⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

fil-usd

Filecoin Rockets 15% on Solana Partnership: What’s Next for FIL?

Arslan Butt•Tuesday, February 20, 2024•2 min read

Filecoin (FIL), the decentralized storage network, has surged over 15% in the past 24 hours, fueled by its recently announced partnership with high-speed blockchain Solana. This collaboration aims to strengthen Solana’s infrastructure, potentially positioning it as a more competitive alternative to Ethereum by bolstering its decentralized storage capabilities. But is this partnership and the recent price uptrend enough to sustain FIL’s momentum?

Filecoin-Solana Synergy Fuels the Fire

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

The key driver behind FIL’s recent rally seems to be its integration with Solana. This collaboration offers several benefits for both parties:

- Solana Gains Muscle: By leveraging Filecoin’s decentralized storage solutions, Solana can enhance its network’s scalability and accessibility, attracting more users and developers. This could potentially position Solana as a stronger competitor to Ethereum, which currently faces scalability challenges.

- Filecoin Expands Reach: Partnering with a prominent and rapidly growing blockchain like Solana exposes Filecoin to a wider audience, boosting its visibility and potential adoption.

More Than Just Solana

While the Solana partnership is a major catalyst, other factors contribute to FIL’s uptrend:

- Growing Demand for Decentralized Storage: The increasing demand for secure and reliable data storage solutions outside centralized control bodes well for Filecoin’s long-term prospects.

- Rising Network Activity: On-chain metrics showcase increasing user activity and data storage on the Filecoin network, indicating growing adoption and utility.

- Positive Market Sentiment: The overall cryptocurrency market has seen a recent uptick, contributing to positive sentiment towards FIL and other digital assets.

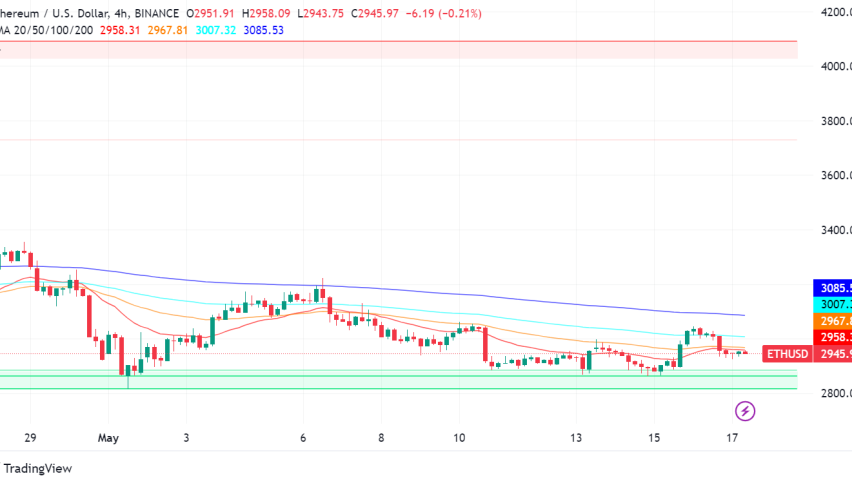

FIL/USD Technical Analysis

Here’s a technical analysis of FIL/USD:

- Overbought RSI: The Relative Strength Index (RSI) suggests the asset might be overbought in the short term, indicating a potential pullback before further upward movement.

- Increased Volatility: Recent price action has been highly volatile, with large swings that could challenge short-term traders.

- Key Resistance Levels: Areas around $8 and $8.50 could act as major resistance zones in the near term.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Top

FX

Crypto

Commodities

Indices

Start Trading

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |