USD Little Changed After Soft NFP, Despite Volatility

The US dollar weakened across the board immediately after the soft NFP jobs numbers, but it claimed all the losses again ending up unchanged. This must be welcomed by Japanese officials found as deteriorating US economic fundamentals provided them with a favorable tailwind following their currency intervention efforts during the week.

April 2024 US Employment Report from the Non-Farm Payrolls NFP

- March non-farm payrolls increased by 175,000, falling short of the expected 243,000.

- Prior month’s figure was +303,000.

- Two-month net revision was -22,000 compared to the prior revision of +22,000.

- Unemployment rate rose to 3.9% from the expected 3.8%.

- Prior unemployment rate was 3.8%.

- Participation rate remained unchanged at 62.7%.

- U6 underemployment rate increased to 7.4% from the prior 7.3%.

- Average hourly earnings rose by 0.2% month-on-month, below the expected 0.3%.

- Unrounded figure for average hourly earnings was +0.202%.

- Prior average hourly earnings increased by 0.3% month-on-month.

- Average hourly earnings increased by 3.9% year-on-year, below the expected 4.0%.

- Average weekly hours stood at 34.3, below the expected 34.4.

- Change in private payrolls was +167,000, missing the expected +190,000.

- Change in manufacturing payrolls was +8,000, surpassing the expected +5,000.

- Household survey showed a decrease of 25,000 compared to the prior increase of 498,000.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | CySEC, MISA, FSCA | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | CBCS, CySEC, FCA, FSA, FSC, FSCA, CMA | USD 10 | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | IFSC, FSCA, ASIC, CySEC | USD 1 | Visit Broker >> |

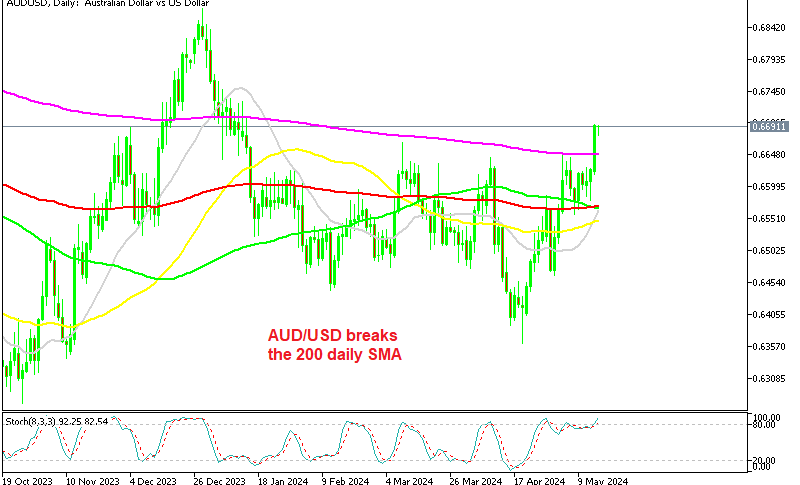

This decline in the pair is part of a broader wave of US dollar selling triggered by the Non-Farm Payrolls report, which revealed that the US created 175,000 in April jobs compared to the projected 238K. Additionally, the jobless rate ticked higher to 3.9% from 3.8%. Consequently, the USD fell to a three-week low, erasing gains made earlier in the week when the market was concerned about a hawkish pivot by the Federal Open Market Committee (FOMC). But, the decline didn’t last too long and the USD reversed the losses.

Fed’s Goolsbee commented that the labour figures like the NFP provide confidence that the economy isn’t overheating. The more employment figures resemble pre-COVID-19 levels, the more reassured we can be about the economy’s stability. While inflation increased earlier this year, the Fed needs to ensure recent inflation doesn’t signal a re-acceleration.

Adjustments in the jobs market this year should be based on projections of increased immigration, which are still being analyzed. Goolsbee acknowledged crosscurrents in the economy and questioned whether we’re following the same trajectory as last year’s declining inflation or facing a different environment. If restrictions persist, the employment aspect of the Fed’s mission will need consideration. USD/JPY declined by 150 pips to 151.86.bounced 100 pips higher in the afternoon, where we decided to open a sell USD/JPY signal.

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |