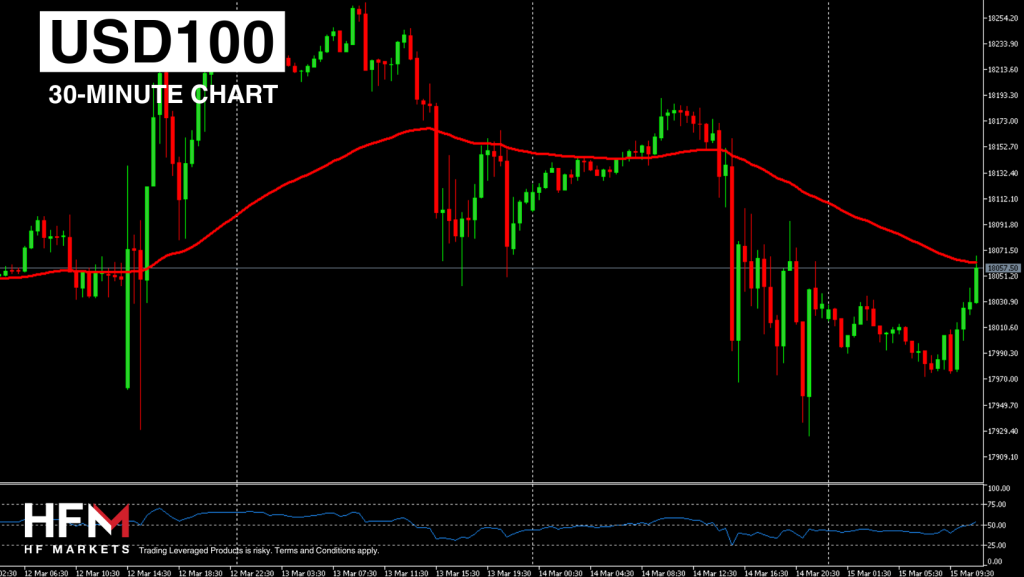

The USA100 increased by 0.19% with the opening of European markets, along with other indices like the DAX, French CAC, and even the NIKKEI225. This upward movement in global equities suggests a heightened risk appetite and positive investor sentiment. Furthermore, US Bond Yields are currently trading lower, a factor that typically supports stocks. These developments hint at a possible correction towards the trend line at $18,090, although investors should remain vigilant throughout the day.

From a fundamental analysis perspective, yesterday’s Producer Price data and Retail Sales figures have exerted pressure on equities. Most analysts now anticipate the Federal Reserve to implement only 2-3 rate hikes in 2024. While some economists still predict a rate cut by June, subsequent cuts are expected to be less frequent. If this scenario persists, certain analysts caution that the index may struggle to revisit the highs seen on March 8th.

DAX’s Day’s Performance > +0.45%

CAC’s Day’s Performance > +0.38%

NIKKEI225’s Day’s Performance > +0.98%

The monthly PPI amounted to 0.6%, which was higher than the predicted 0.3%, and annually, it was at 1.6%, also drastically exceeding expectations of 1.1%. While the Core PPI was 0.3% MoM against a forecast of 0.2%, and annually 2.0% instead of 1.9%. This would mark the second consecutive month where inflation has risen, which is a real concern for the stock market. Wholesale inflation in the US is showing signs of accelerating, which could push consumer prices higher and give US Federal Reserve officials more reasons to keep interest rates high.

The best performing stock of the components which hold more than 1.00% within the NASDAQ is Intuitive Surgical which rose 3.52% and Tesla which rose 0.82%. The worst performing was Adobe, which fell 11.58% due to negative guidance for the next quarter by the company. From the stocks holding a weight of 1.00% and 14 rose in value and 7 are trading lower. These figures are based on Friday’s sessions in pre-market hours.