U.S. Consumer Prices Rise 0.3% In March, Annual Growth Accelerates To 2.7%

Closely watched readings on inflation released by the Commerce Department on Friday showed consumer prices in the U.S. increased in line with economist estimates in the month of March. The Commerce D...

Closely watched readings on inflation released by the Commerce Department on Friday showed consumer prices in the U.S. increased in line with economist estimates in the month of March.

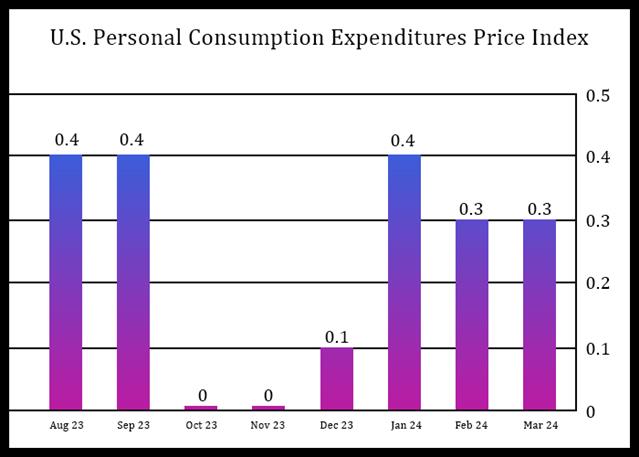

The Commerce Department said its consumer price index rose by 0.3 percent in March, matching the increase seen in February as well as economist estimates.

Excluding food and energy prices, core consumer prices also climbed by 0.3 percent for the second straight month, in line with expectations.

Meanwhile, the report said the annual rate of consumer price growth accelerated to 2.7 percent in March from 2.5 percent in February. Economists had expected the pace of growth to tick up to 2.6 percent.

The annual rate of growth by core consumer prices in March came in unchanged from February at 2.8 percent, while economists had expected the pace of growth to slow to 2.6 percent.

Prices for services continued to drive annual growth, with services prices for March surging by 4.0 percent compared to the same month a year ago. Prices for goods inched up just 0.1 percent year-over-year.

“The hot inflation readings through March should write off any rate cuts in the first half of 2024,” said Nationwide Senior Economist Ben Ayers. “Given the momentum for the economy and prices, we don’t expect the Fed to strongly consider easing monetary policy until its September meeting at the earliest.”

He added, “There is also a risk that the further economic resilience pushes off any rate declines until 2025, a key downside risk for growth next year.”

The readings on inflation, which are said to be preferred by the Federal Reserve, were included in the Commerce Department’s report on personal income and spending in the month of March.

The Commerce Department said personal income climbed by 0.5 percent in March after rising by 0.3 percent in February. The increase matched economist estimates.

Disposable personal income, or personal income less personal current taxes, also rose by 0.5 percent in March after edging up by 0.2 percent in February.

The report also said personal spending advanced by 0.8 percent for the second straight month, while economists had expected spending to increase by 0.6 percent.

Excluding price changes, personal spending climbed by 0.5 percent for the second consecutive month.

With spending increasing by more than income, personal saving as a percentage of disposable personal slumped to 3.2 percent in March from 3.6 percent in February.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account