Following the pullback seen late in the previous session, stocks may move back to the upside in early trading on Wednesday. The major index futures are currently pointing to a higher open for the markets, with the S&P 500 futures up by 0.4 percent.

Traders may once again look to pick up stocks at somewhat reduced levels after early buying interest faded over the course of Tuesday’s session.

The major averages spent much of yesterday’s session in positive territory before coming under pressure in the final hour of trading, with the Dow and the S&P 500 closing lower for the third straight day.

Overall trading activity may be somewhat subdued, however, with a lack of major U.S. economic data likely to keep some traders on the sidelines.

Traders may also be reluctant to make significant moves ahead of the release of reports on weekly jobless claims, Chicago business activity and pending home sales on Thursday.

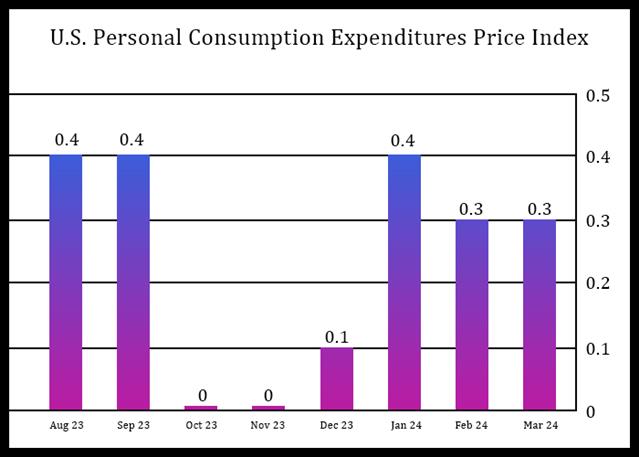

A report on personal income and spending that includes readings on inflation said to be preferred by the Federal Reserve is also due to be released while the markets are closed on Good Friday.

The holiday will also see Fed Chair Jerome Powell participate in a moderated discussion before the Federal Reserve Bank of San Francisco Macroeconomics and Monetary Policy Conference.

Stocks saw modest strength throughout much of the trading day on Tuesday before coming under pressure in the final hour of the session. The major averages all moved to the downside, finishing the day in negative territory.

After climbing by more than 100 points earlier in the day, the Dow ended the session down 31.31 points or 0.1 percent at 39,282.33. The Nasdaq also fell 68.77 points or 0.4 percent to 16,315.70 and the S&P 500 dipped 14.61 points or 0.3 percent to 5,203.58.

In overseas trading, stock markets across the Asia-Pacific region turned in a mixed performance on Wednesday. Japan’s Nikkei 225 Index jumped by 0.9 percent, while China’s Shanghai Composite Index and Hong Kong’s Hang Seng Index slumped by 1.3 percent and 1.4 percent, respectively.

The major European markets have also turned mixed on the day. While the U.K.’s FTSE 100 Index is down by 0.4 percent, the French CAC 40 Index is up by 0.3 percent and the German DAX Index is up by 0.6 percent.

In commodities trading, crude oil futures are falling $0.50 to $81.12 a barrel after falling $0.33 to $81.62 a barrel on Tuesday. Meanwhile, an ounce of gold is trading at $2,207.90, up $8.70 compared to the previous session’s close of $2,199.20. On Tuesday, gold inched up $1.

On the currency front, the U.S. dollar is trading at 151.25 yen compared to the 151.56 yen it fetched at the close of New York trading on Tuesday. Against the euro, the dollar is trading at $1.0815 compared to yesterday’s $1.0831.