NordFX Review

- NordFX Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security Measures

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Leverage and Margin

- Trading Instruments and Products

- Deposit and Withdrawal Options

- Educational Resources

- Pros and Cons

- In Conclusion

Overall, NordFX is a trustworthy and well-established Forex Broker with over 60 accolades for its exceptional service and trade conditions. The Broker offers access to competitive leverage of up to 1:1000 and has a trust score of 71 out of 99.

| 🔎 Broker | 🥇 NordFX |

| 📈 Established Year | 2008 |

| 📉 Regulation and Licenses | None |

| 3️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| ⚙️ Trading Platforms | MetaTrader 4 |

| 🖱️ Account Types | Fix, Pro, Zero, Savings |

| 🪙 Base Currencies | USD |

| 💹 Spreads | From 0.0 pips on Zero |

| 💱 Leverage | Up to 1:1000 |

| 💴 Currency Pairs | 33; major, minor, and exotics |

| 💵 Minimum Deposit | 10 USD |

| 💶 Inactivity Fee | ✅ Yes, 20 USD after 6 months of inactivity |

| 🔊 Website Languages | English, Chinese, Spanish, Portuguese, Thai, Arabic, etc. |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from 0.0035% per trade, per side |

| 🥰 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States, Canada, EU, Russian Federation, Cuba, Sudan, Syria |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, cryptocurrencies, index CFDs, share CFDs, energies |

| 🚀 Open an Account | 👉 Click Here |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

NordFX Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ NordFX Account Types

- ☑️ How To Open an Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commissions

- ☑️ Leverage and Margin

- ☑️ Trading Instruments and Products

- ☑️ Deposit and Withdrawal Options

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

Established in 2008, NordFX is a global brokerage with over 60 accolades for its exceptional service and trade conditions. With 1.7 million accounts created by traders from 190 countries, the company offers a wide range of trading instruments, including forex pairings, precious metals, cryptocurrencies, oil, and major stock indexes.

NordFX promotes trader empowerment through competitive leverage of up to 1:1000, multiple account types, and the industry-leading MetaTrader 4 platform.

Beyond its core trading services, NordFX aims to be a helpful partner in clients’ financial journeys, offering educational materials, analytical tools, market news, passive income opportunities from investment funds, trading signals, and the PAMM service.

With its long history, dedication to customer success, and ongoing innovation, NordFX is an attractive option for traders seeking a respected and well-rounded brokerage partner.

How many trading instruments does NordFX offer?

NordFX offers various trading products, including currency pairs, cryptocurrencies, metals, indices, share CFDs, and energy, to suit various trader needs.

Does NordFX provide prospects for passive income?

NordFX offers passive income opportunities via its investment funds, trading signals, and PAMM service, enabling traders to generate more funds from their investments.

Detailed Summary

| 🔎 Broker | 🥇 NordFX |

| 📈 Established Year | 2008 |

| 📉 Regulation and Licenses | None |

| 3️⃣ Ease of Use Rating | 3/5 |

| 🎁 Bonuses | None |

| ⏰ Support Hours | 24/5 |

| ⚙️ Trading Platforms | MetaTrader 4 |

| 🖱️ Account Types | Fix, Pro, Zero, Savings |

| 🪙 Base Currencies | USD |

| 💹 Spreads | From 0.0 pips on Zero |

| 💱 Leverage | Up to 1:1000 |

| 💴 Currency Pairs | 33; major, minor, and exotics |

| 💵 Minimum Deposit | 10 USD |

| 💶 Inactivity Fee | ✅ Yes, 20 USD after 6 months of inactivity |

| 🔊 Website Languages | English, Chinese, Spanish, Portuguese, Thai, Arabic, etc. |

| 💷 Fees and Commissions | Spreads from 0.0 pips, commissions from 0.0035% per trade, per side |

| 🥰 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States, Canada, EU, Russian Federation, Cuba, Sudan, Syria |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, cryptocurrencies, index CFDs, share CFDs, energies |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security Measures

NordFX is committed to ensuring a secure trading environment for its customers by implementing comprehensive security measures. These include firewalls, complex authentication systems, and strict training of employees to protect private information.

NordFX also prioritizes the safe storage of cryptocurrency holdings using cold storage technologies to reduce cyber theft risks. This approach combines regulatory monitoring with advanced security technology to protect customer assets and data, fostering customer trust and dependability.

Are client funds protected in the event of NordFX’s insolvency?

Yes, NordFX ensures that client funds are segregated from company funds, protecting clients’ funds in the event of NordFX’s insolvency or bankruptcy in compliance with regulatory requirements.

Does NordFX conduct regular security audits?

Yes, NordFX conducts regular security audits and assessments to identify and address any potential vulnerabilities or weaknesses in its systems and infrastructure, ensuring the continuous improvement of its security measures.

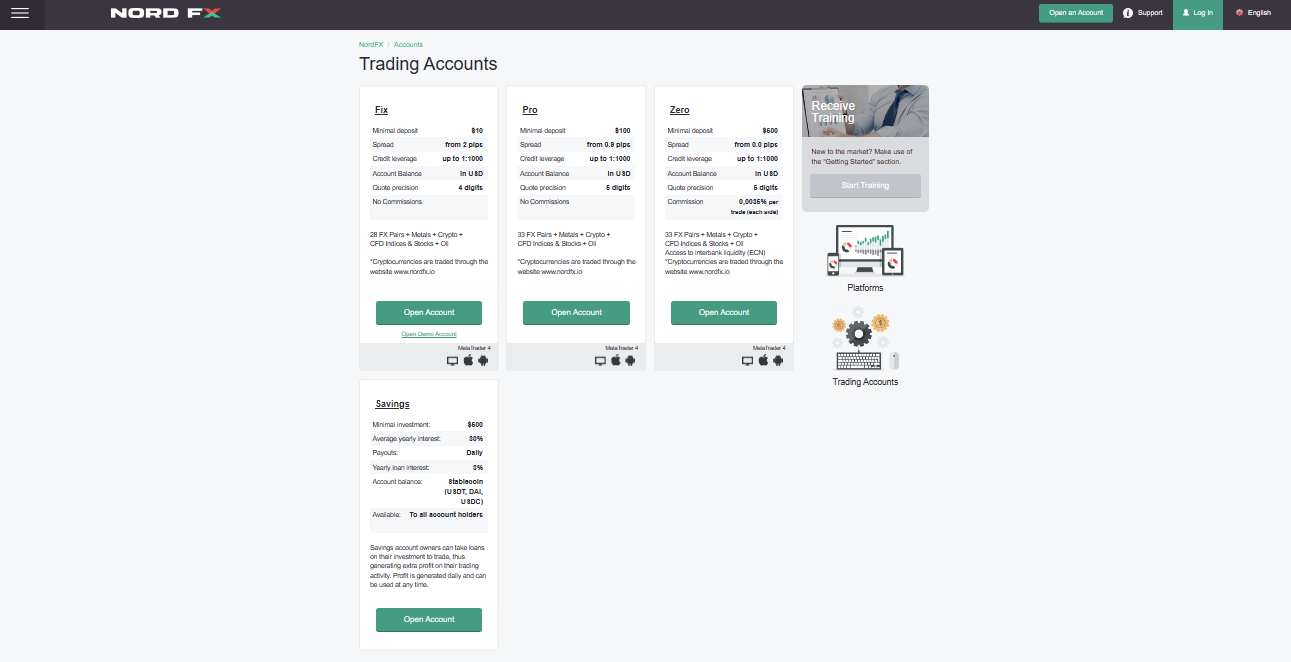

Account Types

| 🔎 Account Type | 🥇 Fix | 🥈 Pro | 🥉 Zero | 🏅 Savings |

| 🩷 Availability | Ideal for beginners and casual traders | Ideal for experienced traders | Ideal for scalpers, day and algorithmic traders | Ideal for those who want to earn interest on deposited funds |

| 📈 Markets | Forex – 28 Metals Crypto – 13 CFD Indices CFD Shares Energies | Forex – 33 Metals Crypto CFD Indices CFD Shares Energies | Forex – 33 Metals Crypto CFD Indices CFD Shares Energies | None |

| 💷 Commissions | None. Only spreads are charged | None. Only spreads are charged | 0.0035% per trade, per side | None. The account earns 3% on loan interest per year |

| 📉 Platforms | All | All | All | N/A |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | N/A |

| 💹 Leverage | 1:1000 | 1:1000 | 1:1000 | N/A |

| 💶 Minimum Deposit | 10 USD | 100 USD | 500 USD | 500 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Fix Account

This account offers consistent trading across various assets, including currency pairings, cryptocurrency pairs, metals, and CFDs.

With a minimum deposit of $10 and credit leverage of up to 1:1000, it offers rapid execution and set spreads, making it suitable for beginners and experienced traders.

Pro Account

The Pro Account offers a range of trading instruments, including 33 currency pairs, 13 cryptocurrency pairings, commodities, and CFDs.

With a minimum deposit of $100 and credit leverage of up to 1:1000, it provides market execution, low dynamic spreads, and 5-digit quote accuracy for effective trading.

Zero Account

The Zero Account offers market execution and minimal spreads, suitable for all levels of traders. It offers variable spreads for currency pairings and cryptocurrencies, with a minimum deposit of $100 and credit leverage of up to 1:1000. Fast market execution and quotation accuracy enhance the trading experience.

Savings Account

The Savings Account uses DeFi technology to generate passive income from deposited funds and trading loans. With a minimum $500 deposit, traders can receive daily income with varying interest rates. Trade loans offer low interest rates, allowing maximum earnings from trading operations. Withdrawals are daily.

Demo Account

The Demo Account offers a risk-free environment for traders to practice trading methods, with a $10,000 virtual deposit and an intuitive interface, allowing them to develop confidence and skills before moving to live trading.

Islamic Account

The Islamic Account is a MetaTrader 4 platform designed for Arabic traders, offering trading without interest or fees in line with Islamic standards. It offers various account types for new and experienced traders, allowing them to trade confidently and in line with their religious beliefs.

What is the leverage available with NordFX’s Pro account?

NordFX’s Pro account provides leverage of up to 1:1000, enabling experienced traders to increase their market exposure while successfully controlling risk.

Is the NordFX Demo account restricted in any way?

No, it is not. The NordFX demo account offers traders a risk-free environment to practice with a $10,000 virtual deposit, with the same tools and functionality as live trading accounts but without the fear of losing real money.

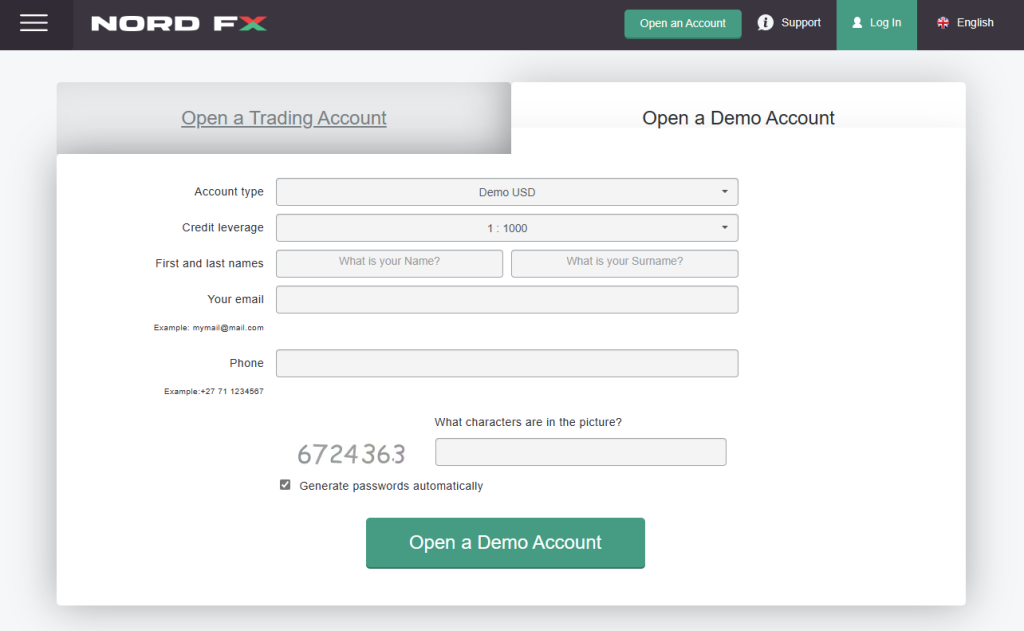

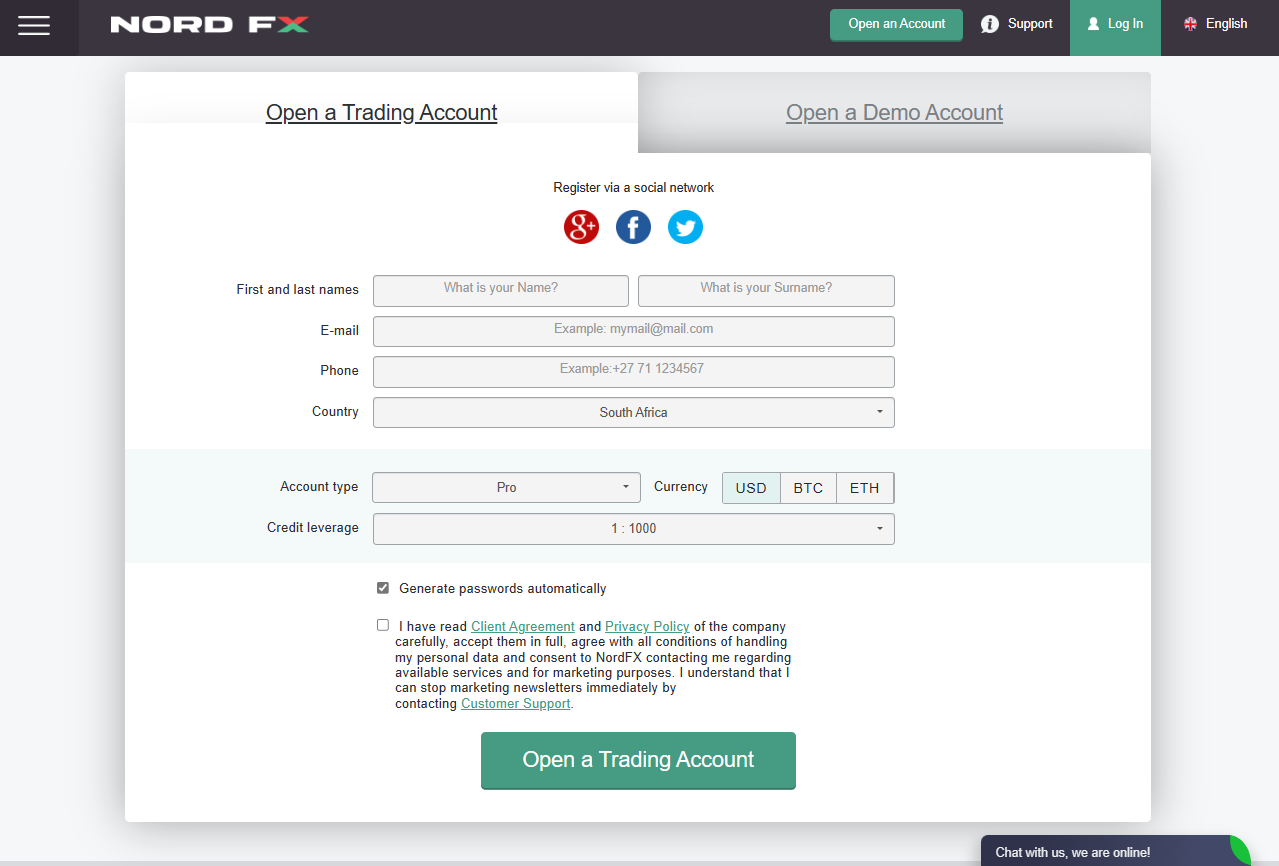

How To Open an Account

To register an account with NordFX, follow these steps:

- Go to the NordFX website and find the “Open a Trading Account” area. This option may be found on the site or by following a specific link, such as [account registration NordFX].

- You can manually complete the form or use Google, Facebook, or Twitter to log in more quickly.

- Complete the registration form, including your name, email address, and phone number.

- Choose your preferred account type.

- Choose the account currency or cryptocurrency (USD, BTC, ETH, etc.) and leverage level that best suits your trading strategy.

- To ensure you are not a bot, complete a simple verification step.

- Review and accept NordFX’s terms and conditions.

- Click the “Open a Trading Account” button to complete your registration.

Once your account is established, you will be given login information and access to your NordFX Trader’s Cabinet, where you may manage your account, deposit funds, and begin trading.

How long does it take to create a NordFX account?

Registering a NordFX account is often fast and simple, with customers able to complete registration and verification in minutes and begin trading immediately.

Is there a limit on who may establish a NordFX account?

Yes, there is. While NordFX welcomes traders from over 190 countries, certain countries, including the United States, Canada, EU, Russian Federation, Cuba, Sudan, and Syria, are restricted from accessing NordFX’s services.

Trading Platforms and Software

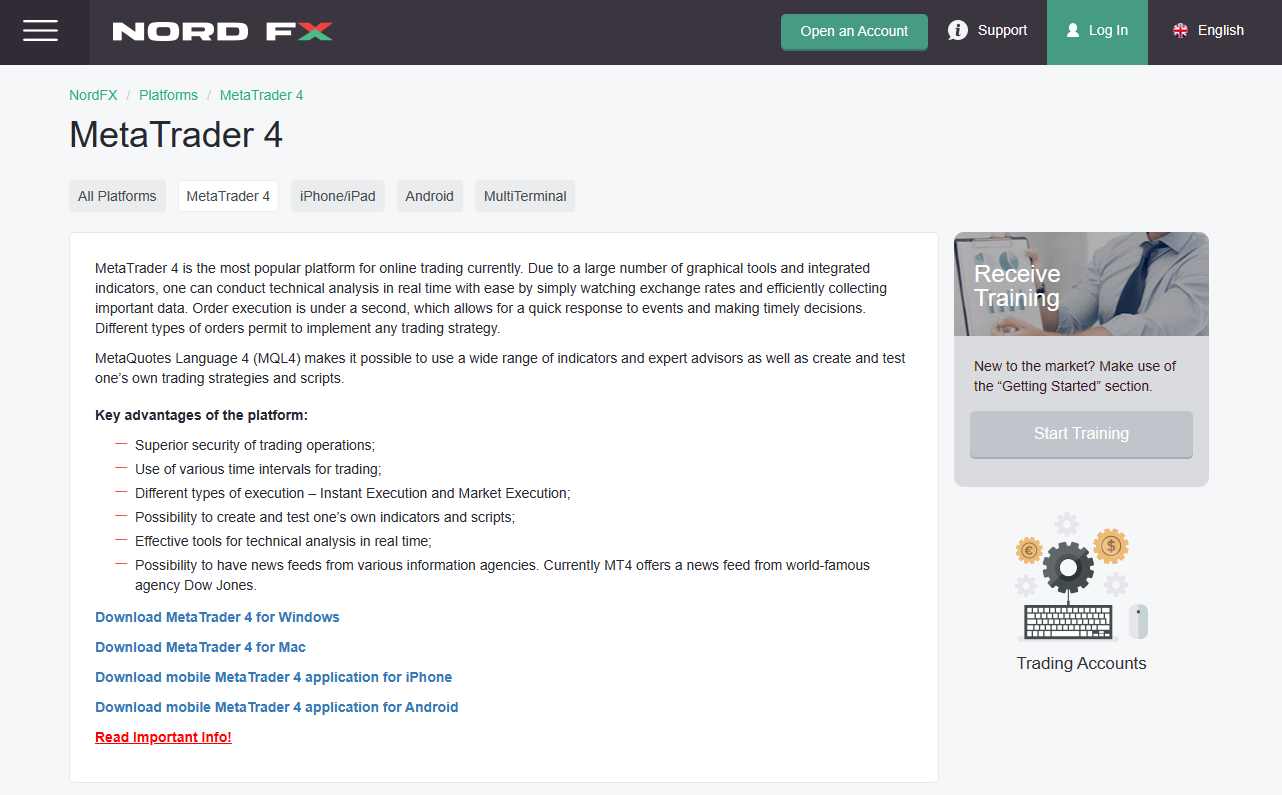

NordFX offers the MetaTrader 4 (MT4) platform, a powerful online trading tool with real-time technical analysis, order execution, and a wide range of order types.

Its adaptability is further enhanced by MetaQuotes Language 4 (MQL4), which allows users to use various indicators and expert advisors and design and test their trading strategies.

MT4’s key features include excellent trading security, support for various time intervals, and execution choices like Instant Execution and Market Execution. Traders can also design and test custom indicators and scripts, allowing them to customize their trading experience.

Does NordFX offer any proprietary trading platforms?

NordFX exclusively offers the MetaTrader 4 (MT4) platform, a widely acclaimed and industry-standard trading platform known for its robust features and user-friendly interface.

Can I use automated trading strategies with NordFX’s trading platform?

NordFX’s MetaTrader 4 (MT4) platform supports automated trading strategies through expert advisors (EAs), allowing traders to execute trades automatically based on predefined criteria.

Fees, Spreads, and, Commissions

Spreads

NordFX offers competitive spreads for various asset types and key trading expenses. These spreads are dynamic and can change based on market factors like volatility and liquidity.

The Zero account allows trading major Forex pairs for as little as 0.0 pips, while other account types have larger spreads.

Commissions

NordFX’s commission structure varies by account type. Zero accounts have zero spreads but incur fees per transaction. Fix and Pro accounts often include commission costs in broader spreads.

Overnight Fees

Positions in leveraged products like Forex and CFDs may incur overnight fees, representing the difference in interest rates between currencies or assets. These fees are charged daily and are listed on NordFX’s website.

Deposit and Withdrawal Fees

NordFX typically does not charge deposits, but it is important to check for any additional costs from your preferred payment method, as withdrawals may be subject to costs, with bank wire transfers often having higher costs.

Inactivity Fees

NordFX charges clients an inactivity fee for unpaid accounts, requiring them to contact Customer Support to regain access, and imposes a $20 yearly maintenance fee on dormant accounts.

Currency Conversion Fees

NordFX might charge currency conversion costs if the base currency differs from the item currency.

Are there any additional fees for using the NordFX Demo account?

No, the NordFX Demo account is free to use and does not incur any fees or charges, allowing traders to practice and familiarize themselves with the platform risk-free.

How does NordFX calculate overnight fees?

NordFX calculates overnight fees based on the difference in interest rates between currencies or assets involved in leveraged positions, with fees charged daily and listed on its website.

Leverage and Margin

NordFX offers traders leverage options to increase market exposure with minimal funds. The highest leverage is 1:1000, depending on account type and asset. Margin is the amount of funds required as collateral to initiate and sustain a leveraged position, represented as percentages.

NordFX provides resources like a margin calculator to help assess needed margins for different transaction sizes and leverage levels. Using leverage intelligently while minimizing risk when trading with NordFX is crucial.

Does NordFX offer negative balance protection?

Yes, NordFX offers negative balance protection to its clients. This ensures that traders cannot lose more than their initial investment, providing an added layer of security and risk management.

Is there a maximum leverage limit on NordFX?

Yes, while NordFX offers leverage of up to 1:1000, certain account types or trading instruments may have specific leverage limits imposed to ensure responsible trading practices and risk management.

Trading Instruments and Products

NordFX offers the following trading instruments and products:

- A large choice of currency pairings for trading.

- Numerous prominent cryptocurrencies.

- Precious metals such as gold and silver.

- Contracts for difference (CFDs) on a wide range of global indices.

- CFDs on various equities.

Moreover, NordFX allows you to trade various commodities, including energy resources such as oil and gas and agricultural items.

Are there any restrictions on trading cryptocurrencies with NordFX?

NordFX offers trading in cryptocurrencies with no restrictions.

Does NordFX provide access to stock CFDs?

NordFX allows traders to trade Contracts for Difference (CFDs) on various equities.

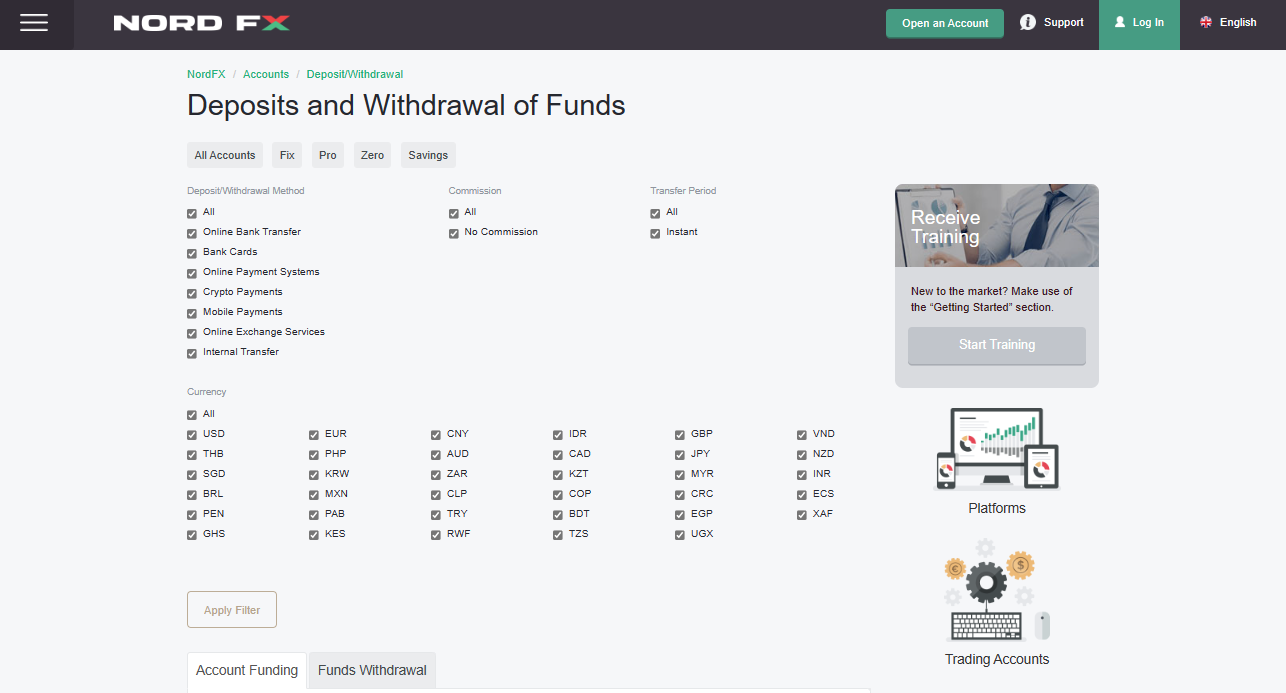

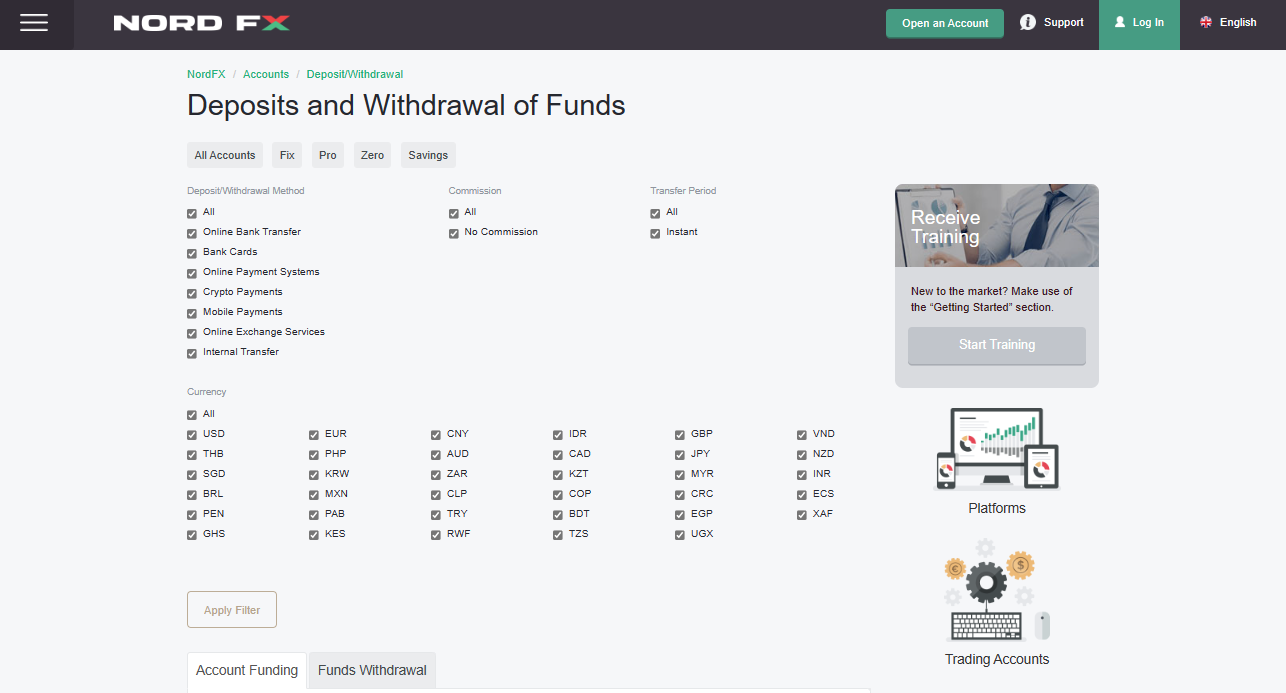

Deposit and Withdrawal Options

| 🔎 Payment Method | 🌎 Country | ☑️ Currencies Accepted | ⏰ Processing Time |

| 🪙 Online Bank Transfer | 📍All | AUD, EUR, CAD, JPY, | 1 hour |

| 💰 Debit/Credit Card | 📍All | USD, EUR | ⚡Instant |

| 💴 Skrill | 📍All | USD, EUR | Instant – 1 day |

| 💵 Neteller | 📍All | USD | Instant – 1 day |

| 💶 Perfect Money | 📍All | USD, EUR | Instant – 1 day |

| 💷 Help2Pay | Asian Countries | VND, IDR, MYR, PHP, | ⚡Instant |

| 💳 PayToday | Thailand | THB | Instant – 1 day |

| 🪙 Thailand QR Code | Thailand | THB | ⚡Instant |

| 💰 Vietnam QR Code | Vietnam | VND | ⚡Instant |

| 💴 Dragonpay | Philippines | PHP | 1 hour – 24 hours |

| 💵 Fasapay | Indonesia | IDR | ⚡Instant |

| 💶 Sticpay | 📍All | USD, EUR, CNY, JPY, | ⚡Instant |

| 💷 PIX | Brazil | BRL | ⚡Instant |

| 💳 Boleto | Brazil | BRL | ⚡Instant |

| 🪙 OXXO | Mexico | MXN | ⚡Instant |

| 💰 FairPay | Latin America | BRL, CLP, COP, CRC | 1 hour |

| 💴 Turkey QR Code | Turkey | TRY | ⚡Instant |

| 💵 Bangladesh Bagad/Bkash | Bangladesh | BDT | ⚡Instant |

| 💶 Pinikle Voucher | Egypt | EGP | 1 hour |

| 💷 Cryptocurrencies | 📍All | USD, EUR | ⚡Instant |

| 💳 Cameroon Mobile | Cameroon | XAF | 1 hour |

| 🪙 Ghana Mobile | Ghana | GHS | 1 hour |

| 💰 Kenya Mobile | Kenya | KES | 1 hour |

| 💴 Rwanda Mobile | Rwanda | RWF | 1 hour |

| 💵 Tanzania Mobile | Tanzania | TZS | 1 hour |

| 💶 Uganda Mobile | Uganda | UGZ | 1 hour |

Deposit Methods

Bank Wire

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Deposit” section.

- Choose “Bank Wire Transfer” as your method.

- Get NordFX’s bank account information.

- Send a wire transfer from your bank account, including all the information supplied.

Credit or Debit Card

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Deposit” section.

- Choose “Credit/Debit Card” as your method.

- Enter your card information (number, expiry date, CVV) and deposit amount.

- Follow the on-screen instructions to confirm the transaction with your card issuer.

Cryptocurrency

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Deposit” section.

- Choose your preferred cryptocurrency (e.g., Bitcoin, Ethereum, or USDT).

- Your NordFX account will be assigned a unique deposit address.

- Make the transfer from your crypto wallet to the given address.

- Funds will be reflected in your NordFX trading account after completing blockchain confirmations.

e-wallets or Payment Gateways

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Deposit” section.

- Choose your favorite e-wallet or payment gateway.

- Enter the deposit amount and your e-wallet account information.

- Follow the directions to the e-wallet/gateway’s website, where you can finish the payment.

Withdrawal Methods

Bank Wire

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Withdraw” section.

- Choose “Bank Wire Transfer” as your method.

- Provide your bank account information.

- Enter the desired withdrawal amount and submit your request.

Credit or Debit Cards

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Withdraw” section.

- Choose “Credit/Debit Card” as your method.

- Enter the desired withdrawal amount and submit your request.

Cryptocurrency

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Withdraw” section.

- Choose your selected cryptocurrency.

- Provide your external crypto wallet address and the withdrawal amount.

- Submit your request, and NordFX will send funds to your wallet after processing.

e-wallets or Payment Gateways

- Log in to your NordFX Trader’s Cabinet.

- Navigate to the “Withdraw” section.

- Choose your favorite e-wallet or payment gateway.

- Enter the withdrawal amount and your e-wallet account information.

Are there any costs for NordFX deposits?

NordFX typically does not charge deposit fees, but traders should check for additional costs from their chosen payment method, as certain methods may incur fees.

Can I withdraw funds from NordFX using an e-wallet?

Yes, NordFX supports withdrawals through various e-wallets and payment gateways, providing traders with flexibility and convenience in managing their funds

Educational Resources

The NordFX Learning Center is an online resource designed for traders to enhance their trading knowledge and abilities, covering various subjects from forex trading fundamentals to advanced methods and analyses.

Moreover, NordFX provides forex education for beginners and experts, offering free training, tips, methods, videos, and detailed recommendations on how to trade Forex profitably on its website.

Can I access educational resources in languages other than English on NordFX?

Yes, NordFX offers educational resources in multiple languages, catering to a diverse global clientele and ensuring accessibility for traders from various linguistic backgrounds.

Does NordFX provide practical trading tips and strategies?

Yes, NordFX offers practical trading tips and strategies through its educational materials, providing traders with actionable insights and techniques to improve their trading performance.

Pros and Cons

| ✅ Pros | ❎ Cons |

| Traders can trade forex, cryptocurrencies, equities, indices, commodities, and other assets | NordFX offers market news and certain tools but not comprehensive fundamental/technical analysis as its rivals |

| NordFX provides up to 1:1000 for improved trading possibilities | While MT4 is robust, some traders prefer other options like MT5 or proprietary systems |

| NordFX allows traders to follow other traders' methods or share their own | Accounts that remain idle for more than 6 months incur dormancy charges |

| NordFX, founded in 2008, has a strong track record in the sector. | Variable spreads on the Fix and Pro accounts are greater than those at other brokers, particularly for less-traded pairings |

| Support is given on numerous days of the week, often during market hours | It can be difficult to discover specifics on the website at times |

In Conclusion

According to our findings, NordFX portrays itself as a trustworthy brokerage choice in the forex and CFD markets, with various trading products and account types to meet the requirements of all traders.

In our experience, NordFX’s competitive leverage, several account choices, and industry-standard MetaTrader 4 platform offer traders many prospects for success in the financial markets.

Creating a live account is simple, requiring online registration, personal information, and identification verification.

Withdrawals from NordFX normally take 1 hour and 1 day to complete, depending on the withdrawal type and verification procedure.

NordFX’s minimum deposit requirement varies by account type, beginning at $10 for the Fix account and $100 for the Pro account.

Yes, NordFX offers demo accounts for practicing trading. These accounts use virtual funds to imitate market circumstances, enabling you to test ideas without risking your real wealth.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |