Gold (XAU/USD) Hits $2,441 Amid Fed Rate Cut Hopes and Geopolitical Tensions; Buy Now?

Gold (XAU/USD) gained momentum on Monday, reaching a record high near $2,441 during the Asian session. This surge is driven by renewed hopes for interest rate cuts from the US Federal Reserve (Fed) and rising geopolitical tensions in the Middle East.

The ongoing conflict between Russia and Ukraine has further bolstered safe-haven demand, with significant attacks from both sides over the weekend.

Impact of Fed Speeches on Gold Price

Later on Monday, gold traders will focus on speeches from Fed officials Bostic, Barr, Waller, Jefferson, and Mester. These speeches could provide insights into the future path of monetary policy. A cautious approach or hawkish comments from these officials may limit the upside for gold.

Currently, financial markets have priced in a 10% probability of a rate cut in June and nearly 80% in September, according to the CME FedWatch tool.

Geopolitical Risks and Safe-Haven Demand

Geopolitical risks continue to support the gold price. Iranian state television reported that there is “no sign of life” at the crash site of a helicopter carrying Iran’s President Ebrahim Raisi. This incident adds to the existing tensions in the Middle East, further enhancing gold’s appeal as a safe haven.

Additionally, heightened tensions between Russia and Ukraine over the weekend have also contributed to the increased demand for gold.

Central Bank Actions and Gold Purchases

The People’s Bank of China (PBoC) added 60,000 troy ounces of gold to its reserves in April, marking the 18th consecutive month of gold purchases. This move highlights continued central bank interest in gold as a stable asset.

Richmond Fed President Thomas Barkin noted that while inflation is easing, it will take more time to reach the Fed’s 2% target. Cleveland Fed President Loretta Mester mentioned that the Fed’s current monetary policy stance is appropriate as it continues to assess incoming economic data.

Fed Governor Michelle Bowman stated that the policy is restrictive, but she is open to rate hikes if inflation stalls or reverses.

Gold Price Forecast: Technical Outlook

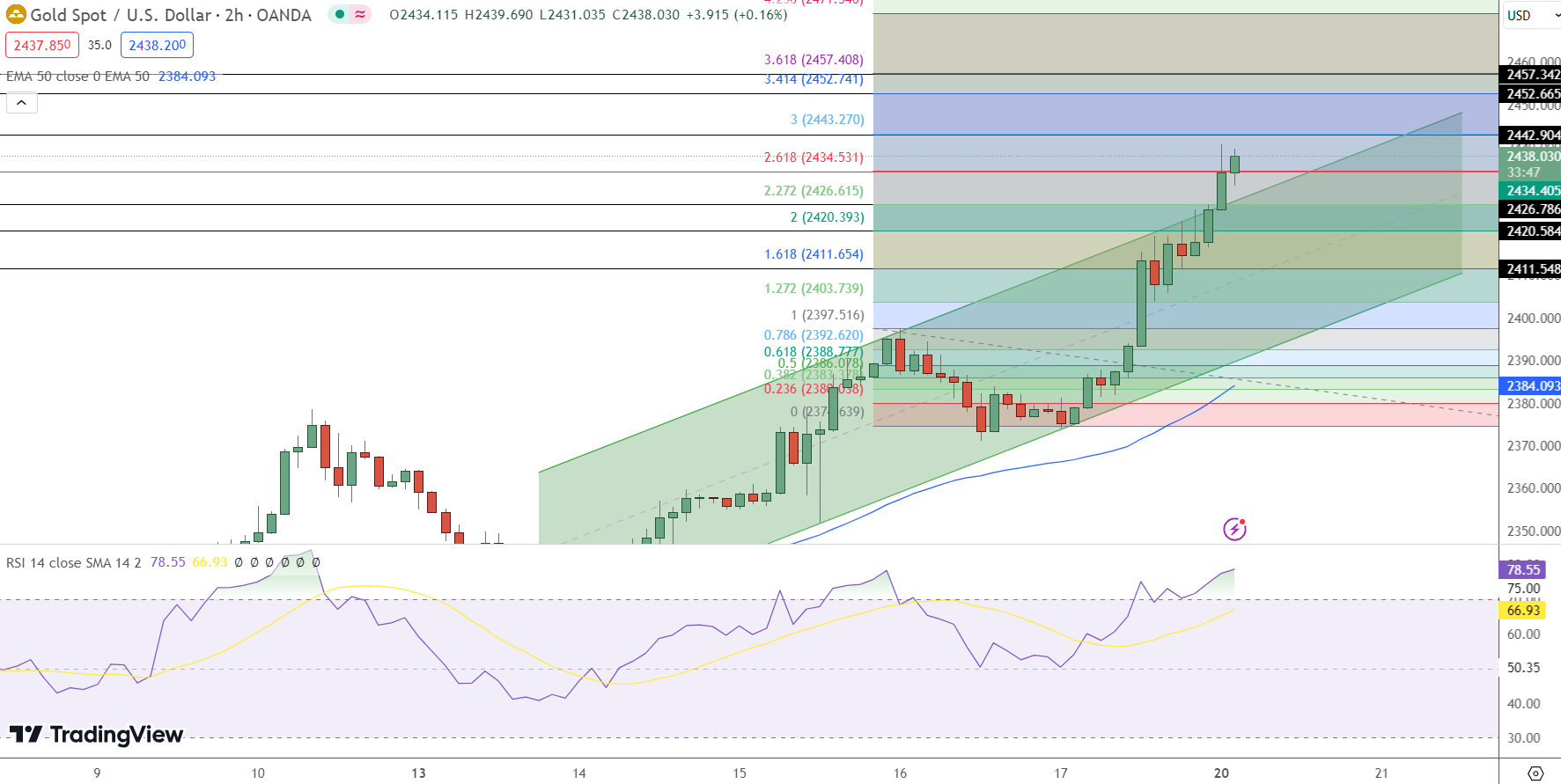

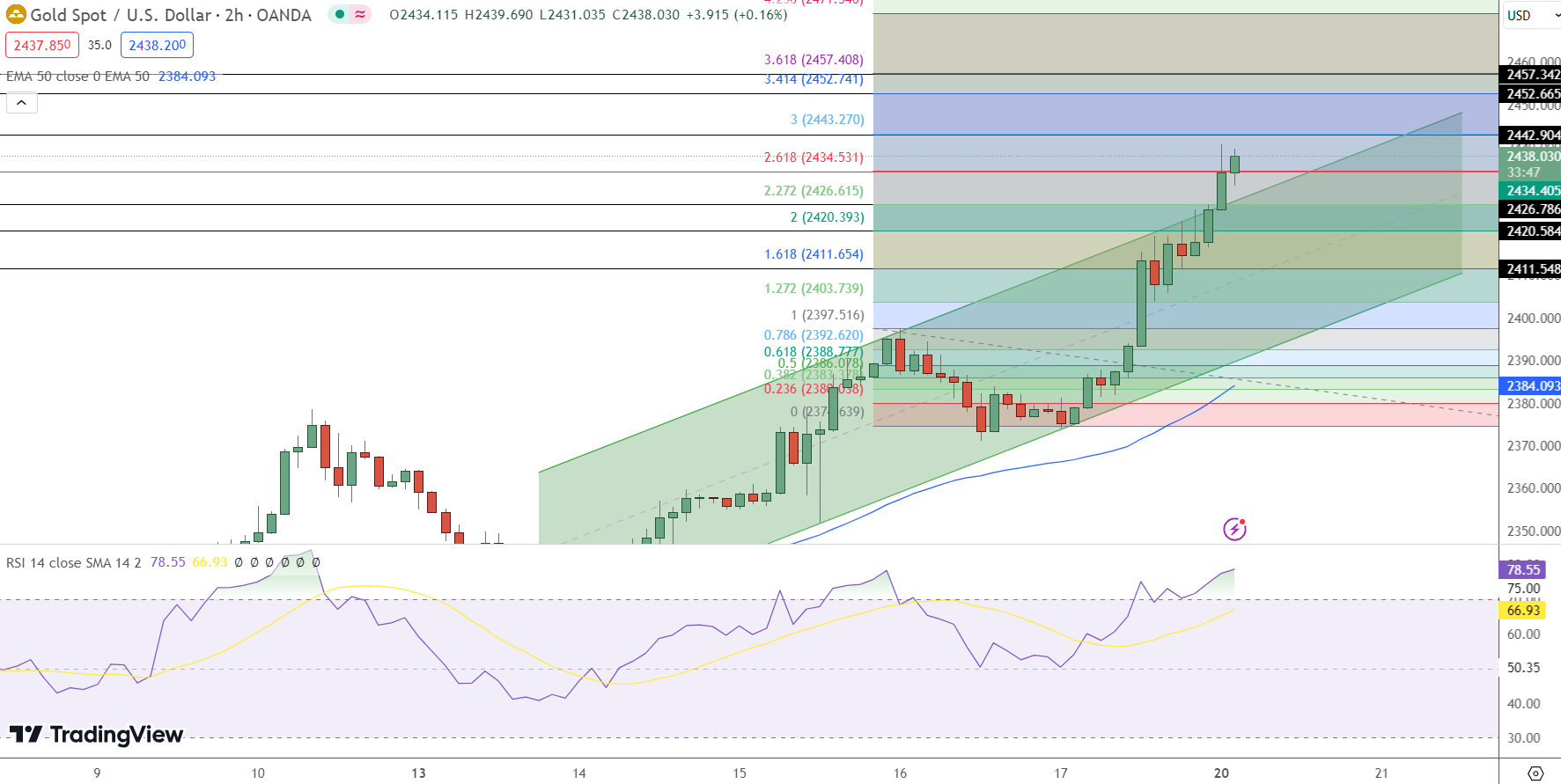

Gold (XAU/USD) is trading at $2,438.030, up 0.94%. The 4-hour chart highlights the pivot point at $2,434.41, crucial for near-term price action. Immediate resistance is at $2,442.90, followed by $2,452.67 and $2,457.34.

On the downside, immediate support lies at $2,426.79, with further support at $2,420.58 and $2,411.55.The Relative Strength Index (RSI) is at 78, indicating overbought conditions. The 50-day Exponential Moving Average (EMA) at $2,384.09 supports the uptrend.

The formation of a “Three White Soldiers” candlestick pattern suggests a strong bullish trend. Holding above the pivot point of $2,434.41 could drive prices higher towards resistance levels.

However, a break below this level could trigger a sharp selling trend. The overall outlook remains bullish above $2,434.41.

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |