FXOpen Review

- FXOpen Review – Analysis of Broker's Main Features

- Overview

- Summary

- At a Glance

- Security Measures

- Account Types

- How To Open an FXOpen Account

- Trading Platforms and Software

- Fees, Spreads, and, Commissions

- Which Markets Can You Trade with FXOpen?

- Leverage and Margin

- Deposit & Withdrawal Options

- Educational Resources

- Pros & Cons

- Conclusion

Overall, FXOpen Review can be summarised as a trustworthy and well-regarded entity within the online financial trading arena. They have a global presence in crucial financial hubs like Australia and the United Kingdom. FXOpen has a trust score of 89 out of 99.

| 🔍 Broker | 🥇 FXOpen |

| 💵 Minimum Deposit | 1 USD |

| 4️⃣ Ease of use Rating | 4/5 |

| 🎁 Bonuses | ✅ Yes |

| ⏰ Support Hours | 24/5 |

| 🚀 Open an Account | 👉 Click Here |

FXOpen Review – Analysis of Broker’s Main Features

- ☑️Overview

- ☑️Detailed Summary

- ☑️Security Measures

- ☑️Account Types

- ☑️How to Open an FXOpen Account

- ☑️Trading Platforms and Software

- ☑️Fees, Spreads and Commissions

- ☑️Markets can you Trade with FXOpen?

- ☑️Leverage and Margin

- ☑️Deposits and Withdrawals

- ☑️Educational Resources

- ☑️Pros and Cons

- ☑️In Conclusion

- ☑️Frequently Asked Questions

Overview

Overall, FXOpen is considered low-risk, with an overall Trust Score of 89 out of 100. They are also licensed by two Tier-1 Regulators (high trust), one Tier-2 Regulator (average trust), and zero Tier-3 Regulators (low trust). They offer four retail accounts, namely Micro, STP, ECN, and Crypto.

Summary

The firm in Limassol, Cyprus, set out to give traders and institutional investors frictionless access to the foreign currency market. Their dedication to technology and transparency has driven its fast growth over the years

With a presence in global financial hotspots, including Australia, Saint Kitts and Nevis, and the United Kingdom, They have established themselves as a major player.

The company’s commitment to regulatory compliance is reflected in its licenses from reputable agencies such as ASIC and FCA, which ensure stringent regulatory compliance.

They attract traders from all over the globe because they offer a wide choice of account types designed to suit various trading styles and preferences.

The availability of liquidity from major banks such as Dresdner and Barclays Capital and sophisticated trading platforms like MetaTrader 4 and MetaTrader 5 provides traders with a solid foundation for accurate and rapid transaction execution.

The broker promotes client safety and convenience by offering quick deposit/withdrawal procedures and segregating customer cash in separate accounts, building confidence and trustworthiness among its clients.

Furthermore, their policy environment encourages traders to use diverse techniques such as scalping, hedging, or expert advisors, emphasizing providing a responsive trading experience that reflects the dynamic nature of financial markets.

As FXOpen extended its product range to cover commodities and CFDs on stock indices, its worldwide reach increased, with customers in over 150 countries.

Overall, FXOpen‘s continuing emphasis on reasonable spreads, high liquidity, and quick execution offers its customers a simple and successful trading experience globally.

At a Glance

| 🔍 Broker | 🥇 FXOpen |

| 🔢Established Year | 2005 |

| ⌛Regulation and Licenses | ASIC, FCA |

| 4️⃣ Ease of Use Rating | 4/5 |

| 🎁Bonuses | ✅ Yes, ForexCup Trading Championship 2024 |

| ⏰Support Hours | 24/5 |

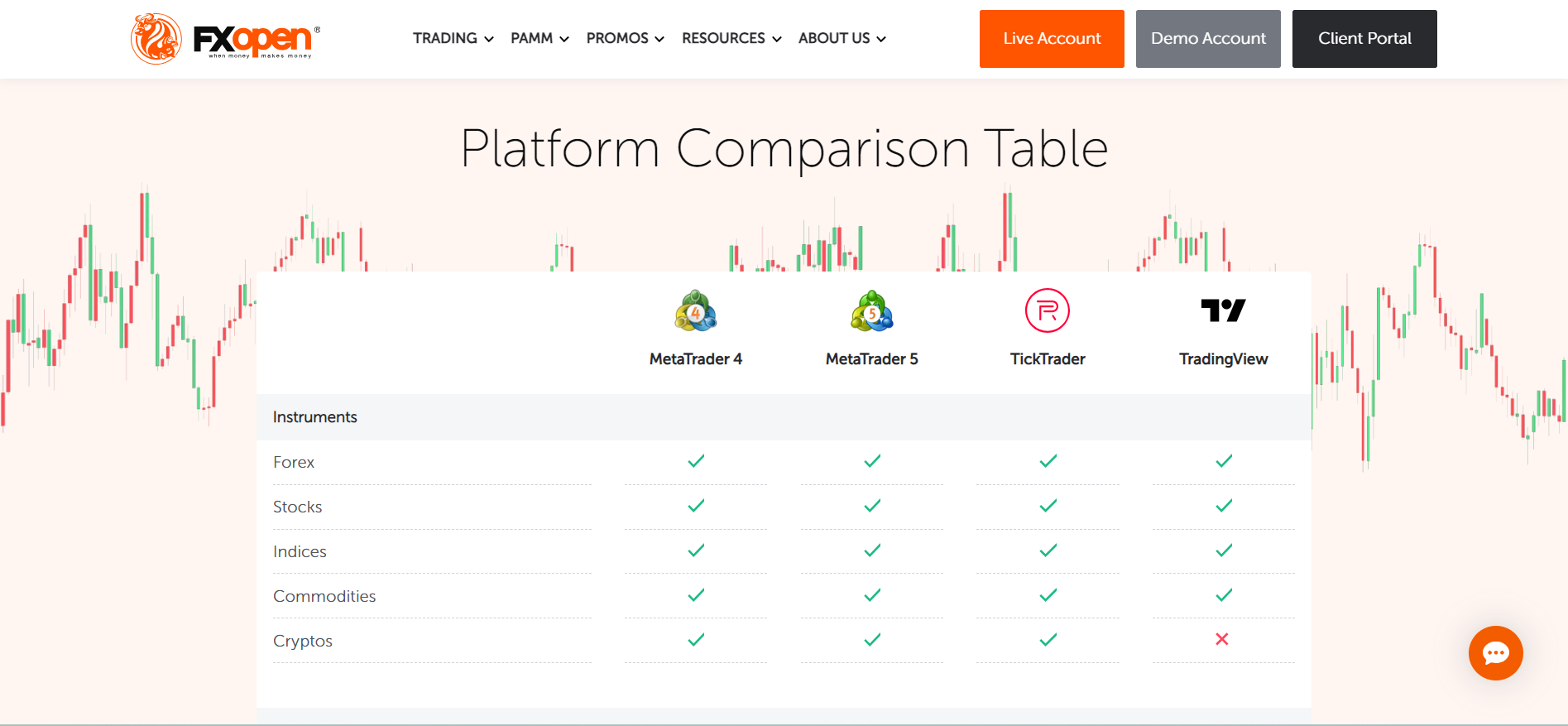

| 📊Trading Platforms | MetaTrader 4, MetaTrader 5, TickTrader, TradingView |

| 🗂️Account Types | Micro, STP, ECN, Crypto |

| 💴Base Currencies | USD, AUD, CHF, EUR, GBP, JPY, RUB, SGD, Gold, mBTC (depends on the account type) |

| 📝Spreads | From 0.0 pips |

| 📈Leverage | 1:1000 (TickTrader) |

| 💷Currency Pairs | 50; major, minor, exotic pairs |

| 💵Minimum Deposit | 1 USD |

| 💶Inactivity Fee | ✅ Yes, 10 USD on maintenance and 50 USD on reactivation of the dormant account |

| 🗣️Website Languages | English, French, German, Italian, Spanish, Turkish, Arabic, Chinese, Russian, Indonesian, Hungarian, etc. |

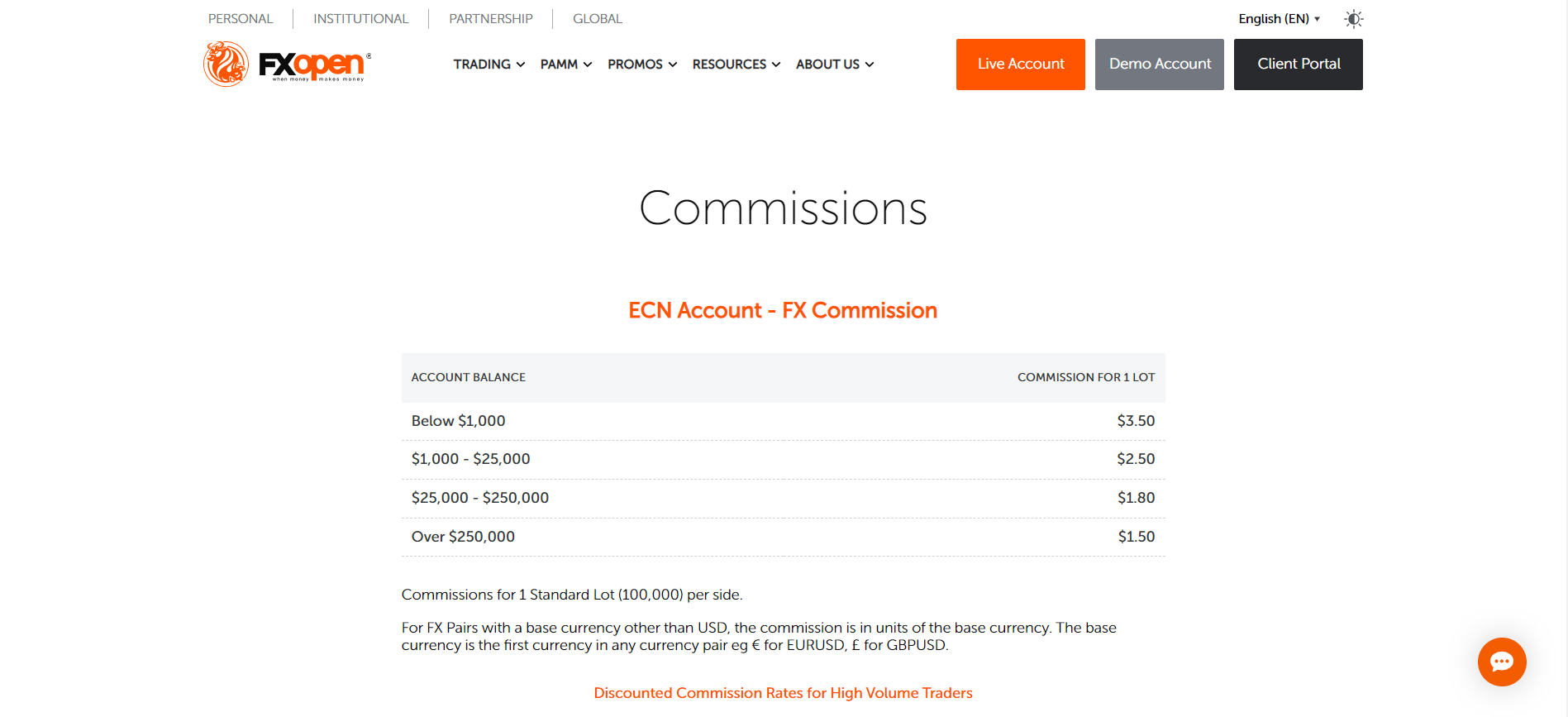

| 💸Fees and Commissions | Spreads from 0.0 pips, commissions from $1.5 - $3.5 depending on the account balance |

| 🤝Affiliate Program | ✅ Yes |

| ❌Banned Countries | United States |

| ➡️Scalping | ✅ Yes |

| 👉Hedging | ✅ Yes |

| 🛢️Trading Instruments | Forex, indices, commodities, shares, ETFs, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Where is FXOpen headquartered?

The headquarters are in the United Kingdom, Australia, and Saint Kitts & Nevis, demonstrating its global influence in the financial markets.

What types of accounts does FXOpen offer?

They provide various account options, including ECN, STP, Micro, and Crypto accounts, to accommodate various trading tastes and tactics.

Security Measures

The broker implements various security measures to ensure the safety of its client’s assets and personal information. A crucial feature in the security framework is its utilization of segregated accounts.

This means that customer funds are separated from operational finances, thus ensuring they will not be appropriated for other purposes and remain secure even in the eventuality of company insolvency.

Moreover, as a member of The Financial Commission, It offers further protection to its clients with access to a compensation fund that ensures their safety.

This additional layer of security guarantees up to €20,000 per customer when there are issues or cases of broker insolvency beyond internal resolution capabilities.

The broker employs robust encryption techniques to ensure secure data transfer between customer devices and FXOpen servers. Consequently, personal and financial information is safely encrypted, which reduces the probability of unauthorized access or loss of data.

In addition, they offer two-factor authentication (2FA) to ensure customer account safety. Verification is required before granting access to the trading account, providing added protection against unauthorized entry.

This feature is a valuable deterrent for potential security threats and bolsters overall customer asset and information safeguarding measures.

Does FXOpen offer any compensation scheme?

Yes, they are a member of The Financial Commission, which provides a compensation fund to safeguard clients, with reimbursement of up to €20,000 per client in certain circumstances.

Does FXOpen support two-factor authentication (2FA)?

Yes, They provide two-factor authentication (2FA) for customer accounts, adding extra protection against illegal access.

Account Types

| 🔍Account Type | 🥇Micro | 🥈STP | 🥉ECN | 🏅Crypto |

| ⌚Availability | All; suitable for beginners | All; ideal for casual traders | All; ideal for scalpers, day, and algorithmic traders | All; ideal for crypto CFD traders |

| 📊Markets | 28 Forex Pairs Gold Silver | 50 Forex Pairs Gold Silver | 50 Spot Forex CFDs 35+ Crypto CFDs 600+ Share CFDs Index CFDs Spot Metals Commodity CFDs | Cryptocurrency CFDs |

| 💵Commissions | None; only the spread is charged | From 0.1% on crypto | Between $1.5 and $3.5 | 0.5% of the trading volume |

| 📈Platforms | All | All | All | All |

| ➡️Trade Size | 0.01 – 100 lots | 0.01 – 100 lots | 0.01 – 100 lots | From 0.01 lots |

| ⬆️Leverage | 1:500 | 1:500 | 1:500, 1:1000 (TickTrader) | 1:3 |

| 💴Minimum Deposit | 1 USD | 10 USD | 100 USD | 10 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here | 👉 Click Here |

Micro Account

The Micro Account has been curated keeping in mind the beginners to Forex trading, as it requires a nominal deposit of only $1.

This account ensures an STP-like environment with versatile spreads that start from 0 pips and no additional costs for commissions, benefiting cost-effectiveness during trades.

Moreover, traders have access to micro-lot trading via this account which reduces risk while allowing participation amidst genuine market conditions.

It can be considered ideal for individuals wishing to begin small-scale trade ventures and get hold of intricate details without investing significantly since its maximum leverage is at 1:500, leveled up against other options available.

STP Account

Traders can gain direct access to the market without dealing desk intervention by opting for an STP Account.

With a minimum deposit of $10, variable spreads commencing at 1 pip, and transactions being executed with transparency using liquidity from their ECN, traders have an affordable option since this account type incorporates broker commission into its spread calculation.

Moreover, automated trading is supported alongside various trading approaches like scalping and hedging – making it diverse in application.

ECN Account

The ECN Account is a prime option for seasoned traders seeking optimal trading conditions. A minimum deposit of $100 grants access to remarkably tight spreads starting at 0 pips and progressively lowering fee rates from $1.5 based on account value.

This type of account boasts substantial transparency and speed by aggregating prices offered through multiple liquidity sources sans re-quotes or significant slippage hindering the execution process irrespective of price competition fluctuations.

This advantageous trait benefits scalpers and high-volume traders—with an extensive range of tradable instruments available.

Crypto Account

Using CFDs, traders can trade Bitcoin and Litecoin through the Crypto Account. With an entrance investment as low as $10, individuals interested in trading within the volatile cryptocurrency market have easy access.

The account offers leverage up to 1:3 with spreads starting at only 1 pip; additionally, a commission cost of merely 0.5% for each half-turn is imposed.

By using the ECN Aggregator for market execution, there are narrow spreads and minimal trading costs associated with this account – rendering it an attractive option for those fascinated by cryptocurrency markets.

Demo Account

The Demo Account presents a secure avenue for traders, regardless of expertise level, to hone their trading techniques sans risk. It mirrors the actual conditions in live trading accounts by availing real-time market statistics and access to trade platforms.

This online simulation habitat is ideal for evaluating tactics, scrutinizing market fluctuations, and mastering threat control with zero financial exposure. Unlimited usage ensures continuity of practice and learning- an indispensable precursor before transitioning into live exchanges.

Islamic Account

Those who abide by Sharia law can take advantage of the Islamic Account choice. This account is devoid of any swap interest on overnight positions and, instead, adheres to the standards outlined in Islamic finance with a fixed commission charge

Whether you have an STP or ECN account type, this service will cater to both equally well; it lets Muslim traders participate in Forex trading while complying with their faith-related beliefs.

The platform offers identical conditions for all its accounts, creating an inclusive atmosphere that caters to Muslims who engage in trading activities.

What is an FXOpen ECN Account?

The ECN Account offers direct access to liquidity providers with tight spreads starting at 0.0 pips and fees that drop with trading volume, making it ideal for big-volume traders.

What is the minimum deposit for an FXOpen Micro Account?

The minimum deposit for a Micro Account is $1, making it accessible to traders with small funds.

How To Open an FXOpen Account

✅To begin registration, go to the official website and look for the “Open a Live Account” option, usually in the homepage’s upper right corner. Click on it.

✅Depending on your trading needs and preferences, select the appropriate type of trading account from the available alternatives, such as ECN, STP, or Crypto accounts.

✅Fill out the electronic registration form with your personal information, including your full name, email address, and country of residence, ensuring everything is correct and current.

✅Submit the completed registration form by clicking the “Register” button, and the broker will send you a confirmation email with additional verification steps.

✅Proceed to verify your account by following the directions in the email, which often include uploading proof of identification papers like a passport or driver’s license and proof of residence documents like a utility bill or bank statement.

✅After the verification procedure is completed and FXOpen confirms the activation of your account, you may deposit funds using one of the available payment methods, such as bank transfer, credit/debit cards, or e-wallets.

✅After financing your account, you will be ready to start trading after successfully opening an account and receiving the tools and platform access required to interact with the financial markets.

How do I start the process of opening an account with FXOpen?

To create an account, go to their website, click the “Open a Live Account” button, and complete the registration requirements offered online.

How long does it take to open an FXOpen account?

Opening an account with this broker is rapid, requiring less than a day after all needed papers are provided and approved.

Trading Platforms and Software

MetaTrader 4

Renowned for its extensive tools, MT4 is a trusted platform among Forex traders globally. Despite being user-friendly with an intuitive interface, it has powerful capabilities such as advanced charting and abundant technical indicators alongside automated trading systems referred to as Expert Advisors.

Its popularity is heightened by the customizable nature that permits personalized adjustment of the trading environment to individual preferences.

Notably reliable and stable, this feature-rich platform aids novice and seasoned traders seeking precision in their trade-related activities while ensuring maximum efficiency.

MetaTrader 5

This broker’s multi-asset platform, MetaTrader 5, offers traders enhanced features to cater to their needs more effectively.

With access extended to different markets through CFDs on equities and commodities, the platform comes packed with advanced financial trading functionalities and refined technical and fundamental research tools.

The upgraded MQL5 language facilitates script writing for designing intelligent algorithmic trading strategies that significantly improve automation opportunities and customization options.

Furthermore, it provides a broader range of periods, configurable graphical components, and other critical technical indicators, enabling traders to expediently implement complex trade setups accurately while remaining adaptable in fluid market scenarios.

TickTrader

TickTrader platform offers a complete solution for trading that combines Forex and cryptocurrency in one seamless interface, equipped with advanced charting tools, level 2 pricing, and one-click trades.

Its flexibility is noteworthy as it enables traders to switch between various trade instruments while supplying manual or automatic trading methods.

The architecture behind the software aims at optimizing efficiency by equipping users with an extensive market analysis which allows them to make informed decisions promptly and execute transactions accurately.

TradingView

While this broker recognizes the widespread appeal of TradingView – a web-based platform for charting and social networking- it does not offer it as an official trading venue.

Traders commonly use this user-friendly tool, which includes advanced charts and social features, to share strategies with like-minded individuals regardless of their experience level.

Despite lacking direct integration with FXOpen‘s platforms, many traders often turn to TradingView for comprehensive research before placing trades on those provided by FXOpen.

Is there a web trading platform available at FXOpen?

Yes, they offer an online trading platform for MetaTrader 4 and MetaTrader 5, which allows traders to access their accounts and trade straight from web browsers without downloading or installing any software.

Can I trade on FXOpen using my mobile device?

Yes, They offer mobile trading via the MetaTrader 4 and MetaTrader 5 applications for iOS and Android smartphones///.

Fees, Spreads, and, Commissions

Spreads

The broker provides an assortment of spreads to accommodate varying trading styles and strategies. The range of spreads varies depending on the type of account traders choose.

For instance, the ECN account boasts incredibly tight starting spreads from 0.0 pips, significantly reducing high-volume trader’s expenses. In contrast, Micro and STP accounts allow for affordable trading options with lower volume due to minimum spread costs as low as just 1 pip.

They value transparency when it comes to pricing so that clients are informed about any potential fees associated with their trades in advance.

Commissions

Active traders can benefit from a fee system that incentivizes their activity by reducing expenses. Commissions are applied to trades within ECN and Crypto accounts at rates determined by account balance and trading volume.

The fees operate on tiers; for instance, those with an ECN account should expect charges starting at $1.5 per standard lot, which may reduce as equity and volumes increase.

This model proves particularly advantageous for frequent traders carrying significant balances, who stand to considerably lower overall costs of doing business through the brokerage service.

Overnight Fees

Overnight holdings incur rollover or swap fees, a common practice in the industry. These charges compensate for leveraging expenses used by traders over the night and are calculated using interest rate discrepancies between Forex transaction currencies.

Depending on one’s position and current rates, these costs may be credited or debited into their account. It is crucial to monitor such outgoings as they can accumulate significantly when maintaining long-held positions to regulate trading expenditures better and more efficiently.

Deposit and Withdrawal Fees

While they provide convenient solutions for depositing and withdrawing trading accounts, there may be some related expenses. Deposits and withdrawals may include costs, depending on the method utilized.

Credit card deposits, for example, cost around 7% plus a small charge, whereas cryptocurrency deposits may suffer a set network fee. Withdrawal costs also vary, with varying percentages applied to each withdrawal method.

To successfully manage their assets, traders must understand these fees, which can influence net profits, especially when making frequent deposits or withdrawals.

Inactivity Fees

If your trading account is inactive, you must know the inactivity fines. These penalties are levied on accounts that have not executed trades during a specific timeframe.

For instance, if an account remains dormant, it may incur maintenance charges of $10 and reactivation fees of $50 when you recommence trading activities.

Maintaining active accounts becomes evident from these fees and can be a deciding factor for traders who trade infrequently. Therefore, adequately tracking your account’s activity could help evade such expenses.

Currency Conversion Fees

To conduct transactions in currencies other than the account’s base currency, the broker applies fees for currency conversion. Similar to numerous brokers, they charge a fee when exchanging money from one type of currency into another.

This expense is noteworthy mainly for overseas traders who may deposit or withdraw funds using different types of monetary units apart from their trading accounts’ primary denomination.

Though these costs might seem insignificant per transaction, they can accumulate over time, especially among individuals involved in frequent trades and handling significant amounts of cash.

Therefore, conversing with these rates and incorporating them within financial planning are pivotal steps toward effective capital management strategies.

What are the typical spreads at FXOpen?

They charge competitive spreads for ECN accounts starting at 0.0 pips, while Micro and STP accounts start at 1 pip, depending on market conditions and account type.

What non-trading fees does FXOpen have?

They levy a $10 inactivity fee for accounts idle for more than six months and a $50 price to revive dormant accounts.

Which Markets Can You Trade with FXOpen?

FXOpen offers the following trading instruments and products:

✅Forex – Allows traders to trade on 50 currency pairs, including major, minor, and exotic. It provides a diverse range for those interested in the dynamic forex market, noted for its high liquidity and 24/5 trading hours.

✅Indices – Traders can interact with ten global indices, which are baskets of prominent firm stocks gathered in a standardized format and provide a tool to measure overall market performance across sectors and nations.

✅Commodities – Trades five commodities, allowing traders to diversify their portfolios by investing in hard commodities such as gold and oil, frequently used as inflation hedges and reflecting larger economic trends.

✅Shares – Offers over 600 share CFDs, allowing traders to speculate on the price fluctuations of specific business stocks without holding the underlying shares. This provides exposure to a variety of worldwide markets and sectors.

✅ETFs – With 37 ETFs available, they allow traders to trade on a diverse portfolio of assets, providing exposure to various sectors, commodities, or market indexes via a single instrument, combining the benefits of equities and mutual funds.

✅Cryptocurrencies – Allows you to trade 27 cryptocurrency pairs, meeting the rising demand for digital currency trading, which has the potential for significant volatility and gains in a market that runs around the clock.

Can I trade indices with FXOpen?

Yes, they allow traders to trade on global indexes, exposing them to larger market patterns.

Does FXOpen offer trading in cryptocurrencies?

Yes, They do support cryptocurrency trading, allowing clients to speculate on the price fluctuations of numerous digital currencies such as Bitcoin, Ethereum, and Litecoin.

Leverage and Margin

This broker empowers its clients with significant leverage, an influential tool that enhances their trading potential. With ECN accounts, traders can access even more potent leverage of up to 1:1000 by utilizing the TickTrader platform.

The increased level of leveraging is particularly attractive for traders keen on expanding their market exposure despite having a limited capital base.

The utilization of significant leverage comes with an accompanying increase in risk. It is imperative for traders who utilize such leverage to acknowledge that while it may enhance potential profits, it could also magnify probable losses.

The broker’s margin regulations aim to protect traders and brokers from the perils of leveraged trading by requiring a certain amount of capital as collateral, known as “margin.” This serves as a security deposit, enabling one to initiate and uphold a leveraged position.

The broker’s system is set up to track positions and issue a margin call once account equity goes below a specific point. This will urge traders to inject more funds or dispose of holdings to reduce their required margin amount.

If there’s a further decrease in equity, reaching the stop-out level, the broker automatically initiates position closures commencing with those with low returns to keep accounts from entering negative terrain.

Balancing between offering traders the ability to leverage their positions for amplified market exposure and managing associated risks, FXOpen‘s requirements on margin and leverage can be challenging.

As conditions in the market may change swiftly, traders need to exercise prudence by opting for risk management measures that safeguard their investments.

What leverage does FXOpen offer?

They provide leverage up to 1:500 for their offshore branch clients, while leverage is limited for retail clients in the UK, EU, and Australia due to regulatory constraints.

What happens if I get a margin call at FXOpen?

Suppose your account equity falls below the necessary margin level at FXOpen. In that case, you will get a margin call, requiring you to deposit additional cash or liquidate positions to avoid further losses.

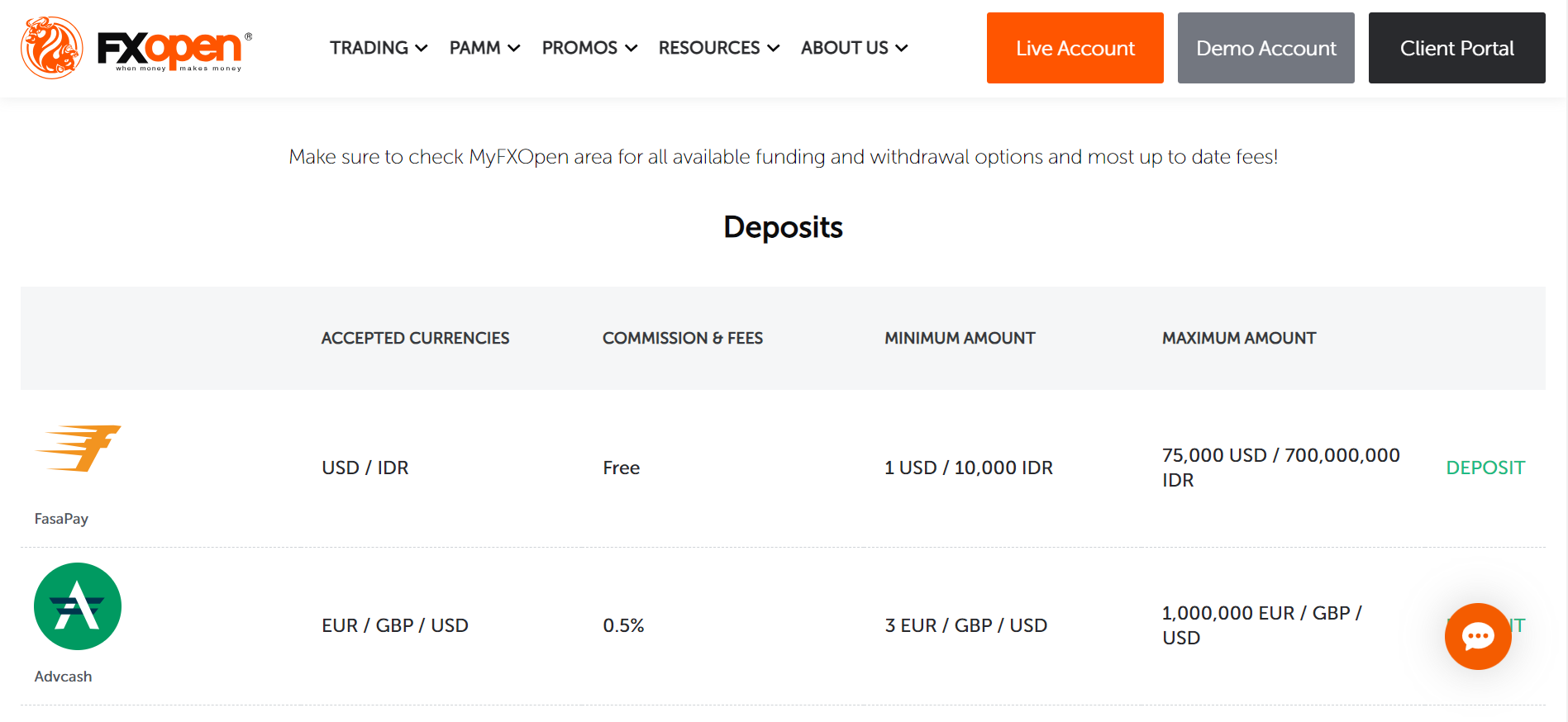

Deposit & Withdrawal Options

| 🔍Payment Method | 🌎Country | 💵Currencies Accepted | 🕰️Processing Time |

| 💷PayPaid | Thailand | THB | Instant |

| 💶WebMoney | All | USD | Instant |

| 💵FasaPay | Indonesia | USD, IDR | Instant |

| 💴ADVCash | All | EUR, GBP, USD | Instant |

| 💰Bitcoin | All | BTC | Instant |

| 💸Bitcoin Cash | All | BCH | Instant |

| ➡️Litecoin | All | LTC | Instant |

| 👉Ethereum | All | UST, ETH | Instant |

| 🎀Tether | All | UST, USDT | Instant |

| ✏️Emercoin | All | EMC | Instant |

| 🏦Bank Transfer | All | GBP, USD, EUR, AUD, CHF | 1 – 3 days |

| 💳Credit/Debit Card | All | EUR, GBP, USD | 2 – 5 days |

| 💻Easy Bank Transfer | All | EUR, GBP | 1 – 3 days |

Deposit Method:

Bank Wire

✅Login to your account.

✅Navigate to the ‘Deposits’ section of the ‘Finance’ menu.

✅Choose ‘Bank Wire’ from the available options.

✅Fill out the deposit form with the relevant banking information.

✅Follow the steps to conduct a wire transfer from your bank account to the FXOpen bank account information given.

Credit or Debit Card

✅Log into your Account.

✅Click either ‘Add Funds’ or ‘Deposits’.

✅Select the credit/debit card option.

✅Enter the amount you want to deposit.

✅Enter your card information as requested.

✅Confirm the transaction by checking that your card is eligible and has enough money for the deposit.

Cryptocurrency Wallets

✅Sign in to your account.

✅Choose the ‘Deposits’ option.

✅Choose your desired cryptocurrency (such as Bitcoin) from the list.

✅The system will create a unique wallet address for the transaction.

✅Send money to this address from your external cryptocurrency wallet.

e-Wallets or Payment Gateways

✅Login to your account.

✅Go to the “Deposits” section.

✅Select your preferred e-wallet.

✅Enter your deposit amount.

✅You will be taken to the e-Wallet’s website to log in and confirm your payment.

Withdrawal Method:

Bank Wire

✅Login to your account.

✅Navigate to the ‘Withdrawals’ section.

✅Select ‘Bank Wire’.

✅Fill out the withdrawal form with your banking information.

✅Submit your request.

✅Funds will be sent from FXOpen to your bank account within 1 to 7 business days.

Credit or Debit Cards

✅Access the client portal.

✅Go to ‘Withdrawals’.

✅Choose the Card option.

✅Enter the amount you want to withdraw (not more than the total deposited with the same card).

✅To complete the withdrawal request, simply follow the steps on-screen.

Cryptocurrency Wallets

✅Sign in to your account.

✅Select the ‘Withdrawals’ option.

✅Choose the cryptocurrency for withdrawal.

✅Enter the withdrawal amount and the address for your external wallet.

✅Submit a withdrawal request.

e-Wallets or Payment Gateways

✅ Go to the ‘Funding’ page in your account.

✅Choose ‘Withdrawals’.

✅Choose an e-wallet (such as Skrill or Neteller).

✅Enter your withdrawal amount.

✅You will be transferred to the e-Wallet service to confirm your withdrawal.

✅Funds are normally credited immediately or within a day.

How can I withdraw funds from my FXOpen account?

Withdrawals at FXOpen can be accomplished using the same ways as deposits, including bank wires, credit/debit cards, and e-wallets, through the client site.

How long do withdrawals take at FXOpen?

Withdrawal processing times can vary by method, with e-wallets completed within 24 hours and bank transfers requiring 1 to 3 business days.

Educational Resources

FXOpen offers the following educational resources:

✅What is Forex? – This resource provides a comprehensive understanding of the forex market, the world’s largest financial market for currency trading. It covers fundamental forex principles, such as currency pairs trading, currency fluctuations, leverage, and key terms like pips, lots, and spreads.

✅The goal is to provide a detailed understanding of the market’s structure, players, and mechanics, aiding novices in comprehending its operations.

✅What is a Forex Broker – The broker discusses the role of a forex broker in the trading environment, highlighting its role as a middleman between traders and the forex market. It covers various types of brokers, their services, earnings methods, and what traders should look for when selecting a broker.

✅This information is crucial for choosing a reputable broker that meets a trader’s trading style and requirements.

✅How to start trading – This resource guides beginners through the stages of their trading career, including opening a trading account, understanding a platform, creating a basic strategy, risk management, and market analysis. It emphasizes disciplined trading, constant learning, emotional control, and the benefits of starting with a demo account for risk-free practice.

✅It also provides advice on managing emotions and assessing the market.

Can beginners learn how to trade with FXOpen’s educational materials?

Yes, their instructional materials are intended to assist beginners in understanding the fundamentals of trading. However, they may find the resources limited compared to what other brokers provide.

Are FXOpen’s educational resources free?

Yes, all of their teaching tools are free to all clients, making them an invaluable learning tool for traders of all skill levels.

Pros & Cons

| ✅ Pros | ❌ Cons |

| FXOpen has narrow spreads and clear commission structures for cost-conscious traders | Though FXOpen provides certain crypto CFDs, their selection is limited in comparison to other prominent brokers |

| Traders can use industry-standard platforms like MetaTrader 4 and 5 | While certain resources are available, the quality and breadth of instructional information may not satisfy seasoned traders |

| Beginner investors can use the Social Trading tool to replicate the methods of experienced traders | FXOpen cannot accept clients from the United States owing to regulatory constraints |

| FXOpen has several regulatory licenses from recognized agencies like as CySEC (Cyprus), FCA (UK), and FSCA (South Africa) | Dormant accounts pay monthly fees, which can deplete unused funds |

| Starting with just $1, even beginners may test the waters with little risk | Depending on the method used, deposits and withdrawals might incur processing costs |

| If you have any questions or need assistance, multilingual support is accessible via phone, live chat, or email | While most customer evaluations are excellent, some complain about platform difficulties, withdrawal delays, or communication concerns |

| FXOpen offers Standard, ECN, STP, and Social Trading accounts with varying features and leverage choices to meet the needs of traders of all levels | While enticing to skilled traders, leverage options up to 1:500 might result in large losses |

Our Review Methodology: For each of our broker evaluations, we investigate, evaluate, analyze, and compare what we feel to be the most crucial criteria to consider when selecting a broker. Based on our findings, this evaluation comprises positives, disadvantages, and an overall score. We want to assist you in locating the ideal broker for your requirements.

Please remember the following text: “Do not consider our broker review as financial advice.” However, we urge traders to seek professional financial advice before making investment decisions.”

Addendum/Disclosure: No matter how diligently we strive to maintain accuracy, the forex market is volatile and may change anytime. Even if the information supplied is correct when going live.

Investor Warning: All South African investors should be aware that trading foreign currency on margin carries high risk and may not be suitable for everyone. Before engaging in foreign currency or Contract for Difference (CFD) trading, you must evaluate your investing goals, expertise, appetite for risk. Willingness to be exposed to risk. In addition, you should not start investing capital. You cannot afford to lose because you could lose part of your original investment.

| Broker | Review | Regulators | Min Deposit | Website | |

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | SVGFSA | USD 5 | Visit Broker >> |

Conclusion

FXOpen‘s commitment to stringent regulatory standards and robust implementation of security measures such as segregated accounts and membership in. The Financial Commission instills confidence in the company’s reliability and dedication to safeguarding its clients’ interests.

No, FXOpen does not accept clients from the United States due to regulatory constraints.

Withdrawal times at FXOpen vary by method, with bank transfer withdrawals being handled between 1-3 days and card withdrawals taking up to 5 days, which is consistent with industry standards.

They provide Standard, ECN, STP, and Social Trading accounts to accommodate a variety of expertise levels and preferences.

FXOpen’s minimum deposit for Micro accounts is as little as $1, making it possible for traders of all levels to begin trading.

Yes, they provide CFDs on some of the most popular cryptocurrencies, but their range is less comprehensive than other brokers.

Yes, FXOpen is regarded as a secure broker, licensed by recognized agencies and implementing strong security measures such as segregated accounts and sophisticated encryption to safeguard customer cash and data.

Yes, they supply some analytical tools, economic calendars, and instructional resources, but the depth may not be sufficient for experienced traders.

Yes, their Social Trading feature enables beginners to mimic the tactics of established traders.

FXOpen has headquarters in the United Kingdom, Australia, and Saint Kitts & Nevis, representing its global footprint.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |

For scalping traders, FXOpen is suitable because of the tight spreads on ECN accounts starting from zero, for swing traders you need to pay attention to swap fees if holding positions overnight.