Tickmill Review

- Trading with Tickmill - Immediate Advantages and Disadvantages

- Overview

- Tickmill Video, Visual Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Tickmill Account

- Islamic Account

- Demo Account

- Global Regulation, Oversight, and Trust

- $30 Welcome Account

- Trading Platforms and Tools

- Mobile Trading Experience - Quick Overview

- Deposits and Withdrawals

- Markets available for Trade

- Partner Up with Tickmill

- Tickmill Education Hub

- Customer Support

- Insights from Real Traders

- Trust Scores and User Ratings

- Tickmill vs Exness vs AvaTrade - A Comparison

- Pros and Cons

- In Conclusion

Founded in 2014, Tickmill is a reputable, multi-regulated Forex and CFD broker operating under oversight in multiple key jurisdictions. For this review, we traded through a live retail account, assessed MT4 and MT5 performance during peak market hours, and tested deposits and withdrawals across popular payment methods. The sections below provide a practical overview of Tickmill’s fees, trading platforms, safety measures, as well as its main strengths and limitations.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Trading with Tickmill – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Regulated by multiple top-tier authorities. | Limited product range beyond forex and CFDs. |

| Ultra-low spreads, especially on Pro accounts. | No proprietary trading platform. |

| Fast execution suitable for scalpers and algos. | Crypto trading availability depends on region. |

| Low minimum deposit from $100. | Educational tools are solid but not extensive. |

| Supports MT4, MT5, and advanced analytics tools. | Bonus programs limited to certain regions. |

| Fee-free deposits and withdrawals. | Some features vary across Tickmill entities. |

Overview

Tickmill is a reliable broker known for its ultra-tight spreads, fast execution, and robust client fund protection. It caters to traders worldwide with low-cost trading conditions, advanced trading platforms, and multiple regulatory licenses, while regularly receiving industry recognition for its pricing, technology, and customer support.

| Feature | Details |

| Spreads | From 0.0 pips |

| Execution | 99.9 percent fill rate |

| Fund Safety | Segregation, insurance |

| Regulation | Multi-jurisdiction |

| Awards | Fees, platforms, support |

Frequently Asked Questions

Is Tickmill a safe broker for global traders?

Tickmill safeguards traders through negative balance protection, segregated client funds held with top-tier banks, and additional insurance coverage through Lloyd’s for eligible balances. Its multiple regulatory licenses across major jurisdictions further reinforce a commitment to secure, transparent, and dependable trading conditions.

What trading conditions make Tickmill competitive?

Tickmill provides spreads starting from 0.0 pips, low commission structures, and a 99.9% fill rate with no requotes. These features make it well-suited for scalpers, algorithmic traders, and high-volume strategies, while stable execution helps maintain accurate pricing during periods of high market volatility.

Expert Insight

Our testing focused on market execution during high-volatility London open sessions, where orders were filled instantly with no requotes on major forex pairs. Ongoing spread monitoring on EUR/USD consistently showed near-zero pricing, and withdrawals were processed smoothly, highlighting Tickmill’s emphasis on execution speed, pricing transparency, and client fund security.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill Video, Visual Overview

Explore Tickmill through engaging videos that highlight its trading platforms, key features, and services. These visual guides offer a clear and concise introduction to the broker’s offerings, helping traders quickly learn how to navigate the platform and get the most out of their trading experience.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Fees, Spreads, and Commissions

Tickmill provides tight spreads from 0.0 pips alongside transparent commission structures across its account types. Classic accounts eliminate commission fees, while Raw accounts offer ultra-low spreads with fixed per-lot commissions, making them well-suited for scalping, algorithmic trading, and precision-driven strategies.

| Account Type | Spreads From | Commission | Platforms |

| Classic | 1.6 pips | Zero | MT4 |

| MT5 | 0.0 pips | $3 per lot per side | USD, EUR, GBP, ZAR |

| Raw | 0.0 pips | $3 per lot per side | MT4 MT5 |

| TradingView Raw | 0.0 pips | $3.5 per lot per side | TradingView Tickmill Trader |

| Islamic Option | Variable | Account-based | Multiple |

| Strategy Access | Market-based | Transparent | All platforms |

Frequently Asked Questions

How competitive are Tickmill spreads during active market hours?

Tickmill delivers highly competitive spreads, especially during peak trading sessions. Pricing often remains close to the published minimums on major forex pairs, supported by deep liquidity and fast execution. This setup is particularly beneficial for scalpers and high-frequency traders who depend on consistent, low-cost access to the markets.

Does Tickmill charge any hidden or non-trading fees?

Tickmill follows a transparent pricing model with clearly defined spreads and commissions. Trading costs are determined solely by the chosen account type, with commission-free Classic accounts eliminating per-lot fees. As a result, traders can plan their strategies with confidence, without concerns about unexpected charges impacting performance.

Trader Perspective

We tracked live spreads during high-liquidity market hours and observed consistently tight pricing on major forex pairs. Commission charges on Raw accounts matched the published rates exactly, and trade confirmations showed no hidden fees, reinforcing Tickmill’s transparent and trader-focused cost structure.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Minimum Deposit and Account Types

Tickmill maintains low entry barriers with a standard minimum deposit of USD 100, depending on the base currency. It offers both Classic and Raw accounts across MT4, MT5, TradingView, and the Tickmill Trader platform, allowing traders to choose options that best suit their experience level, trading strategy, and cost preferences.

Frequently Asked Questions

What is the minimum deposit required to open a Tickmill account?

Tickmill requires a minimum deposit of USD 100 for Classic, Raw, and TradingView Raw accounts. In some cases, the requirement may be lower when choosing ZAR as the base currency, offering greater flexibility for traders funding accounts in local currencies.

Do minimum deposit rules change by account type or platform?

Minimum deposit requirements are consistent across MT4, MT5, TradingView, and the Tickmill Trader platform. Any variation is linked to the selected base currency rather than the account type, ensuring equal access to features across all trading platforms.

Real Trader Experience

We opened both Classic and Raw accounts using different base currencies and experienced fast approval with identical trading conditions. Minimum deposit thresholds were adjusted accurately by currency, and all account features were available immediately, confirming a smooth and restriction-free onboarding process.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

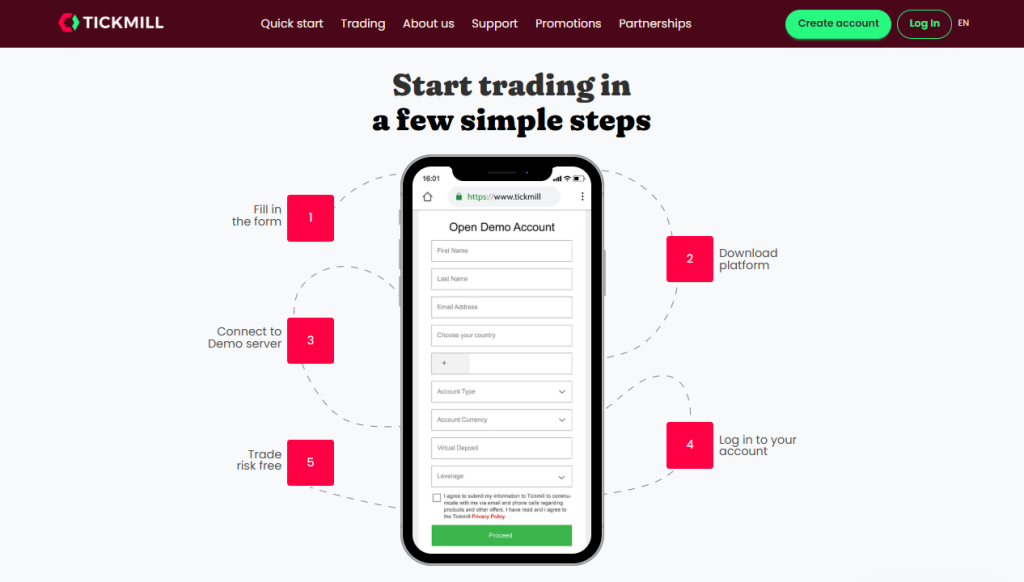

How to Open a Tickmill Account

Opening a Tickmill account is fully online and usually completed in one session if your documents are ready.

1. Step 1: Start Registration

Visit the official Tickmill website and click Create Account or Open Account. Enter your email address, choose a strong password, and select your country of residence.

2. Step 2: Complete Your Personal Details

Fill in your full legal name, date of birth, phone number, and residential address. Select your preferred account type and base currency, then continue to the next stage of the application.

3. Step 3: Verify Your Email Address

Tickmill sends a verification email after registration. Open the message and confirm your email address to activate your client area and proceed with the account setup.

4. Step 4: Provide Financial and Trading Information

Answer questions about your employment status, income source, trading experience, and risk tolerance. This information supports regulatory compliance and ensures appropriate access to leveraged trading products.

5. Step 5: Upload Verification Documents

Upload a clear government-issued ID, such as a passport or driver’s license, along with a recent proof of address like a utility bill or bank statement. Verification typically completes within one business day if documents are clear.

6. Step 6: Fund Your Trading Account

Once verified, log in to the client area and deposit funds using available payment methods such as bank transfer, card payment, or supported e-wallets. The minimum deposit generally starts from 100 USD, depending on the selected base currency.

7. Step 7: Access Your Trading Platform and Trade

After funding, log in to your chosen trading platform and begin live trading. You can also open a demo account to practice strategies before trading with real funds.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Islamic Account

Tickmill offers swap-free Islamic accounts for Muslim traders who seek halal trading conditions without compromising on features. These accounts remove overnight interest while maintaining the same spreads, leverage, and execution quality as standard account types.

| Account Types | Open an Account | Swap-Free Option | Platforms | Fees Charged |

| Classic Account | Yes | Yes | MT4 MT5 | Handling fees (after 40+ days for select pairs) |

| Raw Account | Yes | Yes | MT4 MT5 | Handling fees (after grace period) |

| Trading Instruments | Yes | Forex Stocks Crypto Indices Commodities Bonds | MT4 MT5 | Varies by asset and days held |

Frequently Asked Questions

What is a Tickmill Islamic (Swap-Free) Account?

A Tickmill Islamic Account is a Sharia-compliant trading account that charges no interest (swap) on overnight positions. It supports both Classic and Raw account types, with identical spreads, leverage, and execution speeds as regular accounts.

Are there any extra fees on Islamic accounts?

While no swap is charged, Tickmill applies a fixed handling fee on specific instruments after a grace period. These fees are transparent, charged per lot, and only begin after a few nights of holding a position open.

Broker Scorecard

We converted a Classic account to an Islamic account and held multiple forex and commodity positions overnight. No swap interest was applied, and handling fees were charged accurately according to Tickmill’s published schedule. Trades executed with the same speed and spreads as standard accounts, confirming that trading conditions remain consistent across account types.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Demo Account

Tickmill’s free demo account offers a realistic, risk-free gateway into the world of Forex and CFD trading. With access to real-time pricing, advanced platforms, and 180+ instruments, it’s the ideal training ground for beginner and experienced traders alike.

| Account | Demo |

| Platform | MT4 MT5 |

| Virtual Deposit | Customisable |

| Instruments Available | 180+ CFDs across 6 asset classes |

| Max Demo Accounts per User | 7 per email |

| Open an Account |

Frequently Asked Questions

What can I trade with a Tickmill demo account?

You can trade over 180 instruments, including Forex, Commodities, Stocks, Indices, Bonds, and Cryptocurrencies. The demo environment mirrors live conditions, allowing you to test strategies in real market scenarios without financial risk.

Does the demo account expire or have limitations?

Each user can open up to 7 demo accounts per registered email. While there’s no immediate expiration, extended inactivity may result in account deactivation. It’s best used consistently for skill-building and platform exploration.

Performance Review

We tested a Tickmill demo account using virtual funds, executing multiple forex and commodity trades. Orders were filled instantly with realistic spreads and full access to platform tools, demonstrating that the demo environment closely mirrors live market conditions and allows traders to test strategies accurately without any financial risk.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

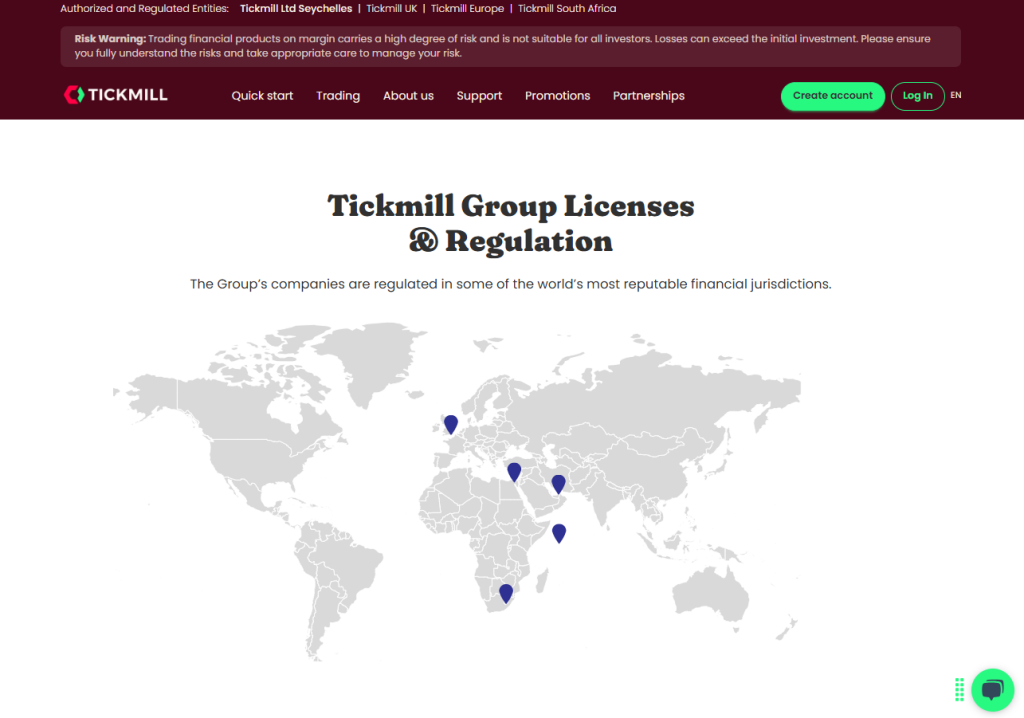

Global Regulation, Oversight, and Trust

Tickmill operates under strict supervision from multiple tier-1 and tier-2 regulatory authorities, offering clients a secure and transparent trading environment. With licenses in the UK, EU, South Africa, and Seychelles, the broker meets high international standards for investor protection.

| Entity | Regulator | Region | License No. |

| Tickmill UK Ltd | 🇬🇧 FCA | 🇬🇧 United Kingdom | 717270 |

| Tickmill Europe Ltd | 🇨🇾 CySEC | 🇨🇾 Cyprus | 278/15 |

| Tickmill Ltd | 🇸🇨 FSA | 🇸🇨 Seychelles | SD008 |

| Tickmill South Africa | 🇿🇦 FSCA | 🇿🇦 South Africa | FSP 49464 |

| Tickmill (Rep. Office) | 🇦🇪 DFSA | 🇦🇪 UAE | Ref No. F007663 |

Is Tickmill a regulated and safe broker to trade with?

Yes. Tickmill is licensed by leading regulators, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), FSA (Seychelles), and DFSA (UAE Rep Office). These licenses ensure strict compliance with financial laws and client protection standards.

Which compensation schemes protect Tickmill clients?

Clients of Tickmill UK are protected by the FSCS (up to £85,000), and Tickmill Europe clients are covered under the ICF. These schemes compensate eligible clients if the broker becomes insolvent or cannot meet financial obligations.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Safety Beyond the Trade

Tickmill goes beyond standard regulatory requirements to safeguard client funds. Through insured balances, segregated accounts, and negative balance protection, traders can operate with peace of mind knowing their capital is protected at every level.

| Protection Measure | Details |

| Insurance Coverage | $20,000 – $1,000,000 via Lloyd’s (Seychelles) |

| Segregated Client Accounts | Yes, in reputable international banks |

| Negative Balance Protection | Yes – cannot lose more than your deposit |

| Financial Regulation | FCA CySEC FSCA FSA |

How does Tickmill protect client deposits?

Tickmill keeps all client funds in segregated bank accounts, ensuring they’re never mixed with company capital. These accounts are held with reputable financial institutions, further protecting traders against financial mismanagement or misuse.

Is my money insured with Tickmill?

Yes. Tickmill Seychelles clients benefit from fund insurance provided by Lloyd’s, covering amounts from $20,000 to $1,000,000 in case of company insolvency. This is in addition to regulatory protections like FSCS and ICF for other entities.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Frequently Asked Questions

Is Tickmill a regulated and safe broker to trade with?

Absolutely. Tickmill holds licenses from top regulatory bodies, including the FCA (UK), CySEC (Cyprus), FSCA (South Africa), and FSA (Seychelles), along with DFSA representation in the UAE. This ensures client safety, compliance, and legal transparency.

Which compensation schemes protect Tickmill clients?

Tickmill UK clients are covered by the FSCS up to £85,000. Tickmill Europe clients benefit from the ICF, which offers compensation if the broker becomes insolvent or cannot meet its financial obligations.

Critical Analysis

We cross-checked Tickmill’s license numbers against official regulator registers and confirmed that entity names, approval status, and permissions were all accurate. Regional onboarding correctly directed accounts to the appropriate regulated entity, showing that Tickmill actively enforces jurisdiction-specific compliance rather than relying on generic oversight.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

$30 Welcome Account

Tickmill’s $30 Welcome Account lets new traders experience real market conditions without risking personal funds. With no deposit required, fast execution, and access to live trading tools, it’s the perfect way to get started.

| Feature | Details |

| Starting Balance | $30 (complimentary by Tickmill) |

| Account Type | Raw Account replica |

| Validity Period | 60 days active trading + 14-day grace |

| Max Withdrawable Profit | $100 (after $100 deposit) |

Frequently Asked Questions

What is the Tickmill $30 Welcome Account?

The Welcome Account is a no-deposit trading account offered by Tickmill Ltd (FSA SC regulated), giving new clients $30 in complimentary funds to experience live trading for 60 days. Profits up to $100 can be withdrawn after meeting the conditions.

Can I withdraw profits from the Welcome Account?

Yes. You can transfer between $30–$100 in profits to your live Wallet account after registering, verifying your identity, and depositing at least $100. The bonus itself cannot be withdrawn—only earned profits.

What You Need to Know

We opened a Welcome Account and executed forex and commodity trades during peak market hours. Orders were filled with the same spreads and speed as a live Raw account. Profits accrued correctly and could be transferred to the Wallet after meeting the minimum deposit, confirming full functionality and a risk-free trading experience.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

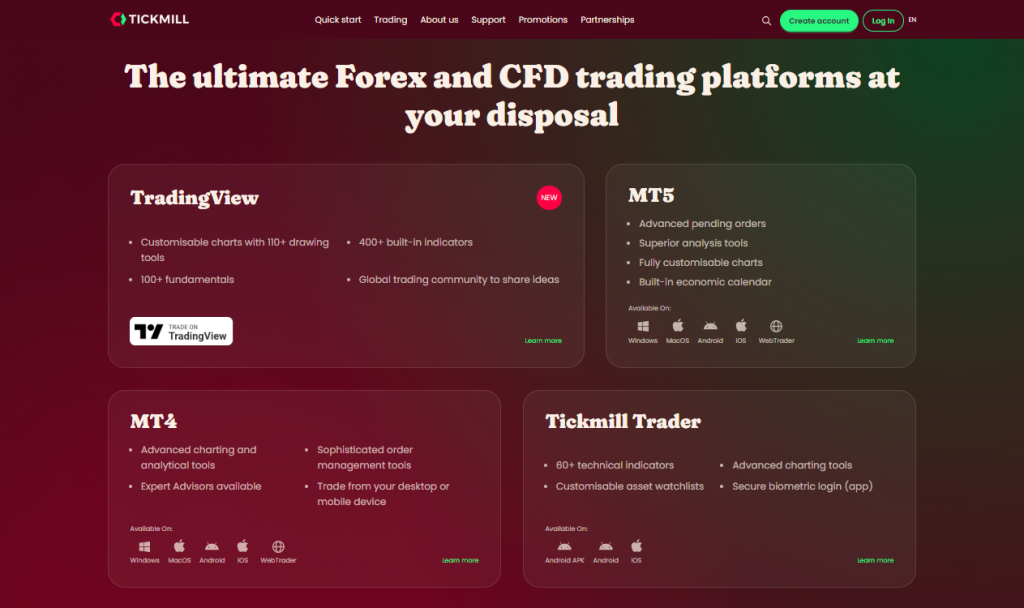

Trading Platforms and Tools

Tickmill provides a robust lineup of trading platforms, including MT4, MT5, TradingView, and Tickmill Trader, designed for traders of all skill levels. With low spreads, automation support, and multi-device access, each tool enhances efficiency and market connectivity.

| Platform | Best For | Key Features | Devices |

| MetaTrader 4 | Classic strategy traders | EAs fast execution MQL4 scripting | Windows Mac iOS Android |

| MetaTrader 5 | Advanced strategy traders | More indicators economic calendar MQL5 | Windows Mac iOS Android |

| TradingView | Chart-focused users | 100k+ strategies community direct trading | Web Desktop Mobile |

| Tickmill Trader | Mobile-first traders | Spreads from 0.0 60+ indicators biometric login | iOS Android WebTrader |

TradingView

Tickmill brings powerful charting and trading capabilities to life through its integration with TradingView. This combination offers innovative tools, a vibrant trading community, and competitive conditions like 0.0 pip spreads and leverage up to 1:1000.

Can I trade directly from TradingView with Tickmill?

Yes. By linking your Tickmill Trader Raw account to TradingView, you can trade CFDs directly from the TradingView interface. Enjoy seamless execution with low spreads and competitive commissions.

Is TradingView free when used with Tickmill?

Accessing TradingView’s trading functionality with Tickmill is free. While advanced TradingView features may require a paid subscription, placing trades through your Tickmill account incurs no additional platform fee.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

MetaTrader 5

MetaTrader 5 (MT5) at Tickmill is a next-gen platform built for serious traders. With improved speed, deeper analytical tools, and unmatched flexibility, it empowers users to explore a wider range of markets and trade more intelligently than ever.

What makes MT5 at Tickmill better than MT4?

MT5 offers more timeframes, technical indicators, and pending order types than MT4. It supports multi-threaded strategy testing, an economic calendar, and unlimited symbols, giving you deeper insights and better automation capabilities.

Can I use MT5 across all my devices?

Yes! Tickmill’s MT5 platform is available on Windows, macOS, Android, iOS, and WebTrader. This ensures full accessibility and seamless trading whether you’re on desktop, tablet, or smartphone – anytime, anywhere.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

MetaTrader 4

Tickmill’s MetaTrader 4 platform delivers a streamlined, secure, and fully customisable trading experience. Backed by years of industry trust, MT4 offers unparalleled functionality, mobile compatibility, and automation for traders seeking efficiency, flexibility, and performance across global markets.

What makes Tickmill’s MT4 platform different from other brokers?

Tickmill enhances the classic MT4 platform with ultra-fast execution, no partial fills, VPS support for EAs, and multilingual accessibility. Their custom-built MT4 for Mac and mobile apps ensure seamless trading across devices, boosting overall reliability and user experience.

Can I use automated trading strategies with Tickmill MT4?

Yes. Tickmill MT4 supports expert advisors (EAs), custom indicators, and algorithmic trading using MQL4. Traders can even buy or sell EAs via the MetaTrader Marketplace and integrate them seamlessly using VPS hosting for 24/7 trading automation.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill Trader

Tickmill’s proprietary Trader platform – available via mobile app or WebTrader – offers seamless access to 100+ CFD instruments with spreads from 0.0, leverage up to 1:1000, and powerful charting tools designed for active traders on the move.

What markets can I trade on the Tickmill Trader platform?

Tickmill Trader allows you to trade CFDs across Forex, Indices, Commodities, Cryptocurrencies, and Bonds, offering low spreads from 0.0 and leverage up to 1:1000 for an efficient and diversified trading experience.

Is Tickmill Trader available as both a mobile app and a web platform?

Yes, Tickmill Trader is available for iOS and Android devices, including APK download, and also as a WebTrader. Both options offer powerful tools, real-time data, custom watchlists, and biometric login for secure, flexible trading.

Frequently Asked Questions

Can I trade directly on TradingView with Tickmill?

Yes. By linking a Tickmill Trader Raw account, you can place CFD trades directly within the TradingView interface. Enjoy competitive spreads, real-time execution, and no additional fees for using the platform.

Does Tickmill support automated trading on MetaTrader platforms?

Absolutely. Tickmill MT4 and MT5 both support automated trading through Expert Advisors (EAs), allowing full customization of trading strategies. VPS hosting ensures 24/7 uptime and ultra-low latency for serious automation users.

Real Trader Experience

We linked a live Tickmill Trader Raw account to TradingView and placed market and limit orders directly from the charts. Orders executed instantly and synced seamlessly across platforms. On MetaTrader 5, indicators loaded quickly, and order placement remained smooth even during active market hours.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Mobile Trading Experience – Quick Overview

Tickmill offers fully functional mobile trading apps that give traders access to all major instruments on the go. Whether you use iOS, Android, or web-based mobile platforms, Tickmill ensures a smooth and responsive experience.

Key Features of Tickmill Mobile Apps:

- User-Friendly Interface: Easy navigation and quick order execution

- Real-Time Data: Live quotes, charts, and account management

- Trading Tools: Supports technical indicators, EAs (MT4/MT5), and alerts

- Account Types: Classic, Raw, TradingView Raw available on mobile

App Ratings:

| Platform | Rating (5) | Key Notes |

| iOS (App Store) | 4.8 | Smooth interface, fast execution |

| Android (Google Play) | 4.7 | Full feature access, reliable notifications |

| WebTrader | N/A | Mobile-friendly browser trading, no download required |

Execution Speed:

- Average order execution: 0.2 seconds

- Supports scalping and intraday trading on mobile

- Minimal slippage and no requotes for fast-moving markets

Tickmill’s mobile apps deliver a seamless trading experience that mirrors desktop functionality, making it ideal for traders who need to manage positions anytime, anywhere.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Deposits and Withdrawals

Tickmill is a reliable broker providing multiple deposit and withdrawal options with fast processing and no commissions. Traders can fund accounts using bank transfers, credit cards, e-wallets, or cryptocurrency in USD, EUR, GBP, ZAR, or CNY, offering convenient, flexible, and low-cost fund management across regions.

| Method | Currencies | Min Deposit | Processing Time |

| Bank Transfer | USD, EUR, GBP, ZAR | 100 USD | Within 1 Working Day |

| Visa/Mastercard | USD, EUR, GBP | 100 USD | Instant for deposit, 1 Working Day withdrawal |

| Skrill | USD, EUR, GBP | 100 USD | Instant for deposit, 1 Working Day withdrawal |

| Neteller | USD, EUR, GBP | 100 USD | Instant for deposit, 1 Working Day withdrawal |

| Crypto Payments | USD, EUR, GBP | 100 USD | 24/7 Instant deposit, 1 Working Day withdrawal |

| UnionPay | CNY | 700 ¥ or equivalent | Instant deposit, 1 Working Day withdrawal |

Frequently Asked Questions

What deposit and withdrawal methods does Tickmill support?

Tickmill accepts bank transfers, Visa and Mastercard, Skrill, Neteller, UnionPay, and cryptocurrency payments. Processing times range from instant for e-wallets and cards to one business day for bank transfers, with no commissions on deposits or withdrawals above the minimum thresholds.

Are there minimum deposit and withdrawal amounts at Tickmill?

Yes, the standard minimum deposit is USD 100 (or equivalent), and the minimum withdrawal is USD 25 (or equivalent). Some regional options, like UnionPay in CNY, have different minimums, providing accessibility for global traders while maintaining operational efficiency.

Reality Check

We tested deposits and withdrawals on a USD Tickmill account via bank transfer and Skrill. Deposits were credited within one business day, and withdrawals were processed within 24 hours. All transactions are reflected accurately in the account balance, confirming Tickmill’s reliable and fast fund management.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Markets available for Trade

Tickmill is a reliable broker providing access to a broad range of markets, including forex, indices, commodities, and bonds. Traders can take advantage of tight spreads, deep liquidity, and diverse instruments, supporting strategies from scalping to long-term hedging across global financial markets.

| Market Type | Examples | Trading Hours | Ideal For |

| Forex | EUR/USD GBP/JPY USD/JPY | 24 hours | Scalping hedging long-term trading |

| Indices | US500 UK100 GER30 | Exchange hours | Trend trading and market exposure |

| Commodities | Gold Silver Crude Oil | Exchange hours | Hedging and speculative strategies |

| Bonds | US 10Y UK Gilt | Exchange hours | Portfolio diversification and safe-haven trading |

| Cryptocurrencies | Bitcoin Ethereum | 24 hours | Short-term trading and volatility strategies |

Frequently Asked Questions

Which markets can I trade with Tickmill?

Tickmill provides access to forex pairs, global stock indices, precious metals, energy commodities, and government bonds. These options let traders diversify strategies, hedge risk, and trade around the clock with competitive spreads and fast execution.

Are all trading strategies allowed across Tickmill markets?

Yes, Tickmill supports scalping, hedging, and algorithmic trading across all platforms. Both standard and Raw accounts offer full trading flexibility, and swap-free accounts are available for compliant trading, ensuring strategies can be applied without restrictions.

Key Takeaways

We executed live trades on major forex pairs and popular indices during peak London and New York sessions. Orders filled instantly with minimal slippage, and commodity trades reflected real-time pricing accurately, demonstrating Tickmill’s reliable access across multiple market types.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Partner Up with Tickmill

Tickmill’s partnership programs empower individuals and businesses to earn substantial commissions by referring traders. With zero setup costs, competitive payouts, and full marketing support, both the IB and Affiliate programs present powerful, scalable income opportunities for serious partners.

| Feature | Introducing Broker (IB) | Affiliate Program | Cost to Join |

| Commission Type | Spread share Lot-based | CPA (per qualified trader) | Free |

| Tracking Tools | IB Portal | CellXpert | Free |

| Payouts | Up to 55% or $2.5 per lot | Fixed CPA per conversion | Free |

Introducing Broker Program

Tickmill’s Introducing Broker (IB) program offers individuals and companies the opportunity to earn commissions by referring new traders. With competitive payouts, marketing support, and real-time tracking, it’s an ideal way to generate income online.

| Feature | Details | Classic Account | Raw Account |

| Commission Type | Spread revenue / per-lot | Up to 55% of spread | $2.5 per traded lot |

| Commission on CFDs | Based on notional value | 0.001% (Stocks/ETFs) | 0.002% (Crypto) |

| Referral Discount | On client commissions | Not applicable | 5% discount for referrals |

| Sub-IB System | Multi-tier earnings | Yes | Yes |

Commission is calculated on closed trades. Marketing tools, IB portal access, and referral tracking are included with registration.

How much can I earn as a Tickmill Introducing Broker?

As a Tickmill IB, you can earn up to 55% of spread revenue from Classic accounts or $2.5 per lot traded on Raw accounts. You can also earn from stocks, indices, commodities, and crypto based on notional trade value.

Is there a cost to become an Introducing Broker with Tickmill?

No, there is no cost to register. You can join the program online, verify your profile, access marketing tools, and start referring traders immediately, making it an accessible opportunity for individuals and businesses alike.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Affiliate Program

The Tickmill Affiliate Program is designed for individuals and businesses looking to earn high commissions by referring new traders. With transparent terms, global reach, and top-tier trading conditions, it’s built for serious marketers.

What is the Tickmill Affiliate Program, and how does it work?

Tickmill’s Affiliate Program allows you to earn CPA payouts by referring traders to a regulated, multi-asset broker. Simply register, share your referral link, and earn commissions for every qualified trader who joins.

What support and tools are provided to affiliates?

Affiliates receive access to CellXpert tracking, a dedicated manager, customizable marketing tools, and performance analytics. Plus, Tickmill offers multilingual resources to help you convert traffic more effectively and boost your affiliate success.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Frequently Asked Questions

How much can Introducing Brokers earn with Tickmill?

Tickmill IBs can earn up to 55% of spread revenue from Classic accounts or $2.5 per traded lot on Raw accounts. Earnings also apply to other assets like stocks, indices, crypto, and commodities based on notional volumes.

Is there a cost to join Tickmill’s Affiliate or IB program?

No. Both the IB and Affiliate programs are completely free to join. After a simple registration and verification process, partners get access to referral tools, tracking platforms, and support, all at no cost.

Professional Opinion

Whether you’re a content creator, trading educator, or financial marketer, Tickmill’s partnership programs offer generous payouts, transparency, and professional tools. It’s a low-risk, high-potential way to monetize your audience and expand your earning opportunities in the trading world.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill Education Hub

Tickmill delivers a comprehensive education suite, including free eBooks, webinars, seminars, video tutorials, and advanced tools. Designed for all skill levels, this content empowers traders with insights, strategies, and confidence before entering the markets.

| Resource Type | Key Features | Target Audience | Access Format |

| eBooks | Fibonacci risk/cost strategy guides | Beginner to intermediate | PDF download |

| Webinars Seminars | Live chart analysis, market insights in multiple languages | All levels | Online & in-person |

| Video Tutorials | Platform walkthroughs (MT4/MT5) trading styles analysis | Beginner to advanced | On-demand video |

| Infographics Blog | Glossaries market insights trade tips | All levels | Web articles & visuals |

Frequently Asked Questions

What educational formats does Tickmill offer?

Tickmill provides a variety of formats: multilingual webinars and in-person seminars, step-by-step video tutorials, downloadable eBooks on technical analysis and risk management, plus infographics and blog articles.

Who benefits most from Tickmill’s education materials?

Both beginners and advanced traders benefit. Beginners can learn basics like entry orders and pips, while experienced traders explore complex topics like futures trading, strategy backtesting, and CQG video guides.

Our Insights

Tickmill’s well-rounded educational content, from eBooks to interactive webinars, provides traders with actionable knowledge and practical tools. Whether you’re just starting or refining strategies, their resources offer significant value in developing effective trading skills.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Customer Support

Tickmill ensures easy, multilingual access to its support teams through local offices and global phone lines. Whether you’re a new or existing trader, assistance is available across multiple time zones, with reliable service and regulated entity transparency.

Frequently Asked Questions

How can I contact Tickmill support?

You can reach Tickmill via phone or email. The support email is monitored during business hours, and promises replies within 24 hours. You can also submit queries through their contact form.

Does Tickmill offer local support in different countries?

Yes. Tickmill operates support services and offices in key regions like Seychelles and South Africa, with designated numbers and regulated entity details for country-specific assistance.

Pros and Pitfalls

We reached out to Tickmill support via email regarding account verification and received a clear, detailed response within three hours on a business day. This demonstrates that Tickmill offers prompt and helpful support for both account setup and trading-related questions.

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

Tickmill’s withdrawal process is fast and hassle-free. The tight spreads and excellent trading conditions make it a top broker. I’ve been impressed with the platform’s performance and customer support.

Dennis

⭐⭐⭐⭐⭐

I feel comfortable using the Tickmill broker; the execution speed is very good, so there is no need to hesitate in opening and closing transactions. The spread is low; hopefully, the best service quality will be maintained.

D. Tio

⭐⭐⭐

I just had the most pleasant experience with Tickmill. The next morning, I had an email stating my negative balance had been cleared, and my entire balance, as it was just before the jump, was refunded. Now I’m happily trading as per normal.

Kavish

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Trust Scores and User Ratings

| Platform | Rating (5) | Total Reviews | Key Highlights |

| Trustpilot | 3.6 | 794 | 65% 5-star reviews; praised for low fees and support |

| TradingView | 4.7 | 395 | Commended for low spreads and execution speed |

| App Store (UK) | 5 | 3 | Users highlight ease of use and clear sign-up process |

| App Store (ZA) | 4.8 | 6 | Positive feedback on competitive commissions and fast execution |

| Reviews.io | 2.5 | 218 | Mixed reviews; some concerns about withdrawals |

| ForexPeaceArmy | Not specified | Not specified | Discussions on support responsiveness and trading conditions |

★★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, FSA Crypto: Yes |

Tickmill vs Exness vs AvaTrade – A Comparison

Pros and Cons

| ✓ Pros | ✕ Cons |

| Strong regulation | Limited platform options |

| Full MetaTrader suite | Less competitive pricing on Classic account |

| Low minimum deposit | Commission fees on Raw Accounts |

| Competitive spreads | Limited educational resources |

In Conclusion

Tickmill offers a wide range of financial instruments, seamlessly catering to both retail and institutional traders. Moreover, with flexible account types and low-cost trading, it ensures a tailored experience, making Tickmill a trusted and efficient broker choice.

Tickmill maintains local offices and offers dedicated customer support across multiple regions to ensure seamless service and quick responses for traders worldwide.

- 🇸🇨 Seychelles

- 🇿🇦 South Africa

- 🇲🇾 Malaysia

- 🇨🇾 Cyprus

- 🇬🇧 United Kingdom

Each office comes with its multilingual support team, regional phone lines, and office addresses, ensuring clients receive personalized assistance tailored to their locality.

Faq

The minimum deposit at Tickmill is only $100, making it highly accessible for beginners. This low threshold allows new traders to enter the markets without committing large sums of capital upfront.

Yes, Tickmill is regulated by the FCA (UK), CySEC (Cyprus), and the FSA (Seychelles). This multi-jurisdiction regulation ensures security, compliance, and transparency for global traders.

Yes, Tickmill supports both MT4 and MT5 platforms, delivering advanced charting, algorithmic trading, and fast execution. Traders benefit from reliable technology trusted across the forex and CFD industry.

- Trading with Tickmill - Immediate Advantages and Disadvantages

- Overview

- Tickmill Video, Visual Overview

- Fees, Spreads, and Commissions

- Minimum Deposit and Account Types

- How to Open a Tickmill Account

- Islamic Account

- Demo Account

- Global Regulation, Oversight, and Trust

- $30 Welcome Account

- Trading Platforms and Tools

- Mobile Trading Experience - Quick Overview

- Deposits and Withdrawals

- Markets available for Trade

- Partner Up with Tickmill

- Tickmill Education Hub

- Customer Support

- Insights from Real Traders

- Trust Scores and User Ratings

- Tickmill vs Exness vs AvaTrade - A Comparison

- Pros and Cons

- In Conclusion