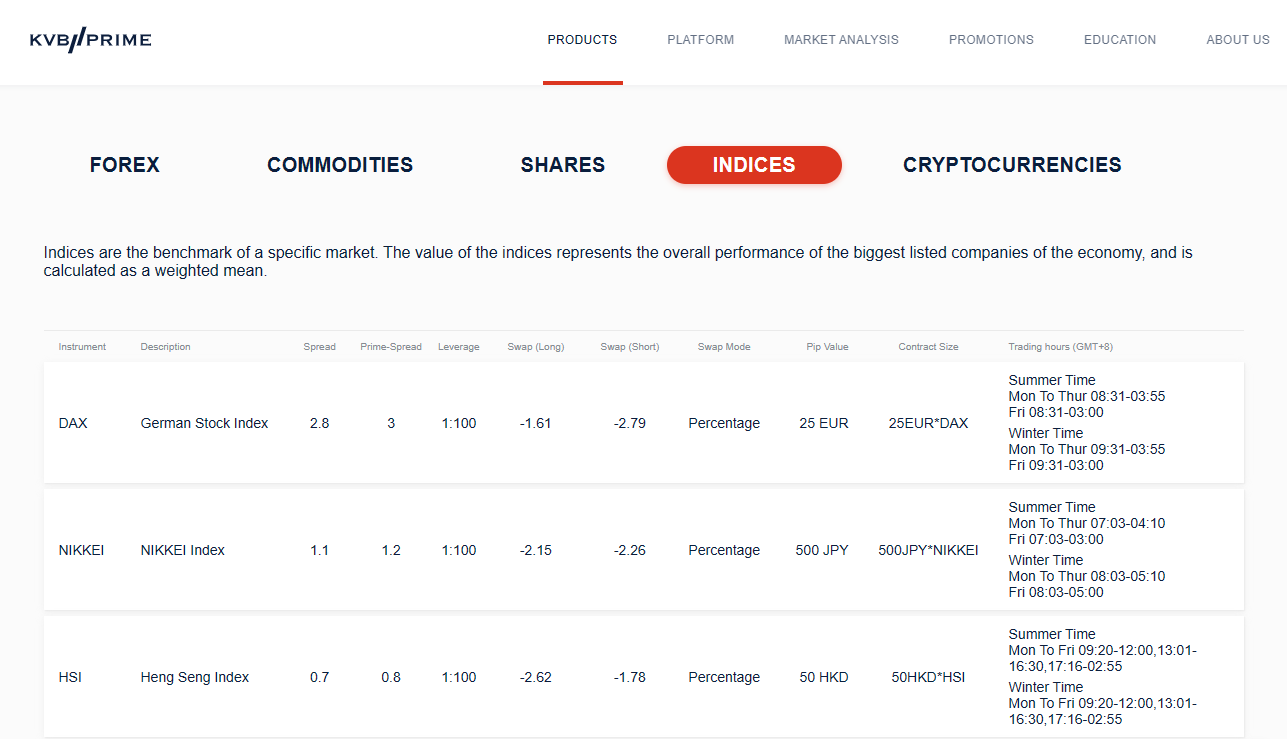

- KVB Prime Trading Instruments and Products

- KVB Prime Deposit and Withdrawal Options

- Educational Resources

- Pros and Cons

- In Conclusion

Overall, KVB Prime can be summarised as a trustworthy Forex Broker with over two decades of experience in the financial market. It offers access to a proprietary trading app and has a trust score of 65 out of 99.

| 🔎 Broker | 🥇 KVB Prime |

| 📈 Established Year | 2001 |

| 📉 Regulation and Licenses | None |

| 3️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, KVB Prime App, KVB Prime CopyTrade |

| 💹 Account Types | Prime, ECN |

| 🪙 Base Currencies | USD |

| 📌 Spreads | From 0.0 pips |

| 📍 Leverage | Up to 1:800 |

| 💴 Currency Pairs | 28; major, minor, and exotic pairs |

| 💵 Minimum Deposit | 0 USD |

| 💶 Inactivity Fee | ✅ Yes, after 6 months of inactivity |

| 🔊 Website Languages | English, Vietnamese, Bahasa Indonesia, Chinese |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions not disclosed |

| 🥰 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Canada, the EU, Hong Kong, Australia, Japan |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, shares, indices, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

KVB Prime Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open a KVB Prime Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Trading Instruments and Products

- ☑️ Deposit and Withdrawal Options

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

KVB Prime, founded in 2001, has over two decades of experience in the financial market. It has undergone significant changes, including a significant reorientation in 2014, transforming it into a global financial services company focusing on innovative technology and client-centric services.

The KVB PRIME APP offers real-time quotations, comprehensive charting, and integrated account management services, enabling traders to execute plans quickly and accurately.

KVB Prime prioritizes fund security and transparency, providing a safe and reliable investment environment. With a global presence, KVB Prime serves a large customer base in various countries, earning it recognition as a financial industry leader.

Do any financial authorities supervise KVB Prime?

No, KVB Prime is not regulated, giving traders freedom and exposing them to unregulated business hazards.

Which languages are supported by the KVB Prime website?

The website is accessible in English, Vietnamese, Bahasa Indonesia, and Chinese, serving a varied international audience.

KVB Prime Detailed Summary

| 🔎 Broker | 🥇 KVB Prime |

| 📈 Established Year | 2001 |

| 📉 Regulation and Licenses | None |

| 3️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| 🖱️ Trading Platforms | MetaTrader 4, KVB Prime App, KVB Prime CopyTrade |

| 💹 Account Types | Prime, ECN |

| 🪙 Base Currencies | USD |

| 📌 Spreads | From 0.0 pips |

| 📍 Leverage | Up to 1:800 |

| 💴 Currency Pairs | 28; major, minor, and exotic pairs |

| 💵 Minimum Deposit | 0 USD |

| 💶 Inactivity Fee | ✅ Yes, after 6 months of inactivity |

| 🔊 Website Languages | English, Vietnamese, Bahasa Indonesia, Chinese |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions not disclosed |

| 🥰 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States, Canada, the EU, Hong Kong, Australia, Japan |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, commodities, shares, indices, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

KVB Prime Safety and Security

One of KVB Prime’s primary security measures is the separation of customer funds from the company’s operating funds.

This implies that traders’ deposits are held in separate accounts with top-tier global banks, guaranteeing that client funds are not utilized for anything other than planned trading operations. Segregation adds security by safeguarding customers’ funds if the broker has financial problems.

Furthermore, KVB Prime employs cutting-edge technology to ensure low latency and narrow spreads, improving the trading experience and adding to the security and dependability of transaction executions.

Professional trading systems, such as MetaTrader 4 and the proprietary KVB Prime mobile application, help to handle transactions and accounts more securely and efficiently.

What technology does KVB Prime use to enhance transaction security?

KVB Prime employs cutting-edge technology to ensure low latency and narrow spreads, enhancing transaction security and reliability for its clients.

Does KVB Prime offer any additional security features for account protection?

Yes, KVB Prime provides professional trading systems such as MetaTrader 4 and its proprietary mobile application, which employ advanced security measures to protect accounts and transactions.

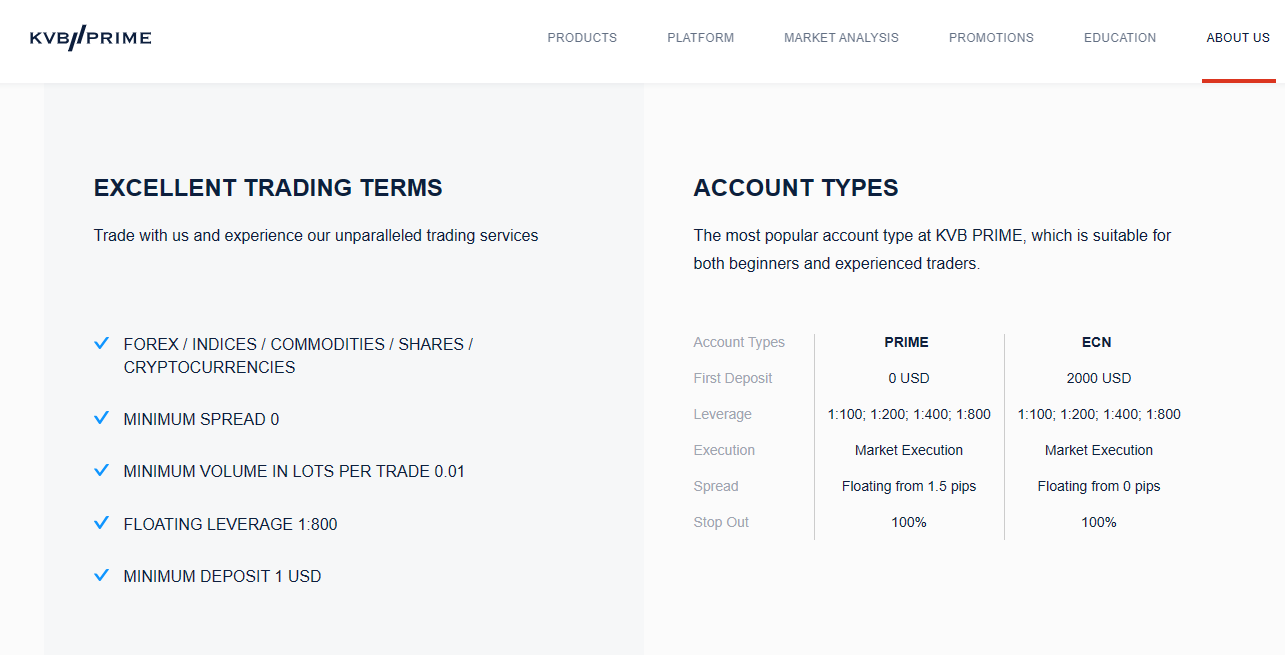

KVB Prime Account Types

| 🔎 Account Types | 🥇 Prime | 🥈 ECN |

| 💗 Availability | Ideal for casual traders and beginners | Ideal for more experienced traders and professionals |

| 📈 Markets | All | All |

| 💴 Commissions | None. Only the spread is charged | Not disclosed |

| 📉 Platforms | All | All |

| 📊 Trade Size | From 0.01 – 800 lots | From 0.01 – 800 lots |

| 💹 Leverage | Up to 1:800 | Up to 1:800 |

| 💷 Minimum Deposit | 0 USD | 2,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here |

KVB Prime Prime Account

The Prime Account is a versatile trading solution suitable for all levels of traders, offering various leverage settings and floating spreads.

It operates on Market Execution and has a 100% Stop Out level, similar to the ECN account. With an initial deposit requirement of just 100 pips, it caters to beginners and experienced traders.

KVB Prime ECN Account

The ECN Account at KVB Prime is designed for traders seeking direct market access and competitive spreads. It requires a larger deposit of $2,000 and offers leverage ratios from 1:100 to 1:800. It uses Market Execution with a floating spread and a 100% Stop Out level.

KVB Prime Demo Account

The KVB Prime Demo Account is useful for novice traders to practice trading techniques without risk. It offers real-time pricing and virtual fund feeds, allowing traders to familiarize themselves with the platform and experiment with different methods. To use a demo account, traders must create a live one.

Does KVB Prime charge any commissions for Prime accounts?

KVB Prime does not charge fees for the Prime account; spreads are applied to transactions.

What leverage is available for both Prime and ECN accounts on KVB Prime?

Prime and ECN accounts provide up to 1:800 leverage, enabling traders to increase the size of their market holdings.

How To Open a KVB Prime Account

To register an account with KVB Prime, follow these steps:

- Visit the KVB Prime website and choose the “Create Account” option.

- Select your country or area from the dropdown menu offered.

- Please provide a valid email address in the designated section.

- Input the verification code supplied to you or the platform requires.

Click the “Register” button to complete the registration process.

How long does it take to register with KVB Prime?

The registration procedure with KVB Prime is simple and takes just a few minutes to complete.

Which papers are necessary to validate my KVB Prime account?

To authenticate your account, KVB Prime may need identifying papers such as a passport or driver’s license and evidence of residence.

KVB Prime Trading Platforms and Software

KVB Prime MetaTrader 4 (MT4)

MT4, a trading platform renowned for its dependability, allows users to customize their feature-rich environment with an effortless user interface.

With MT4’s arsenal of tools for charting assets and managing positions seamlessly, traders can stay informed about quotation dynamics across nine different timeframes while overlaying analytical items.

Additionally, this versatile platform boasts over 50 native indicators and tools, allowing users to conduct technical analysis efficiently and comprehensively.

KVB Prime App

With the KVB Prime App, trading becomes seamless and convenient as it allows traders to engage in market activities from any location at their convenience.

This bespoke mobile app integrates various features such as charting, account management, and transaction capabilities alongside real-time market quotes into a singular user-friendly interface created entirely by our team.

Accessible tools like rapid position opening, one-click closing options, and price change reminders offer optimum speed and flexibility for an exceptional trading experience.

In addition to its customizable grouping and instant money settlement capabilities that facilitate personalized trading experiences, the app offers special account management features.

Moreover, customers enjoy swift access services like multiple payment choices and around-the-clock business processing, which enhance accessibility and responsiveness.

FOLLOW ME Integration

KVB Prime only offers FOLLOWME integration for MetaTrader 4 (MT4) trading accounts. Users who link their KVB Prime trading account to FOLLOWME may easily utilize COPYTRADE services, enabling them to duplicate transactions in real time.

This connection streamlines the process, allowing traders to follow trading indications and profit from market opportunities easily.

Importantly, trading costs are unchanged since FOLLOWME runs on a signal subscription model, in which users pay a monthly price to obtain real-time trade signals without incurring extra transaction fees.

Does KVB Prime support algorithmic trading?

Yes, KVB Prime supports algorithmic trading through its MetaTrader 4 (MT4) platform, allowing traders to automate their strategies and execute trades precisely.

What are the advantages of using the KVB Prime App?

The KVB Prime App offers real-time market quotes, comprehensive charting tools, and integrated account management services, providing traders with a seamless and efficient trading experience.

KVB Prime Fees, Spreads, and, Commissions

KVB Prime Spreads

Clients will be charged spread costs when they enter and close transactions. The spread, which varies according to the product and service, is not set and may be altered in response to market circumstances, such as public statistics or unexpected news.

The Prime Account charges spread from 1.5 pips EUR/USD while the ECN Account has zero-pip spreads.

KVB Prime Commissions

Clients must pay commission fees computed per comparable instrument or instruments, as agreed upon by KVB Prime and the client. The amount of commission is decided by parameters available in the customer agreement, which clients and KVB Prime decide on.

KVB Prime Overnight Fees

Clients who conduct certain transactions will be charged overnight, swap, or finance fees. These costs are levied for holding positions overnight and vary according to the instrument and position direction (long or short).

KVB Prime Deposit and Withdrawal Fees

KVB Prime does not charge any deposit fees. However, withdrawal fees might apply. To view these, traders must register an account with KVB Prime and access the information on the Withdrawal Section of their dashboard.

KVB Prime Inactivity Fees

Clients may be charged a monthly inactivity fee if there has been no trading activity on their account for at least six months. This charge is designed to pay the operating expenses of keeping the account.

KVB Prime Currency Conversion Fees

When customers conduct currency conversion operations, such as depositing funds in a currency other than their account base or trading products denominated in a foreign currency, currency conversion fees may apply.

These expenses are paid when changing one currency to another at the current exchange rate and are usually stated as a percentage of the transaction value.

What are the typical spreads on KVB Prime?

The Prime account on KVB Prime offers spreads starting from 1.5 pips for major currency pairs like EUR/USD, while the ECN account offers zero-pip spreads.

Are there any inactivity fees on KVB Prime?

Yes, clients may be charged a monthly inactivity fee if there has been no trading activity on their account for at least six months as part of KVB Prime’s fee structure.

KVB Prime Leverage and Margin

KVB Prime provides a variety of leverage ratios to meet different trading demands and risk tolerances, including 1:100, 1:200, 1:400, and 1:800. Margin requirements for trading a single lot differ per product and may be seen in the trading products section.

When traders unlock positions, they must replenish the initial one-way margin amount. For example, if a trader purchases one lot of EURUSD with a margin of $600 and then sells one lot of EURUSD with the same margin, the hedging margin needs to remain at $600.

Furthermore, automatic liquidation happens when account equity falls below the necessary margin level, stressing the significance of keeping track of account balances and margins even when hedged.

What happens if my account equity falls below the required margin level on KVB Prime?

Automatic liquidation occurs when account equity falls below the necessary margin level on KVB Prime, emphasizing the importance of monitoring account balances and margins.

Does KVB Prime offer margin call notifications to its clients?

Yes, KVB Prime provides margin call notifications to clients when their account equity approaches the required margin level, helping them manage their positions effectively.

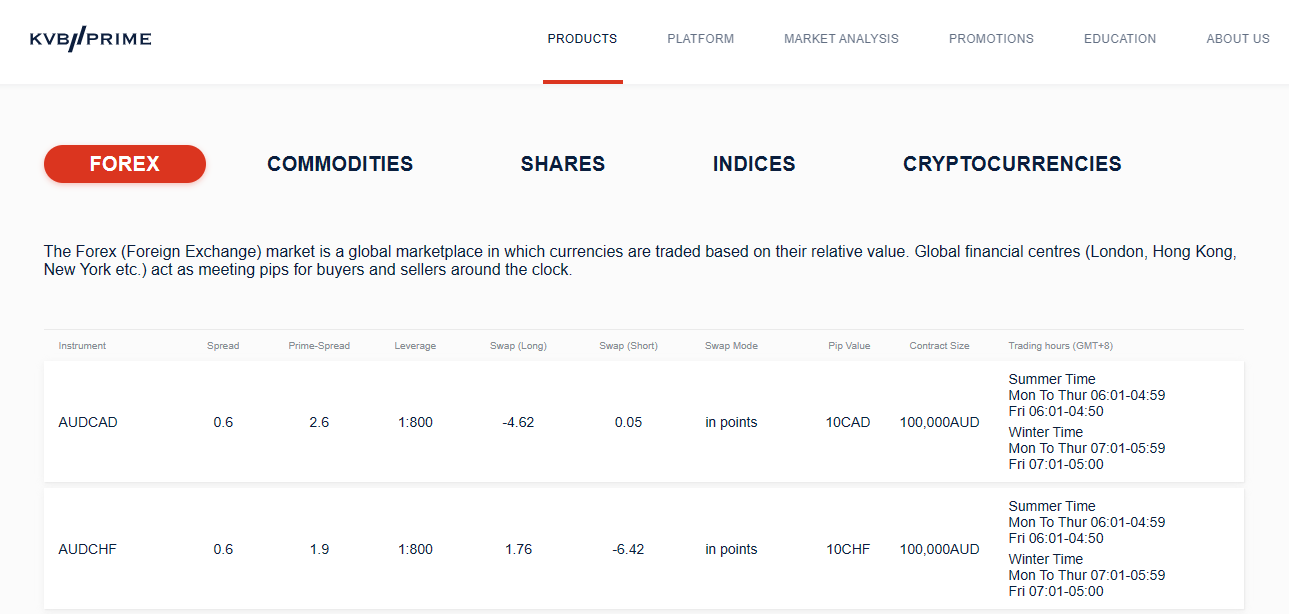

KVB Prime Trading Instruments and Products

KVB Prime offers the following trading instruments and products:

- 28 forex currency pairs, including major, minor, and exotic pairings, giving traders a broad choice of possibilities for forex trading.

- Four commodities: silver, gold, US oil, and UK oil, enabling traders to diversify their portfolios with these key raw resources.

- 40 shares, allowing traders to invest in a wide range of firms from various industries and countries, creating possibilities to profit from stock market moves.

- Different global stock market indexes, enable traders to bet on the overall performance of major stock exchanges globally.

- KVB Prime enables trading in eight cryptocurrencies, including major digital assets like Bitcoin, Ethereum, and Litecoin

Are shares available for trading on KVB Prime?

Yes, KVB Prime offers trading in 40 shares, enabling traders to invest in a wide range of firms from various industries and countries.

Can I trade cryptocurrencies on KVB Prime?

Yes, KVB Prime enables trading in eight cryptocurrencies, including major digital assets like Bitcoin, Ethereum, and Litecoin, providing exposure to the fast-growing cryptocurrency market.

KVB Prime Deposit and Withdrawal Options

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💴 Credit/Debit Card | All | Multi-currency | Instant – 3 days |

| 💵 Net Banking | All | Multi-currency | Instant – 3 days |

| 💶 USDT | All | Multi-currency | Instant – 3 days |

Deposit Methods:

Net Banking

Access your account and go to the ‘Deposit’ section, selecting ‘NB’ as the method.

- Specify the deposit amount.

- You will be redirected to your online banking site.

- Log in to your bank account to complete the transaction.

- Confirm the payment; the deposit will be processed per your bank’s processing periods.

Credit or Debit Card

Log in to the KVB Prime account dashboard.

- Navigate to the ‘Deposit’ area and choose ‘Credit/Debit Card’ as your deposit method.

- Enter the amount you want to deposit.

- Fill out your card information, including the card number, expiry date, and CVV code.

- Confirm the transaction and complete any extra authentication steps requested by your bank.

- The funds should be credited to your trading account instantly.

Cryptocurrency Wallets

In your account, choose ‘Deposit,’ then ‘Cryptocurrency’ or ‘USDT,’ if applicable.

- Enter your deposit amount.

- You will be given a wallet address to transfer the USDT to.

- Go to your cryptocurrency wallet, input the address, and transfer the USDT.

- The deposit will be credited to your account after the blockchain approves the transaction, which might take time.

Withdrawal Methods:

Bank Wire

Login to your KVB Prime trading account.

- Go to the ‘Withdrawal’ area and choose ‘Bank Wire’ as your withdrawal option.

- Fill out the withdrawal form with your bank information, including the account number and SWIFT/BIC code.

- Enter the amount that you want to withdraw.

- Submit the withdrawal request and wait for the funds to be processed, which may take several business days.

Credit or Debit Cards

Access your account and navigate to the ‘Withdrawal’ option, choosing your card.

- Select the card you used to deposit (if applicable) and enter the withdrawal amount.

- Confirm the withdrawal details.

- The withdrawal will be processed back to the same card within a few business days.

Cryptocurrency Wallets

Pick ‘Withdrawal’ within your account and either ‘Cryptocurrency’ or ‘USDT.’

- Enter the amount you want to withdraw in USDT.

- Provide the USDT wallet address where you wish to receive the payments.

- Confirm the withdrawal request.

- The funds will be sent to your wallet, subject to blockchain confirmation timeframes.

Can I withdraw funds using cryptocurrencies on KVB Prime?

Yes, clients can withdraw funds using cryptocurrency wallets, providing flexibility and convenience in accessing their funds.

Does KVB Prime charge withdrawal fees?

While KVB Prime does not charge deposit fees, withdrawal fees may apply, depending on the chosen withdrawal method.

Educational Resources

KVB Prime offers the following educational resources:

The Operation Guide is a comprehensive resource covering technical and practical trading elements with KVB Prime. Moreover, The FAQ area quickly answers questions about account administration, trading operations, and platform use. This resource benefits novice and seasoned traders seeking quick solutions to operational questions.

In addition, Interactive learning materials contain tools and features that enable users to interact with the subject actively. This includes quizzes, interactive charts, and practice trading situations.

Furthermore, KVB Prime offers instructive films on many trade themes, making learning fun and accessible. These films provide visual and practical insights into forex trading, market analysis, risk management, and trading methods, suitable for beginners and experienced traders seeking advanced information.

Under the Trading Knowledge banner, KVB Prime provides various teaching tools, such as real-time market quotations, insights, and technical analysis. These materials help traders make educated judgments and better comprehend market dynamics.

How can I access the interactive learning materials on KVB Prime?

Traders can access interactive learning materials on KVB Prime’s platform, including quizzes, interactive charts, and practice trading situations, to actively engage with the content and enhance their trading skills.

Are there any fees associated with accessing educational resources on KVB Prime?

No, KVB Prime does not charge fees for accessing its educational resources, ensuring that traders can benefit from valuable learning materials at no additional cost.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The popular MetaTrader 4 platform provides a familiar and user-friendly trading experience | There have been complaints of limitations and delays for certain traders while withdrawing funds |

| KVB Prime provides an accessible starting point with a modest deposit requirement | According to reports, customer service channels are not particularly accessible or responsive |

| KVB Prime allows users to trade Forex, commodities, stocks, indices, and certain cryptocurrencies | Some authorities have raised concerns about KVB Prime's restricted and confusing regulations |

| High-leverage options up to 1:800 are available | Some complaints and unfavorable reviews express worry about possible pyramid schemes and the way KVB Prime functions |

| KVB Prime offers instructional materials such as market insights, technical analysis, and resources for beginners | KVB Prime levies inactivity fees after a specific time |

In Conclusion

According to our research, KVB Prime is a Forex and CFD broker that offers a user-friendly interface and minimal deposit requirements, making it accessible to a wide range of traders. The platform allows traders to trade various products, including Forex, commodities, equities, indices, and cryptocurrencies.

Yes, KVB Prime offers the option of opening a demo account for trial trading. However, establishing and converting an actual account may be required before creating a demo account.

KVB Prime provides high-leverage choices of up to 1:800. High leverage may multiply possible rewards, but it also increases risk and should be utilized carefully.

Withdrawals at KVB Prime have varying processing timeframes; certain processes are quick, while others may take up to several business days.

Yes, KVB Prime provides a custom mobile app in addition to the MetaTrader 4 platform. The smartphone app allows for on-the-go trading.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |