Interactive Brokers Review

- Interactive Brokers Review – 13 key points quick overview:

- Overview

- At a Glance

- Interactive Brokers Account Types

- How To Open an Interactive Brokers Account

- Interactive Brokers Deposit & Withdrawal Options

- Trading Instruments & Products

- Interactive Brokers Trading Platforms and Software

- Interactive Brokers Spreads and Fees

- Leverage and Margin

- Educational Resources

- Interactive Brokers Pros & Cons

- Security Measures

- Conclusion

Overall Interactive Brokers is considered a low risk, with an overall Trust Score of 99 out of 100. They are licensed by nine Tier-1 Regulators (highly trusted), zero Tier-2 Regulators (trusted), zero Tier-3 Regulators (average risk), and zero Tier-4 Regulators (high risk). The broker offers two retail accounts: IBKR Lite and IBKR Pro.

Interactive Brokers Review – 13 key points quick overview:

- ☑️Overview

- ☑️At a Glance

- ☑️Interactive Brokers Account Types

- ☑️How To Open an Interactive Brokers Account

- ☑️Interactive Brokers Deposit & Withdrawal Options

- ☑️Trading Instruments & Products

- ☑️Interactive Brokers Trading Platforms and Software

- ☑️Interactive Brokers Spreads and Fees

- ☑️Leverage and Margin

- ☑️Educational Resources

- ☑️Interactive Brokers Pros & Cons

- ☑️Security Measures

- ☑️Conclusion

Overview

Interactive Brokers, founded in 1977 by Thomas Peterffy, is a leading electronic brokerage firm at the forefront of trading technology since its inception.

The company’s early breakthrough was the development of portable trading computers in 1983, which significantly streamlined the trading process.

The broker has since led the creation of computerized trading systems for options and stocks, offering advanced tools and access to global markets.

The company’s focus on innovation benefits traders by increasing transaction execution speed, providing advanced trading tools, and offering a wide range of tradable assets.

Today, they are one of the world’s largest electronic brokerage firms, serving a diverse clientele from individual traders to large institutions.

With a strong regulatory status and commitment to transparency, the company ensures its users can access the latest information and platforms for their investment plans.

Who can benefit from the services offered by Interactive Brokers?

The broker services a wide range of clients, from individual traders to huge institutions, and provides tailored solutions for several investing methods.

What regulatory status do Interactive Brokers hold?

They are licensed by nine Tier-1 Regulators, which ensures a high trust score and solid regulatory standing for safe trading.

At a Glance

| 🗓 Established Year | 1977 |

| ⚖️ Regulation and Licenses | FINRA, IIROC, FCA, CSSF, CBI, MNB, ASIC, SFC, MAS |

| 🪪 Ease of Use Rating | 3/5 |

| 📞 Support Hours | 24/5 |

| 💻 Trading Platforms | IBKR Trader WorkStation, IBKR Desktop, IBKR Mobile, IBKR GlobalTrader, IBKR Client Portal, IBKR APIs, IBKR Impact |

| 🛍 Account Types | IBKR Lite, IBKR Pro |

| 🤝 Base Currencies | USD, AUD, CAD, CHF, EUR, GBP, HKD, JPY |

| 📊 Spreads | 0.6 pips |

| 📈 Leverage | 1:30 |

| 💸 Currency Pairs | 100+ |

| 💳 Minimum Deposit | 0 USD |

| 🚫 Inactivity Fee | None |

| 🗣 Website Languages | English, Spanish, Portuguese, Chinese |

| 💰 Fees and Commissions | Spreads from 0.6 pips, commissions from 0.0005 USD |

| ✅ Affiliate Program | Yes |

| 🏦 Banned Countries | None |

| ✔️ Scalping | Yes |

| 📉 Hedging | Yes |

| 🎉 Trading Instruments | Forex, stocks, ETFs, options, futures, indices, mutual funds, cryptocurrencies, metals, bonds |

| 🎖 Open an Account | Open Account |

Interactive Brokers Account Types

| IBKR Lite | IBKR Pro | |

| ✅ Availability | All; beginners and casual traders | All; professional traders |

| 🛍 Markets | All | All |

| 💸 Commissions | From 0.0005 USD | From 0.0005 USD |

| 💻 Platforms | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots |

| 📈 Leverage | 1:30 | 1:30 |

| 💰 Minimum Deposit | 0 USD | 0 USD |

| 🎖 Open an Account | Open Account | Open Account |

IBKR Lite Account

IBKR Lite is a simple, cost-effective trading account for individuals, investors, and joint or IRA clients. It offers a 0% commission on US equities and ETFs, making it accessible to all skill levels. The account also lacks inactivity penalties, making it appealing to casual traders.

However, customers can access the Client Portal and IBKR Mobile but not the TWS Desktop platform. Overall, IBKR Lite suits those seeking simple, cost-effective trading without complex platform features.

IBKR Pro Account

IBKR Pro is a trading account designed for professional traders with high-volume transactions. It offers competitive fees and pricing structures, with clients liable for inactivity costs until their monthly commissions exceed $10 or their account balance exceeds $100,000.

The account includes access to platforms like IB Trader Workstation, WebTrader, mobile, and API. Pricing models can be fixed or tiered, with volume-tiered pricing for reduced fees at higher volumes. Exchange rebates can be returned, and all regulatory and clearing expenses are clearly stated.

Demo Account

The Demo Account offers a risk-free platform for traders to test their services, test trading methods, and practice trading without committing funds.

This time-limited trial account provides an excellent opportunity to familiarize oneself with the broker’s environment and capabilities. However, not all functionalities are included in the sample version. This virtual trading environment is beneficial for both novice and experienced traders.

Are Interactive Brokers’ IBKR Lite and IBKR Pro accounts available to all traders?

Yes, both account types are available to all traders, with IBKR Lite being better suited for novices and casual traders and IBKR Pro for expert traders.

What leverage does Interactive Brokers offer for IBKR Lite and IBKR Pro accounts?

Their IBKR Lite and IBKR Pro accounts provide up to 1:30 leverage.

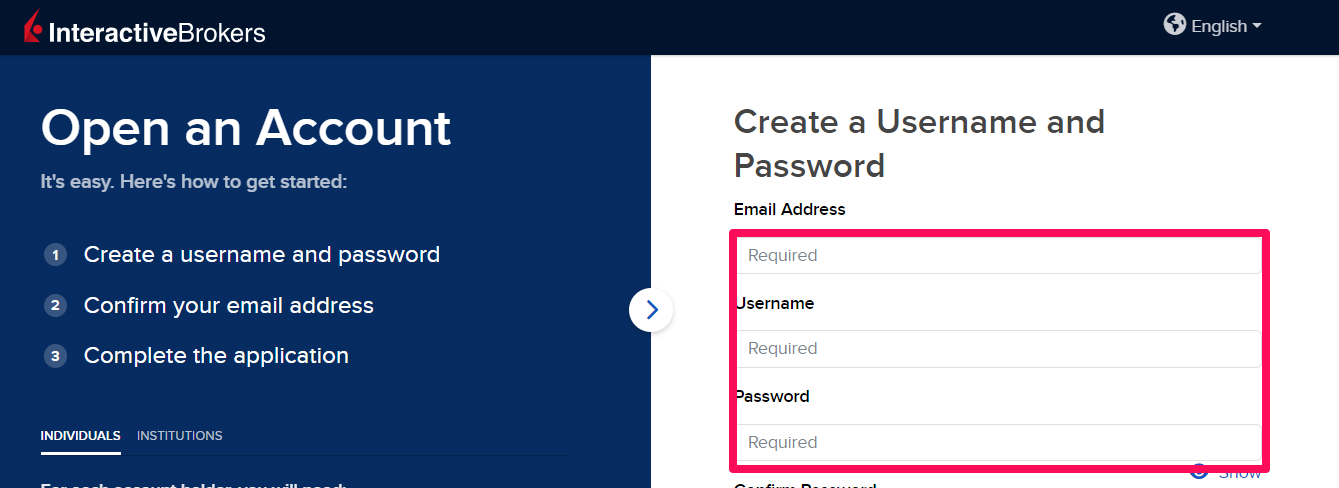

How To Open an Interactive Brokers Account

To register an account, follow these steps:

Step 1 – Click on the open account button.

Go to the Interactive Brokers website and find the “Open an Account” button. Choose the right account type (individual, joint, trust, etc.) based on your requirements.

Step 2 – Complete the form.

Complete the application by entering your name, address, date of birth, tax identification number, and employment information.

Step 3 – Answer the questions.

To assist Interactive Brokers tailor your account to your specific needs, you will be asked questions about your investing objectives, risk tolerance, and previous trading experience. Once your application has been accepted, select a funding method (bank transfer, wire transfer, or transfer from another brokerage) and deposit funds into your new Interactive Brokers account.

Interactive Brokers Deposit & Withdrawal Options

💳 Payment Method 🏛 Country ⚖️ Currencies Accepted ⏰ Processing Time

SEPA All Multi-currency 1 day

Wise Balance All Multi-currency A few hours

Bank Wire All Multi-currency 1 day

ACH United States Only USD 1 day

Bill Pay Several USD 1 – 6 days

Checks Several USD 6 days

BPAY Australia AUD 1 – 6 days

ETF Several Multi-currency 1 day

Local Bank Accounts Several Multi-currency Instant – a few hours

e-Wallets Several Multi-currency Instant – a few hours

Crypto wallets Several Multi-currency Instant – a few hours

Deposit Methods:

Bank Wire

✅Log into your account and navigate to the “Transfer & Pay” or “Deposit Funds” section.

✅Select “Wire Transfer” and enter the base currency for your deposit.

✅You will be provided with bank details (beneficiary bank, account number, SWIFT/BIC, etc.).

✅Use the information provided to start the wire transfer with your bank.

ACH Step by Step (US Only)

✅Connect your external bank account to your account. This usually requires inputting your bank’s routing and account information.

✅Once linked, navigate to the “Transfer & Pay” section and select “ACH.”

✅Choose the amount to deposit and complete the steps to approve the funds transfer from your bank account.

HCryptocurrency Wallets

✅Your account will include a distinct “Cryptocurrency Deposit” section if it is available in your area.

✅Choose the coin to deposit, and your account will generate a unique wallet address.

✅Start the transfer from your external cryptocurrency wallet and send the funds to the wallet address.

e-Wallets or Payment Gateways

✅In some cases, may support particular e-wallets or gateways, such as PayPal.

✅Locate the available e-wallet option in your account’s “Deposit” section.

✅Follow the on-screen instructions, often directing you to the e-wallet provider’s website to complete the deposit.

Withdrawals Methods:

Bank Wire

✅Choose “Wire Transfer” from the “Transfer & Pay” or “Withdraw Funds” options.

✅Enter the amount you want to withdraw and your bank account information as the destination for money.

✅Examine and confirm the withdrawal request.

ACH Step by Step (US Only)

✅Find the “ACH” option in the “Withdraw Funds” section.

✅Enter the amount you wish to withdraw and the bank account to which the funds should be sent.

✅Review and authorize the withdrawal transaction.

Cryptocurrency Wallets

✅Go to the “Cryptocurrency Withdrawal” section of your account.

✅Select the coin you want to withdraw and input the destination address associated with your external cryptocurrency wallet.

✅Enter the withdrawal amount, double-check the details, and submit the request.

e-Wallets or Payment Gateways

✅If supported, look for the relevant e-wallet option in the “Withdraw Funds” section.

✅Enter your e-wallet account details and the amount you wish to withdraw, then follow the instructions to complete the process.

Can I use e-wallets for deposits and withdrawals with Interactive Brokers?

Yes, the broker accepts deposits and withdrawals using e-wallets and payment gateways, which can be completed instantly or within a few hours.

How can US clients deposit funds into their Interactive Brokers account using ACH?

Clients in the United States can link their bank accounts to their accounts and deposit funds via ACH using the “Transfer & Pay” option.

Trading Instruments & Products

The broker offers the following trading instruments and products:

➡️Forex – Interactive offers more than 100 currency pairings, spanning from major currencies to exotic combinations, giving forex traders plenty of options.

➡️Stocks – Traders may access equities from over 150 exchanges in 33 countries, giving them a true global reach in the equity markets.

➡️ETFs – The broker has many Exchange-Traded Funds (ETFs) that provide exposure to various sectors, themes, and investing techniques.

➡️Options – The platform provides advanced tools and access to options on stocks, indexes, futures, currencies, and more.

➡️Futures – They allow you to trade futures contracts for various asset types, including commodities, stocks, indexes, and interest rates.

➡️Indices – Index futures and options allow traders to speculate on or hedge important global market indexes.

➡️Mutual funds – The broker provides various mutual funds to simplify investment and diversification across many fund families.

➡️Cryptocurrencies – While the selection is limited, they offer trading in Bitcoin, Ethereum, Litecoin, and Bitcoin Funds.

➡️Metals – Traders can obtain exposure to precious metals such as gold and silver through spot contracts or exchange-traded funds that follow metal prices.

➡️Bonds – The broker allows you to trade various fixed-income securities, including corporate, government, and municipal bonds.

Does Interactive provide access to global stock exchanges?

Yes, Interactive provides access to stocks from over 150 exchanges across 33 countries, giving traders a genuine worldwide reach in the stock market.

Do Interactive Brokers offer mutual funds as part of their trading instruments?

Yes, the broker offers many mutual funds, allowing diversified investing across many fund families.

Interactive Brokers Trading Platforms and Software

IBKR Trader Workstation (TWS)

Consequently, the IBKR Trader Workstation (TWS) is a robust platform designed for professional traders, offering a wide range of tools and capabilities to execute complex trading strategies across over 150 markets.

This platform empowers traders to manage a broad portfolio from a single interface. In addition, it provides powerful trading tools, risk management features, and extensive market data.

IBKR Desktop

Overall, IBKR Desktop is a new trading platform, designed for traders seeking simplicity and efficiency.

In addition, it offers a balanced environment for beginners and advanced traders, combining elements from the flagship TWS platform with additional functions. Furthermore, with over 150 markets worldwide, it offers excellent order execution and a user-friendly interface.

IBKR Mobile

IBKR Mobile offers traders flexibility, with extensive trading capabilities across 150 global markets. In addition, it provides access to various asset classes, including stocks, options, futures, currencies, and bonds.

The platform offers complex order types, trading tools, and real-time market data, ensuring users stay connected to markets and their portfolios, regardless of location.

IBKR GlobalTrader

Overall, IBKR GlobalTrader is a platform designed for beginners and intermediate traders to simplify trading stocks, ETFs, options, and cryptocurrencies internationally.

It offers a user-friendly interface, allowing for small investments, including fractional shares. Additionally, it features a virtual trading account for practice and learning. Consequently, it offers a cost-effective solution for exploring overseas markets.

IBKR Client Portal

Therefore, the IBKR Client Portal is a user-friendly web-based tool for traders and investors, allowing easy account management, portfolio monitoring, and transactions.

This platform eliminates the need for downloads and grants access to Interactive Brokers’ trading tools, research, and market data, thereby providing a simplified trading experience for individuals.

IBKR APIs

Overall the APIs cater to various developers and traders, offering solutions for Excel automation and high-frequency trading.

The TWS API is renowned for its support and documentation, which allows users to customize their trading experience. These versatile solutions can then be adjusted to meet different trading demands and technical knowledge levels.

IBKR Impact

Overall, IBKR Impact is a mobile app designed for socially conscious investors, offering a platform to match investing decisions with personal beliefs.

Additionally, available on iOS and Android devices, it helps investors find and invest in companies that meet ethical, social, and governance standards, including options and cryptocurrencies, thereby promoting financial goals and personal principles.

Can I trade on the go with Interactive?

Yes, their IBKR Mobile provides significant trading capabilities across worldwide markets, making it suitable for traders who want flexibility and market access anytime and from any location.

Does Interactive Brokers offer an API for customized trading applications?

Yes, the broker offers API solutions, including the TWS API, that allow developers and traders to construct bespoke trading apps and automate tactics.

Interactive Brokers Spreads and Fees

Spreads

The broker offers narrow spreads from 0.6 pips, enhancing trading efficiency, particularly for forex and CFD traders. Collecting quotes from various sources ensures clients receive the best pricing, reducing trading costs and benefiting high-volume traders and frequent traders.

Commissions

The broker offers competitive commission structures for casual and active traders, with tiered pricing options for stocks and ETFs from 0.0005 USD.

Commissions decrease with trading volume, saving costs for large-volume traders. Options and futures fees are organized per contract, providing transparency for traders to reduce overall costs.

Overnight Fees

The broker charges overnight fees, also known as finance rates, for positions in leveraged accounts.

These fees, calculated using benchmark rates and a spread, affect long-term trading profitability. Traders must consider these fees as they demonstrate their commitment to providing cost-effective solutions.

Deposit and Withdrawal Fees

Overall, the broker provides low-cost financing and withdrawal methods, promoting smooth account administration.

The first withdrawal is free. However, subsequent charges are applied based on method and currency. In contrast, no deposit fee is imposed, making it easy for traders to establish accounts and start trading.

Inactivity Fees

Overall, they charge inactivity fees for less active traders if specific trading activity and account balance requirements are unmet.

However, Interactive offers exemptions and lower criteria for clients with lesser account balances, demonstrating its adaptability and dedication to serving diverse clients.

Currency Conversion Fees

Overall, the broker offers competitive currency conversion rates, enabling traders and investors to diversify their portfolios across worldwide markets without incurring exorbitant fees.

These rates are crucial for traders dealing in multiple currencies and are often a low proportion of transaction value.

How are commissions structured for the accounts?

The broker provides a tiered commission system, with costs for stocks and ETFs starting at 0.0005 USD and lowering with higher trading volume.

Can I expect additional fees for trading options or futures?

Yes, trading options and futures may incur per-contract fees, but the structure gives transparency to assist traders in controlling expenses.

Leverage and Margin

Overall, the broker provides clients with a variety of leverage and margin trading options, which vary based on account type, instruments, and market access. In adherence to the Federal Reserve Board’s Regulation T for stock trading in the US, they allow up to 50% initial margin (2:1 leverage).

Furthermore, margin requirements for options and futures are determined by volatility and market risk. To emphasize risk management, they require clients to have sufficient equity to support margin positions, thus appealing to both conservative and aggressive traders.

Does Interactive Brokers offer different margin rates for different account types?

No, the margin rates are the same for IBKR Lite and IBKR Pro account types.

Are there any tools to help manage risk when trading on margin?

Yes, the broker offers risk management tools to assist clients in understanding and managing the hazards of margin trading.

Educational Resources

The broker offers the following educational resources:

➡️IBKR Campus – Overall, IBKR Campus is a comprehensive educational platform for trading and investing, offering seminars, webinars, and tutorials to enhance investors’ trading abilities and financial understanding.

➡️Traders’ Academy – Additionally, traders’ Academy offers online courses covering various financial products, trading tools, and tactics, from basic stock trading to advanced futures, currency, and portfolio management, featuring videos, quizzes, and notes for comprehensive learning.

➡️Traders’ Insight – Moreover, traders’ Insight is a blog by IBKR financial analysts that provides market analysis, trading tactics, and global financial market insights, covering equities, bonds, currency, and commodities, assisting traders in making informed decisions.

➡️IBKR Podcasts – Overall, IBKR Podcasts offer in-depth discussions with industry professionals on market trends, trading tactics, and economic observations, perfect for traders and investors seeking in-depth analysis of financial markets.

➡️IBKR Quant Blog – The IBKR Quant Blog offers innovative trading models, analytical tools, and complex tactics for quants interested in technical and quantitative trading components.

➡️Webinars – In addition, they host regular webinars on trading concepts, advanced tactics, and market analysis, featuring industry experts and IBKR-specific tools. Participants can ask questions, making the events engaging and informative.

➡️Student Trading Lab – The Student Trading Lab provides instructors and students with a regulated, real-world trading experience, allowing them to practice trading stocks, options, and futures through a virtual account, making it an excellent resource for financial market education.

➡️Traders’ Glossary – Additionally, the Traders’ Glossary is a comprehensive list of trading and financial terms and definitions, providing valuable insights for traders and investors to understand complex financial market language.

➡️Traders’ Calendar – The Traders’ Calendar provides a comprehensive overview of financial events, earnings releases, and economic indices, enabling traders and investors to stay informed about potential market changes.

Can I find market analysis and trading insights?

Yes, Traders’ Insight, an Interactive Brokers blog, provides market research, trading tactics, and insights into financial markets.

Where can I find definitions for trading and financial terms?

The Traders’ Glossary on the Interactive Brokers website defines various trading and financial concepts.

Interactive Brokers Pros & Cons

✔️ Pros ❌ Cons

Traders can use a variety of order types to execute complicated trading strategies The efficient use of the platforms may need substantial time investment and prior trading experience

Highly competitive commissions and margin rates, especially for active traders Support quality varies; some users claim excessive wait periods

Traders get access to high-quality research, instructional resources, and market commentary Supports cryptocurrency trading. However, the variety is limited compared to specialist cryptocurrency exchanges

Developers can create customized trading applications and automate tactics The sheer number of options and functions might be intimidating for novices

Investors can feel secure knowing that Interactive Brokers is well-regulated and has a strong track record Interactive Brokers does not provide fractional shares or the opportunity to participate in IPOs

Traders can trade stocks, ETFs, options, futures, currency, and other assets in over 150 marketplaces across 33 countries Account minimums might be somewhat high when compared to several beginner-friendly brokers

SmartRouting technology seeks to discover the cheapest costs and the fastest execution times

Provides comprehensive desktop, online, and mobile trading platforms with powerful charting and technical analysis capabilities

Security Measures

Overall, Interactive Brokers (IBKR) is committed to providing a secure trading environment by implementing comprehensive security measures.

Two-factor authentication (2FA) to prevent illegal access to accounts. This adds an extra layer of security by requiring a second verification step, such as a code from your phone, in addition to your password.

IBKR continuously updates its security procedures to address evolving threats and weaknesses, demonstrating a proactive attitude to cybersecurity. Overall, IBKR’s security measures ensure the safety and integrity of its customers.

How does IBKR protect data during transmission?

Interactive Brokers uses powerful encryption methods to protect customer data during transmission, resulting in a secure internet connection.

How does Interactive Brokers help clients prevent unauthorized account access?

Interactive Brokers’ Secure Login System creates a unique code for each login attempt, which helps prevent illegal account access.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

Conclusion

Overall Interactive Brokers is a popular trading platform for experienced traders and investors seeking specialized benefits. Its cost-effectiveness is aided by reasonable commission structures and low-margin rates.

For more information on FXLeaders.

You can withdraw via a bank wire, ACH (US), or other supported ways. Withdrawal requests may be made using your account management page, and the processing time may vary.

Withdrawal timeframes at Interactive Brokers vary by method, with bank wires and ACH transfers often executed in one day, while other ways might take several days.

Interactive Brokers do not need a minimum deposit, allowing traders to start with money appropriate for their trading strategy and budget.

Yes, they provide a paper trading account. This grants you access to their platforms with simulated funds, allowing you to practice trading and become acquainted with the features risk-free.

Yes, IBKR charges commissions, inactivity fees, withdrawal costs, etc. The commission structure varies according to the asset traded and your trading volume.

Yes, Interactive Brokers is considered a safe broker since it holds licenses from nine Tier-1 authorities and employs strict security measures like two-factor authentication and encryption.

IBKR allows you to trade various products, including forex, stocks, ETFs, options, futures, indexes, mutual funds, cryptocurrencies, metals, and bonds.

Yes, although the options are restricted when compared to specialist cryptocurrency exchanges. Interactive Brokers now provides trading in a few prominent cryptocurrencies.

IBKR is located in the United States and was founded in 1977. It has a long history of technological innovation in trading.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |