eth-usd

US Jobs Market Remains Stable Ahead of the FOMC Meeting

Skerdian Meta•Wednesday, May 1, 2024•2 min read

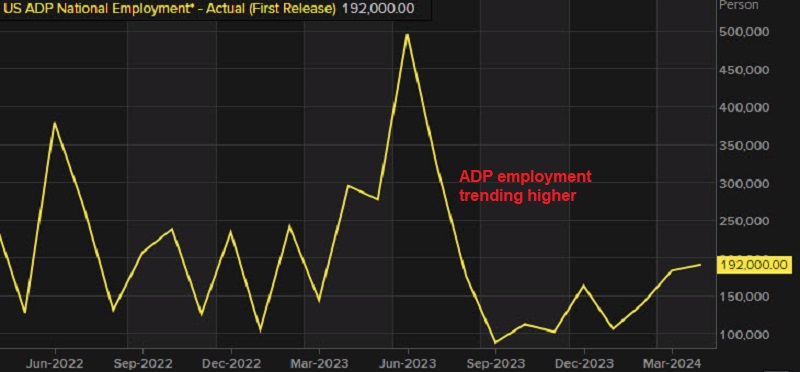

The FED meeting and interest rate projections are the main events today, but before we had the US JOLTS jobs and ADP employment change. The US labour market has been solid throughout these difficult times, keeping the US economy afloat after recession fears, which have diminished now, hence the hawkish FED, however, that’s not enough to keep rates elevated for long.

US April ADP Non-Farm Employment Change

- April ADP employment +192K vs +175K expected

- March ADP employment was +184K (revised to 208K)

- Goods producing sectors added +47K jobs

- Service providing added +145K jobs

In April, the ADP employment report showed an increase of 192,000 jobs, surpassing expectations of 175,000. The previous month’s figure was revised to 208,000 from 184,000. Within the sectors, there was an increase of 47,000 jobs in goods-producing industries and 145,000 jobs in service-providing industries. Regarding changes in annual pay, the median increase for job stayers was 5.0%, slightly lower than the 5.1% reported last month. For job changers, the median increase was 9.3%, down from 10.1% in the previous month.

Regarding the median change in annual pay:

- For job stayers, the median change was 5.0%, slightly lower than the 5.1% reported last month.

- For job changers, the median change was 9.3%, down from 10.1% reported last month.

US April JOLTS Job Openings

- JOLTs job openings for March 8.488M versus 8.686M estimate. Lowest since Feb 2021

- Prior month 8.813M revised from 8.756M

- Job openings came in at 8.488 million down 1.1 million over the year. The rate was little change to 5.1% in March. The level is the lowest since February 2021.

- construction jobs fell -182K

- finance and insurance -158K

- local government education +68K

- Quits rate falls to 2.1% from 2.2% last month.. The total quits for little changed at 3.3 million but was down by 480,000 over the year.

- Hires was little change of $5.5 million down by 455,000 over the year. The rate at 3.5% is little changed from March

- Separations including quits, layoffs, and discharges and other separations decreased to 5.2 million (-339,000) the rate change little at 3.3%

Skerdian Meta

Lead Analyst

Skerdian Meta Lead Analyst.

Skerdian is a professional Forex trader and a market analyst. He has been actively engaged in market analysis for the past 11 years. Before becoming our head analyst, Skerdian served as a trader and market analyst in Saxo Bank's local branch, Aksioner. Skerdian specialized in experimenting with developing models and hands-on trading. Skerdian has a masters degree in finance and investment.

3 weeks ago

Save

Save

3 weeks ago

Save

Save

3 weeks ago

Save

Save