eth-usd

XAUUSD – Analysis Ahead of Vital FOMC Meeting!

Michalis Efthymiou•Tuesday, March 19, 2024•2 min read

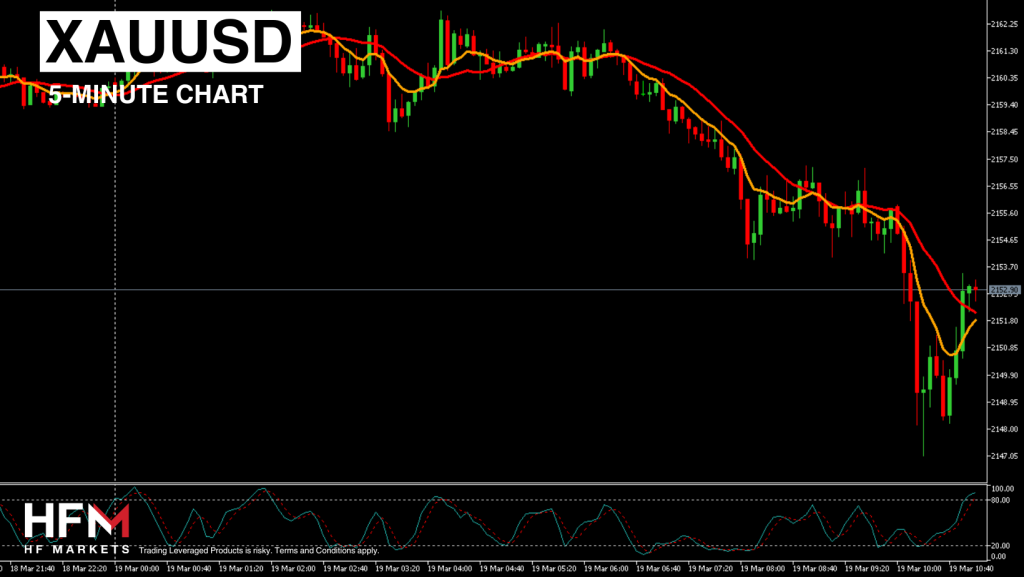

Two key factors are putting pressure on the price of Gold: the strengthening of the US Dollar and the increasing appeal of the Japanese Yen, both regarded as safe haven assets competing for investor’s attention alongside Gold. However, the XAUUSD’s price movement goes beyond a simple descending triangle pattern. Such a pattern typically signals a “neutral-bearish” outlook and represents a mere retracement. Though the price movement will largely depend on the Federal Reserve tomorrow evening. If the Fed signal a change in their outlook and number of rate cuts, Gold can witness a change in volatility.

Two key factors are putting pressure on the price of Gold: the strengthening of the US Dollar and the increasing appeal of the Japanese Yen, both regarded as safe haven assets competing for investor’s attention alongside Gold. However, the XAUUSD’s price movement goes beyond a simple descending triangle pattern. Such a pattern typically signals a “neutral-bearish” outlook and represents a mere retracement. Though the price movement will largely depend on the Federal Reserve tomorrow evening. If the Fed signal a change in their outlook and number of rate cuts, Gold can witness a change in volatility.

The Federal Reserve has been grappling with persistently high inflation, unable to bring it below 3.00%. A duration longer than previously anticipated. Furthermore, producer inflation continues its upward trend, suggesting that inflation will likely remain elevated into this month which will be announced in April.

Compounding these concerns is the uptick in Oil prices, which contributes to inflationary pressures. Should Oil surge by an additional 1.15%, it will reach levels last seen in October 2023. This is another reason why economists are indicating inflation will remain above 3.00% in March 2024. One of the reasons is OPEC members reducing production trying to keep prices at $80 per barrel. The latest to announce production cuts is Iraq. Saudi Arabia has been reducing exports for the second month: in January, the volumes fell 0.2% to 6.30M barrels per day, while the December figure was 6.31M barrels per day.

If the FOMC refrains from implementing interest rate cuts and signals a less dovish stance compared to previous expectations, this could prompt a rise in the Dollar’s value and prompt investors to temporarily reduce their exposure to Gold. Analysis based on Fibonacci levels suggests that a longer-term retracement might drive Gold’s price down to $2,064 to $2,089. However, this depends if the Federal Reserve will be adopting a more hawkish stance. The question remains if the economy and employment sector can remain resilient long enough to bring inflation down. The latest unemployment rate release saw the rate rise from 3.7% to 3.9%. If Unemployment rises further, the Fed may consider a rate cut regardless of inflation.

According to technical analysis, the price of Gold is likely to keep to its price range from the past few days. A breakout and a trend may form after tomorrow’s statement and press conference.

Michalis Efthymiou

HFM’s Market Analyst

Michalis Efthymiou brings over 9 years of extensive experience in the financial services industry across the United Kingdom and Europe. Initially serving as a financial advisor in London for 5 years, he has transitioned into the field of market analysis over the past 4 years.

16 hours ago

Save

Save

21 hours ago

Save

Save

22 hours ago

Save

Save

Two key factors are putting pressure on the price of

Two key factors are putting pressure on the price of