U.S. Trade Deficit Widens Sharply in May as Exports Decline

Despite the growing deficit, the decline in imports suggests that net trade may contribute positively to U.S. economic growth.

Quick overview

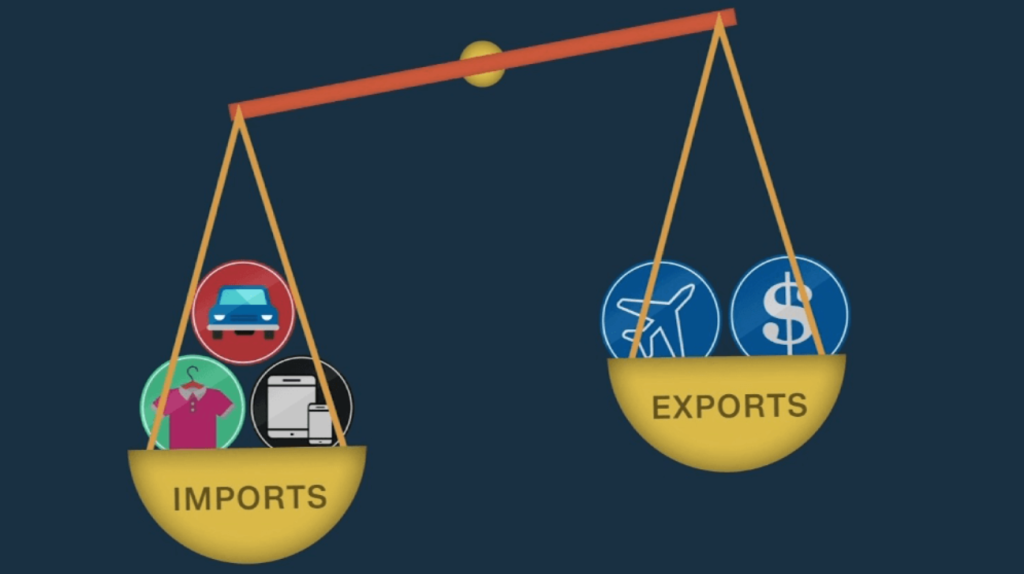

- The U.S. trade deficit widened by 18.7% in May, reaching $71.5 billion due to a significant drop in exports.

- Exports fell 4% to $279 billion, with notable declines in industrial supplies and capital goods.

- Imports decreased slightly by 0.1%, suggesting that net trade may positively impact Q2 GDP growth despite the widening deficit.

- Economists caution that lingering effects from previous tariff policies continue to distort trade data and create uncertainty.

The U.S. trade deficit widened significantly in May, rising 18.7% to $71.5 billion, as exports dropped sharply. Revised data for April showed a lower-than-expected deficit of $60.3 billion, down from the preliminary estimate of $61.6 billion.

The Bureau of Economic Analysis (BEA) at the U.S. Department of Commerce released the figures on Thursday. Economists polled by Reuters had forecast a May deficit of around $71 billion.

Exports fell by 4% to $279 billion, with goods exports down 5.9% to $180.2 billion. The decline was led by a $10 billion drop in industrial supplies and materials, particularly non-monetary gold, natural gas, and finished metal forms.

Exports of capital goods also declined by $1.9 billion, driven by weaker shipments of semiconductors, civilian aircraft engines, and telecom equipment. Meanwhile, services exports fell by $200 million to $98.8 billion, mainly due to declines in travel and transportation services.

Imports Edge Lower, Trade May Support Q2 GDP Growth

On the import side, total imports edged down 0.1% to $350.5 billion, with goods imports also falling 0.1% to $277.7 billion. The goods trade deficit alone widened by 13%, reaching $97.5 billion in May.

Despite the growing deficit, the decline in imports suggests that net trade may contribute positively to U.S. economic growth in the second quarter. In Q1, the trade gap had subtracted a record 4.61 percentage points from GDP, contributing to the 0.5% annualized contraction recorded in the period.

Tariff Policy Still Distorting Trade Flows

Economists warn that distortions from the Trump administration’s tariff policies continue to impact trade data. Although companies and consumers had front-loaded imports in previous months to avoid rising prices, overall consumer spending remains weak, which could limit trade’s positive contribution going forward.

Analysts note it may take time before the effects of reciprocal tariff disruptions fully disappear from the economic indicators, adding continued uncertainty to trade flows in the coming months.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account