eur-usd

EUR/USD Technical Analysis: A Rebound Amid Speculation of Fed’s Policy Shift

Arslan Butt•Monday, December 4, 2023•2 min read

In the early hours of Monday’s Asian trading session, the EUR/USD pair halted its three-day downward trend. The pair’s recovery is fueled by a softening US Dollar (USD) and a decline in US Treasury bond yields, following market speculation that the Federal Reserve (Fed) might be nearing the end of its rate-hiking cycle and considering policy easing. Currently, EUR/USD is trading near 1.0890, marking a modest gain of 0.10% for the day.

Fed Chairman Jerome Powell’s dovish remarks on Friday contributed significantly to the USD’s downturn. Powell hinted at the possibility that the Fed might soon shift from its rate-hiking stance to a more accommodative policy in 2024, stating that it’s premature to assert with certainty the Fed’s attainment of a sufficiently restrictive position or to predict the timing of policy relaxation.

In the US, the manufacturing sector’s momentum remained muted in November. The Institute for Supply Management (ISM) reported that the US ISM Manufacturing PMI remained unchanged at 46.7, below market expectations. Additional data revealed a decline in the Manufacturing Employment Index and a rise in Prices Paid, indicating nuanced shifts in the manufacturing landscape.

Internationally, tensions escalated following an attack on an American warship and commercial vessels in the Red Sea, stoking fears of heightened conflict between Israel and Hamas. Such geopolitical uncertainties may enhance the safe-haven appeal of the USD against its global counterparts.

Meanwhile, in Europe, ECB policymaker and Bank of France Governor Francois Villeroy de Galhau commented last week on the ECB’s cautious stance on interest rates, with potential considerations for reductions later in 2024. Notably, a deceleration in inflation brings the ECB’s 2% inflation target back into focus, suggesting possible monetary policy adjustments.

Market watchers will closely follow upcoming events, including the German Trade Balance data for October and a speech by ECB President Christine Lagarde. These events are expected to provide further direction to the EUR/USD pair.

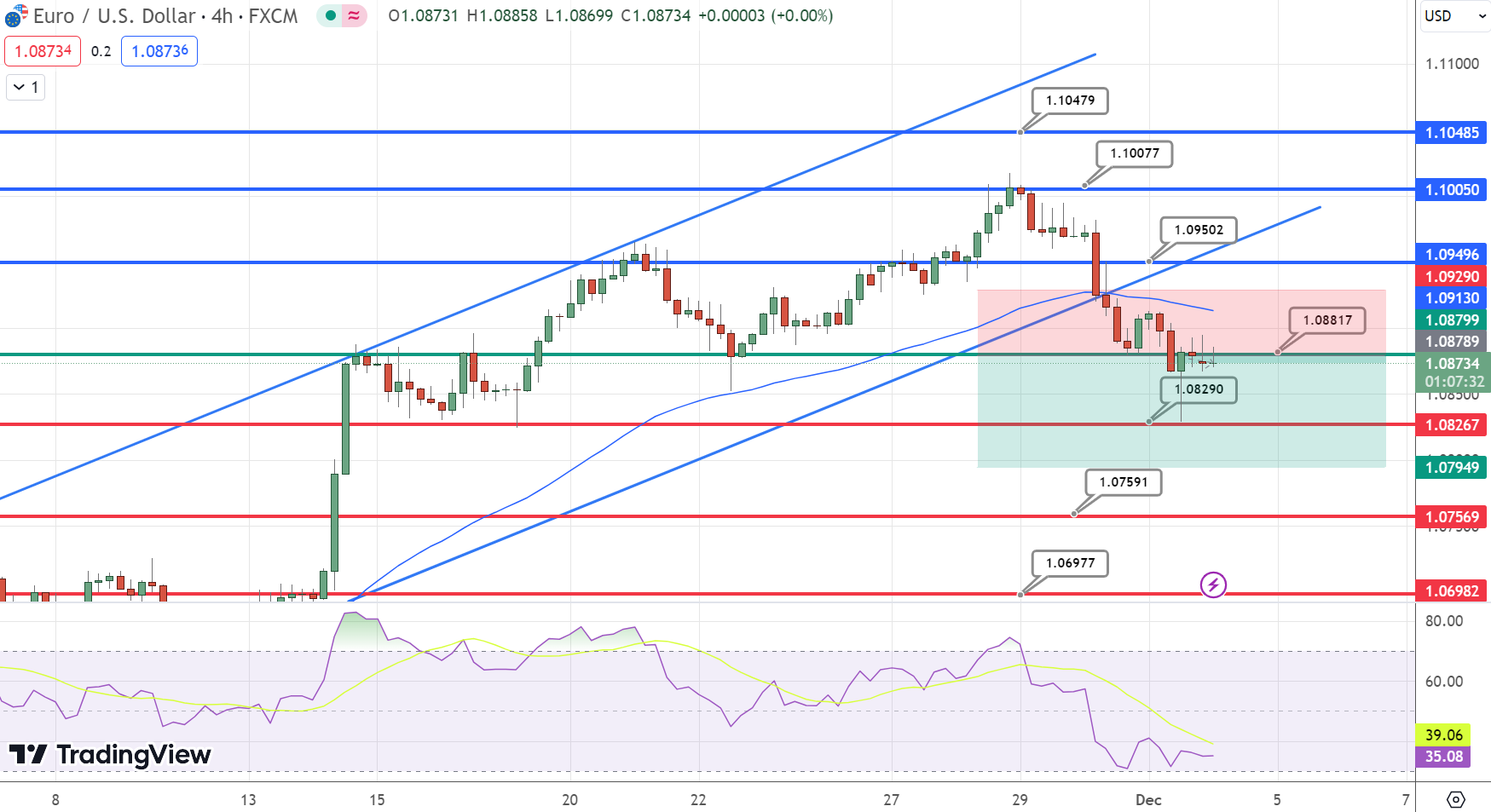

EUR/USD Technical Outlook

The EUR/USD pair’s recent attempts to breach the 1.0860 level were unsuccessful, but it managed to close last Friday above this mark, maintaining its bullish momentum. The pair aims to test the 1.0960 level, with a potential breach setting sights on 1.1080 as the subsequent main target.

Conversely, a break below 1.0860 could reverse the upward trend, exerting downward pressure with initial targets near the 1.0764 level.

Today’s expected trading range lies between 1.0820 support and 1.0970 resistance, with the trend for the day projected to be bullish.

EUR/USD Live Chart

EUR/USD

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.

His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.

His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Comments

0

0

votes

Article Rating

Subscribe

Login

0 Comments

Inline Feedbacks

View all comments

Top

FX

Crypto

Commodities

Indices

Start Trading

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |

U have been succesfuly subscribed!