Ethereum Stares Upward After Whale Activity, Eyes $3,200 Hurdle

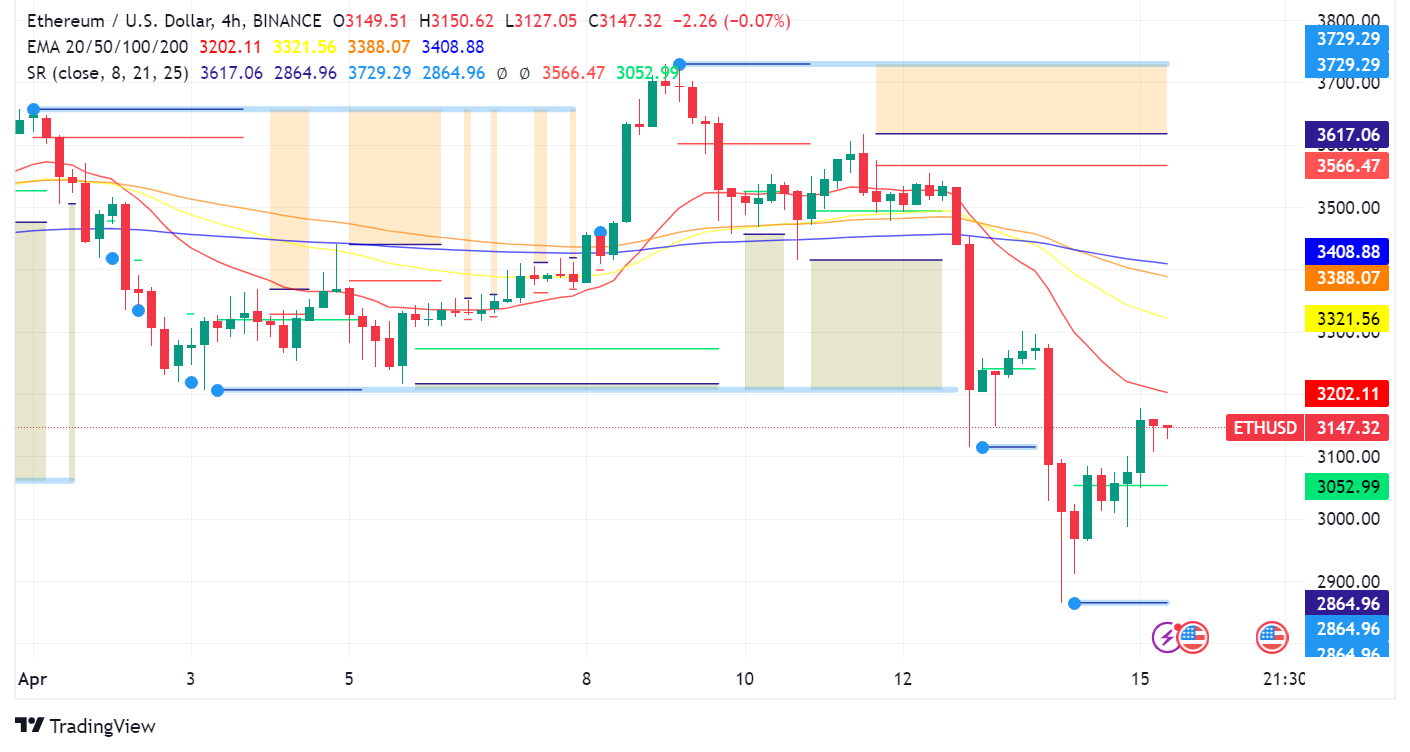

Ethereum (ETH) is attempting a comeback after a recent price dip triggered by the Israel-Iran conflict. The price surged past $3,150, fueled by whales accumulating large amounts of ETH on exchanges.

Whales Accumulate Ethereum Heavily

On-chain data reveals significant Ethereum withdrawals from Binance by a wallet linked to Matrixport, totaling over $50 million. This follows a series of withdrawals by the same wallet since late March, exceeding $228 million in total. Another whale scooped up $3.15 million worth of ETH during the market downturn, adding to their existing holdings.

ETH Long-Term Holders Show Cautious Optimism

While long-term holders offloaded a significant amount of ETH during the initial price drop, their selling pressure has decreased in recent days. This suggests a potential shift towards a more optimistic outlook.

Can the Bulls Push Through?

For the uptrend to be confirmed, bulls need to break through the $3,200 resistance level. Rumors of a spot Ethereum ETF approval in Hong Kong on April 15th could provide an additional boost to the price, but official confirmation is still pending.

Investor Sentiment on the Rebound

A recent study by KPMG indicates renewed investor confidence in the cryptocurrency market, despite a turbulent year. Investors are allocating more to digital assets, with a focus on medium to long-term holding. However, increased caution and scrutiny are also evident, with security remaining a top concern.

Bitcoin Downturn Possible, But Ethereum Eyes $6,800?

Crypto analyst Crypto Kid predicts a potential Bitcoin downturn but remains bullish on Ethereum, suggesting it could reach $6,800 based on its current trend.

Ethereum Developers Planning Next Upgrade

Ethereum developers are already planning the next upgrade, “Pectra,” following the successful Dencun upgrade. This upgrade aims to improve user experience and validator efficiency.

Traditional Finance Embraces Public Blockchains

Traditional financial institutions are increasingly interested in tokenizing assets on public blockchains, with BlackRock’s recent launch of a $100 million tokenized fund on Ethereum being a prime example.

Spot ETH ETF Approval in May Unlikely

Despite the positive developments, a spot Ethereum ETF approval in May seems improbable due to a lack of communication from the US Securities and Exchange Commission (SEC).

Ethereum Recovers, But Liquidations Remain High

While the price has recovered, Ethereum lending markets have witnessed record-breaking liquidation volumes this month, highlighting the market’s volatility.

Overall, Ethereum is in a crucial phase. Overcoming the $3,200 resistance and potential positive news from the ETF front could trigger a significant upswing. However, investor caution and potential headwinds from Bitcoin remain factors to consider.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |