Forex.ee Review

- Forex.ee Review – 13 key points quick overview:

- Overview

- At a Glance

- Forex.ee Account Types

- How to set up a Demo Forex.ee Account – Step by Step

- Forex.ee Deposit & Withdrawal

- Trading Instruments & Products

- Forex.ee Trading Platforms

- Spreads and Fees

- Leverage and Margin

- Educational Resources

- Pros & Cons

- Security Measures

- 🏆 10 Best Forex Brokers

- Conclusion

Furthermore, Forex.ee is licensed by zero Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk).

Forex.ee Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Forex.ee Account Types

- ☑️How to Open A Forex.ee Account

- ☑️Forex.ee Deposit & Withdrawal

- ☑️Trading Instruments & Products

- ☑️Forex.ee Trading Platforms

- ☑️Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Furthermore, Finq.com is a leading internet trading firm, established in Estonia. Founded by skilled financial and technology experts, the firm prioritizes providing traders with a transparent, reliable, and cutting-edge trading experience.

Moreover, building upon this foundation of expertise, Finq.com prioritizes regulatory compliance and security. This focus aims to protect customer assets and has earned them a reputation as a reliable partner in the volatile forex trading industry.

Furthermore, the broker offers a variety of robust trading platforms, educational materials, and rapid customer assistance 24/5. Additionally, the broker is a well-established and globally regarded forex broker offering competitive trading conditions, a diverse range of financial products, and a commitment to putting traders’ interests first.

What distinguishes Forex.ee from other brokers in the market?

Indeed, the broker provides competitive trading conditions.

Can I trust Forex.ee with my trading activities?

However, they are registered in St. Vincent and the Grenadines and are not regulated by Tier-1 authorities.

At a Glance

| 🗓 Established Year | 2004 |

| ⚖️ Regulation and Licenses | None |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

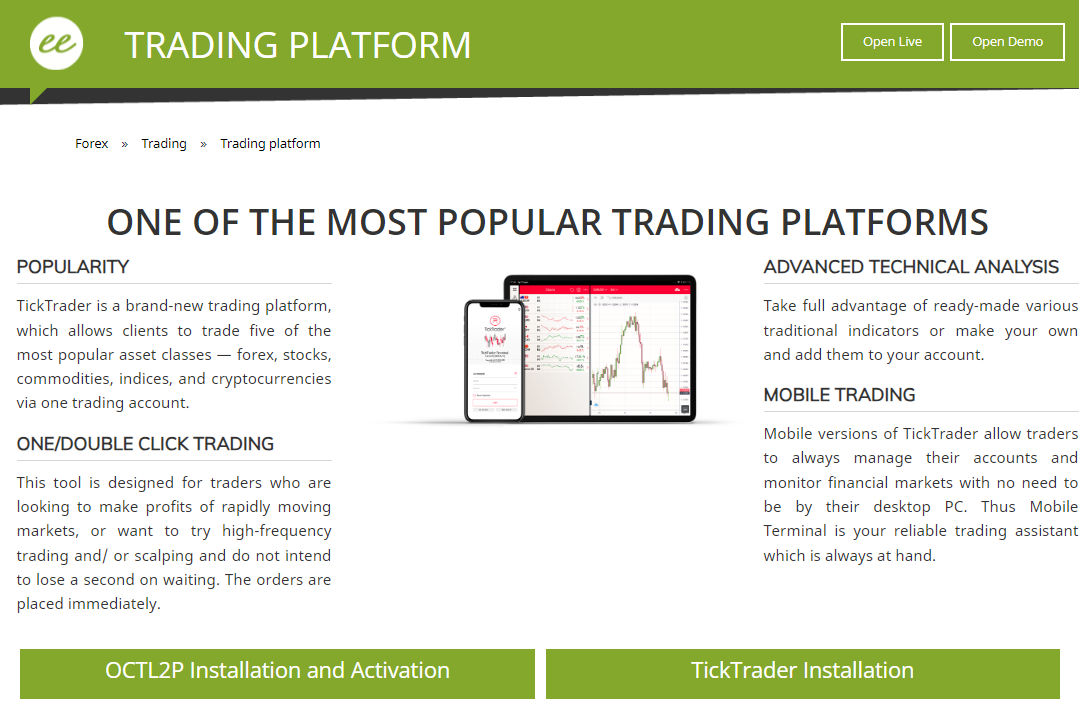

| 💻 Trading Platforms | OCTL2P, TickTrader |

| 🛍 Account Types | Basic ECN, Advanced ECN |

| 🤝 Base Currencies | USD, EUR, RUB, JPY, AUD, BTC |

| 📊 Spreads | From 0.0 pips |

| 📈 Leverage | 1:500 |

| 💸 Currency Pairs | 52; major, minor, and exotic pairs |

| 💳 Minimum Deposit | 100 USD |

| 🚫 Inactivity Fee | Yes, 10 USD per month after 3 months of inactivity |

| 🗣 Website Languages | English, Russian |

| 💰 Fees and Commissions | Spreads from 0.0 pips, commissions from $2.5 per lot traded |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | United States |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, cryptocurrencies, CFDs |

| 🎖 Open an Account | 👉 Open Account |

Forex.ee Account Types

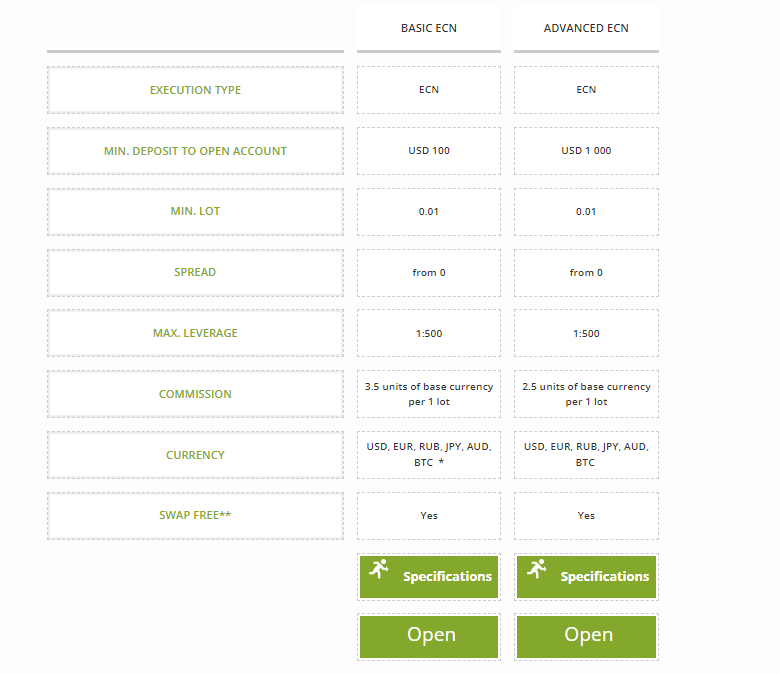

| Basic ECN | Advanced ECN | |

| ✅ Availability | All; ideal for beginners and casual traders | All; ideal for scalpers and experienced traders |

| 🛍 Markets | All | All |

| 💸 Commissions | $3.5 per lot traded | $2.5 per lot traded |

| 💻 Platforms | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots |

| 📈 Leverage | 1:500 | 1:500 |

| 💰 Minimum Deposit | 100 USD | 1,000 USD |

| 🎖 Open an Account | 👉 Open Account | 👉 Open Account |

Basic ECN Account

The Basic ECN account offers a low-cost starting point for traders with a $100 deposit. Additionally, it offers narrow spreads and leverages up to 1:500, making it suitable for beginners and experienced traders. Furthermore, competitive commissions at 3.5 units of base currency ensure fair transactions.

Advanced ECN Account

Moreover, the Advanced ECN account is a trader-friendly option for experienced traders, requiring a $1,000 minimum deposit. It offers narrower spreads and equal leverage, allowing traders to save 2.5 units of base currency per lot in commission costs.

Demo Account

Furthermore, the Demo Account is a valuable tool for novice traders to test techniques without financial risk, replicating live trading conditions on the proprietary platform.

Islamic Account

Moreover, the broker offers Islamic Accounts for traders adhering to Sharia law, which prohibits swapping or interest.

Can I swap account types after creating an account with Forex.ee?

Moreover, traders may move between account types, enabling them to adjust to changing trading preferences or techniques as they advance through their trading adventure.

Are there any limits on which markets I may trade using Forex.ee accounts?

Both accounts provide access to all markets, ensuring traders have the flexibility to trade across a wide range of financial instruments and asset classes.

How to set up a Demo Forex.ee Account – Step by Step

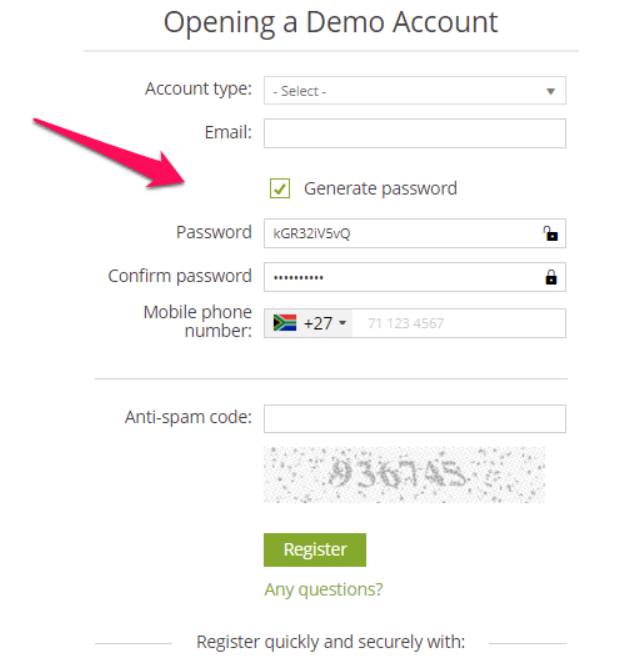

Step 1 – Navigate to the Forex.ee website

Navigate to the demo account section on the website. This can be found at the top of the landing page

Step 2 – Forex.ee account registration page

Additionally, here you will find a link to the registration page. Simply fill out the required details, including your email address and contact information.

Step 3 – Forexe.ee log in details

Save the generated login and password and click Finish. Your account has been successfully registered and you can start trading

Can I open a demo account with Forex.ee?

Indeed, they provide a demo account option for traders to practice trading strategies and become acquainted with the platform without risking real money. This affords a risk-free environment for traders to refine their skills.

Does Forex.ee charge any fees for account registration?

Additionally, the broker does not charge any fees for account registration.

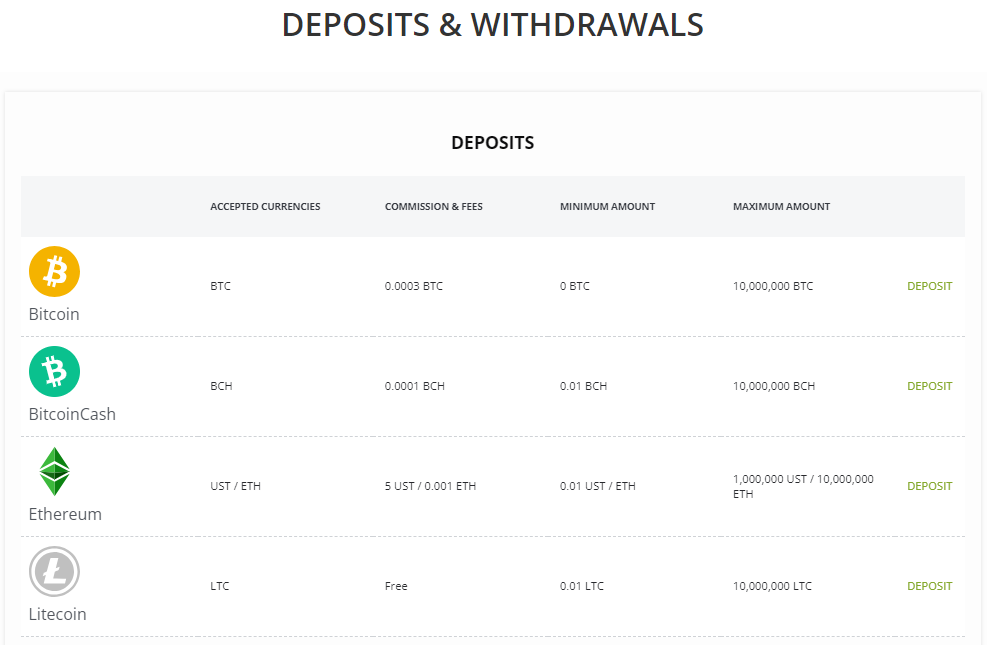

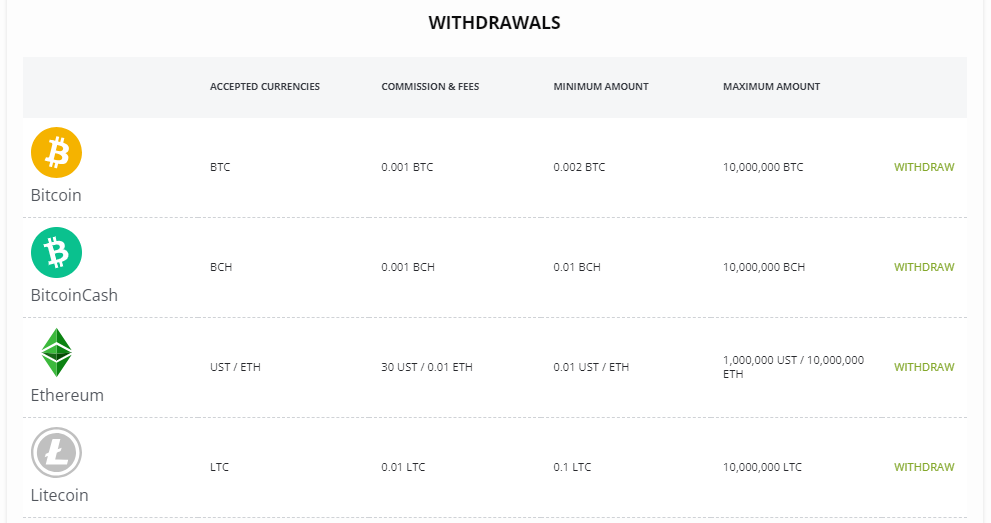

Forex.ee Deposit & Withdrawal

| 💳 Payment Method | 🏛 Country | ⚖️ Currencies Accepted | ⏰ Processing Time |

| Perfect Money | All | USD, EUR | Instant – a few days |

| FasaPay | Indonesia | IDR, USD | Instant – a few days |

| Cryptocurrencies | All | BTC, BCH, LTC, ETH, USDT | Instant – a few days |

| Debit/Credit Card | All | Multi-currency | Instant – a few days |

| Bank Wire Transfer | All | Multi-currency | 1 – 7 days |

Deposit Method:

Bank Wire

✅Log in to the client area.

✅Find the “Deposit” or “Funding” area.

✅Select “Bank Wire Transfer” as your preferred method.

✅Obtain the bank account information supplied.

✅Send a wire transfer from your bank account containing all the necessary details. Funds may take a few business days to appear in your account.

Credit or Debit Card

✅Log in to the client area.

✅Go to the “Deposits” or “Funding” area.

✅Select “Credit/Debit Card” (usually Visa or MasterCard).

✅Enter your card number, expiry date, CVV, and deposit amount.

✅Follow the on-screen steps to confirm the transaction is normally completed immediately.

Cryptocurrency Wallets

✅Log in to the client area.

✅Visit the “Deposit” or “Funding” area.

✅Forex.ee will create a unique wallet address for each deposit.

✅Access your crypto wallet and make a transfer to the given address. Make sure you transfer the proper coin to the appropriate address.

e-Wallets or Payment Gateways

✅Log into your customer area.

✅Choose your favorite e-wallet/payment gateway (Skrill, Neteller, or Perfect Money).

✅Enter your deposit amount and follow the instructions to be taken to the e-wallet provider’s website.

✅Log into your e-wallet account and authorize the transaction. Funds should appear in your account immediately.

Withdrawal Method:

Bank Wire

✅Log in to the client area.

✅Locate the “Withdrawal” section.

✅Select “Bank Wire Transfer”.

✅Give your bank account information properly.

✅Enter the desired withdrawal amount and submit your request. Allow for processing time, which might be several business days.

Credit or Debit Cards

✅Log in to the client area.

✅Enter the “Withdrawal” section.

✅Choose “Credit/Debit Card”.

✅Enter your withdrawal amount (which may be restricted to the amount already used with the card).

✅Submit your request and await processing (typically a few business days).

Cryptocurrency Wallets

✅Log in to the client area.

✅Choose the “Withdrawal” section.

✅Select your selected cryptocurrency.

✅Provide the address of your cryptocurrency wallet where you wish to receive the payments.

✅Enter the withdrawal amount and submit your request. Wait for processing time, which might vary depending on the coin.

e-Wallets or Payment Gateways

✅Log in to the client area.

✅Go to the “Withdrawals” section.

✅Select your favorite e-wallet or payment gateway.

✅Enter the withdrawal amount and submit your request. Funds are often deposited promptly to your e-wallet account.

Are there any deposit fees charged by Forex.ee?

Furthermore, in line with its commitment to affordability, the broker strives to provide a smooth deposit experience for its customers. This is achieved by waiving deposit fees, enabling traders to fund their accounts without incurring additional charges.

How long does it take for deposits to be credited to my Forex.ee account?

Additionally, the processing time for deposits varies depending on the chosen payment method.

Trading Instruments & Products

Moreover, Forex enthusiasts will find over 50 major and minor international currencies available on the platform, enabling them to participate in FX trading and potentially capitalize on global currency movements.

Additionally, catering to the growing demand in the cryptocurrency market, Finq.com provides access to over 40 crypto pairs, including popular choices like Bitcoin, Ethereum, and Litecoin. This allows traders to explore diverse cryptocurrency trading opportunities and potentially profit from the dynamic market.

Furthermore, investors interested in precious metals can utilize Finq.com’s platform to trade based on the spot prices of gold and silver. This presents an opportunity to potentially hedge against inflation or diversify their portfolios by incorporating these valuable assets.

Does Forex.ee offer trading on precious metals?

Expanding Investment Options: In addition to offering Forex and Crypto CFDs, Finq.com also provides trading opportunities on spot metal CFDs. Furthermore, this allows traders to speculate on the prices of gold and silver, effectively diversifying their investment portfolios with precious metal assets.

Are there any restrictions on the number of currency pairs available for trading with Forex.ee?

Diverse Trading Options: While some may express concerns regarding limited currency pair offerings, Finq.com provides a wide range of options. In fact, the platform offers over 50 major, minor, and exotic pairs. Additionally, this variety caters to traders with various risk tolerance levels and trading strategies, allowing them to capitalize on different market movements.

Forex.ee Trading Platforms

Moreover, the broker has introduced TickTrader, a cutting-edge platform offering access to assets and features like one-click and double-click trading, technical analysis, and mobile trading. It caters to traders looking to profit from fast-changing markets or engage in high-frequency trading and scalping tactics.

Does Forex.ee support automated trading?

Moreover, expanding on its feature set, Finq.com allows traders to leverage automated trading through their platforms. This functionality enables users to utilize expert advisors (EAs) and pre-programmed strategies to execute trades efficiently and systematically. This can be particularly beneficial for traders seeking to streamline their trading activity or implement disciplined trading approaches.

Are there any fees for using Forex.ee’s trading platforms?

Furthermore, the broker does not charge any fees for using its trading platforms, ensuring that traders can access and utilize the platform’s features and tools without incurring additional costs or charges.

Spreads and Fees

Spreads

Furthermore, the broker charges competitive spreads on its ECN accounts, which allows traders to execute trades more cost-efficiently. The spreads vary based on account type, with Basic offering 0 pips and Advanced offering even narrower options.

Commissions

In addition, the position size and current swap rate are used to calculate these charges, which can be further influenced by factors such as interest rates and market conditions.

Overnight Fees

Additionally, the position size and current swap rate are used to calculate these charges, with interest rates and market conditions factors influencing them.

Deposit and Withdrawal Fees

Furthermore, regarding deposit and withdrawal costs, Forex.ee prioritizes a customer-centric approach by waiving deposit and withdrawal fees. This eliminates any financial barriers to entering or exiting the trading platform, allowing you to focus on your trading strategy.

Inactivity Fees

Furthermore, the broker charges traders a $10 monthly maintenance fee for accounts inactive for 90 days or more.. Additionally, they also impose a $50 reactivation fee for accounts wishing to resume trading.

Are there any hidden fees associated with trading on Forex.ee’s platform?

Indeed, the broker prides itself on transparent pricing and refrains from imposing hidden fees on traders, thereby ensuring clarity and fairness in its fee structure for all transactions.

How are commissions calculated on Forex.ee’s ECN accounts?

Moreover, commissions on ECN accounts are calculated based on a fixed rate per lot traded, with the Basic ECN account charging $3.5 per lot and the Advanced ECN account charging $2.5 per lot, providing traders with clarity and predictability in their trading costs.

Leverage and Margin

The broker allows traders to trade with leverage of up to 1:500, enabling them to open larger positions using less money. However, the margin requirements at the broker differ based on account type and traded products.

Are there any restrictions on leverage for specific trading instruments?

Moreover, the broker provides traders with different analytical tools like trading calculators, economic calendars, and market news updates to help them make informed trading decisions. Moreover, the leverage and margin requirements may vary depending on the traded instrument and market conditions, which ensures appropriate risk management for traders across various assets. The broker allows leverage of up to 1:500 on its trading accounts.

How does Forex.ee calculate margin requirements for trades?

Additionally, they calculate margin requirements based on the position size, leverage, and prevailing market conditions, ensuring that traders maintain sufficient margins to cover potential losses and protect against margin calls.

Educational Resources

The broker provides traders with various analytical tools, additionally, market news updates are available to help them make informed trading decisions.

Does Forex.ee provide educational resources for traders?

Limited Educational Resources: While Finq.com offers a user-friendly platform and various features, it’s important to note that they don’t provide formal educational materials. This means potential users may need to seek external resources to supplement their trading knowledge.

How can traders access Forex.ee’s trading calculators?

Additionally, traders can use trading calculators on the platform to calculate risk and returns, enabling them to make well-informed trading decisions.

Pros & Cons

✔️ Pros ❌ Cons

Forex.ee uses Straight-Through-Processing (STP) or Electronic Communication Network (ECN) technologies to give direct market access and increased transparency Forex.ee is registered in St. Vincent and the Grenadines, with less strict regulatory control than top-tier nations like the United Kingdom and Australia

The provision of a demo account enables risk-free practice and platform familiarization While Forex.ee does provide currency pairs and certain CFDs, the asset selection may be limited compared to bigger brokers

Forex.ee charges narrow spreads, which reduce trading expenses and make it more cost-effective for traders Some user reviews and comments imply that the content on the Forex.ee website is periodically out of current or contains errors

The broker provides customer service to assist traders in addressing difficulties fast

The broker focuses on efficient trade execution, reducing slippage, and assuring prompt order fulfillment

Security Measures

While the broker does not detail its security measures on the official website, identity verification procedures (KYC) can verify identity and address to prevent fraudulent behavior and ensure the integrity of the trading environment.

Does Forex.ee have a track record of security breaches or incidents?

Additionally, the broker, prioritizing the security and confidentiality of its customers’ information, does not have a history of security breaches or incidents. To mitigate potential risks and vulnerabilities, they employ robust security measures.

How does Forex.ee verify the identity of its customers?

Moreover, the broker verifies the identity of its customers through a rigorous identity verification process to comply with anti-money laundering regulations and ensure the integrity of the trading environment. This process may include submitting identification documents and proof of address.

🏆 10 Best Forex Brokers

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Moreover, Forex.ee is a forex and CFD broker that prides itself on offering low spreads, a wide range of trading instruments, and fast transaction execution. Additionally, they focus on providing… (your next point about Forex.ee).

Forex.ee accepts various deposit options, including credit and debit cards, bank wire transfers, e-wallets (such as Skrill or Neteller), and cryptocurrencies. You may see the various choices and instructions in your client section on their website.

Yes, withdrawal costs might apply depending on the method you choose.

Withdrawals normally take 1 to 7 business days to complete, depending on the withdrawal method used and the recipient’s bank processing time.

Yes, they offer swap-free Islamic accounts that follow Sharia law rules.

The minimum deposit requirement varies by account type, with the Basic ECN account needing a deposit of $100

The broker offers a Basic and Advanced ECN Account. Furthermore, they offer a demo and an Islamic Account.

No, they are classified as a high-risk broker. While it provides competitive trading conditions, its absence of Tier-1 regulatory oversight and registration in St. Vincent and the Grenadines could raise investor protection issues.

Their customer care has received mostly favorable feedback.

The broker is in Estonia and was founded in 2004.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |