Doo Prime Minimum Deposit Review

Doo Prime minimum deposit starts from 0 USD on the CENT Account. The Doo Prime STP account has a low requirement of just 1 USD, while the ECN account needs 100 USD.

| 🔍Account | 🎁Open an Account | 💵Minimum Deposit | ❤️Availability |

| 🥇Cent Account | 👉 Click Here | 0 USD | All Traders |

| 🥈STP | 👉 Click Here | 1 USD | Suitable for Intermediate Traders |

| 🥉ECN | 👉 Click Here | 100 USD | Tailored for Experienced Traders |

Doo Prime Minimum Deposit – Key Point Quick Overview

- ☑️Overview

- ☑️Regulation and Safety of Funds

- ☑️Deposit Fees and Methods

- ☑️Pros and Cons

Overview

Doo Prime’s varying minimum deposit requirements provide flexibility for different types of traders. With options ranging from a low minimum deposit of $100 for beginners on the STP/ECN Account to $50,000 for professional traders on the ECN Plus Account, the Doo Prime minimum deposit caters to a wide range of trading needs and preferences. This tiered structure allows clients to choose an account type that aligns with their trading experience, capital, and goals, ensuring they have access to suitable trading conditions and features.

Regulation and Safety of Funds

Global Regulations

Doo Prime minimum deposits operate under a global regulatory structure that provides flexibility and varying degrees of supervision. Let’s break down the different regulatory bodies:

- FSA: This jurisdiction’s relaxed regulations allow Doo Prime to offer a range of diverse trading conditions.

- VFSC: VFSC regulation permits higher leverage and flexible trading terms, attracting traders with aggressive strategies.

- FSC: This regulatory environment ensures oversight of capital adequacy, risk management, and regular audits.

Protection of Client Funds

| 🔍Security Measure | ℹ️ Information |

| 🗂️Segregated Accounts | Client funds are held in separate accounts from Doo Prime's operational funds, minimizing the risk of misuse |

| 👤Compensation Fund Member | Doo Prime doesn't participate in a compensation fund scheme |

| 💴Compensation Amount | None |

| 🎓SSL Certificate | 256-bit SSL encryption to protect client data and transactions |

| 2️⃣2FA (Where Applicable) | Supported, offers additional account security |

| ⛔Privacy Policy in Place | Comprehensive privacy policy is in place to safeguard user data and ensure compliance with international standards |

| ⚠️Risk Warning Provided | Detailed risk warnings are provided |

| ❌Negative Balance Protection | Available to prevent traders from incurring losses beyond their initial deposit |

| 🛑Guaranteed Stop-Loss Orders | Feature not offered, traders must manage their own stop-loss settings |

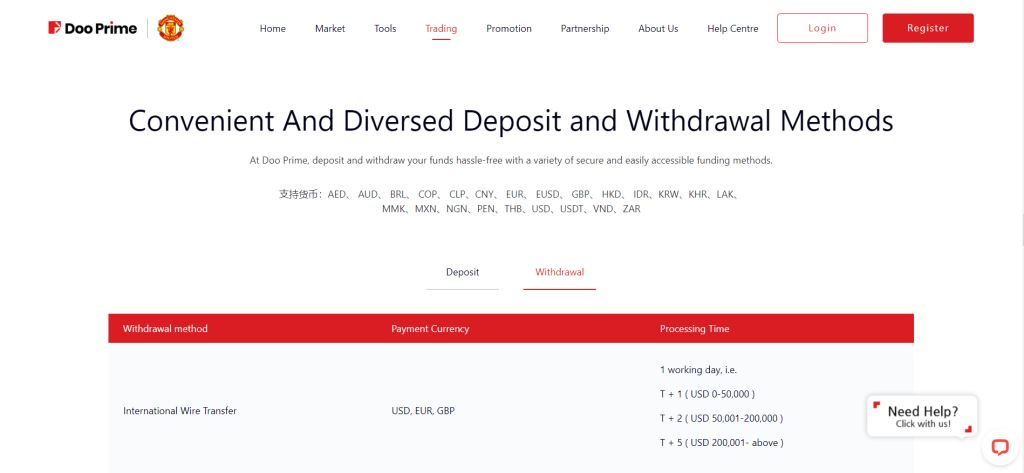

Deposit Fees and Methods

| 🔍Deposit Method | 💵Currencies | 🌎Countries | 💴Fees | ⏱️Processing Time |

| 💻Bank Wire Transfer | USD, EUR, GBP | Global | Potential external fees | 2-5 working days |

| 💳Credit/Debit Card | USD, EUR, GBP, AUD, ZAR, etc. | Global | Dependent on issuer | Instant to a few minutes |

| 🥳Epay | AED, AUD, EUR, GBP, HKD, THB, USD | Various (e.g., Hong Kong) | Possible external fees | Instant |

| 🪅FasaPay | IDR, USD | Indonesia | Possible external fees | Instant |

| 🎉Pagsmile | MXN | Mexico | Possible external fees | Instant |

| 🎊Dragonpay | PHP | Philippines | Possible external fees | 1-5 minutes |

| 🍾AO Pay | ZAR | South Africa | Possible external fees | 5-30 minutes |

| 💝Online Bank Transfers | KRW | South Korea | Possible external fees | 30 minutes |

| 🎁HWGC | TWD | Taiwan | Possible external fees | 45 minutes |

| 🎀OTC Payments | CNY, THB | Various Asian countries | Possible external fees | Instant to 30 minutes |

| 🎈Pay4Broker | CNY | Various Asian countries | Possible external Fees | 30 minutes |

How to Make Deposits with Doo Prime

Bank Wire

After logging into your Doo Prime account, find the ‘Deposit’ section.

- Select ‘Bank Wire Transfer’ from the options provided.

- Choose your preferred currency and enter the amount you want to deposit according to your account type.

- Double-check the bank details provided by Doo Prime.

- Initiate the bank transfer from your bank’s end and include any reference number provided by Doo Prime.

Confirm the deposit within your Doo Prime.

Credit or Debit Card

Log in to your Doo Prime account and locate the ‘Deposit’ section.

- Choose the credit/debit card option.

- Input your card information accurately, including the deposit amount.

- Verify the details.

- Click ‘Deposit’ and follow any additional verification steps from your card issuer.

In most cases, your deposit should be processed instantly or within a few minutes.

e-Wallets or Payment Gateways:

Access your Doo Prime account and go to the ‘Deposit’ tab.

- Opt for the e-wallet or payment gateway method.

- Select your preferred provider from the list.

- Enter the deposit amount and any other required details.

- Follow the instructions given by your chosen provider to complete the transaction.

The deposit should be reflected in your account instantly or within the specified timeframe.

Pros and Cons

| ✅Pros | ❌Cons |

| Decent range of deposit methods | Doo Prime is not a member of a compensation fund |

| No minimum deposit for CENT accounts | Currency conversion fees apply |

| 24/7 multilingual customer support if you have issues with deposits | No active bonuses for deposits |

You might also like:

In Conclusion

Doo Prime offers flexible account options with varying minimum deposit requirements to suit different trading needs.

Faq

Yes, Doo Prime holds customer funds in segregated Barclays accounts. They also provide SSL encryption and negative balance protection.

Doo Prime allows a variety of deposit options, including bank wire transfers, credit/debit cards, and e-wallets (such as Epay and FasaPay).

Yes, traders can register several accounts to diversify their trading strategies or manage multiple portfolios.