EUR/USD Targeting 1.07 and 1.05 With ECB More Dovish than FED

The rate of EUR to USD has been trading in a range since early 2023, but since July the highs have been getting lower and now it seems like we will see a break to the downside, as the price is heading for 1.07 and then 1.05. The FED hasn’t turned as dovish as markets were expecting, while the ECB has been increasing rate cut remarks with certain members even mentioning April as the start of policy easing.

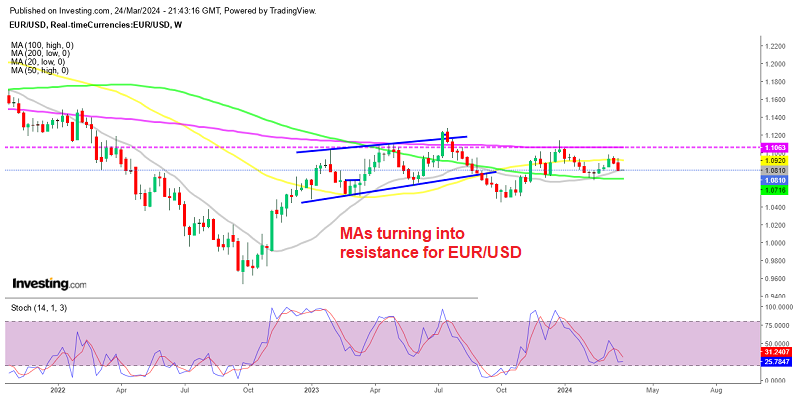

EUR/USD Chart Weekly – The 20SMA Is Under Attack

EUR/USD jumped around 130 pips on Wednesday evening after the FOMC meeting which the market took as dovish initially, but it reversed lower on Thursday and it declined further on Friday, as investors overlooked above-forecast German economic data and instead favored the US Dollar. Despite German sentiment indicators showing improvements, including consumer, investor, and business sentiment surpassing expectations, the Euro continued to slide lower against the Dollar as the dovish remarks by European Central Bank members increase.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

After climbing to 1.09426 on Thursday morning, EUR/USD fell around 150 pips in the next two days, falling to the 1.0800 level by the close of Friday’s market session. The pair experienced a decline of nearly 1.3% from its peak, reaching its lowest levels since the start of this month. The weekly chart shows that this pair failed to break and hold above the 50 SMA (yellow) as the highs get lower, which is a strong bearish signal.

The weekly candlestick pattern indicates a retreat to the 20 Simple Moving Average (SMA) in gray around 1.0800. This suggests the potential for further downside momentum once the 20 SMA is broken, with a possible continuation of the slide towards the previous swing low near 1.07 lows where we can find the 100 SMA (green) and after that moving average breaks, sellers will likely target 1.05.

ECB Officials Keep Pressing on Rate Cuts

President Lagarde’s comments at the Euro Summit indicate a strengthening consensus within the ECB for implementing rate cuts sooner rather than later. This sentiment has been interpreted by markets as a signal of potential near-term rate cuts by the ECB, which is likely to keep the Euro under pressure.

Additionally, ECB’s Edward Scicluna has emphasized the importance of avoiding overburdening economic activity amidst weakened demand. Despite discussions primarily focusing on a potential rate cut in June, Scicluna suggests that April could also be considered as an option. This suggests that the ECB is actively considering monetary policy adjustments to support economic recovery in the face of challenging conditions.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |