TD Ameritrade Review

- TD Ameritrade Review – 13 key points quick overview:

- Overview

- At a Glance

- TD Ameritrade Account Types

- How To Open a TD Ameritrade Account

- TD Ameritrade Deposit & Withdrawal Options

- Trading Instruments & Products

- TD Ameritrade Trading Platforms and Software

- TD Ameritrade Spreads and Fees

- Leverage and Margin

- Educational Resources

- TD Ameritrade Pros & Cons

- Security Measures

- Conclusion

Overall TD Ameritrade is considered a low risk, with an overall Trust Score of 98 out of 100. They are licensed by four Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk). The broker offers 2 retail investor accounts, including a Standard Account and a Margin Trading Account.

TD Ameritrade Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Account Types

- ☑️How To Open an Account

- ☑️Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️Trading Platforms and Software

- ☑️TD Ameritrade Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️TD Ameritrade Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

TD Ameritrade, founded in 1971, is a prominent financial brokerage firm that has expanded through acquisitions and mergers. It caters to investors of all experience levels, offering various platforms and services.

Overall, the thinkorswim platform, known for its comprehensive charting tools and technical indicators, is popular among experienced traders. Additionally, beginners can benefit from the extensive instructional tools, articles, videos, and webinars.

Moreover, its commitment to technology extends to its mobile platforms, providing seamless access and portfolio management capabilities. In 2020, Charles Schwab Corporation purchased TD Ameritrade, bringing together two powerful brokerages.

Today, the broker remains a Charles Schwab company, offering a variety of trading platforms, financial products, research, and customer service.

What year was the broker established?

The broker was founded in 1971 and has a long history in financial services.

Does TD Ameritrade operate globally?

Yes, the broker has a global footprint, including locations in the United States, Europe, and Asia.

At a Glance

| 🗓 Established Year | 1971 |

| ⚖️ Regulation and Licenses | FINRA, CFTC, SEC, SFC |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/7 |

| 💻 Trading Platforms | TD Ameritrade, thinkorswim |

| 🛍 Account Types | Standard, Margin |

| 🤝 Base Currencies | USD |

| 📊 Spreads | None |

| 📈 Leverage | 1:50 |

| 💸 Currency Pairs | 70; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 1 USD |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English |

| 💰 Fees and Commissions | Commissions from 0.65 USD |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Australia, Canada, Hong Kong, Japan, Saudi Arabia, Singapore, United Kingdom, European Union |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, stocks, options, ETFs, mutual funds, futures, bonds, fixed income, annuities, IPOs, CDs, cryptocurrency CFDs |

| 🎖 Open an Account | Open Account |

TD Ameritrade Account Types

Standard Margin

✅ Availability All All

🛍 Markets All All

💸 Commissions From 0 USD From 0 USD

💻 Platforms TD Ameritrade, thinkorswim TD Ameritrade, thinkorswim

📊 Trade Size From 0.01 lots From 0.01 lots

📈 Leverage 1:50 1:50

💰 Minimum Deposit From 1 USD From 1 USD

🎖 Open an Account Open Account Open Account

TD Ameritrade Standard Account

Overall, the Standard Account offers four options: Cash, Cash and Margin, Cash and Option, and Cash, Margin and Option.

In addition, it is multifunctional, allowing simple cash transactions, margin borrowing, and option trading. Moreover, investors can customize their accounts to suit their investment style and risk tolerance, making it an ideal starting point for investment.

TD Ameritrade Margin Account

Overall, the Margin Trading Account enables traders to increase their purchasing power by borrowing against equity, allowing for higher returns and a wider range of trading options. However, traders must understand the potential risks and understand the potential for losses.

TD Ameritrade Demo Account

The Demo Account, also known as paperMoney, provides a risk-free environment for traders to practice trading methods and learn the platform’s capabilities. It is ideal for novices and experienced traders, showcasing TD Ameritrade’s commitment to trader education.

Can I trade on margin with a TD Ameritrade account?

Qualified clients can make trades on margin with TD Ameritrade, subject to clearance.

Does the broker provide accounts for managed portfolios?

Yes, the broker provides managed portfolios for clients who choose professional account management.

How To Open a TD Ameritrade Account

To register an account, follow these steps:

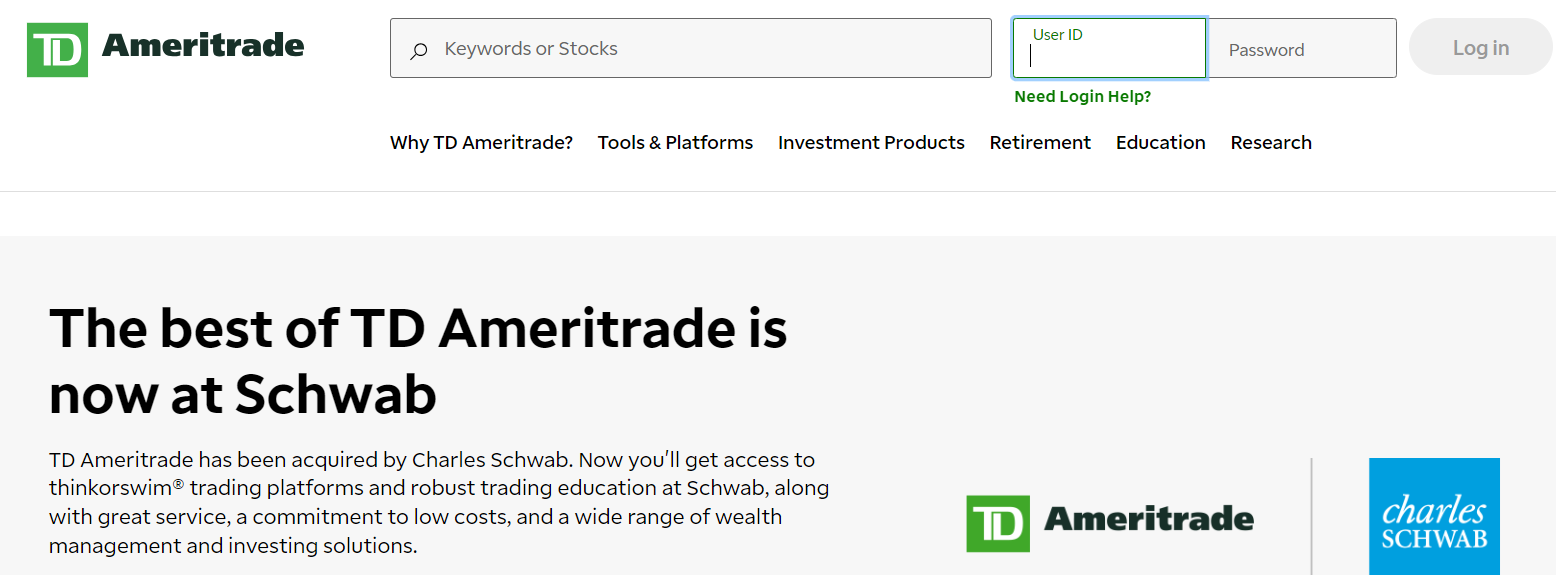

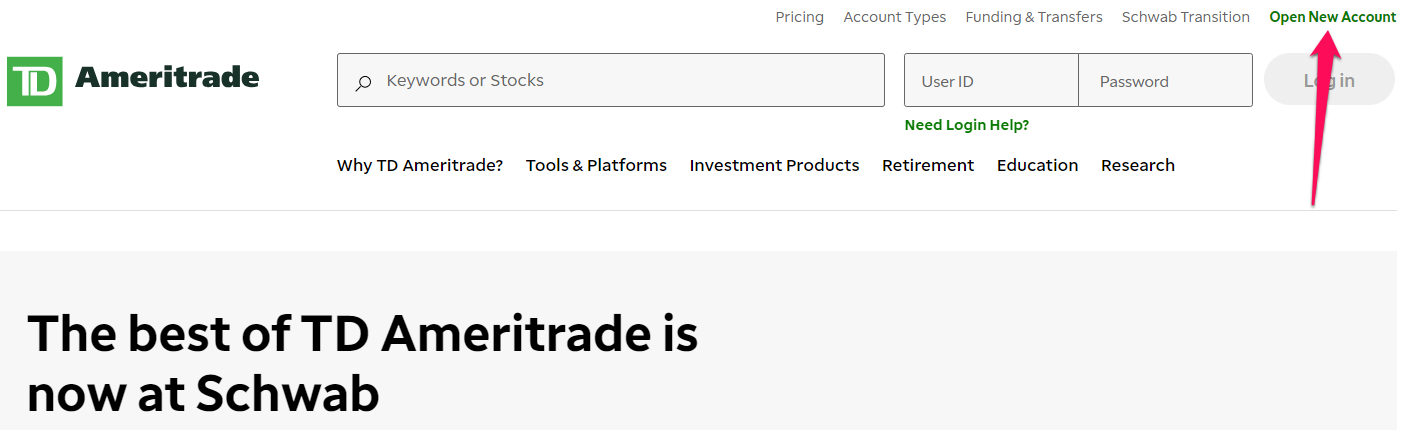

Step 1 – Click on the Register button.

Navigate to the TD Ameritrade website and look for the “Open an Account” or “Get Started” option, which is usually prominent on the front page.

The broker provides a variety of account types, including individual brokerage accounts, joint accounts, retirement accounts (IRAs), and specialized accounts. Choose the account type that best fits your financial goals.

Step 2 – Complete the form.

You will be asked to provide basic personal information such as your name, address, Social Security number, date of birth, and contact information. TD Ameritrade will ask questions about your investment experience, risk tolerance, and financial goals to build a suitable portfolio plan.

Can I open an account online or visit a branch?

You can open a TD Ameritrade account online without visiting a branch.

Are there any account opening fees with TD Ameritrade?

No, the broker does not charge any fees to open an account.

TD Ameritrade Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time

Electronic Bank Deposit (ACH) United States USD 5 Minutes

Wire Transfer All USD 1 Working Day

Check United States USD 1 to 3 Working Days

Broker Transfer All USD Up to 7 Working Days

Stock Certificates All USD 1 Working Day

Deposit Methods:

Bank Wire

✅Obtain wire transfer instructions from your account (usually available online or by contacting support).

✅Make a wire transfer through your bank, following the wire instructions. Wire transfers often arrive the same business day or the next day.

ACH

✅Log into your account and visit the Deposits/Transfers area.

✅Choose the “Transfer Money” option and set up a bank transfer (ACH).

✅Include your bank’s routing number and your checking or savings account number.

✅Enter the amount you want to transfer and start the transaction. ACH deposits usually take a few business days to process.

Check

✅Endorse the reverse of the check and provide your account number.

✅Use the check deposit tool on the mobile app (if available), or send the check to the provided TD Ameritrade address.

✅Mailed-in checks may take longer to process.

Broker Transfer

✅Set up an ACAT (Automated Customer Account Transfer) from your account.

✅Provide the relevant details regarding your external brokerage account.

✅TD Ameritrade will work with your former brokerage to accomplish the asset transfer.

Stock Certificates

✅For stock certificate deposits, contact the broker directly since this transaction requires special processing.

Withdrawal Methods:

Bank Wire

✅Access the withdrawals area of your account.

✅Include your bank’s wiring instructions and the withdrawal amount. Wire transfers generally include a cost.

ACH

✅Navigate to the withdrawals area of your account.

✅Choose the associated bank account where you want to receive funds.

✅Enter your withdrawal amount and submit the transaction.

Check

✅Request a check withdrawal using your account.

✅Confirm your contact and mailing details.

Broker Transfer

✅Use ACAT to initiate a transfer to another brokerage.

Stock Certificates

✅Contact the broker directly since the instructions for removing stock certificates may differ.

How can I withdraw funds from my TD Ameritrade account, and are there any fees?

The broker charges no fees for electronic bank transfers or check withdrawals.

Can I deposit funds into my TD Ameritrade account from an international bank?

Yes, the broker accepts international wire transactions.

Trading Instruments & Products

TD Ameritrade offers the following trading instruments and products:

➡️Stocks – Overall, the broker has many equities, from global multinationals to smaller, local enterprises. Traders have access to both US and foreign markets, allowing them to diversify their investment portfolio.

➡️Options – In addition, they offer traders a range of contracts for options trading. This covers calls and puts on several underlying assets, allowing traders to hedge their holdings or speculate on market changes.

➡️ETFs – The platform offers a diverse selection of Exchange-Traded Funds (ETFs), including domestic and foreign offerings.

➡️Mutual Funds – Additionally, TD Ameritrade offers around 13,000 mutual funds, including approximately 4,000 with no load or transaction fees, providing a wide range of portfolio diversification options.

➡️Futures – Traders interested in commodities and indices can engage in futures trading. This comprises several futures contracts that offer exposure to a wide range of markets and the possibility of leverage.

➡️Forex – The platform allows traders to trade the forex market with currency pairings, taking advantage of the market’s 24/5 hours.

➡️Bonds – A broad range of bonds, from government to corporate bonds, can provide a more solid investment alternative for conservative investors or a source of income through interest.

➡️Fixed Income – Overall, TD Ameritrade provides a variety of fixed-income investment alternatives that can generate consistent income, making them suitable for risk-averse clients looking for stability in their portfolios.

➡️Annuities – Annuities can be used to plan long-term investments, particularly for retirement. These financial instruments may assist in generating a consistent income stream in the future.

➡️IPOs – Initial Public Offerings (IPOs) allow traders to participate in a company’s shares early.

➡️CDs – Certificates of Deposit (CDs) are available to people seeking a low-risk investment. They offer a fixed interest rate for a set length and FDIC protection up to a maximum.

➡️Cryptocurrency Trading – The platform caters to the rising interest in digital assets by offering cryptocurrency trading, allowing traders to participate in this volatile and potentially lucrative market.

Does TD Ameritrade offer commodity futures trading?

Yes, the broker provides a variety of futures trading, including commodities.

What types of bonds can I trade with TD Ameritrade?

The broker allows customers to trade federal, municipal, and corporate bonds.

TD Ameritrade Trading Platforms and Software

TD Ameritrade

Overall, the Web Platform is a user-friendly, no-installation gateway to financial markets, offering a range of features like impartial third-party research, instructional materials, and daily market snapshots.

Moreover, TD Ameritrade’s mission is to provide strong research and data for educated trading decisions, the company offers a wide range of trading options without a minimum account balance.

Thinkorswim

Overall, thinkorswim is a robust trading tool that offers analytical depth and agility, suitable for beginners and experts.

Because of its flexible interface, comprehensive charting capabilities, and paper money for strategy testing, thinkorswim aligns with TD Ameritrade’s commitment to educational advancement and strong trade support system.

Are there any additional charges for using TD Ameritrade’s trading platforms?

No, the broker does not charge any additional fees for using its trading platforms; they are available to clients free of charge.

Does TD Ameritrade offer a desktop platform for advanced traders?

Yes, thinkorswim Desktop is TD Ameritrade’s sophisticated trading platform that caters to the demands of experienced traders with its extensive capabilities.

TD Ameritrade Spreads and Fees

Spreads

Overall, the broker stands out in the financial services sector by not charging trade spreads promoting a competitive pricing philosophy.

This straightforward pricing structure allows traders to participate in various assets without variable charges affecting transaction execution prices. In turn, this strategy further emphasizes TD Ameritrade’s commitment to value and its cost-effectiveness for various trading styles and methods.

Commissions

Overall, the commission structure adapts to market changes, offering commission-free equity trades, ETFs, and options trading across US exchanges and domestic and Canadian markets.

This cost-effective model saves traders money, while some over-the-counter stock trades and broker-assisted transactions maintain a competitive advantage while providing exceptional value to clients.

Overnight Fees

Overall, the broker offers a more inclusive trading environment by not charging overnight fees, rollovers, or swaps, catering to long-term investors who retain positions over multiple trading sessions.

This strategy broadens the platform’s appeal to a wider range of trading styles, reducing transaction settlement costs.

Deposit and Withdrawal Fees

Overall, the broker is eliminating fees for deposits and withdrawals to promote transparency and client satisfaction. Additionally, this aligns with the broker’s goal of providing a seamless financial experience, ensuring traders retain the most value from their transactions.

Inactivity Fees

Additionally, the broker is known for its fair and client-friendly policies, avoiding inactivity fees. This acknowledges the diverse trading styles and frequency of investors, fostering a friendly atmosphere for all clients, aligning with their goal of making investing and trading opportunities accessible to all.

Currency Conversion Fees

Overall, the broker offers global investors a simple and cost-effective trading experience by minimizing currency conversion costs. Deals are paid in USD, and foreign traders incur a low conversion charge to reduce financial strain. This inclusive platform supports global clients.

What are the commission charges for trading options on TD Ameritrade?

In addition to the normal commission cost, TD Ameritrade adds a $0.65 commission per contract for option trading.

Does TD Ameritrade charge any inactivity fees?

No, the broker does not charge their clients inactivity fees, giving infrequent traders more freedom.

Leverage and Margin

Overall, the broker provides various leverage and margin options tailored to sophisticated investors. The portfolio margin account offers up to 6.7 times more leverage than a conventional margin account for clients with portfolio values over $125,000.

Additionally, this account represents net risk and offers a more effective use of money and higher losses and potential rewards. The futures margin is a performance bond, representing a percentage of the notional contract value, and is a good faith deposit required to start and maintain a position.

For forex trading, the broker offers a maximum leverage of 50:1 on major currency pairings and 20:1 on exotic currency pairs. Margin trading is unsuitable for many investors due to the risk involved, and understanding margin calls is crucial.

Moreover, margin interest rates for borrowing through margin accounts are changeable and determined by the debit balance and the firm’s base rate, indicating the cost of borrowing funds.

Is there a minimum deposit requirement for utilizing margin trading?

Yes, a $2,000 minimum deposit is necessary to use the margin or options trading tools on TD Ameritrade’s platform.

Are there any margin call or stop-out procedures?

No, the broker does not have margin call or stop-out processes, giving traders more freedom in managing their positions.

Educational Resources

The broker offers the following educational resources:

➡️Immersive Curriculum – Overall, this comprises classes that walk users through the basics of investing and trading and quizzes to check their progress.

➡️Educational Articles – Additionally, a diverse collection of papers is accessible, covering everything from fundamental financial principles to sophisticated tactics.

➡️Webcasts – Moreover, the broker offers live updates on markets and trading tactics, such as technical analysis and options strategies.

➡️In-Person Events – In addition, these events offer face-to-face learning and engagement with professionals at various venues nationwide.

➡️Talking Green Podcast – This podcast provides talks and ideas on personal finance and investment themes to assist listeners in making educated financial decisions.

Are TD Ameritrade’s educational resources suitable for both novice and experienced traders?

Yes, TD Ameritrade’s instructional offerings are designed for traders of all skill levels, offering important insights and information to both beginner and experienced traders.

Does TD Ameritrade offer personalized educational support?

Yes, the broker offers specialized educational support to clients through seminars, webinars, and one-on-one meetings with trading specialists, allowing them to enhance their trading skills.

TD Ameritrade Pros & Cons

✅ Pros ❌ Cons

TD Ameritrade offers access to stocks, ETFs, options, mutual funds, bonds, futures, and currency, catering to a wide range of trading styles and risk appetites Although sophisticated, the thinkorswim tool has a high learning curve that new traders may find intimidating

Advanced traders will benefit from the well-known thinkorswim platform, while beginners will find the simple online platform and mobile app user-friendly TD Ameritrade's margin rates may be less competitive than those of rival brokers for margin traders

The platform provides a variety of retirement account alternatives (traditional, Roth, and rollover IRAs), as well as regular brokerage accounts and speciality products The platform does not allow for the purchase of fractional shares, making it less accessible to individuals investing lesser sums

Because there are no minimum deposit restrictions, TD Ameritrade is open to investors of all sizes While stock and ETF trading is commission-free, costs for bonds, mutual funds, futures, and some options transactions may be more complex

TD Ameritrade typically obtains great scores for their 24-hour customer assistance by phone, email, and live chat Clients can primarily trade US and Canadian-listed stocks

Clients can trade stocks, ETFs, and a wide range of options contracts without paying a fee TD Ameritrade does not allow direct trading of cryptocurrencies such as Bitcoin and Ethereum

Investors of all levels have access to webinars, articles, videos, and courses that will help them improve their financial knowledge and trading skills

TD Ameritrade provides in-depth market data, analyst reports, third-party insights, and instructional resources to help traders make educated decisions

Security Measures

Overall, the broker employs robust security measures to safeguard investor accounts and data, including two-factor authentication, firewalls, and 128-bit data encryption. They also offer asset protection guarantees, covering the loss of cash and securities in unlawful transactions.

They have a specialized fraud team and provide instructional tools for clients to protect themselves and their money.

Does the broker offer insurance coverage for client funds?

Yes, the broker offers insurance coverage via the Securities Investor Protection Corporation (SIPC) and other insurance plans that safeguard customer assets during broker insolvency.

Are there any additional security features available for clients concerned about account security?

Yes, the broker provides optional security tools such as two-factor authentication and security alerts, allowing clients to secure their accounts further.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Overall, TD Ameritrade distinguishes itself as a forex and CFD broker with its advanced thinkorswim platform, vast training materials, and excellent customer support. Their dedication to delivering comprehensive analytical tools and instructional resources appeals to traders of all skill levels, promoting educated trading decisions.

TD Ameritrade provides 24-hour customer assistance and access to trading expertise.

TD Ameritrade normally completes withdrawals between 5 minutes to 7 business days.

Yes, you may set up an ACAT to transfer equities from another brokerage to your TD Ameritrade account.

The minimum deposit to start a TD Ameritrade account is 1 USD.

TD Ameritrade provides commission-free transactions on US equities and domestic and Canadian ETFs.

Yes, TD Ameritrade is a reputable broker authorized by prominent financial authorities such as FINRA, CFTC, SEC, and SFC.

TD Ameritrade allows you to trade various assets, including stocks, options, ETFs, mutual funds, futures, Forex, and cryptocurrencies.

You can withdraw funds from your TD Ameritrade account using ACH transfers, wire transfers, or by requesting a check.

TD Ameritrade is headquartered in the United States and has offices worldwide, including in Europe and Asia.

TD Ameritrade investments are insured by SIPC insurance, and the broker also provides supplemental insurance products for further security.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |