TradeStation Review

- TradeStation Review – 13 key points quick overview:

- Overview

- At a Glance

- TradeStation Account Types

- How To Open a TradeStation Account step by step

- TradeStation Deposit and Withdrawal

- Trading Instruments and Products

- TradeStation Trading Platforms and Software

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- 🏆 10 Best Forex Brokers

- Conclusion

TradeStation Review is considered low risk, with an overall Trust Score of 99 out of 100. The broker is licensed by seven Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk). They offer four account categories.

TradeStation Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️TradeStation Account Types

- ☑️How to Open A TradeStation Account

- ☑️ Deposit and Withdrawal

- ☑️Trading Instruments and Products

- ☑️Trading Platforms and Software

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros and Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Furthermore, the broker was founded in 1982 by brothers William and Rafael Cruz and aims to democratize access to advanced trading instruments for ordinary traders. Its proprietary scripting language, EasyLanguage, simplifies creating and testing unique trading strategies.

In the mid-1990s, Dow Jones Telerate introduced TradeStation as a premium solution for institutional customers. In 1997, Omega Research became public.

The broker transformed into an online brokerage in 2001, combining powerful trading and analytical tools with real-time market data and order execution. This combination attracts traders seeking advanced features and personalization.

Today, they are a reputable brand in the online trading market, offering advanced research tools, instructional materials, and access to stocks, options, futures, and cryptocurrency markets.

The platform’s versatility and strong features continue to attract traders seeking high levels of control and customization over their trading tactics.

Can I use TradeStation’s teaching materials if I am new to trading?

Yes, the broker provides various instructional resources, including trading manuals, platform tutorials, FAQs, and events such as webinars and seminars for both beginner and expert traders.

Does TradeStation provide individualized customer assistance to help traders with their inquiries?

Moreover, the broker offers individualized customer service by phone, email, and live chat, ensuring that traders with questions or issues get rapid responses.

At a Glance

| 🗓 Established Year | 2001 |

| ⚖️ Regulation and Licenses | SEC, CFTC, FINRA, NFA, FCA, IIROC, ASIC |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | TradeStation, FuturesPlus, TS Crypto, OptionsStation Pro |

| 🛍 Account Types | Individual, Joint, Entity, Crypto |

| 🤝 Base Currencies | USD |

| 📊 Spreads | Variable |

| 📈 Leverage | 1:2 (Overnight Positions), 1:4 (intraday trading) |

| 💸 Currency Pairs | None, only offers stocks, ETFs, options, futures, mutual funds and futures options |

| 💳 Minimum Deposit | 0 USD |

| 🚫 Inactivity Fee | Yes, 10 USD if the month-end equity is <$10,000 or there are fewer than 10 trades in the previous 3 months |

| 🗣 Website Languages | English |

| 💰 Fees and Commissions | Spreads from 0.6% |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Not specified |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Stocks, ETFs, options, futures, futures options, mutual funds |

| 🎖 Open an Account | 👉 Open Account |

TradeStation Account Types

| Individual | Joint | Entity | Crypto | |

| ✅ Availability | All | All | All | All |

| 🛍 Markets | All | All | All | Crypto |

| 💸 Commissions | Commission-free on Stocks and ETFs, commissions from $0.60 per contract on Stock Options | Commission-free on Stocks and ETFs, commissions from $0.60 per contract on Stock Options | Commission-free on Stocks and ETFs, commissions from $0.60 per contract on Stock Options | Variable |

| 💻 Platforms | All | All | All | TS Crypto |

| 📊 Trade Size | Variable | Variable | Variable | Variable |

| 📈 Leverage | 1:2 (overnight positions), 1:4 (intraday trading) | 1:2 (overnight positions), 1:4 (intraday trading) | 1:2 (overnight positions), 1:4 (intraday trading) | - |

| 💰 Minimum Deposit | 0 USD | 0 USD | 0 USD | 0 USD |

| 🎖 Open an Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Individual Account

The Individual Account is a comprehensive platform for solo traders seeking advanced trading tools and detailed market data. It offers a full platform for trading equities, options, futures, and cryptocurrencies, with analytical tools and charting features.

This account is ideal for experienced traders seeking detailed market research and customization. It offers competitive commission rates, instructional materials, and mobile and online trading access.

Joint Account

The Joint Account is designed for individuals or groups to manage a trading account collaboratively. It allows partners, family members, or business colleagues to pool their resources and use the same trading tools, market data, and asset classes as individual accounts.

The account offers multiple types of joint ownership, such as joint tenants with rights of survivorship (JTWROS) or tenants in common (TIC), providing more flexibility in account management and access.

Entity Account

The Entity Account is a trading platform for companies, trusts, partnerships, and LLCs, offering access to TradeStation’s entire platform for market research, strategy testing, and trade execution across various asset classes.

It is ideal for diversifying investment portfolios, hedging existing holdings, or capitalizing on market opportunities. The account provides specialized support, corporate account features, and the ability to manage multiple users with varying access and control.

Crypto Account

Crypto is a platform that provides a clear interface for trading supported cryptocurrencies, offering real-time price quotations, basic charting tools, and the option to place market or limit orders.

It focuses on the fundamentals of bitcoin trading and offers safe storage for acquired coins. However, it is not a full-fledged crypto wallet with the variety of features other standalone wallets may offer.

Crypto also provides basic market information and cryptocurrency-related news feeds, helping traders stay updated on important events and emerging trends in the cryptocurrency market.

Demo Account

The Brokers Securities, Inc.’s Trading Simulator is a program that enables traders to test new ideas and strategies without risking real money.

It provides a risk-free environment for testing new ideas and sophisticated strategies, allowing users to immerse themselves in simulated trading situations using virtual funds. The program offers real-time data, providing traders insights into market movements and price swings.

It also minimizes the worry of financial loss, making it ideal for novice traders. The Trading Simulator also offers infinite paper trading funds, allowing users to experiment with various investment possibilities and trading strategies without restrictions.

It also allows back-testing of trading techniques across various asset classes, allowing users to assess the success of their methods under different market situations and make data-driven tweaks to maximize their trading strategy. This skill allows traders to modify their techniques and respond to shifting market circumstances confidently.

How is a TradeStation Entity Account different from an Individual Account?

An Entity Account is designed for businesses, trusts, partnerships, and LLCs. It provides access to the full platform for market research, strategy testing, and trade execution across several asset classes.

Does TradeStation provide Islamic trading accounts?

No, they do not provide Islamic trading accounts that adhere to Shariah-compliant rules.

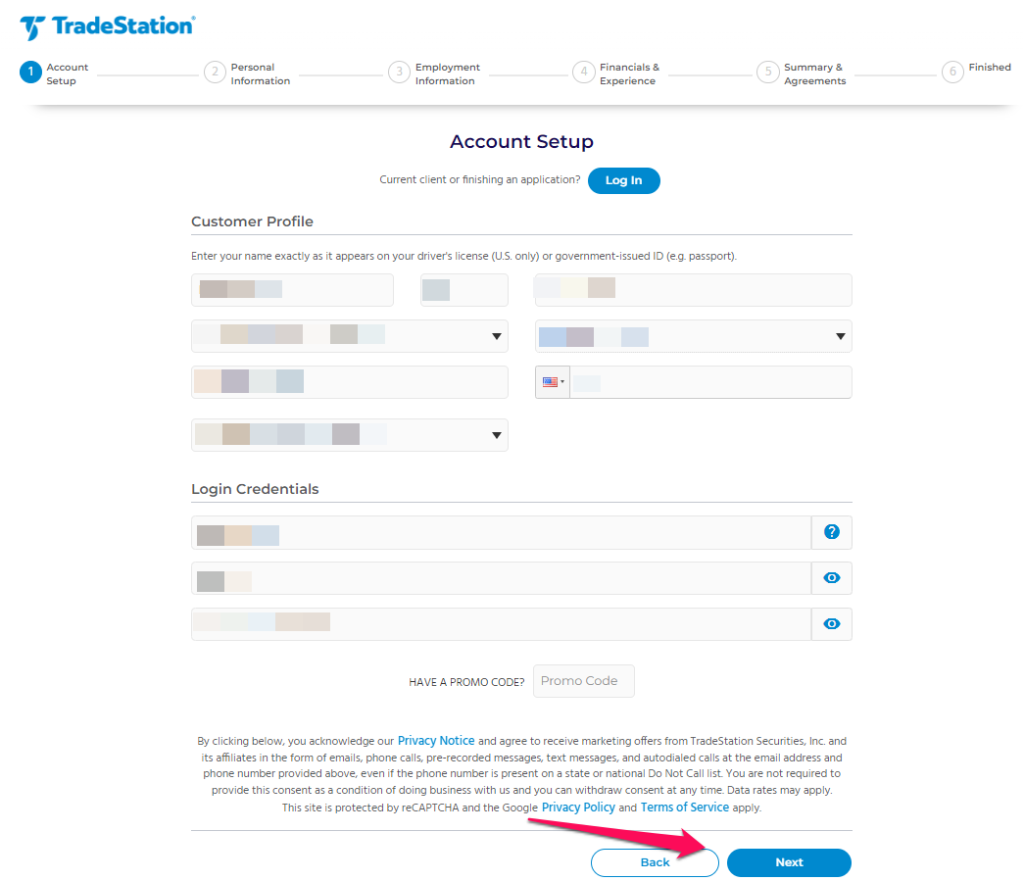

How To Open a TradeStation Account step by step

To register an account with TradeStation, follow these steps:

Step 1: Click on Open on account

Navigate to TradeStation’s account opening page.

Step 2: Fill in your information.

- Start the application process by choosing your preferred account type. This depends on your trading objectives and requirements (individual, joint, IRA, etc.).

- Provide complete and accurate personal information, such as your name, address, contact information, and Social Security number.

- Select a username and password for your account login.

- Examine TradeStation’s customer agreement and disclosures. Before going, please ensure that you understand the terms and conditions.

- Once you have finished the online application, you will be asked to provide supporting papers for verification. These may include a government-issued ID and evidence of residence (utility bill, bank statement).

- After you submit your application and papers, TradeStation will examine them. This procedure usually takes a few business days.

- Once approved, you will receive notice and instructions on funding your new TradeStation account.

- Download and install the TradeStation trading platform on your favorite device. The interface allows you to conduct trades, manage your account, and access market statistics.

- Before making your first transaction, familiarize yourself with the platform’s features and functions. TradeStation provides tutorials and instructional materials to help you get started.

Is there a minimum deposit to start a TradeStation account?

No, the broker does not have a minimum deposit requirement, so traders may begin trading with as little as $0 in their account.

Does TradeStation provide a demo account for practicing trading strategies?

Yes, the broker has a Trading Simulator tool that allows traders to test new ideas and techniques in a risk-free environment with virtual currency before investing real money.

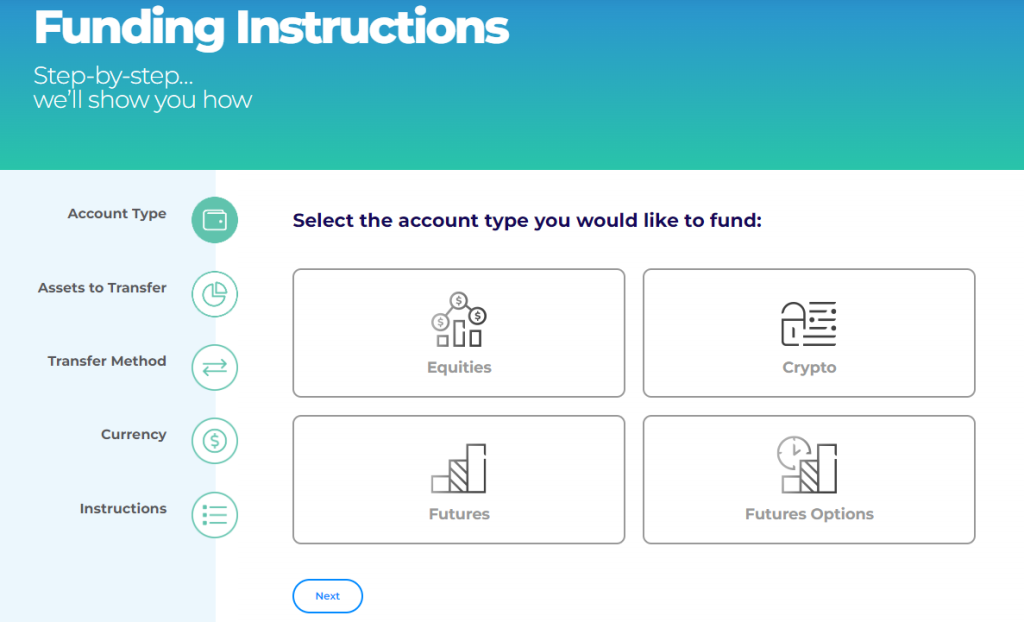

TradeStation Deposit and Withdrawal

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Online Transfer | All | USD | 1 – 7 days |

| Bank Wire Transfer | All | USD | 1 – 7 days |

| Checks | United States | USD | 7 days+ |

| Cryptocurrencies | All | Multi-currency | Instant – a few hours |

Deposit Methods:

Online Transfer

✅Log into your TradeStation account and visit the funding/deposits area.

✅Choose the “ACH” or “Electronic Bank Transfer” option.

✅Link your external bank account by entering your bank’s routing and account numbers.

✅Start the transfer from your TradeStation account, indicating the amount you wish to send.

Bank Wire Card

✅Get bank wiring instructions from TradeStation’s website or by calling support. This will contain their bank name, routing number, and TradeStation account number.

✅Make a wire transfer from your bank and include all the details that TradeStation supplied.

Checks

✅Get TradeStation’s check deposit instructions and mailing address from their website or support.

✅Endorse the check and attach a deposit sheet with your TradeStation account information.

✅Send the cheque to the provided address.

Cryptocurrency

✅Log into your TradeStation Crypto account.

✅Navigate to the “Deposits” area and choose the cryptocurrency you want to deposit.

✅TradeStation will provide a unique deposit address. Carefully copy this address.

✅Start the crypto transfer from your external wallet and send the necessary amount to the TradeStation deposit address.

Withdrawal Methods:

Online Transfer

✅Log into your TradeStation account and navigate to the “Withdrawals” section.

✅Choose “ACH” or “Electronic Bank Transfer.”

✅If you have not connected your bank account, enter your bank’s routing and account numbers.

✅Enter the amount you want to withdraw and submit the request.

Bank Wire

✅Contact TradeStation support or see the wire withdrawal procedures on their website.

✅Please provide your bank’s wiring instructions, including your name, routing number, and account number.

✅Submit the withdrawal request, indicating the amount.

Checks

✅TradeStation’s check withdrawal procedures can be found on their website or by contacting support.

✅Submit a check withdrawal request, including the requested amount and your postal address.

Cryptocurrency

✅Log into your TradeStation Crypto account.

✅Navigate to the “Withdrawals” section and choose the coin you want to withdraw.

✅Provide your external wallet address.

✅Specify the amount and submit your withdrawal request.

Are there any costs for depositing funds into a TradeStation account?

The broker usually does not impose deposit fees, although some payment methods, such as wire transfers, may involve costs from the sending and receiving banks.

How long does it take for deposits to be reflected in a TradeStation account?

Deposit processing times vary based on the deposit method used, with internet transfers and cryptocurrencies being completed instantaneously or within a few hours, while bank wire transfers and cheques might take 1 to 7 days.

Trading Instruments and Products

TradeStation offers the following trading instruments and products:

➡️Stocks – TradeStation provides a diverse range of equities, allowing traders to invest in big corporations from the United States and worldwide.

➡️ETFs – TradeStation offers a wide choice of Exchange-Traded Funds (ETFs) covering a variety of industries, commodities, and foreign markets.

➡️Options – TradeStation offers a broad range of options trading methods and provides access to US and foreign options markets.

➡️Futures – TradeStation provides a diverse range of futures products, including commodities, indexes, and currencies, including standard and micro-futures, enabling traders to capitalize on market moves with precise market data.

➡️Futures Options – TradeStation provides futures options on various assets, combining futures leverage with options trading strategies, allowing traders to hedge or speculate on future commodity and index price changes while maintaining a set risk profile.

➡️Mutual Funds – TradeStation offers a wide range of mutual funds, allowing investors to diversify their portfolios across asset classes and sectors, backed by professional management and intelligent asset allocation.

Can I trade cryptocurrency with TradeStation?

Yes, TradeStation provides a specific Crypto Account for trading supported cryptocurrencies, which includes real-time price quotes, basic charting tools, and order-placing options.

Are there any limits on trading futures contracts with TradeStation?

The broker provides a wide selection of futures products, including commodities, indices, and currencies, with conventional and micro-futures accessible for traders to profit from market movements.

TradeStation Trading Platforms and Software

TradeStation

The broker offers trading platforms that cater to different traders’ needs, offering seamless transitions between desktop, online, and mobile environments. The desktop platform is designed for traders seeking efficiency and customization, offering market research and bespoke apps.

The Web Trading platform offers flexibility without compromising functionality, making it suitable for novice and experienced traders. The mobile apps for Apple and Android smartphones provide a dynamic trading experience with real-time data, sophisticated order execution, and analytical tools.

These platforms work together to provide a seamless trading experience, ensuring seamless device transitions.

FuturesPlus

FuturesPlus is TradeStation’s platform for futures and options traders, offering a comprehensive framework for strategy visualization, risk control, and transaction execution.

It features an interface for immediate Requests for Quotes and efficient position management from browsers and mobile phones, fully integrating with TradeStation’s ecosystem.

TS Crypto

TS Crypto is a specialized cryptocurrency trading platform that offers a seamless trading experience for traders. It provides real-time market data, powerful charting tools, and secure account management features.

TradeStation aims to provide a comprehensive trading solution across various asset classes, allowing traders to access stocks, ETFs, options, futures, and cryptocurrencies with a single login.

OptionsStation Pro

OptionsStation Pro is a specialist platform for options traders, offering a comprehensive suite of tools for analyzing and executing options strategies. It integrates with the platform’s primary trading environment, allowing traders to create, assess, and execute trades, evaluate strategies, track outcomes, and utilize real-time streaming data, configurable charts, and quick trade execution capabilities.

Does TradeStation provide a web-based trading platform?

Yes, the broker provides an online trading platform that is both flexible and functional, making it suited for beginner and expert traders.

Does TradeStation provide automated trading capabilities?

Yes, the broker provides powerful automated trading capabilities, such as the ability to write and test algorithmic trading strategies in EasyLanguage and access to a marketplace for trading applications and indicators.

Spreads and Fees

Spreads

TradeStation’s spreads are not constant and vary based on market conditions, asset liquidity, and order size. Verify the site or contact their support to obtain accurate spread information for individual securities. They may provide tools for popular asset spreads.

Commissions

Moreover, the broker offers various pricing levels for stocks, ETFs, options, and futures, which affect commission structures. They provide per-share, commission-free, or commission-free structures, with options having per-contract costs.

Overnight Fees

Interest costs will be incurred if you keep leveraged positions (using margin) overnight. The margin rates are determined by your account balance and the assets you trade. In general, increased leverage leads to higher overnight interest rates.

Deposit and Withdrawal Fees

Deposits into their accounts are often free, particularly via ACH transactions. Wire transfers (particularly international ones) may involve costs. Withdrawals may also incur costs, depending on the method and amount.

Inactivity Fees

If your account equity falls below a specific level and you have little trading activity in a given time, TradeStation may charge you an inactivity fee. However, certain price options, such as TS Select, waive the inactivity cost.

The typical fee is 10 USD if the month-end equity is <$10,000 or there are fewer than 10 trades in the previous 3 months

Currency Conversion Fees

Because the broker’s accounts are based on USD, you may pay currency conversion costs if you deposit, or trade assets denominated in another currency.

Are there any commission-free trading possibilities on TradeStation?

Yes, the broker provides commission-free trading on stocks and ETFs, giving traders cost-effective ways to participate in these assets.

Does TradeStation impose overnight fees on leveraged positions?

Yes, traders who maintain leveraged positions overnight may face interest charges, with margin rates determined by account balance and traded assets.

Leverage and Margin

The broker allows users to borrow funds to increase purchasing power, potentially increasing earnings and losses. Leverage is expressed as a ratio, such as 2:1, allowing for up to $2 worth of securities for every $1 of purchasing power.

Margin requirements vary per asset type, with stocks offering up to 2:1 leverage for overnight holdings and 4:1 for intraday margin. Futures margin is challenging due to exchange-mandated minimums and their risk management.

Is there a limit on leverage for certain assets on TradeStation?

The broker may apply margin and leverage limitations on certain assets depending on market circumstances, volatility, and regulatory requirements to ensure responsible trading activities.

How does TradeStation compute the margin needs for leveraged positions?

The broker determines margin needs based on account balance, asset type, and position size, with margin rates changing according to leverage and asset class.

Educational Resources

TradeStation offers the following educational resources:

➡️Trading Guides – TradeStation’s trading guides provide comprehensive insights into various trading methods, market research methodologies, and financial instruments, enabling traders to enhance their trading strategies, understand market dynamics, and effectively utilize technical and fundamental research.

➡️Platform Guides – platform guidelines provide comprehensive tools for users, ranging from basic navigation to strategy testing and automated trading, enabling traders to maximize the platform’s analytical capabilities.

➡️FAQs – This resource concisely answers common questions about their services, account administration, and trading operations, especially for new users and those seeking clarification on platform features or trade rules.

➡️Market Insights – the broker offers current market trends, economic events, and trading opportunities, providing traders with valuable insights to adapt their strategies and stay updated on financial market variables.

➡️Support Forums – Support forums on TradeStation foster a sense of community among users by facilitating peer-to-peer learning and assistance.

➡️Steps to Retirement Planning – TradeStation emphasizes the importance of long-term financial planning and offers retirement preparation services, focusing on investment options, risk management, and financial objectives.

➡️TradeStation Master Class – The advanced training program offers comprehensive education on platforms, trading methods, and market analysis, featuring live sessions with qualified instructors aimed at serious traders.

➡️Events – TradeStation hosts webinars, workshops, and seminars to provide educational opportunities, engage traders, and stay updated on trading tactics and market trends.

➡️Retirement Planning – TradeStation offers comprehensive retirement planning tools, including investing techniques, portfolio management, and financial planning for a safe and profitable retirement.

Does TradeStation provide teaching materials for new traders?

Yes, the broker offers beginner-friendly trading guidelines, platform tutorials, and frequently asked questions (FAQs) to assist new traders in comprehending market dynamics and trading basics.

Is TradeStation hosting any live events or webinars for educational purposes?

Yes, the broker provides live events, webinars, and seminars with industry professionals and experienced traders to provide useful insights into trading methods, market analysis, and platform capabilities.

Pros & Cons

| ✔️ Pros | ❌ Cons |

| Traders have access to equities, ETFs, options, futures, and cryptocurrency | Inactivity fees apply to your account if you do not maintain specific balances or trading activity levels |

| Matrix is a one-of-a-kind order entry and management tool that allows you to input and alter transactions while seeing them visually swiftly | The desktop interface, although robust, has a high learning curve and may be intimidating for individuals new to active trading |

| TradeStation offers a customized platform with advanced tools and graphics for option traders | You cannot acquire fractional shares of stocks or ETFs, which may restrict accessibility for people with smaller accounts |

| TradeStation might provide relatively reasonable commissions and fees depending on your trading style and price plan. | TradeStation focuses primarily on technical analysis; nonetheless, fundamental research capabilities and stock screening features might be less powerful than those of other brokers |

| TradeStation is known for its reliable trade execution and secure platform | It might be difficult to choose the best match for your requirements among TradeStation's several price levels |

| TradeStation's fundamental strength is its powerful desktop platform, which provides customized charting, extensive technical analysis, and the ability to design and automate trading strategies using EasyLanguage | TradeStation does not provide direct FX (foreign currency exchange) trading capabilities |

| In addition to the desktop platform, TradeStation offers a web-based platform and mobile applications | |

| TradeStation provides numerous teaching materials, like as seminars, articles, and a separate TradingApp Store for tools and indicators |

Security Measures

The broker prioritizes customer account and personal information security through industry-standard technology and processes. Additionally, it employs a rigorous risk management strategy to protect client assets and information.

Furthermore, Securities is a member of the Securities Investor Protection Corporation (SIPC), providing additional protection for its customers’ investments. SIPC insurance covers up to $500,000, including $250,000 for funds claims. This demonstrates the broker’s commitment to a secure trading environment and ensures customer information’s confidentiality, integrity, and availability.

How does TradeStation prevent illegal transactions?

Additionally, the broker uses powerful encryption techniques and authentication processes to authenticate traders’ identities and prevent fraudulent transactions, assuring the safety of funds and assets.

Are client funds kept separate from TradeStation operations funds?

Moreover, the broker uses segregated accounts to keep client funds distinct from the company’s operating finances, adding an extra degree of safety to traders’ assets.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

In our experience, TradeStation is a flexible platform for Forex and CFD trading, offering access to various financial products like stocks, ETFs, options, futures, and cryptocurrency.

Furthermore, according to our findings, TradeStation’s comprehensive trading tools, customized platforms, and extensive instructional materials make it an attractive choice for seasoned traders. However, it may have inactivity fines and a high learning curve for newcomers.

Yes, the broker provides a variety of price levels. Some programs include monthly membership costs, while others have per-trade charges.

Withdrawals from the broker normally take 1 to 7 days to complete, depending on the withdrawal method used and any extra verification requirements.

The broker has no minimum deposit requirement, so traders may start trading with as little as $0 in their account.

The broker’s desktop platform includes various charting tools, technical indicators, and the option to design bespoke studies using EasyLanguage.

Yes, there is a respectable broker licensed by the SEC, CFTC, FINRA, and others. Furthermore, as a member of the Securities Investor Security Corporation (SIPC), it provides further security to customer assets.

Yes, the broker permits short sales if you fulfill the margin requirements and the stock is available for borrowing.

The broker allows traders to trade a broad range of financial assets, including stocks, ETFs, options, futures, futures options, mutual funds, and cryptocurrency.

TradeStation is based in the United States and headquartered in Plantation, Florida.

You can withdraw funds from TradeStation via ACH, cryptocurrency, wire transfers, or cheques.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |