GoldFX Review

- GoldFX Review – 13 key points quick overview:

- Overview

- At a Glance

- GoldFX Account Types

- How To Open a GoldFX Account

- GoldFX Deposit & Withdrawal Options

- Trading Instruments & Products

- GoldFX Trading Platforms and Software

- GoldFX Spreads and Fees

- Leverage and Margin

- Educational Resources

- GoldFX Pros & Cons

- Security Measures

- Conclusion

Overall, GoldFX is considered high-risk, with an overall Trust Score of 65 out of 100. They are licensed by zero Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and two Tier-4 Regulators (high risk). The broker offers three retail accounts: a Standard, Pro, and VIP Account

GoldFX Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️GoldFX Account Types

- ☑️How To Open a GoldFX Account

- ☑️GoldFX Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️GoldFX Trading Platforms and Software

- ☑️GoldFX Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️GoldFX Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

GoldFX is a financial broker that aims to provide traders with easy and intuitive trading experiences. Furthermore, the company aims to create a transparent and friendly environment that empowers investors at all levels.

In order to achieve this, the broker emphasizes instructional materials and market analysis tools to help traders make informed decisions. Based on their extensive business experience, the founders identified the need for a platform that blended usability with robust functionality and educational assistance.

This customer-centric approach has led to GoldFX’s success, attracting a loyal following of traders. As a result, the broker has built a reputation for reliability and strong customer service despite being a relatively new player.

Furthermore, the broker prioritizes constant innovation, regularly updating its offerings with new trading assets, analytical tools, and platform advancements.

Can I use GoldFX services from any country?

While GoldFX welcomes clients from various countries, access is restricted to residents of some countries, notably the United States and Canada, owing to regulatory requirements.

Does GoldFX provide any other services except trading?

GoldFX has an affiliate program for those who want to bring clients to the platform and earn money depending on their trading activity.

At a Glance

| 🗓 Established Year | 2020 |

| ⚖️ Regulation and Licenses | SVG (Under Olympic Markets LLC) and LFSA (Under Olympic Markets Ltd.) |

| 🪪 Ease of Use Rating | 4/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | MetaTrader 5 |

| 🛍 Account Types | Standard, Pro, VIP |

| 🤝 Base Currencies | ZAR, EUR, USD |

| 📊 Spreads | From 0.1 pips EUR/USD on the VIP Account |

| 📈 Leverage | Up to 1:2000 |

| 💸 Currency Pairs | 300+; major, minor, exotic pairs |

| 💳 Minimum Deposit | 250 USD |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English, Indonesian, Thai, Vietnamese, Malay, Chinese, Spanish |

| 💰 Fees and Commissions | Spreads from 01 pips, no commission fees |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | Belgium, Canada, Cuba, Iran, Iraq, North Korea, Sudan, Syria, United States |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, cryptocurrencies, energies, metals, stocks, ETFs, indices, treasuries, futures |

| 🎖 Open an Account | Open Account |

GoldFX Account Types

Standard Pro VIP

✅ Availability All; ideal for beginners and casual traders All; ideal for more experienced traders Ideal for professional traders and scalpers

🛍 Markets All All All

💸 Commissions None; only the spread is charged None; only the spread is charged None; only the spread is charged

💻 Platforms MetaTrader 5 MetaTrader 5 MetaTrader 5

📊 Trade Size From 0.01 lots From 0.01 lots From 0.01 lots

📈 Leverage 1:2000 1:2000 1:2000

💰 Minimum Deposit 250 USD 5,000 USD 10,000 USD

🎖 Open an Account Open Account Open Account Open Account

GoldFX Standard Account

The Standard Account, with a competitive $250 minimum deposit and tight 0.8 spread, offers a compelling value proposition. It features no hidden fees, commissions, or hedged margins, making it a cost-effective choice for traders.

Additionally, it boasts a maximum leverage of 1:2000 and grants access to a wide range of instruments, including forex, cryptocurrency, metals, and stocks. This combination makes it ideal for traders seeking a low entry barrier and a diverse investment opportunity.

GoldFX Pro Account

With a $5,000 initial deposit, the Pro Account offers narrower spreads starting at 0.6, no financing fees, commissions, or hedged margins, and a maximum leverage of 1:2,000. Additionally, it is suitable for experienced traders who require tighter spreads and are comfortable with higher deposit requirements.

GoldFX VIP Account

The VIP Account, a top-tier option with a $10,000 payment, offers narrow spreads and swap-free trading for Forex Majors. It also has a 70% margin call and 30% stop-out level, making it ideal for high-volume traders seeking premium services and reduced spreads.

GoldFX Demo Account

The broker provides a risk-free demo account for traders to practice and familiarize themselves with the platform’s capabilities. Once you install the Gold FX MetaTrader 5 trading platform, this account becomes accessible, allowing users to open a demo account and start their trading journey.

The demo account simulates real market conditions with virtual funds, making it beneficial for both novice and experienced traders seeking to gain trading experience or learn more about GoldFX’s products.

GoldFX Islamic Account

The Islamic Account, accessible for Pro and VIP accounts, follows Islamic financial principles and allows qualified customers to trade without swaps. It is appropriate for traders seeking Sharia-compliant trading circumstances.

Do VIP account users at GoldFX get any special benefits?

VIP account users at GoldFX enjoy premium services including as tight spreads, swap-free trading for Forex Majors, and priority customer assistance.

What is the primary difference between GoldFX’s Standard and Pro accounts?

The key distinction between GoldFX’s Standard and Pro accounts is the minimum deposit requirement and spread size.

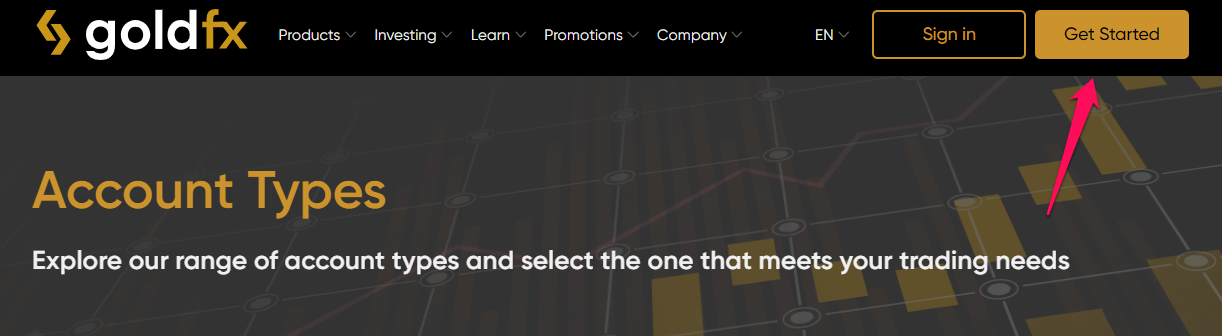

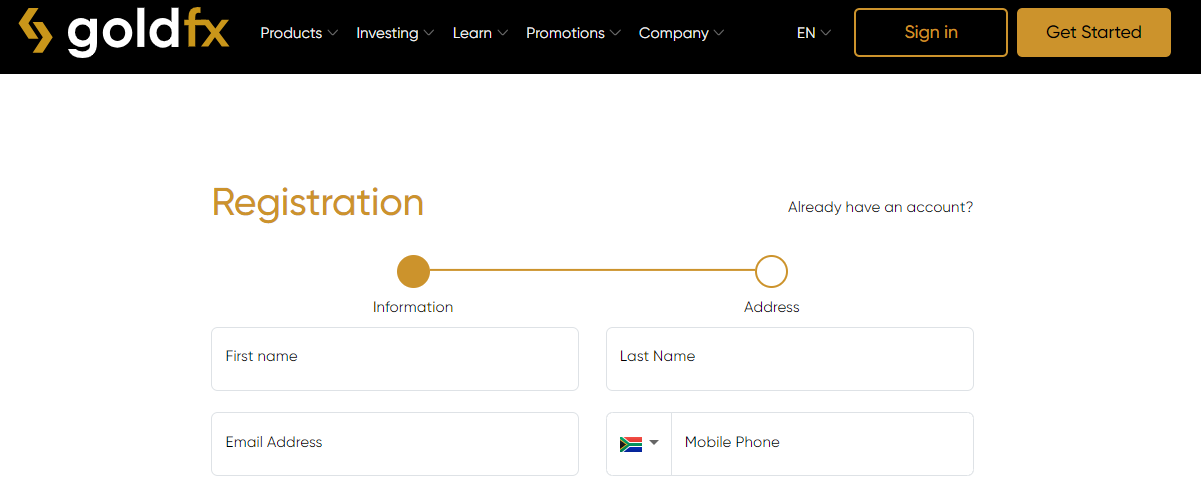

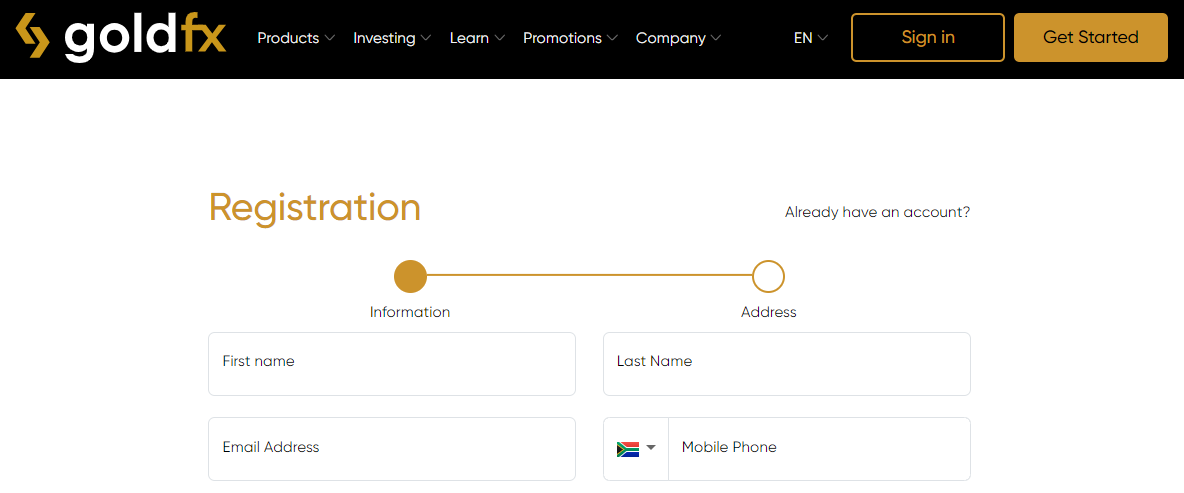

How To Open a GoldFX Account

To register an account, follow these steps:

Step 1 – Click on the Open an Account button.

Go to the GoldFX website and browse to the account opening page.

Step 2 – Fill out the form.

Complete the online application form by entering your personal information, contact information, and trading history. Make sure you have any required papers, such as evidence of identification and residency, available to submit throughout this procedure.

Step 3 – Choose an account type.

Select your chosen account type. GoldFX provides normal accounts, Islamic accounts, and demonstration accounts. When making this decision, keep your trading objectives and your religious beliefs in mind.

GoldFX Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time

Credit/Debit Card All Multi-currency Instant – 24 hours

Wire Transfer All Multi-currency 2 – 3 days

Cryptocurrencies All USDT, BTC, ETH, TRX, BNB Instant – 1 hour

AstroPay All EUR, USD Instant – 24 hours

Perfect Money All USD, EUR, BTC Instant

Neteller All EUR, USD Instant

Skrill All EUR, USD Instant

Deposits Methods:

Bank Wire

✅Log into your trading account.

✅Navigate to the ‘Funding’ or ‘Deposit’ area and choose ‘Bank Wire’ as your deposit option.

✅Obtain the bank wire information supplied by GoldFX, which includes the bank name, account number, and SWIFT/BIC codes.

✅Make a bank wire transfer from your bank to GoldFX using the information given.

✅Enter the amount you want to deposit and finish the transfer. The funds are normally deposited to your trading account within 2-3 business days.

Credit or Debit Card

✅Access your GoldFX trading account.

✅Go to the ‘Funding’ or ‘Deposit’ area and choose ‘Credit or Debit Card’ as your deposit method.

✅Enter your card information, including the number, expiry date, and CVV code.

✅Enter the deposit amount and then confirm the transaction. Deposits made by credit or debit card are normally processed very instantly.

Cryptocurrency

✅Sign in to your account.

✅Choose ‘Cryptocurrency Wallet’ from the ‘Funding’ or ‘Deposit’ menu.

✅Select the coin you want to use for the deposit.

✅GoldFX will provide a wallet address for the deposit.

✅Transfer the crypto from your wallet to the specified GoldFX wallet address. The deposit will be handled after the transaction has been validated on the blockchain.

e-Wallets or Payment Gateways

✅Select your favourite e-wallet or payment channel under ‘Funding’ or ‘Deposit.’

✅Enter your e-Wallet login credentials or payment information as needed.

✅Enter the amount you wish to deposit and then confirm the payment. Funds are normally paid to your account immediately or within a few hours.

Withdrawals Methods:

Bank Wire

✅Access your GoldFX trading account.

✅Navigate to the ‘Withdrawal’ area and choose ‘Bank Wire’ as your withdrawal method.

✅Fill out the withdrawal form with your bank information, including your name, account number, and SWIFT/BIC code.

✅Enter the amount you want to withdraw and then submit the request. Withdrawals via bank wire are executed within a few business days.

Credit or Debit Cards

✅Log into your GoldFX account and then go to the ‘Withdrawals’ section and choose ‘Credit or Debit Card’.

✅If you have not previously stored your card information, enter it now and choose the withdrawal amount.

✅Submit a withdrawal request. The funds will be reimbursed to your card within a few business days, depending on the card issuer’s policy.

Cryptocurrency

✅Sign in to your trading account.

✅In the ‘Withdrawal’ column, choose ‘Cryptocurrency Wallet, then select the coin for the withdrawal and provide your wallet address.

✅Enter the withdrawal amount and then confirm the transaction.

✅After the transaction is validated on the blockchain, the withdrawal will be completed, and the funds will be delivered to your wallet.

e-Wallets or Payment Gateways

✅Access your account and then in the ‘Withdrawal’ section, choose your e-wallet or payment gateway.

✅If necessary, log in to your eWallet or input your payment information.

✅Enter the amount you want to withdraw, then confirm the withdrawal. Withdrawals to eWallets or payment gateways are often done immediately or within a few hours.

Is there a limit to the amount I may deposit or withdraw with GoldFX?

Yes, GoldFX may apply minimum and maximum deposit and withdrawal limitations based on the payment method and account type selected.

Does GoldFX accept credit or debit card deposits?

Yes, GoldFX supports credit and debit card deposits.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – In addition to major and minor currencies, the broker also offers exotic currency pairings.

➡️Stocks – GoldFX traders can trade stocks, namely shares from prominent worldwide firms.

➡️ETFs – Exchange-traded funds (ETFs) are accessible for trading, therefore allowing you to invest in a group of assets or an index.

➡️Indices – The broker trades key worldwide indices, enabling traders to bet on the overall performance of individual stock markets.

➡️Commodities – The site allows you to trade precious metals such as gold and silver, energy commodities like oil and natural gas, and agricultural instruments.

➡️Cryptocurrencies – For individuals interested in the digital currency market, the broker provides trading on several cryptocurrencies.

➡️Treasuries – Trading in government assets, usually known as treasuries, may be accessible, allowing you to invest in government-issued debt

What kind of cryptocurrencies can I trade on GoldFX?

The broker trades on a wide range of cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and others.

Can I trade foreign stock markets with GoldFX?

Yes, GoldFX enables international stock market trading.

GoldFX Trading Platforms and Software

The broker utilizes the MetaTrader 5 (MT5) Trading Platform, fostering a reliable and adaptable trading environment additionally, this platform boasts an extensive range of features, offering one-click trading functionality, comprehensive charting tools, and customizable charts for over 2,500 products across seven asset classes.

Furthermore, the platform empowers traders with six types of pending orders, market liquidity insights, and an integrated economic calendar. Additionally, it prioritizes trustworthy data protection, supporting trading robots for automated trading, and providing free market data and news.

These comprehensive features collectively transform the MT5 Platform into a valuable asset for traders, ultimately delivering a smart and efficient trading experience.

Can I use automated trading methods on GoldFX?

Yes, GoldFX enables automated trading methods using Expert Advisors (EAs) on the MetaTrader 5 platform.

How often does GoldFX update its trading platform and features?

The broker emphasizes continuous upgrades and additions to its trading platform and features.

GoldFX Spreads and Fees

Spreads

The broker offers various trading accounts with reasonable spreads, catering to traders of all levels. Furthermore, the Standard account offers 0.8 pips spreads for beginners, while the Pro account offers 0.6 pips for experienced traders. Moreover, the VIP account offers 0.1 pips spreads for high-volume traders.

Commissions

The broker offers commission-free trading on all products and accounts, simplifying the fee structure for traders. In addition, this strategy allows them to control expenses maximize trading potential, and avoid extra charges, which makes it an appealing option.

Overnight Fees

While additionally GoldFX’s overnight costs policy is not explicitly stated, traders should still check the platform or customer service for updates on swap rates and other expenses. This ensures they are always aware of their trading tactics and any potential costs associated with holding positions overnight.

Deposit and Withdrawal Fees

The broker offers cost-effective funds management with a transparent fee structure: there are no fees for deposits or withdrawals. However, traders should consider additional costs that may arise from third-party sources, such as banks or payment processors, when arranging financial operations.

Inactivity Fees

Overall, The broker offers inactivity fees for non-traders, allowing them to keep their accounts active.

Currency Conversion Fees

In addition, the broker charges traders fees for transferring funds from their trading account to other currencies. This is a standard practice among forex brokers to facilitate global trading and guarantee accurate currency conversions.

Does GoldFX have competitive spreads compared to other brokers?

Yes, GoldFX provides competitive spreads across all account types.

How does GoldFX guarantee that its spreads are competitive?

GoldFX uses liquidity providers and trading technologies to maintain competitive spread pricing.

Leverage and Margin

GoldFX offers leverage, allowing traders to handle larger positions than their account balance allows. With a 1:100 leverage, traders can open a $100 stake for every $1 invested, expanding trading methods. Furthermore, GoldFX provides a maximum leverage of 1:2000, limiting market exposure.

Margin, tied to leverage, is necessary for establishing and maintaining leveraged positions and reducing default risk. additionally, the broker uses a 70% margin call and a 30% stop-out level to protect against excessive losses and maintain account stability.

How does GoldFX compute the margin needs for leveraged positions?

Overall, GoldFX calculates margin needs depending on the position size, the leverage ratio, and the current market price.

What happens if my account at GoldFX hits the margin call level?

If your GoldFX account hits the margin call level, you may need to deposit more funds or cancel off holdings to fulfill margin requirements and prevent liquidation.

Educational Resources

The broker offers the following educational resources:

➡️FAQ – In addition, the FAQ area includes various issues, including account administration, trading conditions, platform use, and trading strategy details.

➡️eBooks – The broker provides a variety of eBooks that appeal to different degrees of trading experience. Therefore, these digital books are an excellent resource for traders wishing to expand their knowledge of the markets.

➡️Video Academy – Therefore, GoldFX’s Video Academy is a dynamic instructional platform that allows traders to participate in various video lessons and webinars. These visual learning aids address trading basics.

➡️Economic Calendar – The Economic Calendar is an invaluable tool for traders who want to keep ahead of market-moving events. Consequently, they maintain an up-to-date schedule of key economic announcements, policy decisions, and noteworthy events that may affect financial markets.

Does GoldFX provide market analysis reports and insights?

Yes, GoldFX delivers frequent market research reports and insights from expert analysts to keep traders updated about market movements and prospective trading opportunities.

Can I find educational materials in languages other than English on GoldFX?

Yes, GoldFX offers instructional materials in several languages.

GoldFX Pros & Cons

✔️ Pros ❌ Cons

The platform offers fast order execution GoldFX is not overseen by a top-tier financial regulator like the FSCA (South Africa). This raises questions regarding investor protection

GoldFX delivers real-time market data to enhance decision-making Overnight and currency conversion fees are not disclosed on the website

GoldFX offers traders access to a variety of assets, including currencies, commodities (such as gold), and indexes GoldFX only offers MetaTrader 5

GoldFX offers demo accounts for risk-free practice and platform testing There are limited educational materials and research tools offered

GoldFX has built-in charting tools and technical indicators to assist traders in market analysis

Client funds are maintained in separate bank accounts, providing an extra degree of protection

The GoldFX trading software allows for automatic trading (using EAs) and copy trading for a more hands-off experience

To secure user data and assets, the broker utilizes a variety of security procedures

Security Measures

Overall, GoldFX is a financial broker prioritizing customer protection through robust security measures backed by regulatory oversight from reputable authorities.

Additionally, it is licensed by the Vanuatu Financial Services Commission and the Labuan Financial Services Authority, ensuring strict financial and operational guidelines.

GoldFX maintains open financial procedures, segregating customer funds from operating funds ensuring secure investments. The broker also employs strong encryption, secure servers, and firewalls to reduce cyber threats and data breaches.

In addition, compliance with international anti-money laundering and KYC standards further enhances security.

Does GoldFX comply with international anti-money laundering (AML) and know-your-customer (KYC) regulations?

Therefore, GoldFX rigorously conforms to international AML and KYC requirements, requiring clients to present identity papers and go through verification processes to prevent funds laundering and protect the integrity of its services.

Are customer funds segregated from GoldFX’s operating funds?

Yes, GoldFX keeps client funds separate from operating funds, adding extra safety to clients’ investments.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Overall, GoldFX is a flexible forex and CFD broker offering a diverse range of assets and markets via the MetaTrader 5 platform. However, concerns about investor protection and transparency arise due to a lack of control from top-tier authorities and concealed fees.

According to our research, GoldFX provides demo accounts for risk-free practice but lacks instructional materials and research tools.

For more information on FXLeaders.

GoldFX normally processes withdrawals within a few business days, although this might vary depending on the withdrawal method used and any extra verification requirements.

The minimum deposit necessary to start an account with GoldFX is $250 on the Standard Account, $5,000 on the Pro, and $10,000 on the VIP Account.

GoldFX accepts various deposit options, including bank transfers, credit/debit cards, and perhaps e-wallets. Check their website for precise choices and prices.

It might be. While GoldFX takes security precautions such as isolating client assets and using encryption methods, investors should undertake due diligence to verify the broker meets their risk tolerance and security standards.

Yes, GoldFX’s MetaTrader 5 platform has social trading capabilities that enable users to mimic successful traders’ tactics.

GoldFX is situated in Vanuatu and is regulated by the Vanuatu Financial Services Commission (VFSC).

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |