Gold Price Forecast: $2,100 Peak Amid Fed Rate Cut Speculation & Middle East Tensions

Gold’s price (XAU/USD) achieved a three-month high on Monday, reaching a record-setting level beyond $2,100, propelled by anticipation that the Federal Reserve might begin reducing interest rates come June.

This surge was also supported by escalating geopolitical tensions in the Middle East, enhancing the appeal of gold as a safe-haven asset.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Despite this, during Tuesday’s Asian session, investors decided to secure profits, awaiting further indications on the Fed’s rate reduction trajectory before committing to more significant investments in gold.

Thus, attention is squarely on Federal Reserve Chair Jerome Powell’s upcoming semi-annual testimony to Congress.

Federal Reserve’s Influence on Gold Prices

The imminent week’s crucial U.S. economic data, especially the Nonfarm Payrolls (NFP) report due on Friday, is expected to significantly influence gold’s future price direction.

Meanwhile, the subdued performance of the U.S. Dollar and the prevailing cautious sentiment in global equity markets may continue to support XAU/USD.

However, gold has momentarily paused its winning streak, signaling investors to exercise caution before presuming a near-term peak and anticipating a substantial correction.

Geopolitical Tensions Bolster Safe-Haven Demand

Recent U.S. economic data and less hawkish remarks from Fed officials have reinforced the likelihood of a rate cut in June, boosting gold prices to surpass the $2,100 threshold.

Concurrently, the U.S. Dollar’s weakness, amidst expectations for a Fed policy shift and ongoing geopolitical risks, particularly in the Middle East, continues to favor gold.

The risk of escalating Middle Eastern tensions, especially after Israel’s significant counter-terrorism operation in Ramallah, remains a critical factor influencing gold prices.

Looking Ahead: Key Economic Indicators

Investors are now focused on Powell’s two-day congressional testimony for further insights into interest rate trends and upcoming U.S. macroeconomic releases to gauge gold’s directional momentum. This week’s agenda includes the U.S. ISM Services PMI, with a spotlight on the eagerly anticipated NFP report on Friday.

Additionally, recent remarks from China’s Premier Li Qiang at the National People’s Congress and China’s 2024 GDP growth target have yet to significantly impact investor sentiment or gold prices.

Today’s key data releases, including the ISM Services PMI and Factory Orders, will be closely monitored for their potential effects on XAU/USD.

Gold Price Forecast: Technical Outlook

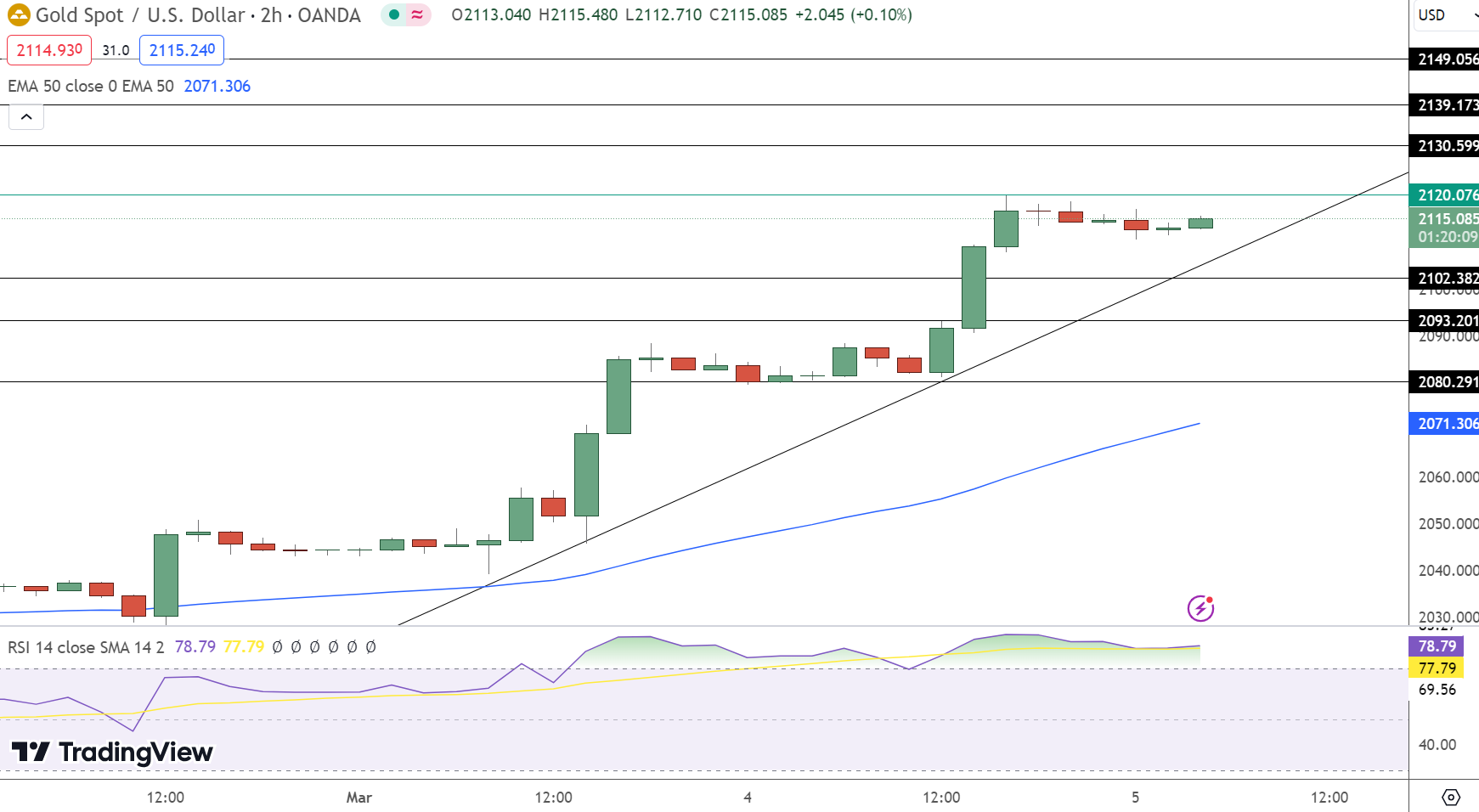

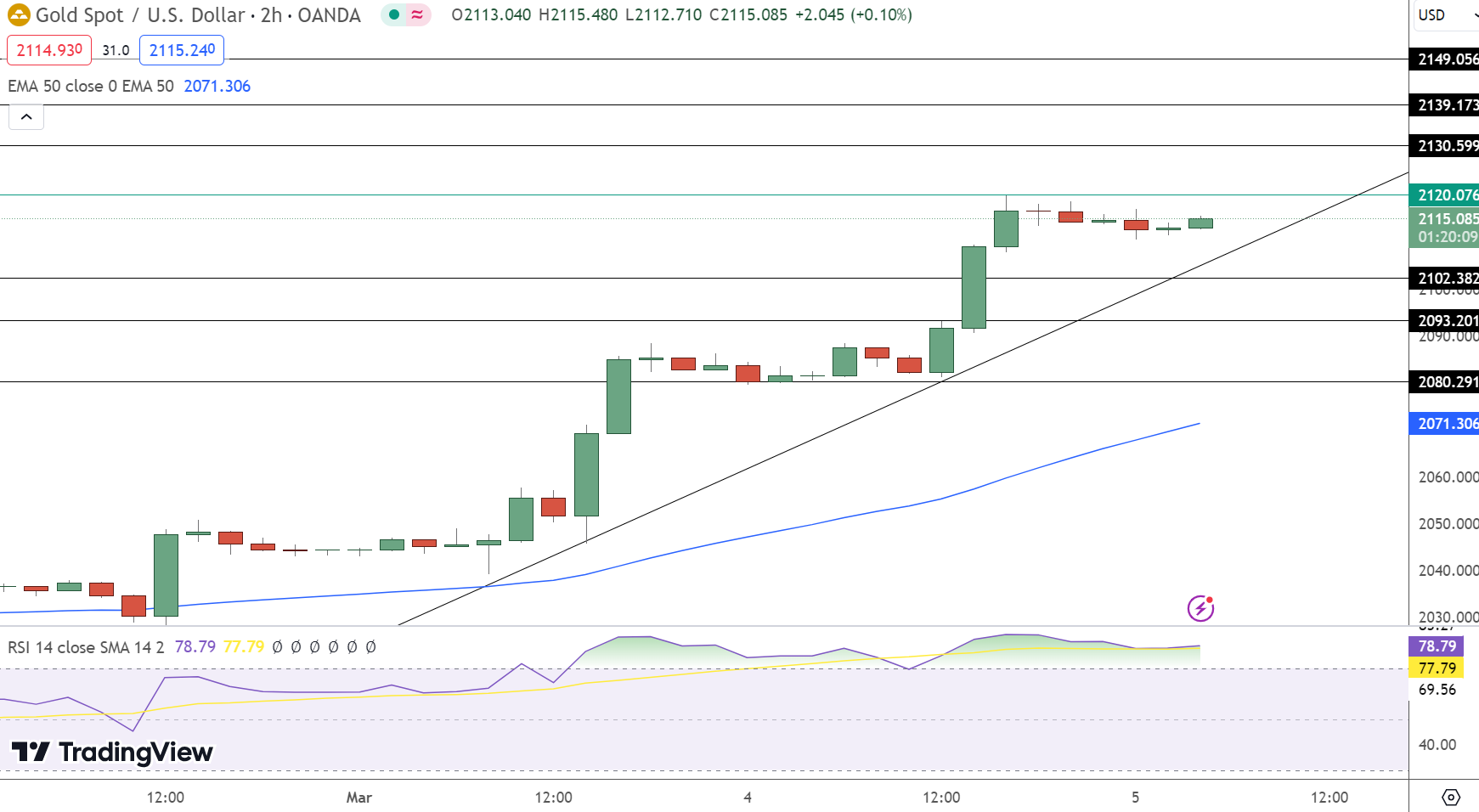

Gold’s price (XAU/USD) marginally increased by 0.01%, closing at $2115.08 on March 5. The metal hovers slightly below its pivot point of $2120.08, indicating a poised stance between gains and stability.

Immediate resistance levels are identified at $2130.60, $2139.17, and $2149.06, setting clear markers for potential upward movements.

Conversely, support is established at $2102.38, with subsequent levels at $2093.20 and $2080.29, providing safety nets for price dips. The Relative Strength Index (RSI) at 78 leans towards overbought conditions, suggesting cautious optimism.

Meanwhile, the 50-Day Exponential Moving Average (EMA) at $2071.31 underlines a bullish trend above the $2120.08 threshold, indicating room for further appreciation if the momentum sustains.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |