S&P 500 Price Hits $5,100: Fed’s Hawkish Outlook & US Economic Strength Drive Gains

The S&P 500 index, which represents 500 large-cap US stocks, started this new week on a positive track and remained well-bid around the 5,088 level. However, the reasons behind the S&P 500’s upward momentum can be attributed to the strength of the US economy.

Furthermore, the absence of negative economic indicators suggests a stable economic environment, which boosts investor confidence. Meanwhile, the hawkish stance adopted by the Federal Reserve in managing monetary policy contributes to market stability.

Despite uncertainties surrounding the timing of potential rate cuts by the Federal Reserve, the strength of the US economy has been a driving force behind the S&P 500’s upward trend.

On the negative side, ongoing geopolitical tensions cap gains in the S&P 500 index, with investors closely monitoring developments and adjusting strategies accordingly.

US Fed’s Stance and Upcoming Data Influence S&P 500

On the US front, investors are closely monitoring the upcoming US Federal Reserve speeches and economic data releases. This forthcoming information could change market sentiment and expectations regarding stock market performance.

However, the Federal Reserve has been cautious about implementing interest rate reductions, significantly influencing investor confidence in the market. While some speculate that the Fed may consider lowering rates later this year, current indicators such as CME FedWatch suggest there are unlikely any rate cuts during the Fed’s meetings in March and May.

Investors are awaiting the release of the core PCE Price Index data for January. This data is crucial as it provides an understanding of inflation trends, which, in turn, could influence market expectations regarding future actions by the Federal Reserve. Any surprises in the data could lead to shifts in investor sentiment and impact the direction of the S&P 500.

In addition to economic data, speeches from Federal Reserve officials will also be closely monitored for any hints or signals regarding future monetary policy decisions. However, the contrasting views expressed by Fed Governor Christopher Waller and New York Fed President John Williams highlight the uncertainty surrounding the timing of potential rate cuts and add to the complexity of market dynamics.

Geopolitical Issues and Their Impact on S&P 500

Besides this, the ongoing geopolitical tensions, including the conflict between Israel and Palestine, can potentially disrupt global markets, including the S&P 500.

Despite talks of a ceasefire and negotiations hosted by Qatar, the situation in Gaza is still dire as humanitarian efforts to deliver aid to the region are facing challenges due to increased attacks and bombardment from the Israeli military.

Despite these challenges, the S&P 500 has shown resilience, indicating that investors still have confidence in the fundamental strength of the US economy and the potential for corporate earnings growth.

S&P 500 Price Forecast: Technical Outlook

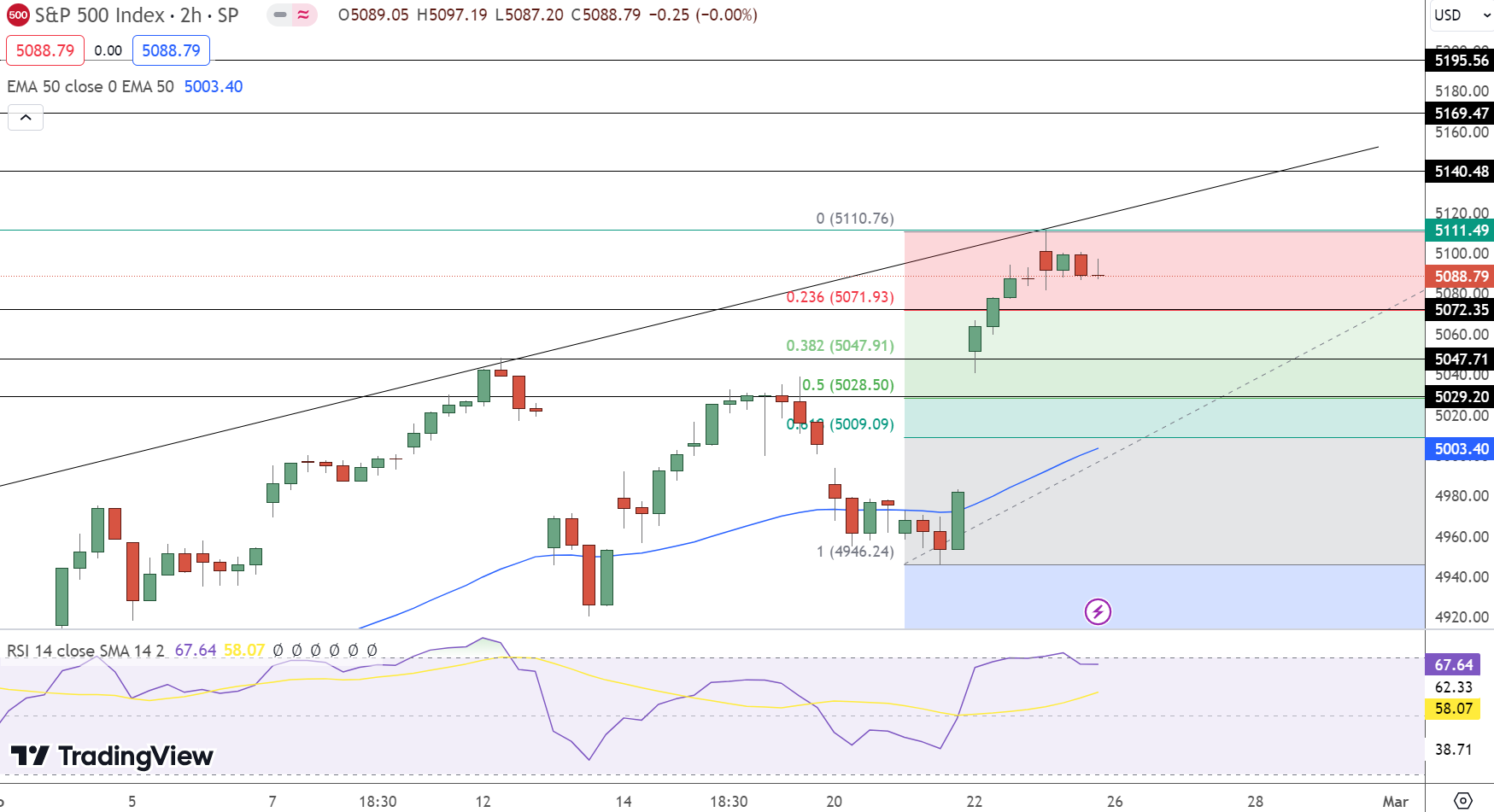

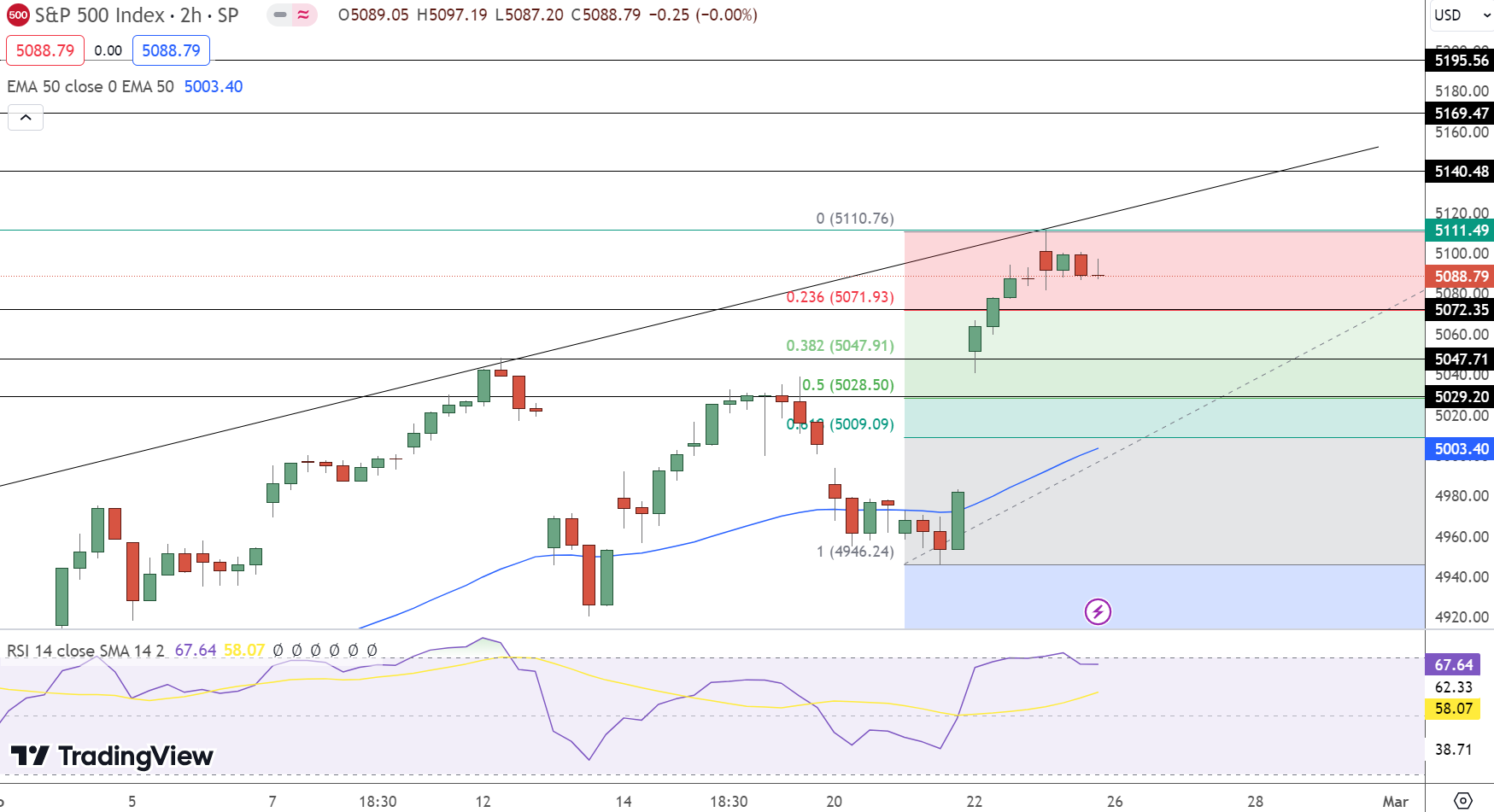

The S&P 500 experienced a slight uptick, closing at 5088.79, marking a 0.03% increase. This movement indicates a steady market, with the day’s pivot point at 5111.49 acting as a crucial indicator for the index’s short-term direction.

Resistance levels are identified at 5140.48, 5169.47, and 5195.56, presenting potential barriers to upward movement. Conversely, support levels at 5072.35 and 5029.20 suggest areas where the market might stabilize in case of a decline.

The Relative Strength Index (RSI) at 67 points towards a market that is approaching overbought territory, suggesting caution. The 50-Day Exponential Moving Average (EMA) at 5003.40 underlines the SPX’s positive momentum.

However, the presence of a doji candlestick pattern near the pivot point signals market indecision, hinting at a possible bearish correction if the index falls below this critical level.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |