ActivTrades Review

- Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an ActivTrades Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade with ActivTrades?

- ActivTrades Leverage and Margin

- ActivTrades Deposits and Withdrawal

- Educational Resources

- ActivTrades Pros and Cons

Overall, ActivTrades can be summarised as a trustworthy, UK-based brokerage firm that specializes in online Forex trading. It offers access to safe trading environments and proprietary platforms like ActivTrader and MetaTrader 4 . ActivTrades has a trust score of 90 out of 99.

| 🔎 Broker | 🥇 ActivTrades |

| 📈 Established Year | 2001 |

| 📉 Regulation and Licenses | FCA, SCB, CSSF, CMVM, BACEN, CVM |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes, referral bonus |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | ActivTrader, TradingView, MetaTrader 4, MetaTrader 5 |

| 💹 Account Types | Individual Account |

| 💴 Base Currencies | USD, EUR, GBP, SEK, CHF |

| 📌 Spreads | From 0.5 pips EUR/USD |

| 📍 Leverage | Up to 1:200 (retail), 1:400 (Pro) |

| 💵 Currency Pairs | 47; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 0 USD |

| 💷 Inactivity Fee | ✅ Yes |

| 🥰 Website Languages | English, German, Spanish, French, Italian, Russian, Chinese, Thai, Japanese, Portuguese, Malay, Vietnamese |

| 💰 Fees and Commissions | Spreads from 0.5 pips, variable commissions |

| 🫶 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, shares, indices, cryptocurrencies, ETFs, commodities, bonds |

| 🚀 Open an Account | 👉 Click Here |

Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Safety and Security

- ☑️ Account Types

- ☑️ How To Open an ActivTrades Account

- ☑️ Trading Platforms and Software

- ☑️ Fees, Spreads, and, Commission

- ☑️ Which Markets Can You Trade with ActivTrades?

- ☑️ Leverage and Margin

- ☑️ Deposits and Withdrawal

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ Frequently Asked Questions

Overview

ActivTrades, a UK-based brokerage firm, specializes in online Forex trading, CFDs, and spread betting. With over 170 countries, it has grown its clientele over the past two decades.

ActivTrades prioritizes safe trading environments and offers proprietary platforms like ActivTrader and MetaTrader 4 and 5.

ActivTrades also provides extra insurance coverage to protect customer assets. The company offers multilingual assistance five days a week and has earned industry recognition for its excellent customer service.

ActivTrades supports new and experienced traders, making it a popular choice for accessing global financial markets.

In how many countries does ActivTrades offer its services?

ActivTrades provides trading services to customers in over 170 countries across the world.

Does ActivTrades provide services in the United States?

No, ActivTrades does not provide services to residents of the United States.

Detailed Summary

| 🔎 Broker | 🥇 ActivTrades |

| 📈 Established Year | 2001 |

| 📉 Regulation and Licenses | FCA, SCB, CSSF, CMVM, BACEN, CVM |

| 5️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes, referral bonus |

| ⏰ Support Hours | 24/5 |

| 📊 Trading Platforms | ActivTrader, TradingView, MetaTrader 4, MetaTrader 5 |

| 💹 Account Types | Individual Account |

| 💴 Base Currencies | USD, EUR, GBP, SEK, CHF |

| 📌 Spreads | From 0.5 pips EUR/USD |

| 📍 Leverage | Up to 1:200 (retail), 1:400 (Pro) |

| 💵 Currency Pairs | 47; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 0 USD |

| 💷 Inactivity Fee | ✅ Yes |

| 🥰 Website Languages | English, German, Spanish, French, Italian, Russian, Chinese, Thai, Japanese, Portuguese, Malay, Vietnamese |

| 💰 Fees and Commissions | Spreads from 0.5 pips, variable commissions |

| 🫶 Affiliate Program | ✅Yes |

| ❌ Banned Countries | United States |

| 📈 Scalping | ✅Yes |

| 📉 Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, shares, indices, cryptocurrencies, ETFs, commodities, bonds |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

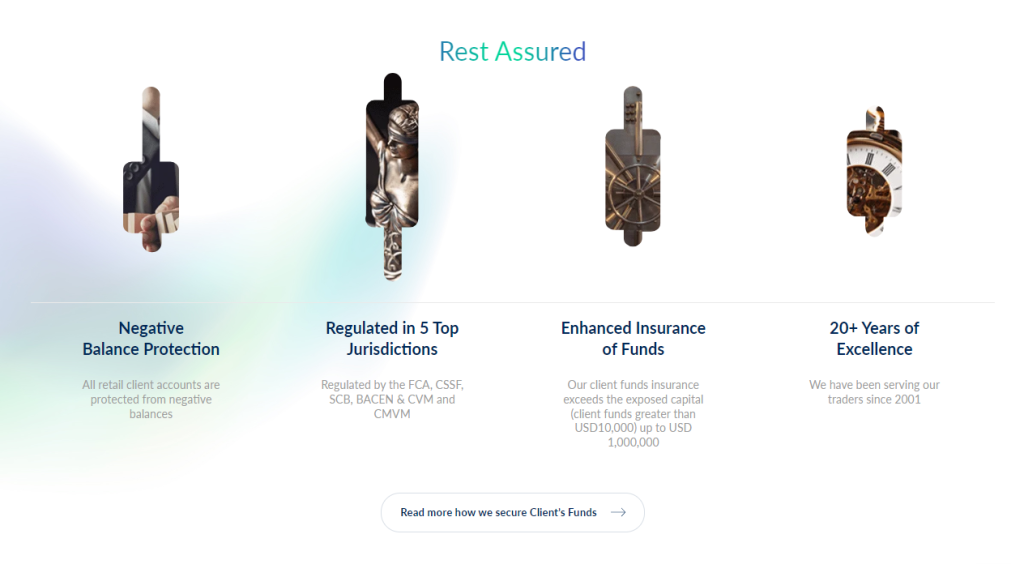

ActivTrades prioritizes the security of its customers’ assets and information through a diversified strategy. The broker offers up to $1 million in Safety Net Insurance, which safeguards customer cash.

To secure trading operations, servers, and transactions, ActivTrades utilizes various security measures, including encryption methods that reinforce protection against negative account balances.

The MetaTrader platform ActivTrades heightens user security by incorporating an additional authentication layer during sign-up. This robust security architecture underscores ActivTrade’s commitment to delivering a secure and dependable trading environment for its traders.

What security features are in place for online trading?

ActivTrades utilizes two-factor authentication (2FA) and other security measures to protect customers’ accounts from unauthorized access.

What certifications or standards ensure the cybersecurity of ActivTrades’ platforms?

ActivTrades follows strong cybersecurity regulatory norms, including those set by financial regulators such as the FCA.

Account Types

| 🔎 Account Type | 🥇 ActivTrades Standard Account |

| 🩷 Availability | Ideal for novices and professionals alike |

| 📈 Commissions | Variable |

| 📉 Leverage | Up to 1:200 |

| 📊 Markets | All |

| 💴 Minimum Deposit | 0 USD |

| 💹 Platforms | All |

| 💱 Trade Size | From 0.01 lots |

| 🚀 Open an Account | 👉 Click Here |

Standard Account

The Standard Account is designed for retail traders who seek ultra-fast execution, with an average time of less than 0.0004 seconds; this guarantees that transactions are completed at the best available price without any requotes or rejections.

This account offers negative balance protection and enhanced funds insurance up to $1,000,000 for retail customers.

Traders can choose their preferred account currency from EUR, USD, GBP, SEK, and CHF options. An expert team is available round-the-clock in 14 languages to assist whenever needed.

Demo Account

The Demo Account offers a risk-free environment for testing ActivTrades’ trading platforms and experimenting with strategies.

The account features cutting-edge tools and indicators investors use worldwide. It allows users to test their strategies under real-market conditions without any restrictions, allowing for a seamless transition from testing to actual trading.

Islamic Account

The Islamic Account caters to traders who wish to follow the principles of Islamic finance by eliminating interest on contracts that last for more than 24 hours and without charging rollover fees. It also provides increased money protection, up to $1 million.

However, traders should be aware that some restrictions may apply, and they should contact ActivTrades beforehand for further information before creating an account.

Professional Account

The Professional Account is specifically tailored for seasoned traders and offers high leverage of up to 1:400 and a close-out level that can reach as high as 30%.

This account bracket also includes the benefit of having an assigned account manager and perks such as rewards schemes for significant trading volumes and referral programs.

Like other accounts on our platform, this category provides negative balance protection and enhanced funds protection for accounts with a balance of $1 million or more.

Does ActivTrades offer a demo account for practice trading?

Yes, ActivTrades offers a demo account with virtual money where you may practice trading methods without risk.

What currencies can I use to fund my account?

You can fund your ActivTrades account with various base currencies, including USD, EUR, GBP, SEK, and CHF.

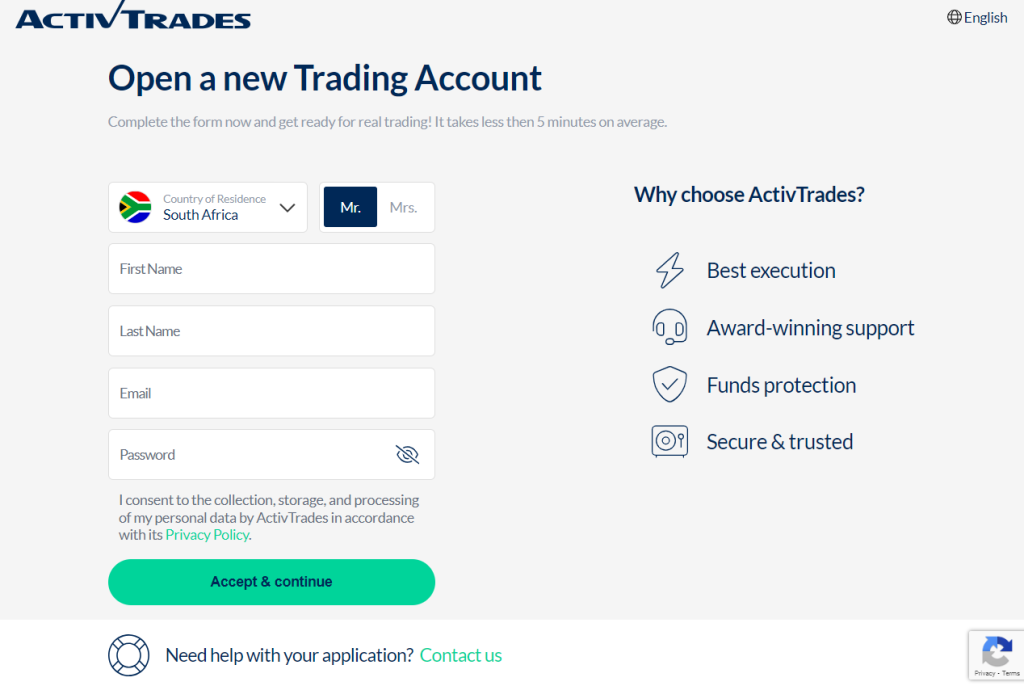

How To Open an ActivTrades Account

To register an account with ActivTrades, follow these steps.

Start by visiting the ActivTrades website. During your initial visit, you will be asked to choose your regulatory area and given an overview of the differences across jurisdictions. Click the “Start Trading Now” button to access the registration form. Fill up your basic information (name, email, phone number) and establish a password. This step sets up your basic account.

You will next be required to enter further information, such as your date of birth, nationality, address, and financial information. This covers your job history, income, trading experience, and investment goals. To meet regulatory standards, take a quick quiz to check your comprehension of trading and its hazards.

Choose your favorite trading platform (MT4, MT5, or ActivTrader) and your account’s currency. To verify your identification, submit the relevant papers, such as a passport, national ID, or driver’s license, as well as evidence of domicile. A picture of yourself may also be needed.

After you submit your papers, ActivTrades will confirm your details. Account approval may take around a day. Upon verification, you will get an email confirmation.

There is no minimum deposit. You may fund your account using various methods, including bank transfers, credit/debit cards, and e-wallets such as Neteller, Skrill, and AstroPay. Deposits are typically handled within one business day. However, certain payment methods may incur costs.

Once your account is funded, you may start trading. Explore the trading platforms to get acquainted with the tools and features offered.

Can I open an account in any country?

ActivTrades serves customers from many different nations but does not allow traders from the United States.

Can I open multiple accounts for different trading strategies?

Yes, ActivTrades enables customers to establish several accounts, which is excellent for testing different trading methods.

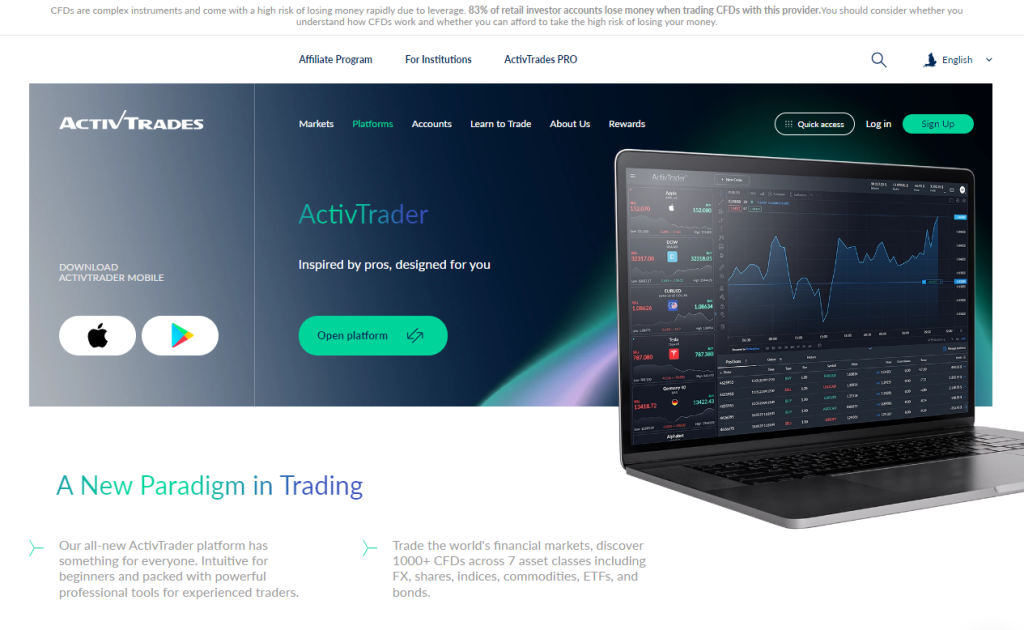

Trading Platforms and Software

ActivTrades

ActivTrader prioritizes usability and functionality. It is well-known for its simple layout, which makes it user-friendly while delivering powerful charting capabilities and technical indicators.

The platform also prioritizes speedy order execution and incorporates risk management tools that align with ActivTrades’ commitment to safe trading practices.

As an option for traders who desire a well-integrated, no-frills interface tailored to the broker’s specialized products, ActivTrader stands out from other platforms due to its efficient design.

ActivTrades TradingView

Although not ActivTrades’ proprietary platform, the incorporation of TradingView grants customers direct access to its esteemed charting environment.

Traders can use sophisticated technical analysis tools, a lively social trading community, and prospects to generate and exchange trade concepts.

The integration with TradingView benefits seasoned traders seeking exhaustive research and novice traders looking forward to connecting with a larger trading society.

ActivTrades MetaTrader 4

ActivTrades supports MetaTrader 4, the industry-standard platform for forex trading. MT4 offers straightforward charting, substantial customization possibilities via Expert Advisors (EAs), and compatibility with many indicators.

Therefore, this option is best suited to traders with previous expertise using MT4 and those seeking automated trading solutions that take advantage of the platform’s rich ecosystem.

ActivTrades MetaTrader 5

ActivTrades offers MetaTrader 5, the latest version of MT4. This platform allows users to enjoy optimized charting options, improved backtesting features, and access to trading assets beyond forex.

Designed for experienced traders who require advanced testing capabilities and greater flexibility with asset selection while using the MetaTrader interface for multi-asset trades, it complements ActivTrades’ CFD instrument offerings perfectly.

Can I use automated trading strategies on ActivTrades platforms?

Yes, both MetaTrader 4 and MetaTrader 5 platforms supplied by ActivTrades enable automated trading using Expert Advisors (EAs).

Do ActivTrades provide any unique tools on its platforms?

Yes, ActivTrades provides various innovative features to assist trading on its platforms, including SmartOrder 2 and SmartForecast.

Fees, Spreads, and, Commissions

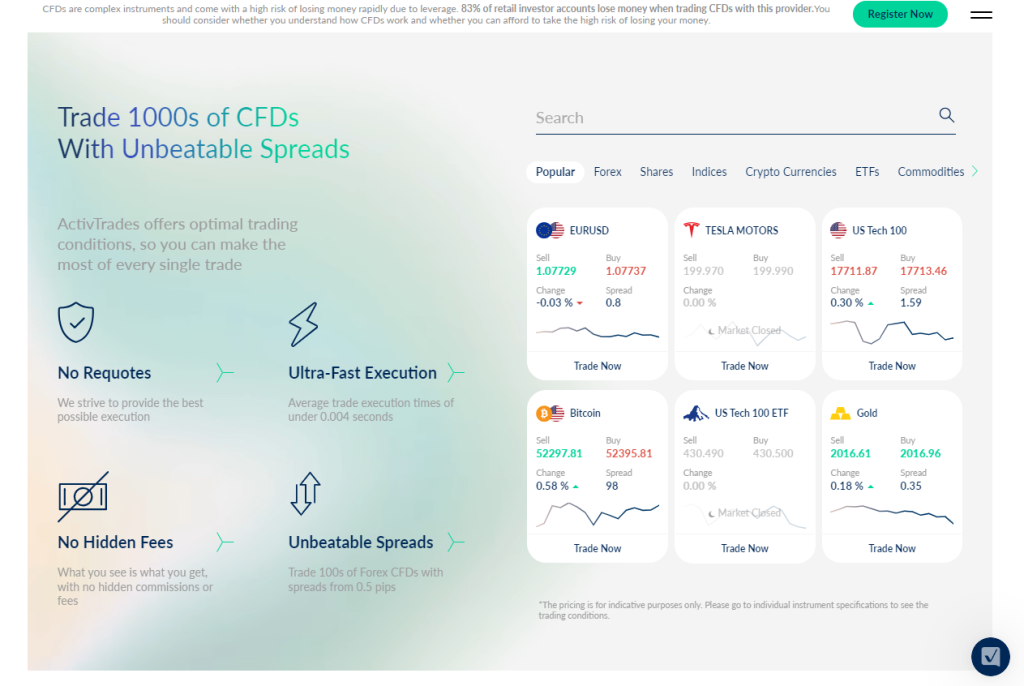

ActivTrades Spreads

ActivTrades charges variable spreads from 0.5 pips for key forex pairings such as EUR/USD and USD/JPY. The spread for GBP/USD starts from 0.8 pips. They do not charge commissions for forex trading.

ActivTrades Commissions

Trading forex is free of charge while trading CFDs on stocks and ETFs costs money. For example, trading on the US stock market costs $0.02 per share, UK shares cost 0.1% for each ticket, and European exchanges cost 0.01%.

ActivTrades Overnight Fees

Swap or rollover expenses apply to overnight positions and are computed using interbank rates plus or minus a markup.

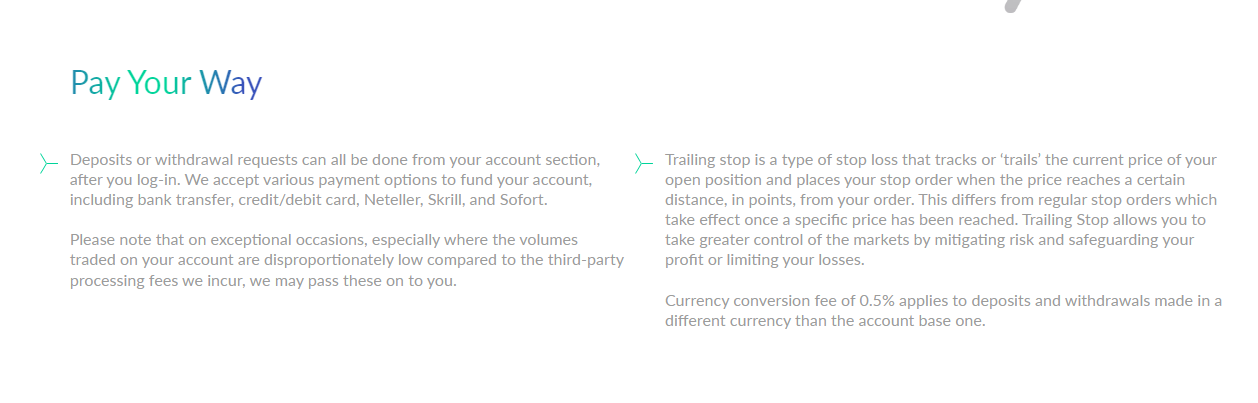

ActivTrades Deposit and Withdrawal Fees

ActivTrades does not charge fees for deposits made using bank transfers or supported digital payment methods in the UK and EEA.

Deposits made with credit or debit cards from outside the UK and EEA are subject to a 1.5% charge. Withdrawals are normally free, although non-SEPA or CHAPS bank transfers may be charged, and USD bank transactions may be subject to a cost.

ActivTrades Inactivity Fees

After one year of inactivity on a trading account, a monthly cost of £10 is applied.

ActivTrades Currency Conversion Fees

Traders may be charged currency conversion costs if they deposit or withdraw money in a currency other than their account base.

What are the spreads for EUR/USD with ActivTrades?

ActivTrades provides attractive spreads beginning at 0.5 pips for the EUR/USD currency pair.

How does ActivTrades charge for overnight positions?

ActivTrades imposes swap fees for overnight positions, computed using interbank rates plus a markup or markdown.

Which Markets Can You Trade with ActivTrades?

ActivTrades offers the following trading instruments and products.

ActivTrades offers access to a diverse choice of major, minor, and exotic currency pairings, allowing traders to participate in the dynamic world of forex trading. This category enables traders to purchase and sell Contracts for Difference (CFDs) on shares of prominent global firms from various industries, allowing them to participate in stock market movements without owning the stock directly.

ActivTrades provides CFD trading on several key stock market indexes worldwide, allowing players to bet on larger market movements. Clients can trade CFDs on prominent cryptocurrencies such as Bitcoin, Ethereum, and others to profit from the volatility of cryptocurrency markets.

Exchange-traded funds (ETFs) provide exposure to a basket of assets. ActivTrades offers CFDs on a wide range of ETFs, enabling traders to diversify their portfolios easily.

To access these diversified markets, you can trade CFDs on energy commodities like oil and natural gas, precious metals like gold and silver, and agricultural items.

ActivTrades offers CFDs on government bonds, allowing you to trade swings in the fixed-income markets while possibly hedging other holdings.

What range of cryptocurrencies is available for trading with ActivTrades?

ActivTrades offers CFD trading on popular cryptocurrencies such as Bitcoin and Ethereum.

Can I engage in forex trading with exotic pairs through ActivTrades?

Yes, ActivTrades offers access to currency pairings, including major, minor, and exotic ones.

ActivTrades Leverage and Margin

ActivTrades provides varying leverage levels based on the account’s regulatory jurisdiction. The maximum leverage for accounts registered in the European Union or the UK is 1:30, while accounts under the.com domain can have up to 1:400.

Leverage allows traders to manage larger holdings with less committed cash, such as managing a $50,000 position with a $500 deposit. However, it also increases the possibility of bigger losses, so traders must exercise caution.

ActivTrades’ leverage rates follow ESMA rules, which set a 1:30 leverage limit for main currency pairings. Different assets have different leverage ratios, such as commodities CFDs at a 10:1 ratio and shares and indices at a 20:1 ratio.

Professional accounts with larger leverage levels are available, but traders must meet specific requirements, such as financial industry expertise and portfolio size.

How do margin requirements vary across different instruments with ActivTrades?

Margin requirements at ActivTrades vary per product, with greater leverage available for major FX pairs than for more volatile assets such as cryptocurrency.

Are there risks associated with using high leverage with ActivTrades?

High leverage with ActivTrades can greatly increase possible gains and losses; thus, risk must be managed correctly.

ActivTrades Deposits and Withdrawal

| 🔎 Payment Method | 🌎 Country | 💰 Currencies Accepted | ⏰ Processing Time |

| 💴 Debit/Credit Card | All | Multi-currency | 30 minutes – same-day |

| 💵 Neteller | All | Multi-currency | 30 minutes – same-day |

| 💶 Skrill | All | Multi-currency | 30 minutes – same-day |

| 💷 AstroPay | All | Multi-currency | 30 minutes – same-day |

| 💴 Cryptocurrencies | All | Multi-currency | 30 minutes – same-day |

| 💵 Bank Transfer | All | Multi-currency | 30 minutes |

Deposit Methods:

Bank Wire

Log in to your ActivTrades Personal Area and go to the Deposit area. Select “Bank Wire Transfer” to receive the relevant bank information for ActivTrades.

Make a transfer from your bank account to ActivTrades, including any needed reference numbers. Funds often take a few business days to appear in your trading account.

Credit or Debit Card

Access the deposit area from your ActivTrades Personal Area. Choose “Credit/Debit Card” and enter your card information (number, expiration date, and CVV).

Enter the desired deposit amount and then confirm the transaction. Deposits made using credit cards are sometimes immediately credited to your trading account.

Cryptocurrency Wallets

Obtain the address of a suitable cryptocurrency wallet from your Area. Navigate to your cryptocurrency wallet and initiate a transfer to the specified address. Make sure you choose the relevant cryptocurrency.

Transactions on the blockchain may need many confirmations before they appear in your trading account.

e-wallets or Payment Gateways

Select your preferred e-wallet or payment mechanism from the ActivTrades Personal Area deposit area. You may be forwarded to the provider’s website to access your e-wallet account.

Enter your preferred deposit amount and finish the authorization procedure. Like card payments, e-wallet deposits are often credited to your trading account immediately.

Withdraw Methods:

Bank Wire

In your Personal Area’s withdrawal section, choose “Bank Wire Transfer.” Provide your banking information (account name, number, IBAN/SWIFT code, etc.).

Enter the amount you want to withdraw and then submit the request. Allow a few business days for processing and cash to arrive in your bank account.

Credit or Debit Cards

Typically, you can withdraw up to the amount you originally deposited via card. Choose “Credit/Debit Card” in the withdrawal area. Enter your desired withdrawal amount (up to your deposit limit) and confirm. Card withdrawals may take several business days to be completed.

Cryptocurrency Wallets

Provide your cryptocurrency wallet address amount, and start the withdrawal process. The processing timeframes will be governed by blockchain speeds and protocols.

e-wallets or Payment Gateways

In the withdrawal area of your Area, choose your preferred e-wallet. Follow the platform’s steps to complete the withdrawal request.

How quickly do ActivTrades process withdrawal requests?

If withdrawal requests are received before the cut-off time, ActivTrades will process them on the same working day.

What e-wallets can I use to deposit and withdraw funds?

ActivTrades allows a variety of e-wallets, including Neteller and Skrill, for both deposits and withdrawals.

Educational Resources

The Following Educational Resources are on Offer:

A range of instructional tools for traders, including webinars designed to enhance their trading skills and knowledge. Webinars, delivered by industry professionals, cover various topics and feature interactive Q&A sessions for further learning.

The manuals given are an invaluable resource for traders who prefer self-study. Guides will likely offer thorough instructions and recommendations for different trading platforms, tools, and principles.

When it comes to analysis, traders have access to the tools and insights they need to make educated trading choices, including thorough market research reports and tools built into their trading platforms to help with technical and fundamental analysis.

ActivTrades offers an economic calendar, a useful tool for traders who want to stay on top of significant financial events and indications that may affect the markets. Traders may use this tool to arrange trading operations around significant economic news.

Does ActivTrades host any offline educational events?

Yes, they hold seminars and workshops that provide face-to-face learning and networking opportunities.

How can I access market analysis through ActivTrades?

Market analysis is accessible on the platform, providing insight into market patterns and prospective trading opportunities.

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements. Our broker review should not be considered financial advice. However, traders are urged to seek professional financial advice before making investment decisions.

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime, even if the information supplied is correct when going live.

Investor Warning: Foreign currency trading on margin is associated with an elevated risk and may not be appropriate for all South African investors. Before engaging in foreign currency or Contract for Difference (CFD) trading, evaluate your investing goals, expertise, appetite for risk, and willingness to be exposed to risk. In addition, you should not start investing capital you cannot afford to lose because you could lose part of your original investment.

ActivTrades Pros and Cons

| ✅ Pros | ❌ Cons |

| Choice of proprietary ActivTrader and MetaTrader 4/5, with tools for traders of all levels | ActivTrades only has one retail account |

| Client money is safeguarded against unforeseen market occurrences that might result in negative account balances | The educational materials and trading tools are not as comprehensive as those offered by competitors |

| ActivTrades is well-known for its rapid, multilingual customer service, which is accessible via a variety of channels | There is a high inactivity fee charged on dormant accounts |

Yes, ActivTrades provides leverage on the majority of its products. However, bear in mind that leverage may increase both earnings and losses.

Withdrawal requests from ActivTrades are typically handled the same working day if made before the cut-off time, with monies arriving within a few business days, depending on the withdrawal type and bank processing delays.

No, ActivTrades is a registered broker with a positive reputation and negative balance protection, making it unlikely to be a fraud.

ActivTrades gives traders a competitive advantage by not requiring a minimum deposit to create an account, allowing them to trade whatever amount matches their financial capability.

Yes, ActivTrades is regarded as a secure broker, licensed by numerous top-tier agencies, including the FCA, and offering extra security features such as customer money protection of up to $1 million.

ActivTrades is a forex and CFD broker where you may trade currencies, stocks, indices, commodities, and more.

ActivTrades allows traders to trade forex, stocks, indices, cryptocurrencies, ETFs, commodities, and bonds, giving a comprehensive portfolio for trading.

You may create an account on the ActivTrades website. The procedure is really simple and takes just a few minutes.

ActivTrades has offices in Milan, the Bahamas, Dubai, Bulgaria, and Luxembourg, and its headquarters in London.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |