Finq.com Review

- Finq.com Review – 13 key points quick overview:

- Overview

- At a Glance

- Finq.com Account Types

- How To Open a Finq.com Account

- Finq.com Deposit & Withdrawal

- Trading Instruments & Products

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- 🏆 10 Best Forex Brokers

- Conclusion

Overall, Finq.com is considered a high risk, with an overall Trust Score of 65 out of 100. Finq.com is licensed by zero Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and one Tier-4 Regulator (high risk).

Finq.com Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Finq.com Account Types

- ☑️How to Open A Finq.com Account

- ☑️Finq.com Deposit & Withdrawal

- ☑️Trading Instruments & Products

- ☑️Finq.com Trading Platforms and Software

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Finq.com, a leading online trading platform, launched in 2017 offering a wide range of financial markets and trading techniques, including CFDs for Forex, metals, indices, commodities, and equities.

Regulated by the Seychelles Financial Services Authority (FSA), Finq.com provides traders with protection and monitoring.

The platform offers a user-friendly environment for new and seasoned traders, offering various account types and an innovative web-based platform accessible from any browser.

Finq.com also provides extensive resources for customer education, including market research, webinars, and an economic calendar. The platform is a good choice for new online traders due to its transparency, assistance, and extensive choice of trading instruments.

How does Finq.com maintain transparency in its operations?

Finq.com maintains transparency by giving full information about its regulatory status, fees, and trading conditions on its website.

Why does Finq.com distinguish itself from other online trading platforms?

Finq.com differentiates itself by providing a varied choice of financial instruments, user-friendly trading platforms, and significant instructional materials to meet the requirements of both new and experienced traders.

At a Glance

| 🗓 Established Year | 2017 |

| ⚖️ Regulation and Licenses | FSA Seychelles |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | MetaTrader 4, Finq WebTrader |

| 🛍 Account Types | Silver, Gold, Platinum, Exclusive, Classic ECN, Pro ECN |

| 🤝 Base Currencies | EUR, USD, GBP |

| 📊 Spreads | From 0.1 pips EUR/USD on Pro ECN |

| 📈 Leverage | 1:300 |

| 💸 Currency Pairs | 55; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 100 USD |

| 🚫 Inactivity Fee | Yes, 500 CHF |

| 🗣 Website Languages | English, German, English, Arabic, Chinese, Bahasa Indonesia, Bahasa Malay, Russian, Spanish, Vietnamese, Persian |

| 💰 Fees and Commissions | Spreads from 0.1 pips, commissions from 0.08% on the Exclusive Account |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | United States, European Union |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, stocks, indices, commodities, bonds, cryptocurrencies, ETFs |

| 🎖 Open an Account | 👉 Open Account |

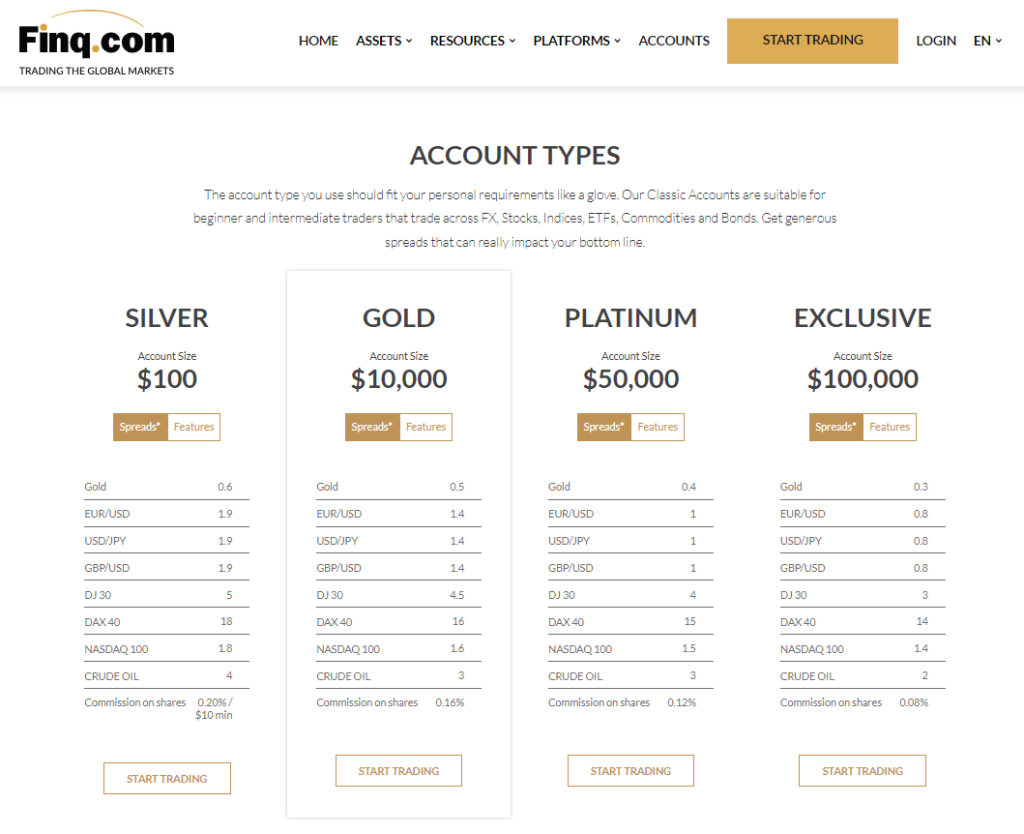

Finq.com Account Types

| Silver | Gold | Platinum | Exclusive | Classic ECN | Pro ECN | |

| ✅ Availability | All; ideal for beginners | All; ideal for casual traders | All; ideal for day traders, scalpers | All; ideal for professional traders | All; ideal for scalpers, day traders, algorithmic traders | All; ideal for scalpers, day traders, algorithmic traders, and professionals |

| 🛍 Markets | All | All | All | All | All | All |

| 💸 Commissions | 0.20% on share CFDs | 0.16% on share CFDs | 0.12%% on share CFDs | 0.08% on share CFDs | $0.03 per unit on Forex and Metals | $0.04 per unit on Forex and Metals |

| 💻 Platforms | All | All | All | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 📈 Leverage | 1:300 | 1:300 | 1:300 | 1:300 | 1:300 | 1:300 |

| 💰 Minimum Deposit | 100 USD | 10,000 USD | 50,000 USD | 100,000 USD | 1,000 USD | 50,000 USD |

| 🎖 Open an Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account | 👉 Open Account |

Silver Account

Moreover, Finq.com’s Silver Account, starting at $100, offers reasonable spreads across key currency pairings and commodities, a 0.20% fee on shares, daily analysis, access to trading platforms, and 24-hour customer care. Furthermore, it is ideal for new traders, offering a balance of cost and necessary features.

Gold Account

Additionally, the Gold Account, with a $10,000 minimum deposit, offers narrower spreads and a 0.16% fee on shares. It also provides a dedicated account manager, premium daily analysis, and access to Trading Central, making it ideal for experienced traders seeking improved trading conditions and specialized assistance.

Platinum Account

Furthermore, the Platinum Account, with a minimum deposit of $50,000, offers favorable spreads and reduced share commissions. Additionally, it includes Gold Account perks such as dedicated account management, daily analysis, and premium customer support. Ideal for serious traders with significant funding, it provides top-tier service.

Exclusive Account

Moreover, Finq.com’s Exclusive Account offers a $100,000 minimum deposit, low spreads (0.8 EUR/USD), and the lowest share fee (0.08%). Additionally, it requires a $100,000 minimum deposit and provides exceptional service and market knowledge, making it ideal for elite traders.

Classic ECN Account

Furthermore, the Classic ECN Account, with a $1,000 minimum deposit, offers direct market access, low spreads for popular pairings, and a $0.03 fee on Forex and commodities. Additionally, it emphasizes quick execution and transparency for traders in fast-moving markets.

Pro ECN Account

Moreover, the Pro ECN Account is a premium account for expert traders with a $50,000 deposit. It offers ultra-tight spreads, a $0.04 fee on Forex and commodities, and premium services like dedicated account management, daily analysis, and customer support.

Demo Account

Finq.com offers a free $10,000 demo account for traders to practice before joining real markets. This virtual account allows users to test the platform, study tradable products, and experiment with trading techniques without risking real money.

It simulates real-world market conditions, providing a genuine learning experience and familiarizing traders with order placing, charting tools, and risk management measures.

Islamic Account

Finq.com offers Islamic Accounts, or swap-free accounts, to traders who adhere to Islamic religious principles. These accounts comply with Sharia law, which prohibits interest payments.

Positions opened overnight in Islamic accounts are not subject to overnight fees, but a flat administration cost may be charged.

However, not all instruments are available on Islamic accounts, and Finq.com reserves the right to limit or terminate transactions. To activate an Islamic account, users must specify it during the application process or contact Finq.com customer care.

Can I switch between account kinds on Finq.com?

Yes, traders on Finq.com can upgrade or downgrade their account types depending on their trading preferences and capital requirements.

Can I tailor my trading experience on Finq.com depending on my account type?

Yes, Finq.com provides customizable trading experiences across all account categories.

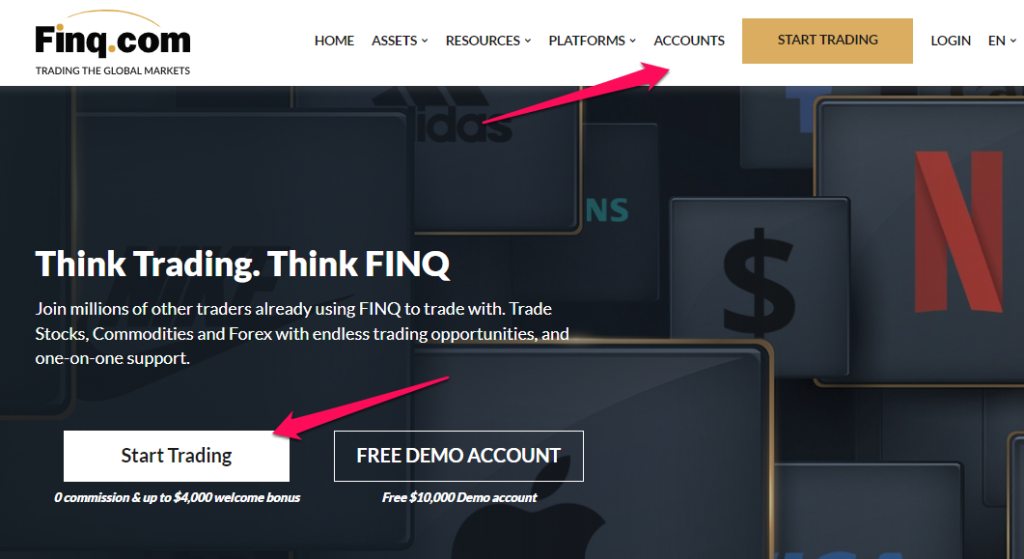

How To Open a Finq.com Account

To register an account with Finq.com, follow these steps:

Step 1 – Navigate to the Finq.com website and click on ‘Start Trading”

Navigate to the account registration area on the Finq.com website. This can be accessed by clicking on the Start Trading button at the top of the landing page.

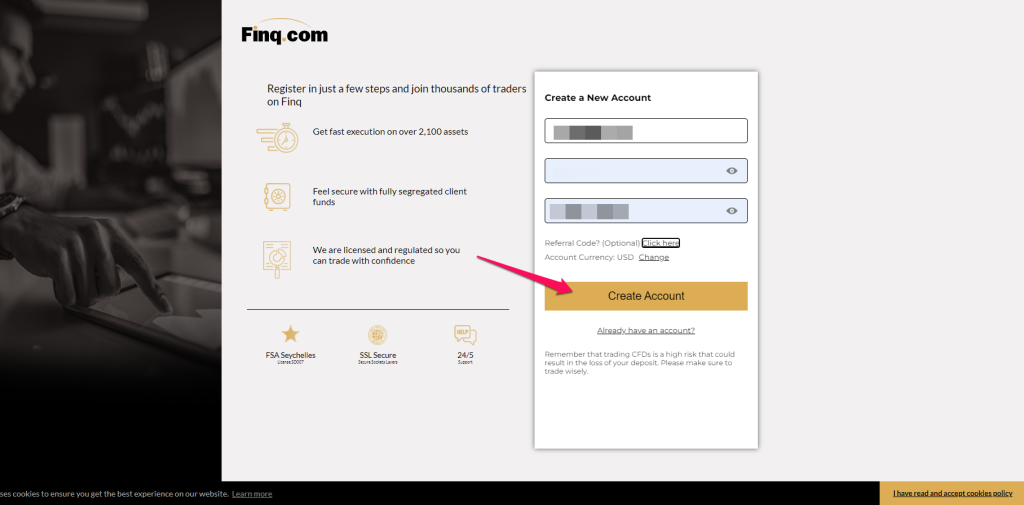

Step 2 – Fill out the Finq.com account registration form

Fill out the short online registration form. You will need to provide your email address, and password and click on Create Account.

Finq.com is regulated and needs identification verification to ensure compliance. Upload copies of a government-issued ID, such as a passport or driver’s license, and evidence of residency, such as a utility bill or bank statement, as directed by the platform.

After submitting the registration form and uploading the required papers, follow any on-screen prompts or instructions given by Finq.com to complete the account opening procedure.

Finq.com Deposit & Withdrawal

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Credit/Debit Card | All | Multi-currency | Instant – a few days |

| e-wallets | All | Multi-currency | Instant – a few days |

| Bank Wire Transfer | All | Multi-currency | Instant – a few days |

| Local Payment Methods | All | Multi-currency | Instant – a few days |

Deposit Methods:

Bank Wire

✅Log into your Finq.com account and go to the “Deposits” area.

✅Select “Bank Wire” to acquire Finq.com’s bank account information.

✅Make a wire transfer from your bank, specifying Finq.com as the destination. Allow for processing time (typically a couple of business days).

Credit or Debit Card

✅Log in to Finq.com, go to the “Deposits” area, and pick your card type (Visa/Mastercard, etc.).

✅Enter your card number, expiry date, CVV code, and desired deposit amount.

✅Follow any extra authentication prompts provided by your bank or card issuer.

e-Wallets or Payment Gateways

✅Log into your Finq.com account and go to the “Deposits” area.

✅Choose your favorite e-wallet (such as Skrill or Neteller).

✅You will be routed to the e-wallet login page. Enter your e-wallet credentials.

✅Authorize payment and confirm the deposit amount.

Withdrawal Methods:

Bank Wire

✅Log into Finq.com and navigate to the “Withdrawals” area.

✅Select “Bank Wire” and provide your bank account information.

✅Enter the amount you want to withdraw and submit your request.

Credit or Debit Cards

✅Log into Finq.com and navigate to the “Withdrawals” area.

✅Select the card you initially used to make deposits.

✅Enter the withdrawal amount and submit your request.

e-Wallets or Payment Gateways

✅Log into Finq.com and navigate to the “Withdrawals” area.

✅Choose your favorite e-wallet.

✅Enter your e-wallet account information and desired withdrawal amount.

✅Confirm the withdrawal request.

Are there any fees for deposits and withdrawals on Finq.com?

No, Finq.com does not impose deposit or withdrawal fees for most payment methods.

Does Finq.com have any deposit or withdrawal limits?

No, it does not. However, while Finq.com does not have stringent deposit and withdrawal limitations, traders should be mindful of any transaction limits established by their preferred payment methods or financial institutions.

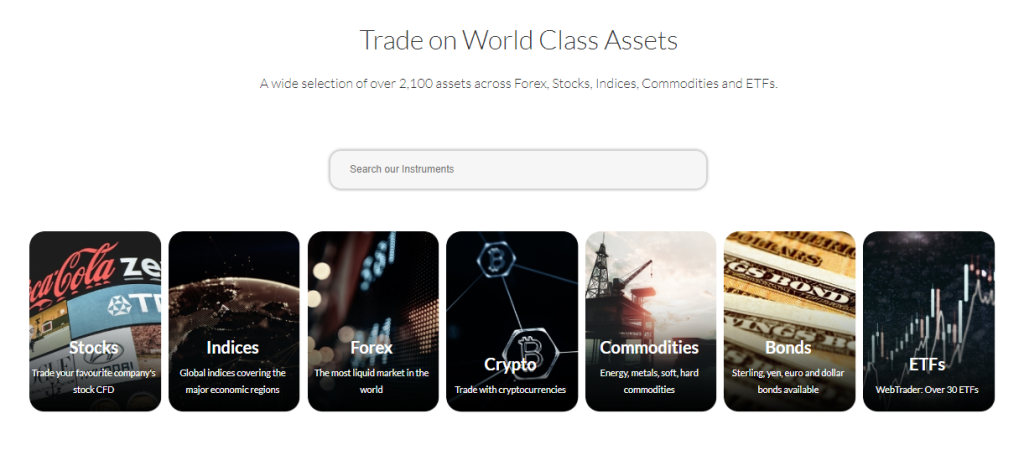

Trading Instruments & Products

Finq.com offers the following trading instruments and products:

- Forex – Finq.com offers 55 forex pairs, two trading platforms, and tools like Events & Trade for traders to study market moves. It provides educational tools, daily news, price, and trading alerts.

- Stocks – Finq WebTrader offers over 2000 stocks from Asia, Europe, and the US, allowing traders to trade around the clock. It provides leverage of up to 1:20, spreads as low as 0.005 Eurocents, and trending equities information, especially during high volatility.

- Indices—Finq offers 28 indexes covering key economic regions like Europe, India, China, the US, and South Africa. It offers competitive trading conditions, leverage up to 1:200, and spreads as low as 0.10 USD, catering to traders specializing in technology or major US corporations.

- Commodities – Finq offers 19 commodities trading with no commissions, competitive spreads (0.70 USD for gold and 0.03 USD for crude oil), and high-leverage options, making commodities trading accessible and potentially profitable.

- Bonds— Finq provides CFD trading on five major bonds 24/7 on WebTrader and MT4 platforms, promoting attentive monitoring of basic data due to economic performance’s impact on bond pricing. The platform engages in a market responsive to economic trends and results.

- Crypto —Finq offers regulated cryptocurrency trading on the WebTrader platform, featuring popular instruments like Bitcoin, Ethereum, Litecoin, and Dash, with spreads ranging from 0.8 to 80 USD.

- ETFs – Finq offers 39 ETFs across commodities, bonds, utilities, and equities, making it ideal for CFD traders seeking volatility. With leverage of up to 1:100, narrow spreads of 0.02 USD, and no fee, traders can experiment with alternative trading methods.

MetaTrader 4

Finq.com offers MetaTrader 4 (MT4), a trading platform with over 370 assets across five asset classes. It offers flexibility, one-click trading, and comprehensive technical analysis capabilities. MT4 features highly graphic charts with customizable indicators for in-depth technical analysis.

It also offers one-click trading, oscillators, trend-following tools, and volume indicators for informed decisions. The platform integrates news and fundamental data, enhancing market insights and preparing traders for trading success.

Does Finq.com provide mobile trading options?

Yes, Finq.com offers mobile trading programs for iOS and Android smartphones, enabling traders to access their accounts, make trades, and monitor markets while traveling.

What benefits does MetaTrader 4 (MT4) provide to Finq.com traders?

Finq.com’s MetaTrader 4 (MT4) platform offers traders comprehensive technical analysis tools, one-click trading capabilities, real-time market data, and a large library of expert advisors (EAs).

Spreads and Fees

Spreads

Finq.com offers a wide range of account levels, allowing traders to choose the most cost-effective option based on their trading volume and approach. The Silver account offers spreads as low as 1.9 for key currency pairings like EUR/USD and GBP/USD and as high as 4 for commodities like crude oil.

The Gold account reduces spreads to 1.4 for the same currency pairings and 3 for crude oil, offering a more advantageous trading environment for experienced traders.

The Platinum and Exclusive tiers provide competitive rates, while the Classic ECN and Pro ECN accounts offer smaller currency spreads.

Commissions

Finq.com charges commissions tiered, starting at 0.20% for silver accounts and dropping as account levels increase. Exclusive accounts offer 0.08%, while Pro ECN accounts have the lowest prices for Forex, metals, and shares.

Overnight Fees

Additionally, Finq.com charges overnight fees for active positions, varying based on instrument and position length. Furthermore, the platform’s triple rollover fees compensate for weekend market closures, emphasizing the importance of smart trade planning and understanding holding costs, highlighting the industry standard pricing structure.

Deposit and Withdrawal Fees

Moreover, under the category of Cost-Effective Trading, a significant advantage offered by Finq.com is the elimination of deposit and withdrawal fees. This applies to various payment methods like credit cards, e-wallets, and wire transfers. By eliminating these fees, Finq.com ensures simplicity and affordability for traders. Furthermore, this structure allows them to retain a larger portion of their potential profits.

Inactivity Fees

Moreover, Finq.com charges $50 after three months of inactivity, emphasizing the need for frequent account interaction and closing non-use accounts.

Currency Conversion Fees

Currency Conversion Fees are charges imposed when a trader’s account currency differs from the stated currency of a transaction, affecting margin utilization and profit and loss computations. These fees are crucial for traders trading in markets other than their home currency.

How does Finq.com compute commissions for various account types?

Finq.com calculates commissions on a tiered framework, with reduced commission rates available on higher-tier accounts such as Exclusive and Pro ECN.

How do Finq.com’s spreads vary by account type?

Additionally, Finq.com’s spreads vary based on the account type, with narrower spreads available on premium accounts like Exclusive and Pro ECN.

Leverage and Margin

Finq.com offers features that cater to experienced traders seeking amplified returns:

- High Leverage: Finq.com offers leverage of up to 1:300 on forex key pairs. This allows traders to increase their holdings and magnify potential profits but also magnifies potential losses.

It’s crucial to remember that leverage is a double-edged sword. While it allows traders to control larger positions with minimal funds, it also amplifies potential losses.

- Margin Requirements: Margin is the amount of funds traders must have in their trading account to initiate and close positions. This amount is directly affected by market price changes. Understanding margin requirements is essential for managing risk effectively when utilizing leverage.

Does Finq.com provide negative balance protection for its traders?

Moreover, Finq.com provides negative balance protection to its traders.

How does Finq.com manage margin calls?

Finq.com alerts traders about margin calls when their account equity exceeds the necessary margin amount. Traders are advised to deposit funds into their accounts or liquidate trades to fulfill margin requirements and avoid liquidation.

Educational Resources

Finq.com offers the following educational resources:

- Videos: Finq.com provides a free four-part video curriculum for novices, covering basic trading ideas, market analysis, and potential CFDs and Forex trading tactics. Furthermore, this introductory resource equips beginners with the fundamental knowledge needed to navigate the trading landscape.

- Trading Platform: Finq.com’s WebTrader trading platform is renowned for its tools, charts, and features. Building upon this foundation of knowledge, traders can apply their learnings in real-time trading scenarios on various CFD and Forex assets directly through the platform.

- Finq Training: Finq’s comprehensive training program further enhances users’ confidence in trading. Going beyond video lectures, it offers interactive seminars, quizzes, and hands-on activities, providing a well-rounded instructional strategy.

- Resources Section: Finq.com’s Resources section serves as a valuable repository of information. This includes an Economic Calendar, Weekly CFD Expiration Rollover, and other essential materials. These resources empower traders to plan their trades effectively and gain a deeper understanding of CFD trading mechanics.

Does Finq.com provide individualized training or mentoring programs?

No, the broker does not. However, while Finq.com does not provide customized training or mentoring, traders may take advantage of the complete training program’s interactive seminars, quizzes, and hands-on exercises.

Can traders access educational materials using Finq.com’s mobile app?

Yes, traders may access Finq.com’s educational materials via the mobile app.

Pros & Cons

| ✔️ Pros | ❌ Cons |

| Many traders have had favorable experiences with the site | Commissions are charged per transaction on all accounts, as well as on certain asset classes and account types |

| Offering a demo account provides for risk-free practice and platform familiarization before investing real money | The FSA is not regarded as a top-tier regulatory authority when compared to agencies such as the FCA (UK) or ASIC (Australia) |

| The Finq.com platform prioritizes accessibility via a web-based interface and mobile trading applications | While materials are available, Finq.com might not be the most beginner-friendly site owing to its features and language |

| Islamic account choices appeal to traders who follow Shariah law | If an account is idle for a long length of time, it will incur costs |

| Traders can access Forex, shares (CFDs), commodities, indices, and more | Spreads can widen amid turbulent market circumstances, raising trading expenses |

| Offers real-time market sentiment data from Finq.com users | |

| Finq.com works under the authority of the Seychelles Financial Services Authority (FSA) | |

| Webinars, videos, research, and an economic calendar are available to help traders improve | |

| Queries and help can be directed to dedicated customer support | |

| With many account types, traders can choose the one that best suits their interests and skill level |

Security Measures

Finq.com is a regulated trading platform with robust security measures to protect its customers’ data and assets. The platform separates customer money from its operating funds, keeping them in Tier 1 banks for easy withdrawal.

Finq.com also uses advanced technology, such as Secure Socket Layer (SSL) encryption, to secure sensitive information transmitted over the Internet.

The platform also employs DDoS attack prevention measures to protect its infrastructure from distributed denial-of-service attacks, which could disrupt trading activities and compromise the platform’s security. This ensures the platform’s safety and integrity.

How does Finq.com ensure data privacy and GDPR compliance?

Finq.com follows stringent data privacy standards and abides by GDPR requirements to secure traders’ personal information while also ensuring transparency and accountability in data processing and storage methods.

Can traders report suspicious activity or security problems to Finq.com?

Furthermore, reporting suspicious activity, should traders encounter suspicious activity or security concerns, they can directly report them to Finq.com’s dedicated customer support staff. This ensures prompt action can be taken to address any potential issues.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

For more information on FXLeaders

Conclusion

According to our findings, Finq.com presents itself as a versatile trading platform. It caters to many traders by offering numerous account settings, a wide range of tradable assets, and a user-friendly interface. However, our findings also revealed that Finq.com offers instructional tools, real-time market sentiment data, and specialized customer assistance.

It’s important to note that Finq.com has inactivity penalties after three months of account dormancy. Furthermore, the Seychelles Financial Services Authority, which oversees Finq.com, may not offer the same level of security as regulatory agencies in more established financial jurisdictions.

Yes, the broker provides customer service via many methods, including email and live chat. Users’ feedback on their support quality varies, so your experience may differ.

Withdrawal processing timeframes vary based on the withdrawal method used. However, withdrawals may take a few business days to a week to appear in your account.

Yes, they provide leverage on a variety of instruments. The highest leverage is 1:300 on forex major pairs.

The broker’s minimum deposit requirement varies per account type, ranging from $100 for the Silver Account to $100,000 for the Exclusive Account.

Yes, it is; however, they employ strong security measures like SSL encryption and DDoS attack protection, its regulation by the Seychelles Financial Services Authority (FSA) might cause anxiety for certain traders.

The brokers mainly provide MetaTrader 4 (MT4), a widely used trading platform, its own web-based platform, and mobile applications.

The broker is situated in Seychelles and is regulated by the Seychelles Financial Services Authority (FSA).

The broker allows withdrawals via various ways, including bank transfers, e-wallets, and credit/debit cards.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |