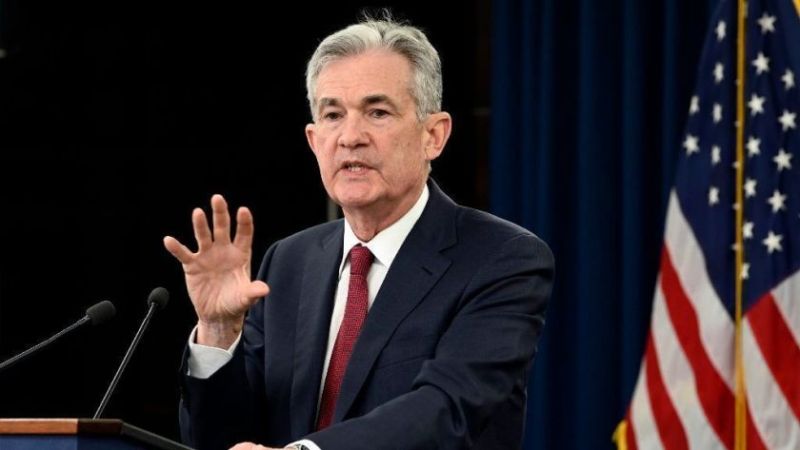

White House Suggests Trump May Oust Jerome Powell Soon from Fed Chairmanship

The most troubling signal is not a formal shift but rather the erosion of the informal norms that have traditionally shielded the Fed.

Quick overview

- Financial markets declined amid speculation that President Trump may remove Federal Reserve Chair Jerome Powell.

- The possibility of ousting Powell was discussed in a closed-door meeting with Republican lawmakers, with some expressing support but acknowledging potential market volatility.

- Kevin Hassett is viewed as a leading candidate to replace Powell, with other names including former Fed Governor Kevin Warsh and Treasury Secretary Scott Bessent.

- Analysts warn that political pressure on the Fed could undermine its credibility and lead to rising inflation expectations.

Financial markets reacted negatively to growing speculation that President Donald Trump may remove Federal Reserve Chair Jerome Powell.

The possibility was raised during a closed-door meeting with Republican lawmakers on Tuesday night, according to a senior White House official cited by Bloomberg.

While many GOP legislators reportedly expressed support for the move, they also acknowledged that ousting Powell before the end of his term could spark significant market volatility and a legal showdown. No final decision has been made yet, but the matter is said to be under serious consideration.

Kevin Hassett, director of the National Economic Council and a close Trump advisor, is widely seen as the leading candidate to replace Powell when his term expires in May next year. Other names reportedly under discussion include former Fed Governor Kevin Warsh and current Treasury Secretary Scott Bessent.

Concerns Over Fed Credibility

While the Federal Reserve is formally an independent institution, analysts note that its autonomy has always existed within the boundaries of political realities. Even central banks with strong legal safeguards have historically faced political pressure. And that pressure—whether or not it leads to rate cuts—can erode institutional credibility.

A loss of confidence in the central bank is often tied to rising inflation expectations, which can result in real economic consequences.

In this case, the most troubling signal is not a formal policy shift but rather the erosion of the informal norms that have traditionally shielded the Fed from political interference.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account