MultiBank Group Review

- MultiBank Group Review - Analysis of Brokers' Main Features

- Overview

- Detailed Summary

- Safety and Security

- Account Types

- How To Open an Account

- Trading Platforms and Software

- Fees, Spreads, and Commission

- Leverage and Margin

- Trading Instruments and Products

- Deposit and Withdrawal Options

- Educational Resources

- Pros and Cons

- Conclusion

Overall, MultiBank Group is a trustworthy and highly regulated global financial derivatives provider with several industry awards. It offers commission-free options with narrower spreads and ECN accounts for direct market access. The Broker has a trust score of 99 out of 99.

| 🔎 Broker | 🥇 MultiBank Group |

| 📈 Established Year | 2005 |

| 📉 Regulation and Licenses | ASIC, AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC |

| 4️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | 20% deposit bonus, 30% deposit bonus, cashback program, deposit bonus up to $40,000 |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | MultiBank-Plus, MetaTrader 4, MetaTrader 5, MultiBank Trader 4, MultiBank Trader 5 |

| 📌 Account Types | Standard, Pro, ECN |

| 💴 Base Currencies | EUR, GBP, USD, CHF, AUD, NZD, CAD |

| 💹 Spreads | From 0.0 pips |

| 💱 Leverage | 1:500 |

| 💵 Currency Pairs | 55; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 50 USD |

| 💷 Inactivity Fee | 60 USD after 3 months of inactivity |

| 🔊 Website Languages | English, French, Spanish, German, Portuguese, Italian, Russian, Thai, Arabic, Vietnamese, Traditional Chinese, Simplified Chinese, Malay |

| 💳 Fees and Commissions | Spreads from 0.0 pips, commissions from $3 per lot traded on the ECN Account |

| 🥰 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States and others |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, shares, indices, commodities, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | ASIC, BaFin, CMA, CySEC, DFSA, FCA, SCB | USD 200 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | CySEC, MISA, FSCA | USD 25 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

MultiBank Group Review – Analysis of Brokers’ Main Features

- ☑️ Overview

- ☑️ Detailed Summary

- ☑️ Group Safety and Security

- ☑️ Account Types

- ☑️ How To Open an Account

- ☑️ Group Trading Platforms and Software

- ☑️ Fees, Spreads, and Commission

- ☑️ Leverage and Margin

- ☑️ Trading Instruments and Products

- ☑️ Deposit and Withdrawal Options

- ☑️ Educational Resources

- ☑️ Pros and Cons

- ☑️ In Conclusion

Overview

MultiBank Group, established in 2005 in California, USA, is a global financial derivatives provider with a paid-up capital of over $322 million. With over one million traders from over 100 countries, the broker is known for its accessibility and global market presence.

It is regulated by renowned financial agencies worldwide, including ASIC (Australia), BaFin (Germany), FMA (Austria), and CNMV (Spain). Moreover, MultiBank Group is committed to regulatory compliance, ensuring a safe and transparent environment for traders.

The company constantly improves its technology infrastructure and trading platforms, earning multiple industry awards. In addition, MultiBank Group offers financial products, including forex, metals, stocks, indices, commodities, and cryptocurrencies.

Furthermore, MultiBank Group offers commission-free options with narrower spreads and ECN accounts for direct market access, catering to traders with varying expertise levels.

Does MultiBank Group provide services designed exclusively for institutional investors?

Yes, MultiBank Group serves institutional clients with its ECN Account, which provides raw spreads and quick execution.

How does MultiBank Group support charity causes and social responsibility initiatives?

MultiBank Group regularly supports philanthropic organizations and social responsibility programs, proving its dedication to making a positive difference in society beyond its financial services offers.

Detailed Summary

| 🔎 Broker | 🥇 MultiBank Group |

| 📈 Established Year | 2005 |

| 📉 Regulation and Licenses | ASIC, AUSTRAC, BAFIN, CIMA, ESCA, CySEC, FSC, FMA, MAS, TFG, VFSC |

| 4️⃣ Ease of Use Rating | 4/5 |

| 🎁 Bonuses | 20% deposit bonus, 30% deposit bonus, cashback program, deposit bonus up to $40,000 |

| ⏰ Support Hours | 24/7 |

| 📊 Trading Platforms | MultiBank-Plus, MetaTrader 4, MetaTrader 5, MultiBank Trader 4, MultiBank Trader 5 |

| 📌 Account Types | Standard, Pro, ECN |

| 💴 Base Currencies | EUR, GBP, USD, CHF, AUD, NZD, CAD |

| 💹 Spreads | From 0.0 pips |

| 💱 Leverage | 1:500 |

| 💵 Currency Pairs | 55; major, minor, and exotic pairs |

| 💶 Minimum Deposit | 50 USD |

| 💷 Inactivity Fee | 60 USD after 3 months of inactivity |

| 🔊 Website Languages | English, French, Spanish, German, Portuguese, Italian, Russian, Thai, Arabic, Vietnamese, Traditional Chinese, Simplified Chinese, Malay |

| 💳 Fees and Commissions | Spreads from 0.0 pips, commissions from $3 per lot traded on the ECN Account |

| 🥰 Affiliate Program | ✅Yes |

| ❎ Banned Countries | United States and others |

| 🅰️ Scalping | ✅Yes |

| 🅱️ Hedging | ✅Yes |

| 📐 Trading Instruments | Forex, metals, shares, indices, commodities, cryptocurrencies |

| 🚀 Open an Account | 👉 Click Here |

Safety and Security

MultiBank Group has a robust security system to protect customer funds and personal information. Moreover, this system is regulated by various financial authorities worldwide, ensuring the highest level of client funds security.

Furthermore, the company uses advanced technology to prevent illegal access, abuse, loss, or alteration of personal information. It isolates client funds from company funds, ensuring assets are held in top-tier banks.

Additionally, it provides negative balance protection, preventing customers from losing more than they have put in their accounts. Furthermore, this comprehensive approach to security reflects MultiBank Group’s commitment to maintaining trust in its trading environment.

Can traders trust MultiBank Group with their personal information?

MultiBank Group takes customer privacy and data security seriously, implementing strict confidentiality measures.

What measures does MultiBank Group take to prevent unauthorized access to accounts?

MultiBank Group employs advanced security technology and encryption protocols to prevent unauthorized account access.

Account Types

| 🔎 Account Type | 🥇 Standard | 🥈 Pro | 🥉 ECN |

| 🩷 Availability | Ideal for beginners and casual traders | Ideal for experienced traders | Ideal for scalpers, algorithmic, and day traders |

| 📈 Markets | All | All | All |

| 💴 Commissions | None. Only the spread is charged | None. Only the spread is charged | From $3 per lot traded |

| 📉 Platforms | All | All | All |

| 📊 Trade Size | From 0.01 lots | From 0.01 lots | From 0.01 lots |

| 💹 Leverage | 1:500 | 1:500 | 1:500 |

| 💷 Minimum Deposit | 50 USD | 1,000 USD | 10,000 USD |

| 🚀 Open an Account | 👉 Click Here | 👉 Click Here | 👉 Click Here |

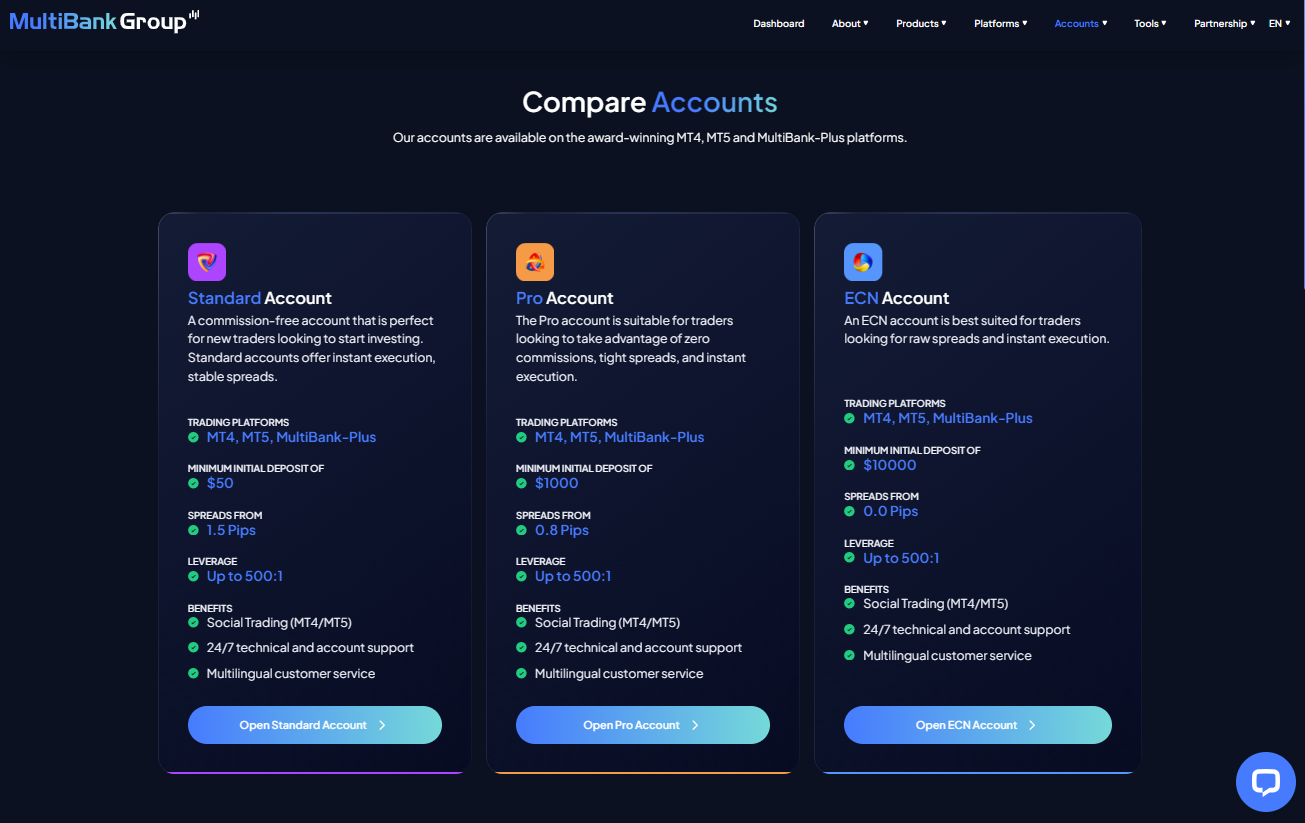

Standard Account

The Standard Account is a cost-effective option for novice traders, offering consistent spreads and rapid execution. Moreover, a low minimum initial investment of $50 makes it accessible to all budgets. Popular trading platforms like MT4, MT5, and MultiBank-Plus provide flexibility.

Pro Account

The Pro Account is a top choice for experienced traders seeking efficiency and tighter spreads. It offers no commission costs, 0.8 pips spread, and a $1,000 minimum deposit. In addition, access to popular platforms and 24/7 technical assistance make it a popular choice.

ECN Account

The ECN Account offers raw spreads and fast execution for traders, with spreads as low as 0.0 pips. It requires a $10,000 initial commitment, which is ideal for experienced traders and institutional investors. The account also provides access to reputable platforms and support services.

Islamic Account

MultiBank Group’s Islamic Account, also known as a “Swap-Free Account,” caters to Islamic traders by eliminating swap charges for overnight holdings. Moreover, this account allows traders to participate in global markets while maintaining religious beliefs.

Furthermore, customers can choose between swap-free and swap-standard accounts, but they must adhere to MultiBank Group’s restrictions while using the Islamic Account.

Demo Account

MultiBank Group provides a demo account for traders to experience trading various financial products without risking real money.

In addition, the account is powered by MT4 and MT5 and mobile app trading platforms, offering a realistic trading environment for new and experienced traders. Furthermore, the demo account has a limitless length, allowing users to practice trading methods over time without time restrictions.

Are there any limits on the transaction amount or trading techniques that MultiBank Group Standard Account members may use?

No, MultiBank Group’s Standard Account users are not limited in the quantity of transactions or trading techniques they may use.

How does MultiBank Group guarantee that its pricing is fair and transparent across all account types?

MultiBank Group offers fair and transparent pricing across all account types by providing reasonable spreads and fee structures suited to each trader category’s demands.

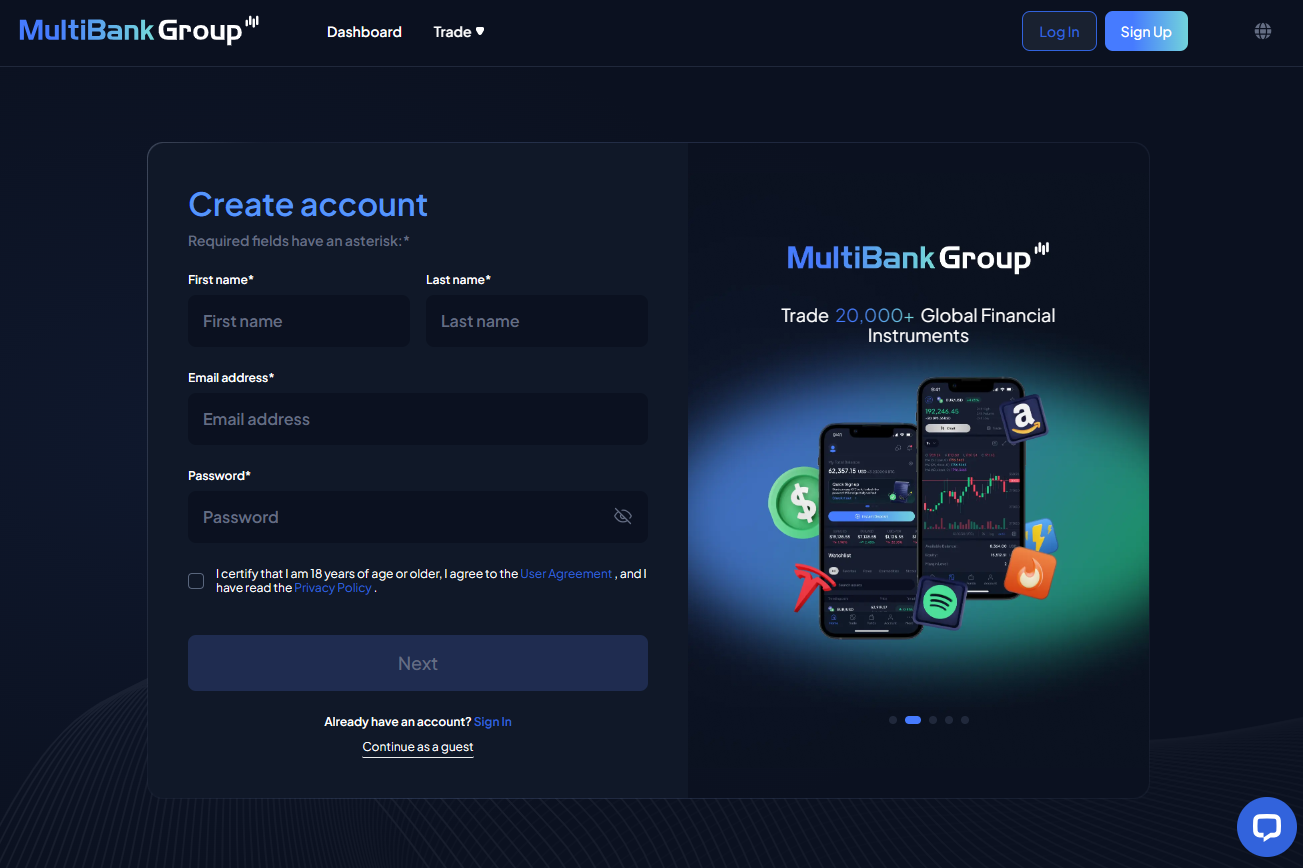

How To Open an Account

To register an account with MultiBank Group, follow these steps:

- Go to the MultiBank Website to begin the online account application procedure.

- Choose the account that best meets your trading requirements.

- Complete the application form and include your personal data, trading experience, and financial information.

- Submit the required documents to prove your identity and residential residence.

- Select your chosen deposit method and send the first investment funds to start your trading account.

- Choose your desired trading platform, such as MultiBank-Plus, MT4, or MT5.

Use MultiBank Group’s training resources and tutorials to improve your trading knowledge and abilities before joining real markets.

Can traders practice trading before establishing an actual account with MultiBank Group?

MultiBank Group offers traders a demo account opportunity to experience trading different financial products without risking real money.

Does MultiBank Group provide any incentives or bonuses for new account openings?

MultiBank Group provides numerous advantages for new account openings, such as deposit bonuses and reward programs.

Trading Platforms and Software

MultiBank-Plus

MultiBank-Plus offers advanced trading systems with real-time functionality and reliability. Moreover, its intuitive interface and industry-wide spreads provide transparent market environments, starting at 0.0 pips.

In addition, the technology offers 24-hour execution, negative balance protection, and up to five layers of market depth, ensuring a transparent trading experience.

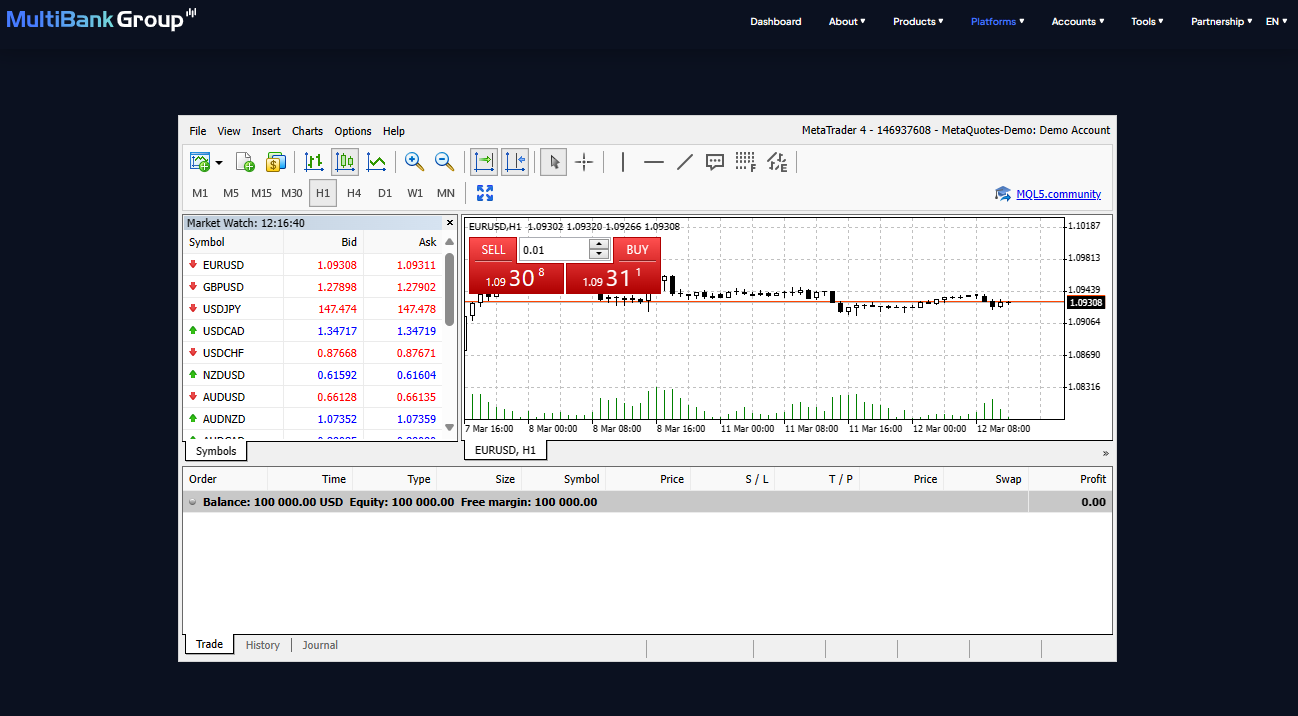

MetaTrader 4

MT4 is a popular trading platform with advanced functionality and analytical tools, offering traders access to various tradable items like forex, metals, stocks, indices, commodities, and cryptocurrencies.

Moreover, it features market depth, alerts, over 80 technical analysis indicators, one-click trading, and complete EA capabilities for smooth trading experiences.

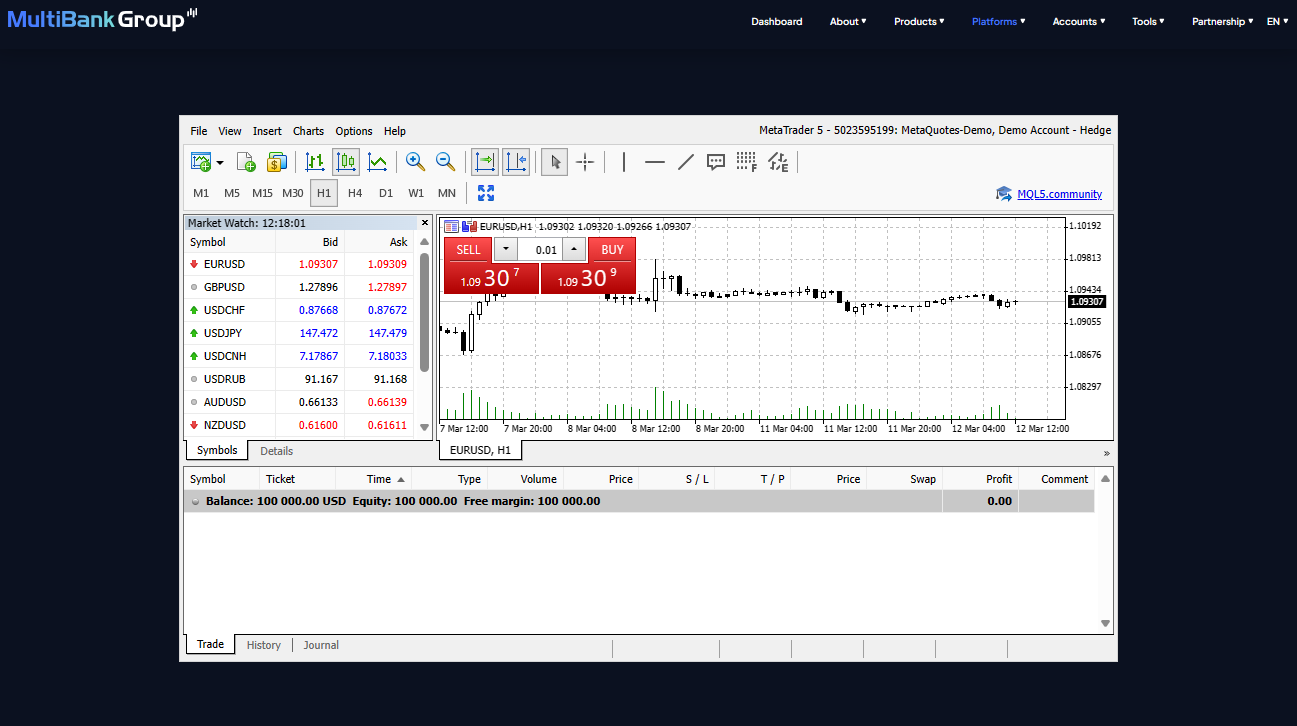

MetaTrader 5

MT5 is a trading platform designed to meet the growing needs of brokers and traders.

Moreover, it offers enhanced trading functionality, including tradable goods like forex, metals, shares, indices, commodities, cryptocurrencies, market depth, alert alerts, custom indicators, and expert advisors, making it suitable for beginners and professionals.

Trader 4

MultiBank Trader 4 is a top-tier trading platform with advanced features like technical indicators and signals, user-friendly design, and one-click trading.

In addition, it offers complete EA capabilities, real-time market news, and access to various markets like forex, stocks, indices, metals, commodities, and digital assets.

Trader 5

MultiBank Trader 5 provides diverse financial instruments, including over 150 Crypto CFDs and 1,000+ shares, with 21 time periods and 38 built-in MT5 analytical indicators. It supports netting, order types, and customizable charting, enabling efficient holding management.

Can traders access MultiBank Group’s trading platforms on different devices?

MultiBank Group’s trading platforms are accessible on multiple devices, including desktop computers, laptops, smartphones, and tablets.

Are there any fees associated with using MultiBank Group’s trading platforms?

MultiBank Group typically does not charge fees for its trading platforms. However, traders should be aware of any potential data or internet usage fees incurred while accessing the platforms from their devices.

Fees, Spreads, and Commission

Spreads

VIP account holders enjoy tight pricing and increased trading efficiency with spreads as low as 0.0 pips. Pro account members have spreads at 0.8 pips, while standard account holders have competitive spreads at 1.5 pips, making trading accessible to all skill levels.

Commissions

MultiBank Group offers commission-free trading for all account types. ECN account holders pay $3 per lot transacted, ensuring transparent pricing and allowing traders to make informed decisions without hidden fees.

Overnight Fees

MultiBank Group offers fair and transparent overnight fees for FX and CFD trading positions determined by interest rate differences, market conditions, and broker overnight finance charges.

Furthermore, MultiBank’s website features a swap rate table for traders to view costs. Additionally, it offers swap-free Islamic accounts, aligning trading operations with religious beliefs.

Deposit and Withdrawal Fees

MultiBank Group provides traders with easy deposit and withdrawal methods without fees. However, third parties like banks, credit/debit card providers, and payment gateways might apply fees to transactions.

Inactivity Fees

However, traders should be aware of potential inactivity penalties of $60 per month for 90 days, which can be avoided by frequent trading or maintaining a higher balance.

Currency Conversion Fees

MultiBank Group emphasizes reducing currency conversion costs for traders operating in multiple currencies.

Conversion fees are based on the trading account’s base currency and are determined by a markup on the exchange rate. To reduce costs, traders can choose a base currency or use multi-currency accounts.

Are there any currency conversion fees when trading with MultiBank Group?

Yes, MultiBank Group may apply currency conversion fees based on the base currency of the trading account and the exchange rate markup.

Does MultiBank Group charge inactivity fees for dormant accounts?

Yes, MultiBank Group imposes an inactivity fee of $60 per month for accounts that have been inactive for 90 days or more.

Leverage and Margin

Margin trading is a strategy MultiBank Group uses to increase trading power by leveraging deposited funds. This allows traders to handle larger positions for a fraction of their overall value, potentially increasing earnings.

However, it exposes traders to potential losses greater than their original deposits. MultiBank Group provides risk warnings during account opening to ensure traders know potential hazards.

In the Forex market, margin needs are determined using MultiBank Group’s leverage rate, which can be adjusted based on the current exchange rate. The company also uses a stop-out level to control risk, activating it when equity drops below 50% of the needed margin.

What is the stop-out level used by MultiBank Group to control risk?

MultiBank Group activates the stop-out level when a trader’s equity drops below 50% of the required margin.

Are there any limitations on the use of leverage with MultiBank Group?

Yes, MultiBank Group sets maximum leverage limits to help traders manage risk responsibly, ensuring that excessive leverage is not used.

Trading Instruments and Products

MultiBank Group offers the following trading instruments and products:

- 55 major Forex pairs, offering diversification and profit production.

- Low metal spreads on gold and silver.

- Access over 20,000 global stocks through margin trading, offering flexibility and rewards.

- Access to global stock market indexes like NASDAQ, DAX, and Wall Street 30 Index, offering 100:1 leverage and low spreads, reducing commission costs.

- Cost-effective commodity trading for energy and grains, charging no commissions and maintaining low margin requirements, allowing traders to profit from supply and demand movements.

Moreover, MultiBank Group offers a competitive platform for cryptocurrency trading, offering stable execution, fast order processing, and leverage up to 1:50, suitable for experienced and inexperienced traders.

Is there a limit on the amount of currency pairings available for trading with MultiBank Group?

No, MultiBank Group offers trading in a wide range of currency pairs, including major, minor, and exotic, totaling 55 pairs.

Does MultiBank Group provide cryptocurrency trading?

Yes, MultiBank Group offers trading in cryptocurrencies. It offers a competitive platform with stable execution and leverage up to 1:50 for both experienced and inexperienced traders.

Deposit and Withdrawal Options

| 🔎 Payment Method | 🌎 Country | 🪙 Currencies Accepted | ⏰ Processing Time |

| 💴 Bank Wire Transfer | All | Multi-currency | ⚡ 1 - 7 days |

| 💵 Credit/Debit Card | All | Multi-currency | ⚡ Instant - a few days |

| 💶 Neteller | All | Multi-currency | Instant - 24 hours |

| 💷 Skrill | All | Multi-currency | Instant - 24 hours |

| 💴 Pagsmile | Latin America | Multi-currency | Instant - 24 hours |

| 💵 My Fatoorah | Saudi Arabia, UAE, Egypt, Qatar, Bahrain, Oman | Multi-currency | Instant - 24 hours |

| 💶 Plus Wallets | Various | Multi-currency | Instant - 24 hours |

| 💷 Thai QR Payment | Thailand | 📍 THB | Instant - 24 hours |

| 💴 PayTrust | Southeast Asian Countries | Multi-currency | Instant - 24 hours |

| 💵 Payretailers | Various | Multi-currency | Instant - 24 hours |

| 💶 Korapay | Various | Multi-currency | Instant - 24 hours |

| 💷 PaymentAsia | Asian Countries | Multi-currency | Instant - 24 hours |

| 💴 Boleto | Brazil | 📍 BRL | Instant - 24 hours |

| 💵 PIX | Brazil | 📍 BRL | Instant - 24 hours |

| 💶 SPEI | Mexico | 📍 MXN | Instant - 24 hours |

| 💷 Praxis | Various | Multi-currency | Instant - 24 hours |

| 💴 GCash | Various | Multi-currency | Instant - 24 hours |

| 💵 Dragonpay | Philippines | 📍 PHP | Instant - 24 hours |

| 💷 GlobePay | Various | Multi-currency | Instant - 24 hours |

Deposit Methods

Bank Wire

- Obtain the appropriate bank account information for MultiBank Group from their website or customer portal.

- Make a wire transfer via your bank, ensuring you input all of the information supplied by Multibank correctly.

- Allow 2-5 business days for processing, depending on your bank.

Credit or Debit Card

- Access your MultiBank Group customer portal and visit the “Deposits” area.

- Choose a credit or debit card as your chosen option.

- Enter your card information (number, expiry date, CVV) and the amount you want to deposit.

- Funds should appear in your trading account immediately or within a few hours.

Cryptocurrency

- Navigate to the “Deposits” section of your MultiBank Group customer site.

- Select a supported cryptocurrency (e.g., BTC, USDT) and receive the corresponding wallet address.

- Make the transfer from your cryptocurrency wallet, ensuring the address is valid.

- Processing times vary depending on cryptocurrency and network congestion.

e-wallets or Payment Gateways

- Choose the e-wallet or payment gateway from the “Deposits” section of your MultiBank Group customer site.

- Enter the required deposit amount and follow the redirect to finish payment using your e-wallet/gateway provider.

- Funds should often reach your trading account quickly.

Withdrawal Methods

Bank Wire

- Navigate to the “Withdrawals” section of your MultiBank Group customer site.

- Choose bank wire and input your bank account information carefully.

- Enter the amount you want to withdraw and submit your request.

- Processing normally takes 3-7 business days (depending on your bank).

Credit or Debit Cards

- Log into your account or trader dashboard.

- Choose Credit/Debit Card from the “Withdrawals” column.

- Enter the amount and follow the instructions to ensure safe processing.

- Withdrawal times might vary depending on your card issuer.

Cryptocurrency

- Navigate to the “Withdrawals” section of your client portal.

- Select a compatible cryptocurrency and provide your external wallet address.

- Enter the amount and submit the request.

- Processing times vary depending on cryptocurrency and network traffic.

e-wallets or Payment Gateways

- Select your e-wallet or gateway from the “Withdrawals” choices.

- Enter the amount to be withdrawn and finish the transaction by redirecting to your preferred service.

- Funds should arrive in your e-wallet account quickly.

Is there a withdrawal restriction set by MultiBank Group?

MultiBank Group may set withdrawal limitations based on the trader’s account type and withdrawal method, with larger withdrawals necessitating extra verification steps for security.

What is the processing time for withdrawals from MultiBank Group?

Withdrawals with MultiBank Group normally take 3 to 7 business days, depending on the withdrawal method.

Educational Resources

MultiBank Group offers free platform video instructions to traders, providing tips for efficient trading, platform navigation, market analysis, and strategy implementation. Furthermore, MultiBank Group provides free introduction seminars and training to novice traders, demonstrating its commitment to creating a welcoming learning environment for all traders.

Are there any costs associated with accessing MultiBank Group’s educational resources?

No, MultiBank Group offers its educational resources free of charge to all traders.

Does MultiBank Group offer mentorship programs for aspiring traders?

MultiBank Group provides mentorship programs where experienced traders can guide and mentor aspiring traders.

Pros and Cons

| ✔️ Pros | ❌ Cons |

| The broker accommodates varied trading demands with Standard, Pro, and ECN Pro accounts | MultiBank's research offerings are fairly restricted compared to its main rivals |

| The broker often does not charge fees for depositing or withdrawing funds | Regulatory constraints might prevent MultiBank from operating in some countries |

| MultiBank offers social trading services for people looking to duplicate trading strategies | Certain account types or products may have greater spreads than those offered by other brokers |

| MultiBank provides eBooks, seminars, and other training products to help traders | Not all trading instruments are offered equally across all platform types |

| ASIC, BaFin, FMA, CNMV, and other respected financial regulators oversee MultiBank Group's operations in different countries | The inactivity cost is substantial when compared to other brokers |

Conclusion

In our experience, MultiBank Group is a reputable Forex and CFD broker offering diverse account types and trading instruments. Moreover, the commitment to regulatory compliance and reasonable pricing adds to its popularity.

However, according to our findings, MultiBank faces limitations in research offerings and legal limits in some regions.

No, MultiBank Group supports scalping and hedging strategies for traders of all account types.

Withdrawals with MultiBank Group normally take 3 to 7 business days, depending on the withdrawal method and the recipient’s bank or financial institution’s processing time.

Yes, MultiBank Group offers social trading services for traders who want to replicate trading methods and learn from experienced traders on its platform.

The minimum deposit requirement at MultiBank Group varies by account type, with the Standard Account needing a deposit of $50, the Pro Account requiring $1,000, and the ECN Account demanding $10,000.

Yes, MultiBank offers demo accounts for traders to practice trading methods and get acquainted with their platforms without risking real funds.

Yes, MultiBank Group is considered a safe broker since many respected financial regulators, including ASIC, BaFin, FMA, CIMA, and others, regulate it.

MultiBank Group allows traders to trade various financial assets, including FX, metals, equities, indexes, commodities, and cryptocurrencies.

MultiBank accepts various deposit options, including bank transfers, credit/debit cards, and e-wallets (Skrill, Neteller, etc.).

MultiBank Group is headquartered in California, USA, and serves traders in over 100 countries.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |