Gold Aims For All-Time Highs As Buyers Outnumber Sell Contacts (CFTC)

XAUUSD – Investors Shift Focus from Currencies as Rate Cuts Appear Most Probable!

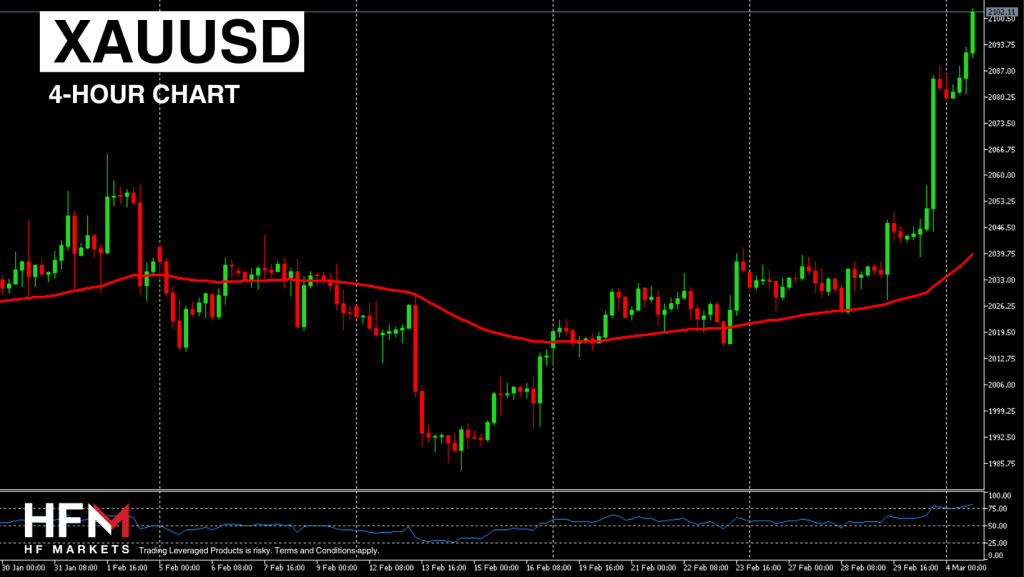

At the start of the US trading session, the price of Gold swiftly climbs by 0.40%, reaching its highest level since December 4th. It now stands slightly above its previous lows in April 2023 and December 2023. An intriguing development for Gold “buyers” is the latest CFTC report, revealing a notable increase in buy positions compared to sell positions.

Trading participants highlighted the decline in consumer sentiment during February, raising concerns about the potential initiation of a borrowing cost reduction program by the US Federal Reserve soon. The University of Michigan’s Consumer Confidence Index fell from 79.6 to 76.9 points, in line with neutral forecasts. Additionally, the Institute for Supply Management’s (ISM) Manufacturing PMI decreased from 49.1 to 47.8 points in February, below analysts’ expectations of 49.5 points.

When looking at Technical analysis, most indicators continue to signal the continuation of buy trades. however, investors are also concerned about purchasing the commodity at such high prices. The Commodity is trading as “overbought” on the RSI on all time-frames under the below the daily chart. However, most technical analysts are advising investors need to give greater importance to the price ranges from the past 12-months as investors are becoming more comfortable with the higher prices required to access the safe haven commodity. According to Fibonacci, a medium term bullish trend can see the price rise by a further 3.50%.

US30 – EU Imposes Fine on Apple, Adding Significant Intra-day Pressure!

During the Asian and European sessions earlier today, the US30 consistently drops in value, trading 0.50% lower before the US market opens. Despite a slight rebound during the US session, risks persist. Most components within the Dow Jones remain in negative territory. Moreover, the NASDAQ and SNP500 also register declines, maintaining certain short-term “sell” indications within the market.

Of the 30 stocks comprising the US30, only 7 are currently trading higher, with Apple experiencing the most pronounced decline, down by -2.20%. Investors are offloading shares following a hefty fine imposed by the EU, totaling $1.8 billion. This penalty stems from allegations that Apple hindered rival music streaming services like Spotify from informing iPhone users about cheaper subscription options outside Apple’s app store.

Another concern for investors is the 10-Year Bond Yields, currently at 0.043%, making it challenging for debt costs to decrease. Additionally, there’s a recognition that momentum from earnings season and data releases may diminish over time. Nevertheless, some positives persist, including the inclusion of Amazon stocks in place of Walgreen Boots, which are currently gaining value by 0.40%. Furthermore, most earnings data from the latest QERs have been generally positive.

Key focus this week will be on employment sector data, particularly JOLTS Job Openings and NFP Change figures. If the data remains robust, it could bolster investor sentiment in the stock market.

Regarding technical analysis, the price is trading around 49.20, near the 75-Bar Exponential Moving Average, suggesting a neutral stance. However, a breach of the day’s low at $38,884.30 could trigger sell signals.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |