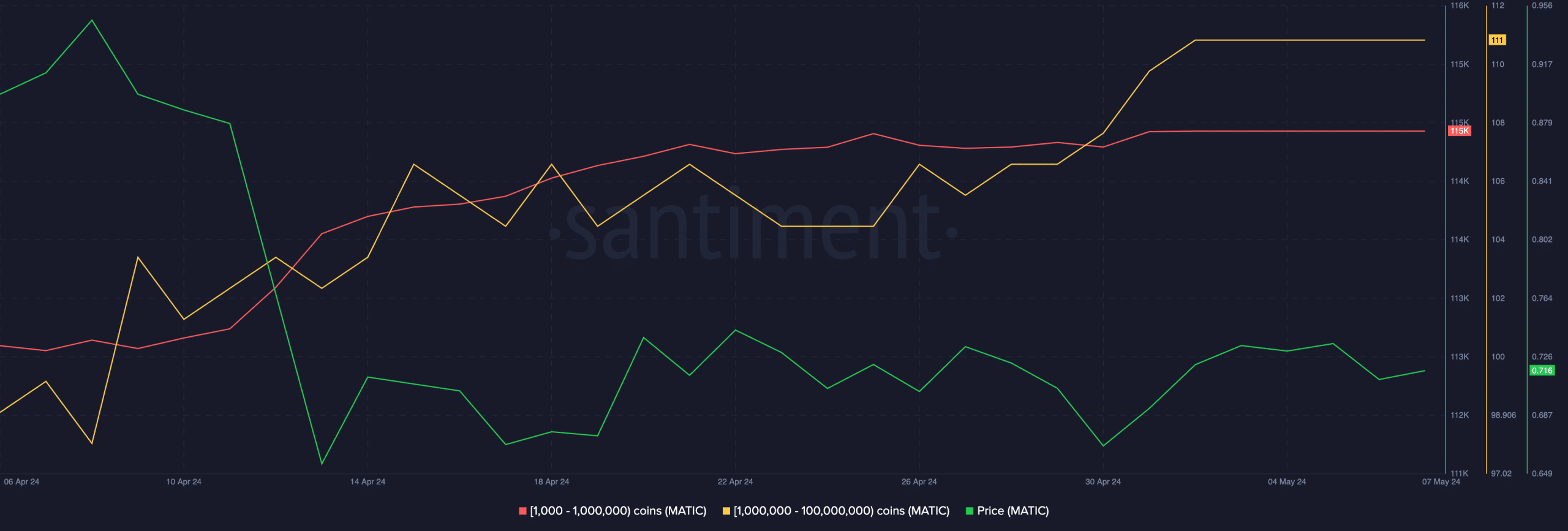

April witnessed a sharp 21% drop in the value of MATIC, a prominent Layer-2 (L2) token, raising concerns among investors about its near-term prospects. Despite this downturn, the Polygon network has seen a notable increase in the number of large-scale investors, or ‘whales,’ according to data from Sentiment.

Over the past month, the number of MATIC whales holding between 1,000 and 1,000,000 tokens grew by 2%, totalling 115,000 holders. Additionally, the largest holders, controlling between 1,000,000 and 100,000,000 tokens, also expanded their stakes by 5%, now commanding 21% of MATIC’s circulating supply of 9.8 billion tokens.

This surge in whale activity poses the question: Could these major stakeholders reverse MATIC’s fortunes in May?

Source: Sentiment

MATIC Struggles Despite Increased Whale Activity, Price Drops to $0.72

espite a rise in large-scale investor engagement over the past month, the price of MATIC has not seen an uptick and has instead fallen by 21%. Currently, the altcoin is trading at $0.72. This price decline coincides with a broader downturn in the cryptocurrency market, which has seen an 11% drop in total market capitalization last month as per CoinGecko. Trading activity has waned, contributing to the downturn.

MATIC’s key indicators reflect ongoing market challenges:

- The Relative Strength Index (RSI) stands at 38.41.

- The Money Flow Index (MFI) is at a low 21.34, suggesting the asset is oversold.

These metrics indicate significant selling pressure, reinforcing the bearish sentiment around MATIC despite the growing number of whales.