Naspers Stock Eyes ZAR 5,955 as Prosus Gains Offset Political Risk

Naspers Ltd (JSE: NPN) is showing resilience, trading at ZAR 5,248 after bouncing off the lower end of its rising channel.

Quick overview

- Naspers Ltd is currently trading at ZAR 5,248, showing resilience with a rising trend and higher lows since April.

- Investor sentiment is bolstered by Prosus' strong Q1 earnings and a buyback program that has improved EPS.

- Geopolitical tensions, particularly between the US and South Africa, are creating macro risks that could impact investor confidence.

- Technical indicators suggest that a close above ZAR 5,300 could confirm an upward trend, while a drop below support may lead to further declines.

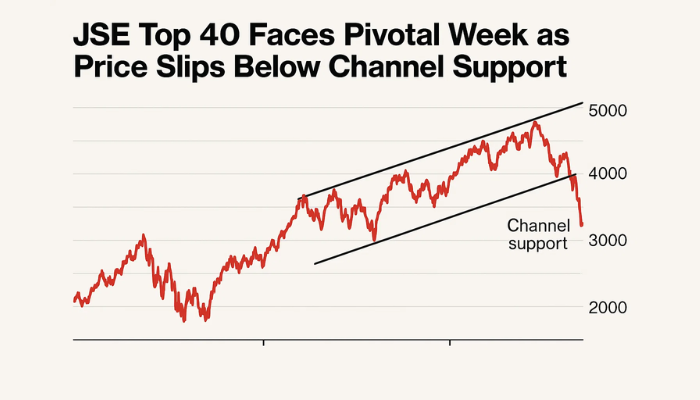

Naspers Ltd (JSE: NPN) is showing resilience, trading at ZAR 5,248 after bouncing off the lower end of its rising channel. The trend is still intact, with higher lows since April and a rising 50-day EMA at ZAR 5,131. But momentum is stalling, with a bearish MACD and a cluster of small candles at trendline support. These indecision patterns often precede a breakout.

A close above ZAR 5,300 could confirm the trend, with targets at ZAR 5,527, then ZAR 5,745 and possibly ZAR 5,955. For entry, a bullish engulfing candle or a bounce off the 50-EMA would be confirmation. Below the trendline and we could see ZAR 4,955.

Prosus Earnings and Buybacks Boost Sentiment

Investor optimism is based on Naspers’ solid fundamentals, especially Prosus’ strong Q1. The earnings beat has lifted the parent company’s valuation, reflecting confidence in its tech portfolio, including its big Tencent stake. Naspers’ buyback programme has reduced share supply and improved EPS, so management is long term convinced.

Despite market volatility, the rand has been relatively stable and that’s helped sentiment. Solid earnings and currency stability has kept Naspers in favour even with external pressures.

Geopolitical Tensions Cloud the Outlook

But macro risks are building. President Donald Trump’s Oval Office confrontation with President Cyril Ramaphosa over land reform and South Africa’s ICJ case against Israel has reignited US-South Africa tensions. Trump’s previous suspension of US aid and the exchange of claims has increased investor caution.

Finance Minister Enoch Godongwana’s 2025 budget tried to balance by not increasing VAT, but his message was overshadowed by the diplomatic fallout. Ramaphosa mentioned ongoing trade talks with the US on LNG and mineral resources but no breakthroughs were announced. Currency strategist Andre Cilliers is cautiously optimistic, saying behind the scenes progress might be happening.

Conclusion

So Naspers is a stock to watch for both technical and fundamental investors. Above ZAR 5,300 and investors are focused on the company. Below support and it’s all about politics. Keep an eye on price.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account