EUR/USD Stuck at 1.1460: Triangle Squeeze Signals Breakout or Breakdown

EUR/USD is stuck in a holding pattern just above 1.1460 after hitting 1.1524 in the European session yesterday. Despite a small bounce...

Quick overview

- EUR/USD is currently trading just above 1.1460, struggling with resistance in the 1.1500-1.1530 range after a pullback from last week's high.

- Geopolitical tensions, particularly the Israel-Iran conflict, are impacting market sentiment and keeping the euro from capitalizing on dollar weakness.

- Recent US retail sales data showed a larger than expected decline, yet the dollar remains steady as traders focus on geopolitical issues.

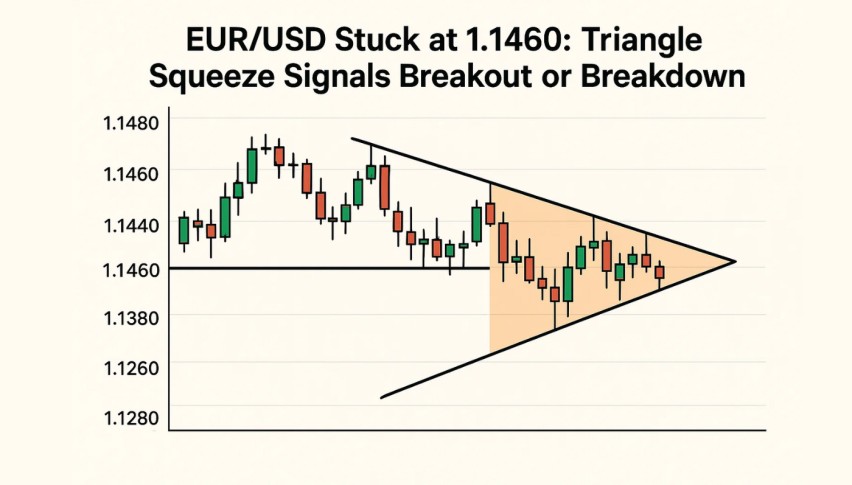

- Technically, EUR/USD is forming a descending triangle, with key support at 1.14530 and potential for a breakout as momentum builds.

EUR/USD is stuck in a holding pattern just above 1.1460 after hitting 1.1524 in the European session yesterday. Despite a small bounce, the pair is still struggling with the 1.1500-1.1530 resistance zone which has been capping upside for a while.

This comes after a big pullback from last week’s 1.1599 high due to growing geopolitical uncertainty and mixed economic signals. The Israel-Iran conflict is now in its 6th day and the US is threatening to launch military strikes to force Tehran to surrender over its nuclear ambitions. This has spooked markets and made investors cautious.

While the dollar is usually negative, the fragile market mood is also weighing on the euro which hasn’t been able to capitalize on the dollar’s weakness. The pair is still 1% below the recent high and trading just above a key support.

Economic Data Adds Confusion, Not Clarity

Tuesday’s US Retail Sales report added to the uncertainty. Data showed a bigger than expected 0.9% decline in May and downward revisions for April. But the dollar held firm, with traders more focused on geopolitics than data.

In Europe, Germany’s ZEW Economic Sentiment Index rose sharply to 47.5 in June from 25.2 in May, beating forecasts. But the euro couldn’t rally as safe-haven demand and broader risk aversion overwhelmed regional optimism.

Key Market Drivers:

- US retail sales fell 0.9% vs expected 0.7% decline

- German sentiment rose, but euro didn’t rally

- Dollar steady despite soft data and global tensions

Investors are also looking ahead to the Fed’s rate decision. No change is expected but Powell’s tone will be key. Futures are pricing in 2 rate cuts in 2025 with 60% chance of the first cut by September.

EUR/USD Technical Setup: Triangle Pattern Tightens

Technically, EUR/USD is forming a descending triangle on the 2-hour chart, compressing between a trend line and flat support at 1.14530. The pair is also below the 50-period EMA (1.15073) which is now resistance.

- Support at 1.14530 is holding but just* MACD lines are flat at zero—no momentum

- Break below 1.14530 targets 1.14087 and 1.13738

- Bullish reversal may retest 1.15000 and 1.15305

The doji candle at the trend line is a sign of indecision. Get ready for a breakout as the triangle apex approaches. Momentum will follow direction—watch price.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account