6 Best Forex Brokers in Bangladesh

The 6 Best Forex Brokers in Bangladesh – Rated and Reviewed. We have rated and reviewed the top 6 Forex Brokers offering Standard and Islamic Accounts to Bangladeshi traders.

In this in-depth guide you will learn:

- The Best Forex Brokers in Bangladesh – a List

- The Best Forex Trading Platforms and Apps in Bangladesh

- Is Forex Trading/Binary Trading Legal in Bangladesh?

- The Best, Safest, and, Cheapest Forex Broker for Bangladeshi Traders

- The Best Forex Brokers in Bangladesh for Beginners

and much, MUCH more!

6 Best Forex Brokers in Bangladesh – a Comparison

| 🔎 Broker | 🤝 Accepts Bangladeshi Traders | 💶 Min. Deposit (BDT) | 🚀Open an Account |

| 🥇 eToro | ✅Yes | ৳5484,86 | 👉 Click Here |

| 🥈 Pepperstone | ✅Yes | None | 👉 Click Here |

| 🥉 RoboForex | ✅Yes | ৳1096.97 | 👉 Click Here |

| 🏅 ThinkMarkets | ✅Yes | None | 👉 Click Here |

| 🎖️ Tickmill | ✅Yes | ৳10'969.71 | 👉 Click Here |

| 🥇 EightCap | ✅Yes | ৳10'969.71 | 👉 Click Here |

6 Best Forex Brokers in Bangladesh (2024)

- ☑️ eToro – Overall, the Best Forex Broker in Bangladesh

- ☑️ Pepperstone – Low Commissions and tight spreads.

- ☑️ RoboForex – Best Forex Broker for Beginners

- ☑️ ThinkMarkets – Best MT4/MT5 Forex Broker

- ☑️ Tickmill – Rich selection of currency pairs.

- ☑️ EightCap – Low ৳ (BDT) Minimum Deposit

eToro

With several regulations and a presence worldwide, eToro is an established Forex Broker that millions trust. eToro offers access to several account types: Personal, Professional, Corporate, and Islamic. A minimum deposit of 50 USD/BDT 5484,86 is required.

Islamic Account

The eToro Islamic account offers access to Sharia-compliant, swap-free Forex Trading. To open an eToro Islamic Account a minimum deposit of 100 USD/BDT 10’969.71 must be made. All assets are available for trade.

Additional Account Options

The eToro Retail or Personal account is the default account type on offer. Traders can trade all available assets, select copy trading, and, invest in smart portfolios. The minimum deposit required is 50 USD/BDT 548.49.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Social trading | Withdrawal Fee |

| Low trading fees | Inactivity fee |

| Negative balance protection | Conversion fees |

| User-friendly Platform | Single base currency |

Our Insights

eToro, according to our research, tops the list of broker choices in Bangladesh. The platform impresses with its social features and safe trading environment. However, it offers a limited selection of stocks and exchange-traded funds.

Pepperstone

As a well-established Forex Broker with over 10 years of experience in the financial markets, Pepperstone has become a popular broker across the globe. ASIC, FCA, and CMA regulate, the Broker offers Standard, Razor, and Islamic accounts. Pepperstone sets no minimum deposit.

Islamic Account

The Pepperstone Islamic Account offers the following notable features:

- No Commissions

- Hedging Allowed

- Scalping Allowed

- EAs Allowed

The minimum deposit set to open a Pepperstone Islamic Account is 200 USD/BDT 21939,42.

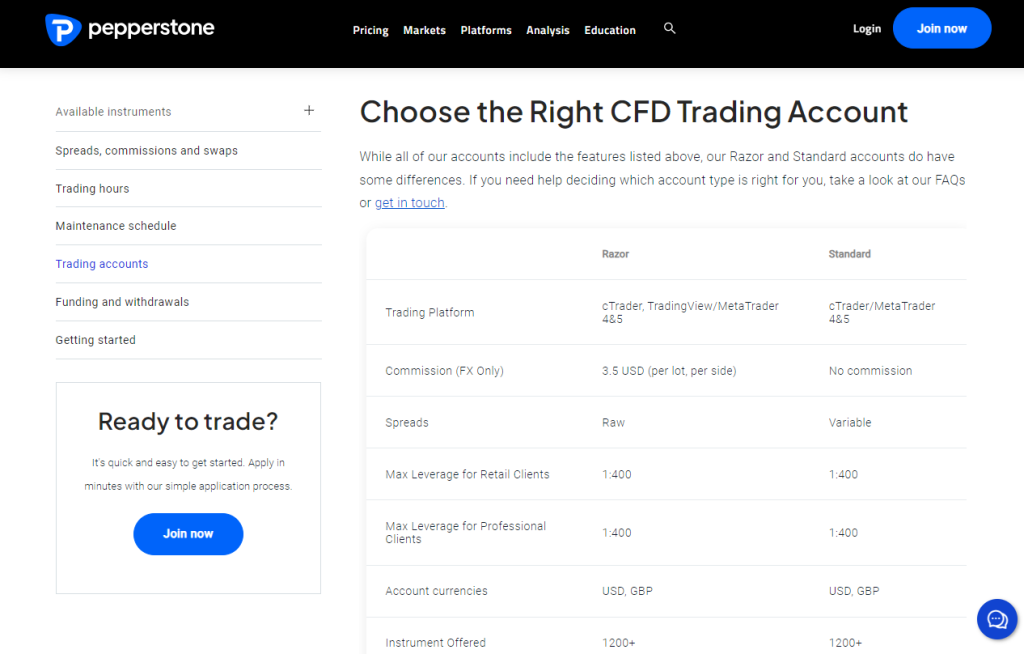

Additional Account Options

Traders can choose a Razor or Standard account, with no minimum deposit set. Both accounts offer MT4/MT5 and cTrader, with the Razor Option including TradingView.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Great customer service | Limited Trading Platforms |

| Low forex fees | High Overnight Fees |

Our Insights

We found Pepperstone’s forex fees to be low and competitive. Furthermore, the brokerage charges no inactivity and account fees, making it a viable broker choice for beginners.

RoboForex

With 12 years of experience in the industry, RoboForex is a multi-award-winning forex broker. RoboForex is overseen by the FSC and provides negative balance protection and 24/7 Customer Support.

Islamic Account

The RoboForex Swap-Free option is available for cent and standard MetaTrader 4-based accounts. The minimum deposit required is 10 USD/ BDT 1096.97.

Additional Account Options

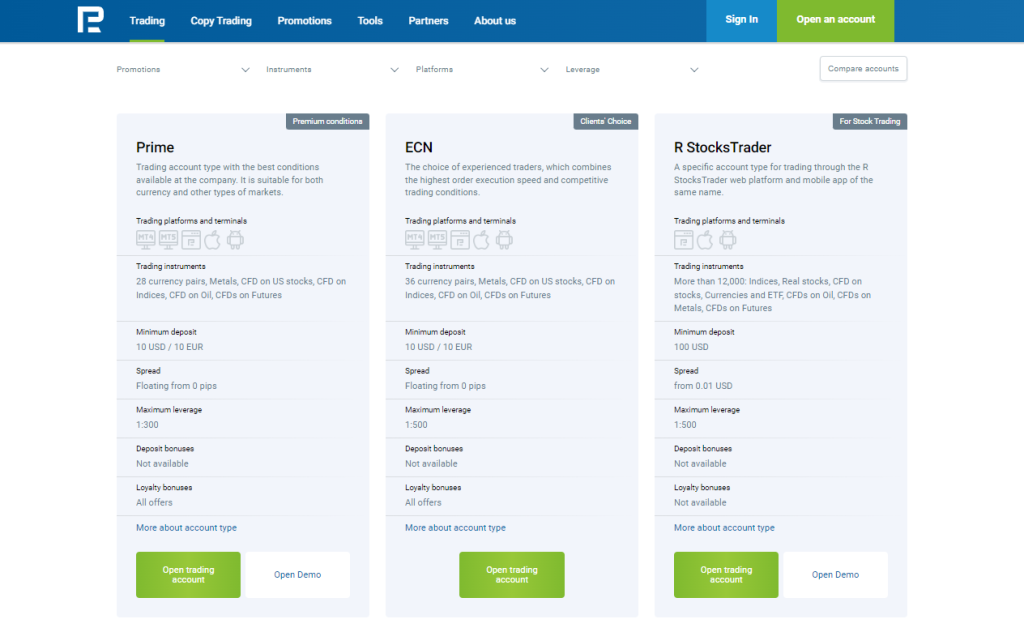

Account options available from RoboForex include:

- Prime

- ECN

- RStocksTrader

- ProCent

- Pro

With the exception of the RStocksTrader option, all account types require a minimum deposit of 10 USD

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low Minimum Deposit | Limited number of currency pairs |

| Well-regulated | Slow execution speeds |

| Copy trading available | Limited cryptocurrency selection |

Our Insights

RoboForex is deemed to provide optimal trading conditions, user-friendly platforms, and robust client fund security, according to our view.

ThinkMarkets

Authorised and regulated by the Financial Conduct Authority (FCA), ThinkMarkets provides quick and easy access to a wide range of markets including forex, CFDs on equities, commodities, indices, futures, and more. Trading Platforms on offer include MT4/MT5, Think Portal, and, ThinkTrader.

Islamic Account

An Islamic Account at ThinkMarkets does not incur swap/rollover charges on overnight positions. The support team can be contacted to open a Swap Free account after choosing between a Standard, ThinkZero, or Mini account type.

Additional Account Options

ThinkMarkets offers Account Types, which include Standard, ThinkZero, and Mini. Spreads vary from 0 Pips and have no minimum deposit for Standard and Mini Accounts. The ThinkZero Account requires a minimum deposit of 500 USD/BDT 54,848.55.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Narrow market spreads | No Cent Accounts |

| Low min. Deposit | No Bonus Offers |

Our Insights

ThinkMarkets has proven to be an excellent choice for beginners interested in Social Trading. They offer a proprietary trading platform that is outstanding.

Tickmill

By offering superior trade conditions and ultra-fast execution, Tickmill sets itself apart from competitors. Tickmill Group entities are regulated across 5 Jurisdictions, including FCA, CySEC, and FSA. Furthermore, Client funds are kept in segregated accounts, coupled with fund insurance.

Islamic Account

The Tickmill Islamic Account is a Swap-Free account with no swap or rollover interest on overnight positions. The Swap-Free account offers the same trading conditions and terms as the regular Tickmill trading account types.

Additional Account Options

Forex and CFD Accounts offered by Tickmill include Classic and Raw. Available Base Currencies are USD, EUR, GBP, ZAR, and the minimum deposit set is 100 USD/ BDT 10’969.71. All strategies are allowed.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low forex fees | Basic news feed |

| Easy account opening | Few account base currencies |

| Free deposit and withdrawal | No two-step login |

Our Insights

From our perspective, Tickmill offers the best all-round package. It provides account types catering to various trading experience levels. However, its customer support falls short.

EightCap

EightCap, established in Australia and regulated in multiple jurisdictions, offers professionals the chance to trade on 800+ CFD markets with TradingView integration.

Islamic Account

No clear mention is made of an EightCap Islamic, Swap-Free Account.

Additional Account Options

The account types offered by EightCap include Raw, Standard, and TradingView. The minimum deposit for all accounts is USD 10/ BDT 10’969.71. Spreads may vary, and scalping is permitted for all.

Pros and Cons

| ✅ Pros | ❌ Cons |

| Low forex fees | Slim product selection |

| Quick account opening | Limited research and education |

Our Insights

With low trading fees, free deposits, and, no inactivity fee, EightCap has the lowest Forex Fees amongst Australian-Based Forex Brokers. However, research, education, and customer support are basic.

Is Forex Trading Legal in Bangladesh?

Forex Trading is legal and well-regulated in Bangladesh. Forex Brokers accepting Bangladeshi Traders fall under the regulatory authority of the Bangladesh Securities and Exchange Commission.

In Conclusion

Islamic and Standard account options are now available through multiple top Forex Brokers in Bangladesh, making Forex Trading an increasingly popular and Halal activity for Muslim and Non-Muslim Traders.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

Our Insights

In the process of reviewing the Best Forex Brokers that accept Bangladeshi Traders, we found 6 excellent options. Each broker has its list of Benefits, ranging from Education and Research to Multilingual Customer Support. Finding the Best Forex Broker will depend on a trader’s individual trading needs.

You might also like:

Frequently Asked Questions

Is Forex Trading Legal in Bangladesh?

Forex Trading is Legal and Regulated in Bangladesh.

Who regulates Forex Trading in Bangladesh?

The Financial markets in the country are regulated by the Bank of Bangladesh.

Do Forex traders have to pay tax in Bangladesh?

Any income made from Forex Trading is subject to Taxation in Bangladesh.

Is leverage and Margin Trading legal in Bangladesh?

Bangladesh imposes leverage and margin trading restrictions to minimize potential risks.