3 Best Forex Brokers in Cambodia

Last Update: April 30th, 2024

The 3 Best Forex Brokers in Cambodia – Rated and Reviewed. We have rated and reviewed the top 3 Forex Brokers that accept Cambodian Traders.

In this in-depth article you will learn:

- The Best Forex Brokers in Cambodia – a List

- The Best Forex Brokers in Cambodia for Beginners

- Is Forex Legal in Cambodia?

- Best MT4/MT5 Forex Brokers with Low KHR Deposits

and much, MUCH more!

3 Best Forex Brokers in Cambodia – a Comparison

| 🔎 Broker | 🚀Open an Account | 🤝 Accepts Cambodian Traders | 💶 Min. Deposit (KHR) |

| 🥇 Fusion Markets | 👉 Click Here | ✅Yes | None |

| 🥈 Pepperstone | 👉 Click Here | ✅Yes | None |

| 🥉 Axi | 👉 Click Here | ✅Yes | None |

3 Best Forex Brokers in Cambodia (2024)

- ☑️ Fusion Markets – Overall, the Best Forex Broker accepting Cambodian Traders

- ☑️ Pepperstone – The Top Cambodian Forex Broker for Beginners

- ☑️ Axi – Low Forex Fees + Free Deposit and Withdrawal

Fusion Markets

International traders highly favor Fusion Markets, known as one of Australia’s lowest-cost forex and CFD brokers. FSA, ASIC, and the VFSC oversee the holding of client funds in segregated accounts at Fusion Markets.

Fusion Markets waives fees for deposits made with Visa, MasterCard, PayPal, Skrill, and Neteller. Through the Fusion platform, clients can participate in copy trading.

Account Types and Features

The broker offers three live trading accounts: Zero, Standard, and Islamic.

Zero Account

| 🔎 Account Type | 🥇 Zero |

| 📈 Spreads | From 0.0 pips |

| 📉 Commission | $4.5 (Round Turn) |

| 📊 Minimum Account Size | None |

| 💹 Micro Lot Trading | ✅Yes |

| 📌 Access to Products | All |

| 📍 Trading Styles Allowed | All |

| 🚀Open an Account | 👉 Click Here |

Classic Account

| 🔎 Account | 🥇 Classic |

| 📈 Spreads | From 0.9 pips |

| 📉 Commission | None |

| 📊 Minimum Account Size | None |

| 💹 Micro Lot Trading | ✅Yes |

| 📌 Access to Products | All |

| 📍 Trading Styles Allowed | All |

| 🚀Open an Account | 👉 Click Here |

Swap-Free Account

Under Sharia Law, Swap-Free Islamic Accounts are provided without interest.

| 🔎 Account | 🥇 Swap-Free |

| 📈 Minimum EUR/USD Spread | 1.4 pips |

| 📉 Minimum Trade Size | 0.01 lot |

| 💴 Commission | None |

| 💶 Minimum Account Balance | None |

| 💵 Account Base Currencies Available | AUD, CAD, EUR, GBP, JPY, THB, SGD, USD |

| 📊 Admin Charge Time | Only once each 7 days per position |

| 💹 Platforms | MetaTrader 4 & MetaTrader 5 |

| 📌 Scalping allowed | ✅Yes |

| 📍 EAs allowed | ✅Yes |

| ⏩ Hedging allowed | ✅Yes |

| 🚀Open an Account | 👉 Click Here |

Demo Account

The Demo Account does not entail cost and is risk-free. Traders can test Trading Platforms and Strategies without incurring any risk.

Markets Available for Trade

Products available for Trade include Forex, Energy, Precious Metals, Equity Indices, Commodities and Share CFDs.

- 90+ currency pairs

- Tight spreads with No Dealing Desk Execution

- Crude Oil, Brent Oil, and Natural Gas

- Precious Metals including Gold, Silver, Zinc, Copper, and, Platinum

- Commodities such as coffee, wheat, cocoa, and sugar

Furthermore, 100+ of the world’s largest equities (USA) are available for Trade via Share CFDs on MT5.

Trading Platforms

Several trading platforms, including MetaTrader4, MetaTrader5, DupliTrade, TradingView, and cTrader, are available. Furthermore, MetaTrader 4 is regarded as an industry-standard trading platform, with advanced charting technology and order management tools being offered by its predecessor, MT5.

MT4/MT5 offers Web, Desktop, and Mobile Trading. Furthermore, traders can integrate their MT4 Account with the DupliTrade copy trading platform.

Moreover, cTrader is a popular trading platform known for offering advanced trading features, an intuitive interface, and coded customization. Finally, TradingView, powered by cTrader, completes the platform selection. Users can execute trades, utilize advanced charting, and run scripts.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low Trading Fees | Basic educational tools |

| Easy Account Registration | Limited product selection |

| Great Customer Support | No minor account currencies accepted |

Our Insights

Unmatched support and user-friendly account registration are features that make Fusion Markets an excellent choice for Cambodian traders seeking low fees.

Pepperstone

Pepperstone, being one of the largest Forex Brokers globally, is regulated by ASIC, FCA, and CMA. Furthermore, it ensures Negative Balance Protection and maintains client funds in segregated accounts. Moreover, a minimum deposit is not a requirement for account registration.

Account Types and Features

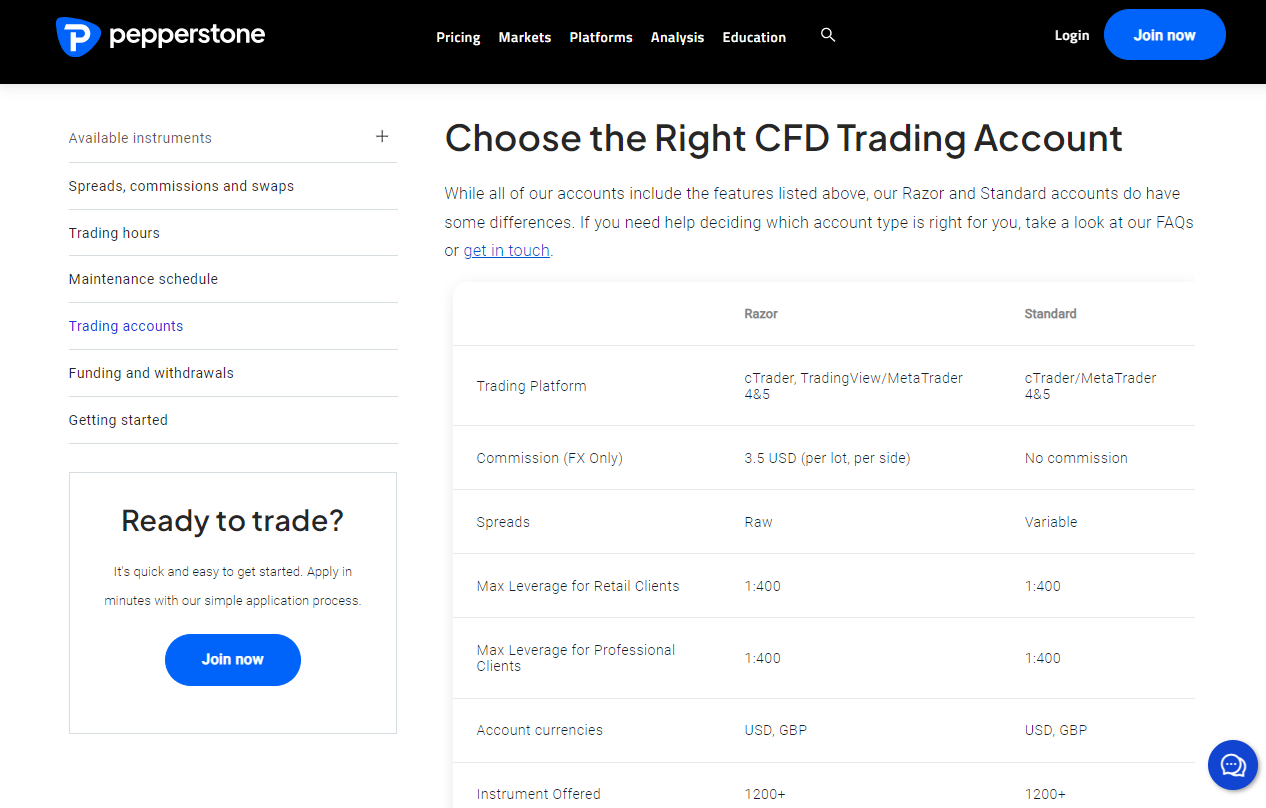

Pepperstone provides 2 different live trading accounts, Standard and Razor. Furthermore, no minimum deposit amount is required to register a Pepperstone live trading account.

| 🔎 Account | 🥇 Razor | 🥈 Standard |

| 💸 Min Deposit | $0 USD | $0 USD |

| 🔁 Average Spread | 0.3 Pips | 0.6 Pips |

| 💳 Commission | ✅ Yes | No |

| 📊 Hedging | ✅ Yes | ✅ Yes |

| 📈 Leverage | 500:1 | 500:1 |

| 🚀Open an Account | 👉 Click Here | 👉 Click Here |

The Razor account offers Raw spreads and commissions, starting from AU$7 round turn, for every 100’000 traded. Furthermore, the Standard Account, on the other hand, features a commission-free structure and low spreads.

Moreover, access to a Pro Account can be requested by Professional Traders. A demo Account is available at no cost. Furthermore, an Islamic, Swap-Free Option can be requested by Muslim Clients.

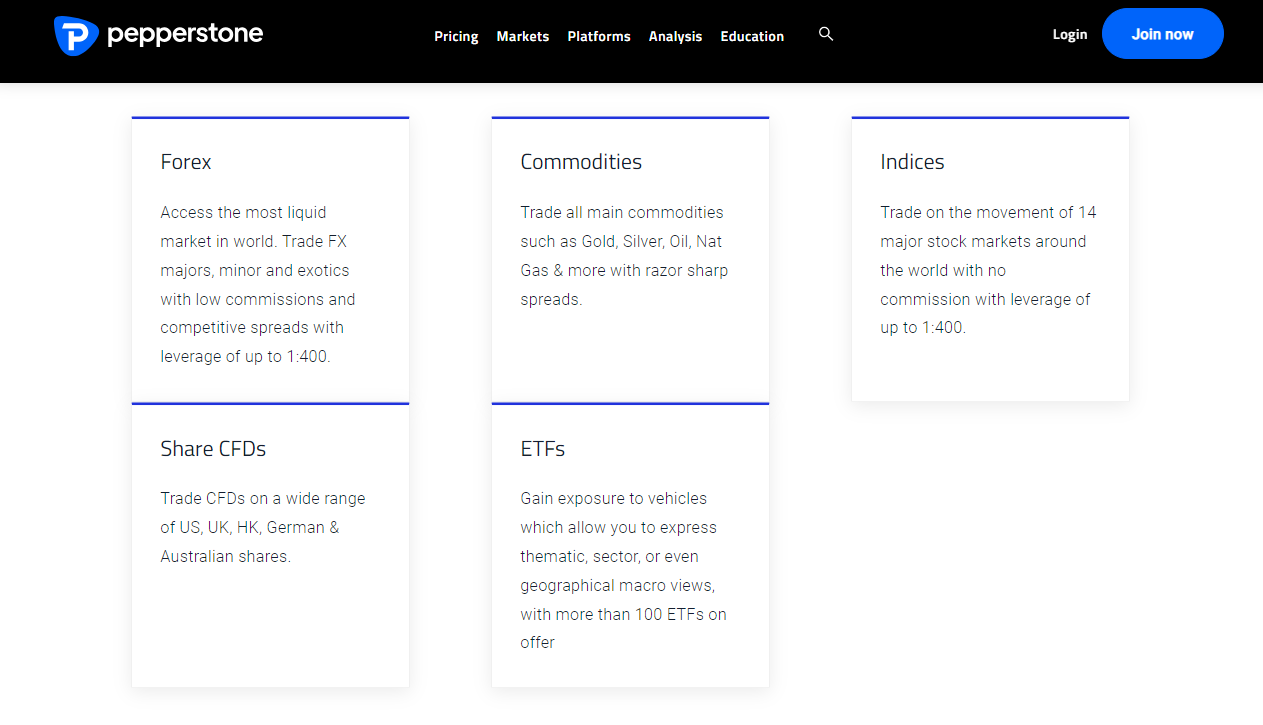

Markets Available for Trade

Markets and Instruments available for trade from Pepperstone include:

- Firstly, 70 Forex pairs

- Secondly, 28 Indices

- Over 1,000 shares

Moreover, clients can trade all main commodities, including Gold, Silver, Oil, and natural gas.

Trading Platforms

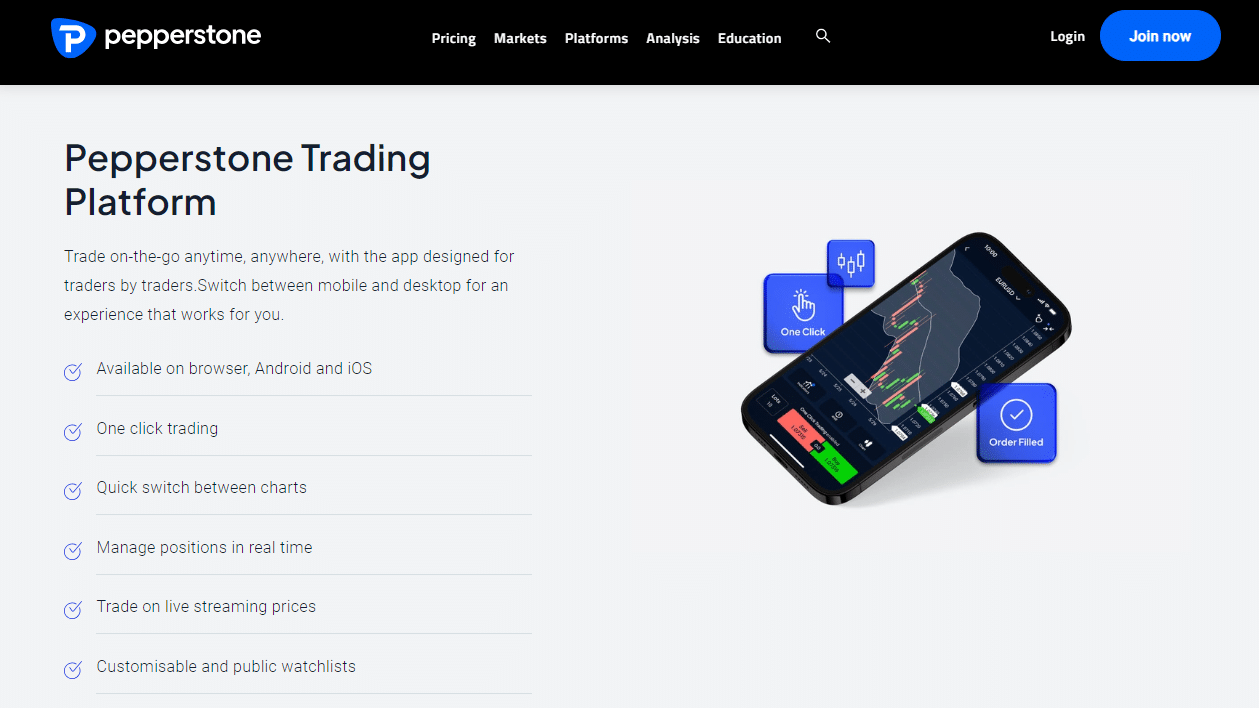

Multiple trading platforms are available, including MetaTrader4, MetaTrader5, cTrader, and, Trading View. Furthermore, the Pepperstone Proprietary Trading Platform is available for Desktop and Mobile.

Notable features of the Pepperstone Proprietary Platform include:

- Available on Browser, Android, iOS

- One Click Trading

- Quick switch between charts

- Manage positions in real time

- Trade on live-streaming prices

Moreover, social trading options are offered.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Great customer service | Limited Trading Platforms |

| Low forex fees | High Overnight Fees |

Our Insights

Pepperstone is an impressive Forex Broker with Regulations from the industry’s best.

Axi

Respected regulatory authorities such as ASIC, FCA, and FMA regulate AxiTrader (Axi), establishing it as a globally recognized Forex Broker.

Additionally, multiple safeguards have been implemented, including the segregation of client funds and the utilization of two-factor authentication (2FA) for login.

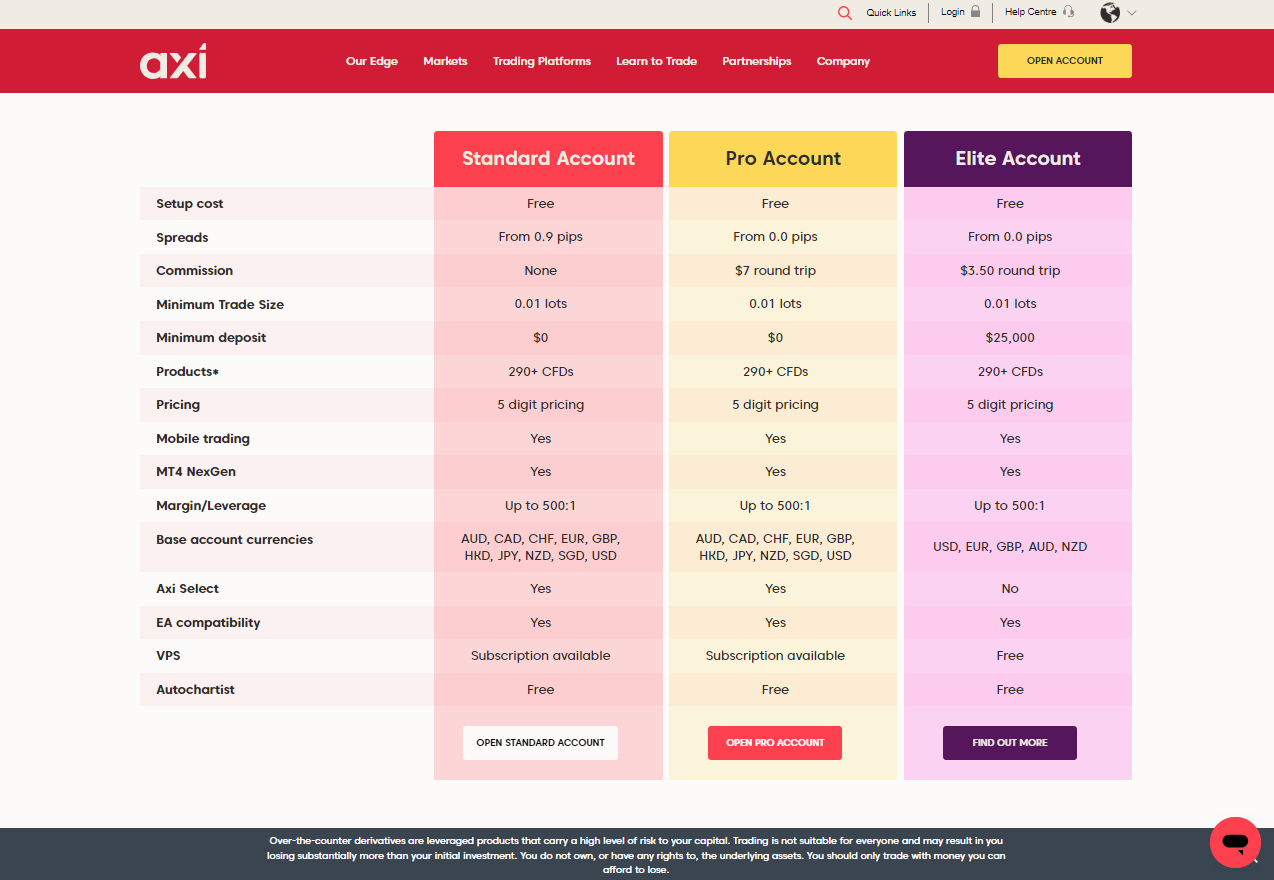

Account Types and Features

Three account types are offered: Standard, Pro, and Elite. All traders are suited to the Standard Account with spreads as low as 0.4 Pips, no transaction fees, and MT4 integration.

With the Axi Pro Account, you are guaranteed narrow spreads and competitive trading fees. Furthermore, sophisticated tools such as AutoChartist, PsyQuation, and MT4 NexGen are included in the Pro Account.

Additionally, the Elite Account is made available to established traders with a minimum deposit of.

Markets Available for Trade

Trading Instruments and Products available for trade include:

- 70 currency pairings

- 100+ CFDs

- 31 indices

- 16 commodities

- 4 separate oil markets

and much more!

Trading Platforms

- Axi Proprietary Trading Platform

- MetaTrader 4

- A Copy Trading App

MetaTrader 4 offers charting abilities, technical indicators, and automatic trading capabilities through Expert Advisors (EAs).

Pros and Cons

| ✅ Pros | ❌ Cons |

| Axi charges competitive spreads on key currency pairings | Axi charges inactivity fees |

| Axi is known for its superior customer support | Axi is known for its superior customer support. |

| There are free trading tools available to all traders | Axi does not have a proprietary platform |

| Axi offers customizable platforms | There is a cap on leverage for UK traders |

Our Insights

Axi has a Limited selection of CFDs and Trading Platforms.

Is Forex Trading Legal in Cambodia?

In Cambodia, Forex Trading does not face legal restrictions. Multiple international Forex Brokers, including Fusion Markets, Pepperstone, and Axi, accept traders from Cambodia.

Moreover, the Securities and Exchange Commission of Cambodia (SECC) regulates Securities Trading and the stock exchange.

In Conclusion

The popularity of Forex Trading holds excellent growth potential.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

Our Insights

In Cambodia, Forex Trading is legal and is gaining popularity among residents. Furthermore, several International Providers welcome Cambodian traders. Unfortunately, no locally based Forex Brokers exist within the country.

You might also like:

Frequently Asked Questions

Is Fusion Markets regulated?

Fusion Markets is regulated by authorities in Australia and Vanuatu.

What is the minimum deposit required for a Pepperstone Account?

No Minimum deposit is set.

Is Axi considered a safe Broker?

Axi is regulated by multiple financial authorities.