S&P 500 Price Surges to $5075 Amid Strong Earnings and Fed Policy Optimism; Brace for Buying

The S&P 500 index’s bullish performance serves as proof that market sentiment globally has been on the rise. The S&P 500 is a key measure of how well the U.S. stock market is doing, including 500 large companies and providing a good idea of overall market performance.

Despite fluctuations, the index has continued to rise as a result of several factors. However, strong corporate earnings have been a key driver of the S&P 500’s performance. Many companies have reported robust earnings growth, exceeding analysts’ expectations.

This positive earnings momentum has boosted investor confidence and supported stock prices. Furthermore, the current policies of the Federal Reserve, which include keeping interest rates relatively high for an extended period, along with the ongoing global economic recovery, are helping to support the S&P 500 stock market index.

Federal Reserve and Economic Data Impact

As we all know, the Federal Reserve’s stance on interest rates and economic data releases has had a significant impact on the S&P 500. Investors have viewed the Fed’s decision to maintain its current monetary policy, which includes its asset purchase program and near-zero interest rates, favourably.

Moreover, recent economic data, such as consumer spending, inflation, and jobless claims, have also influenced market sentiment.

Conversely, concerns about rising inflation and the potential for the Fed to tighten its monetary policy have led to some volatility in the markets. Investors are closely monitoring upcoming economic reports and Fed statements for clues about future policy actions.

Geopolitical Issues and S&P 500 Impact

On the geopolitical front, discussions about a ceasefire between Israel and Hamas remain on the cards. President Biden’s comments about Israel agreeing to stop its attacks during Ramadan have given people hope for peace.

However, the situation remains uncertain and could impact global stocks, including the S&P 500.

S&P500 Price Prediction – Technical Outlook

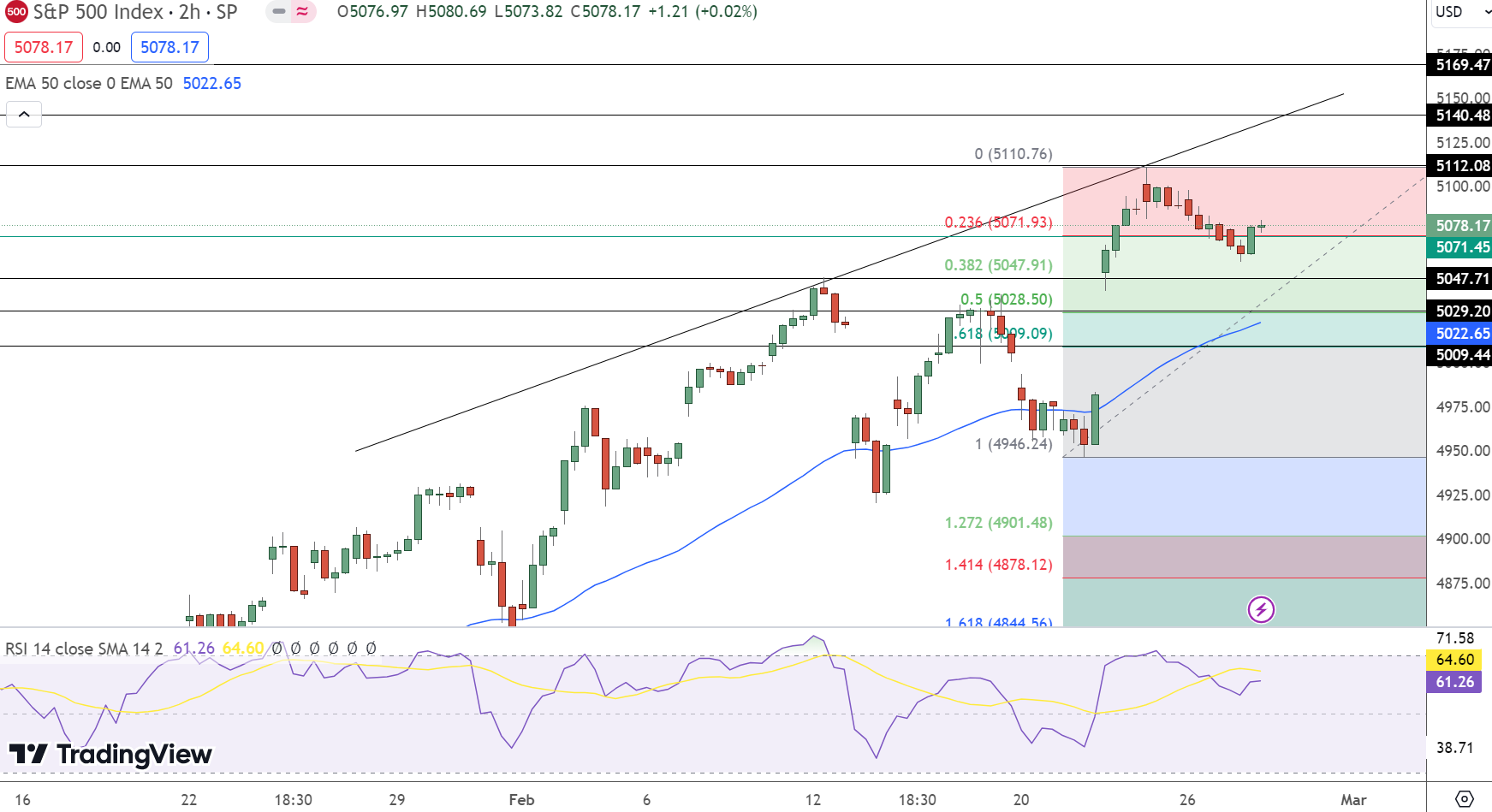

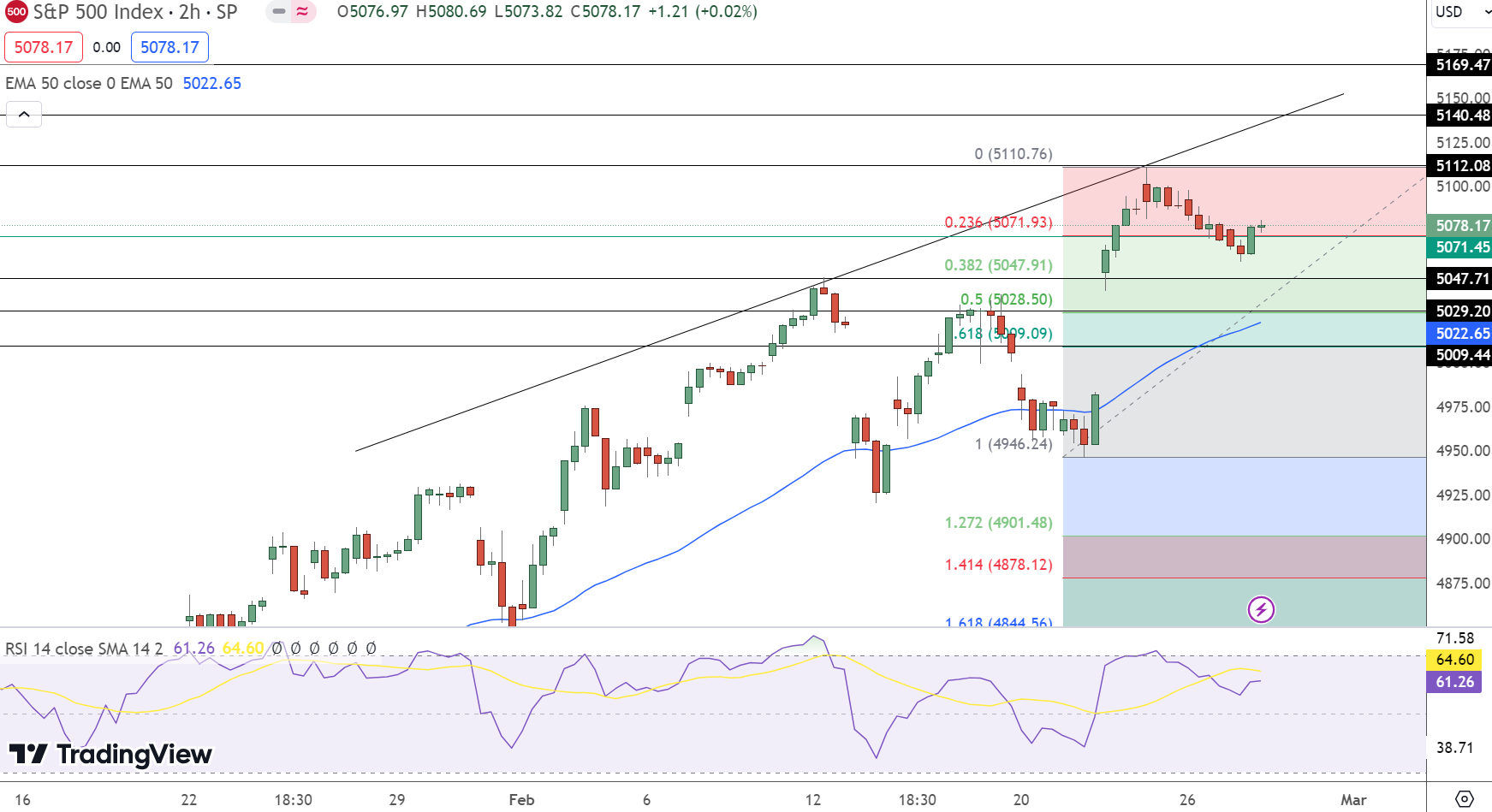

The S&P 500 Index, a barometer for the overall health of the U.S. stock market, has shown a modest uptick, closing at 5078.17, marking a 0.17% increase. This movement positions the index above its pivot point at 5071.45, suggesting a potential for further upward momentum.

Immediate resistance levels are identified at 5112.08, 5140.48, and 5169.47, which the index will need to surpass to continue its ascent. Conversely, support levels at 5047.71, 5029.20, and 5009.44 provide a cushion against any potential downturns.

Technical indicators lend a bullish tone to the market outlook. The Relative Strength Index (RSI) stands at 61, hinting at positive momentum without veering into overbought territory.

The 50-day Exponential Moving Average (EMA) at 5022.65 further underscores this sentiment, indicating a solid foundation below the current price level.

Notably, the S&P 500’s achievement of the 23.6% Fibonacci retracement at $5071, combined with the formation of a bullish engulfing pattern on the four-hour timeframe, bolsters the case for an upward trajectory.

Conclusion: The S&P 500 exhibits bullish signals, poised for growth beyond the $5071.45 pivot point, indicating a favourable market environment.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |