BTC ETFs Lock $2.3B in a Week, Fueled by $642M Pump Pre-Fed Cut

Investors put $2.3 billion into US spot Bitcoin ETFs last week, a big bounce ahead of the Fed’s rate cut. $642 million...

Quick overview

- Investors injected $2.3 billion into US spot Bitcoin ETFs last week, signaling renewed institutional interest ahead of a potential Fed rate cut.

- Fidelity's Wise Origin Bitcoin Fund and BlackRock's iShares Bitcoin Trust received significant inflows, with both funds gaining over 4% for the week.

- The market anticipates a 25-basis-point rate cut at the upcoming FOMC meeting, which could bolster risk assets like cryptocurrencies.

- Despite recent gains, Bitcoin still trails gold, which has risen 40% in 2024, but is showing signs of catching up as investors seek alternatives.

Investors put $2.3 billion into US spot Bitcoin ETFs last week, a big bounce ahead of the Fed’s rate cut. $642 million flowed in on September 12 alone, the most in a single day this month, according to Farside Investors.

Most of the flows went into Fidelity’s Wise Origin Bitcoin Fund (FBTC) which got $315 million and BlackRock’s iShares Bitcoin Trust (IBIT) which got $264 million. Both funds are up more than 4% for the week, showing institutional demand is back.

IBIT added 2,270 BTC in one day, $264.6 million, and had $3.2 billion in daily volume. It’s the most actively traded Bitcoin ETF in the US. BlackRock also plans to tokenize IBIT to expand access through blockchain-based products.

Interessant zu sehen, dass BTC-Spot-ETFs Zuflüsse sehen, während ETH-ETFs ausbluten. Deutet das darauf hin, dass Institutionen Bitcoins Knappheit und Dezentralisierung endlich schätzen, oder ist es nur kurzfristige Sentimentjagd? Was denkt ihr?

— Crypto Dispensers (@cryptodispenser) September 13, 2025

Fed Cuts Loom

The market is waiting for next week’s FOMC meeting where a rate cut is all but certain. Some political voices, including former President Donald Trump, are calling for a 100-basis-point cut but economists expect a smaller move.

A Reuters poll of 107 economists showed 105 expect a 25-basis-point cut to 4.00%-4.25% and one to two more cuts before year-end and as many as three before 2025 ends.

Key expectations:

- September FOMC decision: 25 bps cut

- Year-end outlook: Two to three total cuts

- Impact: Lower yields may support risk assets, including crypto

Traders are piling into Bitcoin ETFs ahead of the easing.

Bitcoin Chases Gold’s Tail

Despite the bounce, Bitcoin is still behind gold. Gold is up 40% in the first 8 months of 2024 and is the clear haven in a world of economic uncertainty. Gold ETFs are still getting inflows while Bitcoin ETFs had stalled until this week.

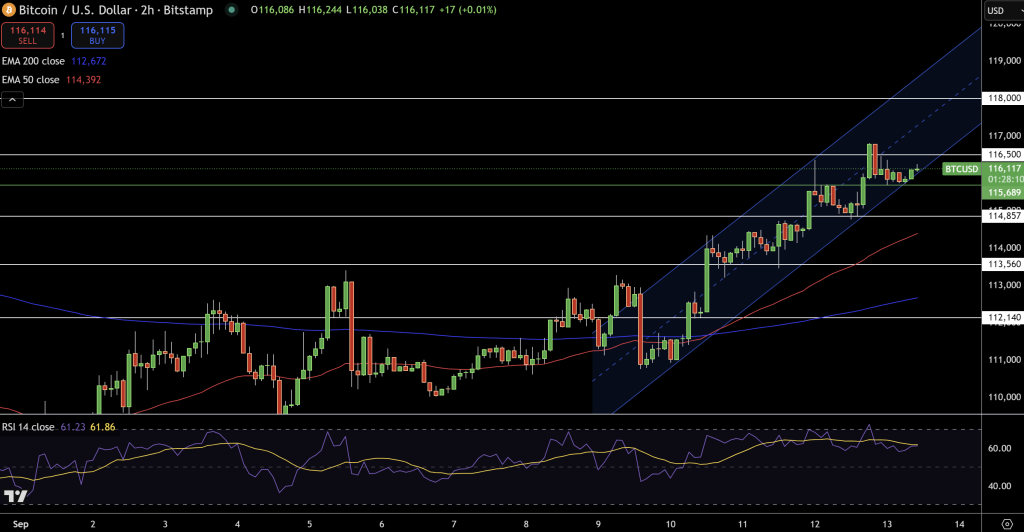

Research firm Ecoinometrics noted that gold is still the go-to hedge in portfolios but Bitcoin is “catching up” with inflows as investors prepare for a weaker US dollar. At $116,000 now, $118,000 resistance. Above that and we’re off to the races.

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account