Chainlink (LINK) Is Facing A Wall Of Resistance And Potential Inflection Point

Quick overview

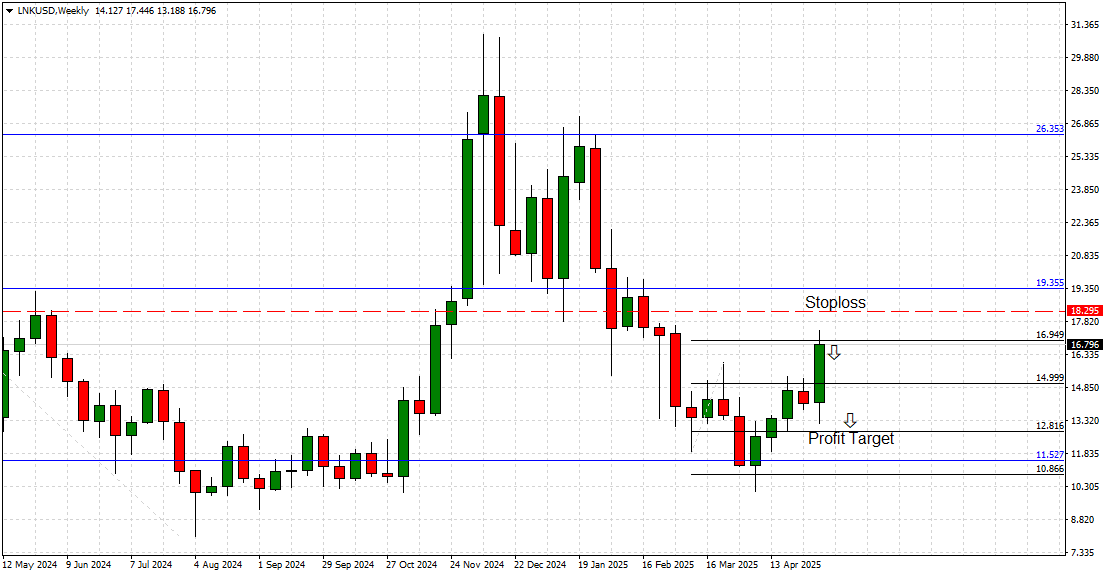

- Chainlink (LINK) has rebounded from a low of $11.52, testing the significant resistance level at $16.95.

- The current weekly candlestick structure indicates a struggle at this resistance, with signs of potential bearish pressure if LINK fails to break above.

- A confirmed break below $14.99 could lead to further losses towards $12.81, while long-term fundamentals remain bullish.

- Chainlink's role in decentralized oracle solutions positions it well for future adoption, despite short-term market challenges.

Chainlink (LINK) has staged a solid recovery over the past few weeks, rebounding from a low of $11.52 to test the significant weekly resistance at $16.95

This level, historically acting as a pivot zone, is now threatening to cap bullish momentum once again.

The weekly candlestick structure, as shown in the chart, reveals a decisive struggle at this resistance barrier. The current candle has produced a noticeable upper wick, indicating a rejection attempt by sellers as buying pressure weakens.

If LINK fails to cross over $16.95 in the coming sessions, bearish pressure is expected to intensify, with a sharp move toward $15.00 becoming increasingly likely. Below this level, the next key support lies at $12.81, with a potential retest of the $11.52–$10.86 demand zone if downside momentum accelerates.

Breakout Levels to Watch

-

Resistance: $16.95, $19.35

-

Support: $14.99, $12.81

A sustained break above $16.95 would open the door for a test of $19.35, though the probability currently favors a bearish reversal scenario.

Momentum Outlook: Bearish Setup Brewing

Momentum indicators on higher timeframes are displaying early signs of exhaustion. The recent bullish leg appears overstretched relative to prior consolidation phases, while the rejection at $16.95 mirrors price behavior seen in early January 2025 and mid-December 2024.

A confirmed bearish engulfing pattern or break below $14.99 would trigger a wave of profit-taking and stop-loss hunts, likely driving LINK toward $12.81. The risk of a full-scale downside correction remains elevated as long as price is capped below $16.95.

Technology & Vision

Technically vulnerable, Chainlink continues to solidify its position as the market leader in decentralized oracle solutions. It acts as the essential middleware connecting smart contracts with off-chain data sources, APIs, and traditional financial systems — a necessity for modern decentralized finance (DeFi), gaming, and enterprise blockchain applications.

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) is gaining traction, addressing one of crypto’s core limitations: blockchain fragmentation. The project’s roadmap for 2025 focuses on expanding CCIP integrations and forging partnerships with major financial institutions for real-world asset tokenization and data verification services.

Even amid short-term market weakness, Chainlink’s foundational role in crypto infrastructure positions it for long-term adoption across both Web3 and traditional finance ecosystems.

Final Verdict

Chainlink’s rally has stalled at $16.95, a level that historically prompts price reversals. The current weekly candle formation hints at an impending downside move, with a break below $14.99 likely to open up deeper losses toward $12.81 and even $11.52.

While long-term fundamentals remain bullish, the immediate technical outlook favors a bearish correction as momentum softens and resistance holds firm.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account