Plus500 Review

- Overview

- Plus500 - A Visual Overview

- Where is Plus500 Open for Business?

- Minimum Deposit and Account Types

- How to Open a Plus500 Account

- Safety and Security

- Fees, Spreads, and Commissions

- Trading Platforms and Tools

- Plus500 +Insights

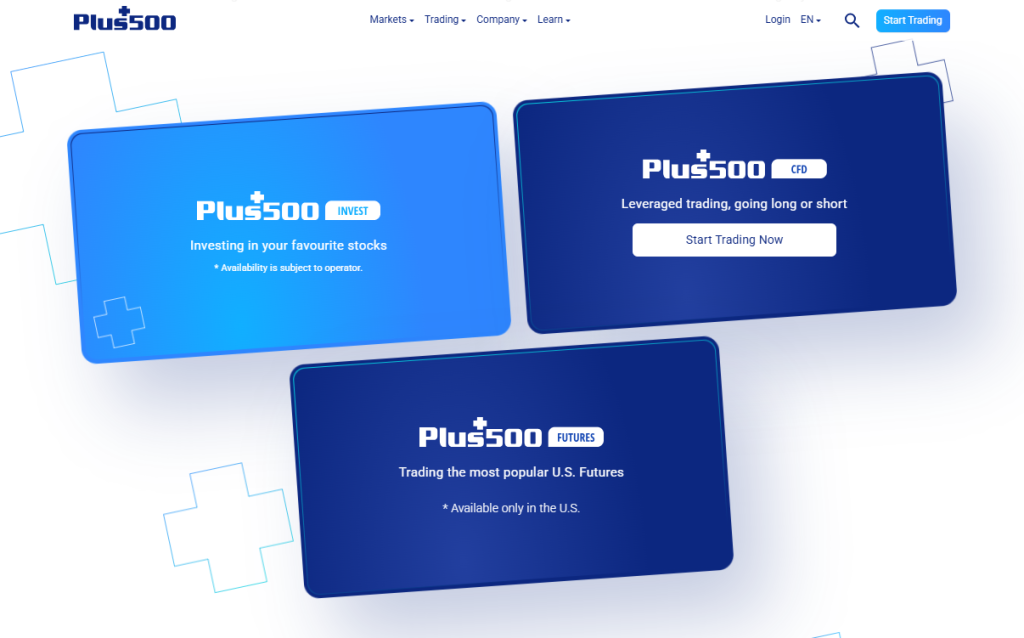

- All Markets, One Platform

- Deposit and Withdrawal

- Leverage and Margin

- Affiliate Program

- Customer Reviews and Ratings

- Inside Plus500: Employee Perspectives

- Discussions and Forums - What Real Traders Are Discussing (Plus 500)

- What Traders Want and Need to Know about Plus500 - Quick Q&A

- Pros and Cons

- In Conclusion

Plus500 is a low-risk broker with a Trust Score of 99/100. Regulated by top-tier authorities, it offers one live account and recently expanded into U.S. futures trading, enhancing its global reach and credibility.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Overview

Plus500™ is a leading global trading platform serving over 26 million users, providing access to CFDs, share dealing, and futures.

Headquartered in Sydney, Australia, Plus500 is publicly listed on the London Stock Exchange and regulated by both the Australian Securities and Investments Commission (ASIC) and the Financial Markets Authority (FMA).

Frequently Asked Questions

What types of trading products does Plus500 offer?

Plus500 offers CFDs, share dealing, and futures trading across various global financial markets.

Is Plus500 available in my country?

Yes, the broker operates in numerous countries, including Australia, New Zealand, South Africa, and the UK, among others.

Our Insights

Plus500 is a reliable and secure platform for both novice and experienced traders. With its advanced technology, user-friendly mobile apps, and diverse trading options, it is an excellent choice for anyone looking to access global financial markets.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Plus500 – A Visual Overview

This video offers a visual overview of Plus500, showcasing its trading platform, features, and tools.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Where is Plus500 Open for Business?

Plus500 operates and is available in multiple regions around the world through its locally regulated subsidiaries. Here is a breakdown of where Plus500 is available, based on the licenses and regulatory authorizations:

| Country/Region | Regulator | Status | Notes |

| 🇦🇺 Australia | ASIC (AFSL #417727) | Authorized to operate and provide financial services in Australia | Office in Sydney |

| 🇿🇦 South Africa | FSCA (FSP #47546) | Authorized to operate and serve South African clients | None |

| 🇬🇧 United Kingdom | FCA (FRN #509909) | Fully regulated in the UK | Crypto CFDs are not available |

| 🇨🇾 Cyprus (EU Clients) | CySEC (Licence No. 250/14) | Serves EEA clients under MiFID II | Crypto CFDs are not available |

| 🇸🇨 Seychelles | FSA (Licence No. SD039) | Serves international clients in less regulated regions | None |

| 🇪🇪 Estonia | EFSA (Licence No. 4.1-1/18) | Regulated in Estonia and parts of the EU | None |

| 🇸🇬 Singapore | MAS (Licence No. CMS100648) | Authorized to offer capital markets products in Singapore | None |

| 🇦🇪 United Arab Emirates | DFSA (Licence No. F005651) | Regulated in DIFC to serve Middle Eastern clients | None |

| 🇧🇸 The Bahamas | SCB (Licence No. SIA-F250) | Serves international clients not covered by stricter rules | None |

However, before signing up, be aware: Plus500 is restricted in some regions due to legal or regulatory barriers.

- USA: While Plus500 has launched futures trading in the U.S., it is not available for CFD trading to U.S. residents due to regulatory restrictions from the CFTC and SEC.

- Belgium: CFD trading is banned for retail clients.

- Canada: Generally not available, as most provinces prohibit or heavily regulate CFDs.

Some regions in the Middle East, Asia, and Latin America may also restrict access depending on local laws.

Frequently Asked Questions

Where is Plus500 fully authorized to operate?

Plus500 is fully authorized to operate in Australia, the UK, South Africa, Singapore, Estonia, and the UAE.

These licenses come from top-tier regulators like ASIC, FCA, and MAS, ensuring compliance and local investor protection.

Can EU clients use Plus500?

Yes, EU clients can access Plus500 through its Cyprus-regulated entity under CySEC. It operates under MiFID II, allowing services across the EEA.

However, UK retail clients cannot trade cryptocurrency CFDs via this entity.

Our Insights

Plus500 operates in major global markets with strong regulatory oversight and regional subsidiaries. However, restrictions apply in certain countries due to legal limitations. Always check local regulations to confirm availability before opening an account.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Minimum Deposit and Account Types

Plus500 offers a straightforward and budget-friendly entry with a minimum deposit of just 100 USD. This low barrier, combined with flexible account options, makes the platform appealing to both beginners and experienced traders exploring new strategies.

Frequently Asked Questions

What account types does Plus500 offer?

Plus500 offers two main account types: a Real Account for live trading with actual funds, and a Demo Account that uses virtual funds – ideal for learning or strategy testing without financial risk.

What is the required minimum deposit to start trading?

The minimum deposit to begin trading with a Plus500 Real Account is 100 USD or the local currency equivalent. This low barrier makes it a great choice for first-time traders or those with smaller budgets.

Our Insights

The 100 USD minimum deposit at Plus500 is ideal for new traders and those preferring to start with smaller capital. Additionally, the Demo Account enhances accessibility by allowing beginners to practice and build confidence without any financial risk.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

How to Open a Plus500 Account

1. Step 1: Begin the Account Registration

To initiate the account registration, simply click on the blue “Start Trading” button located at the top right corner of the Plus500 homepage.

2. Step 2: Complete the Registration

You will need to provide your email address and create a secure password to sign up. Alternatively, you can choose to register using your Google, Facebook, or Apple account for added convenience.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Safety and Security

Plus500 upholds a solid reputation for security and compliance by adhering to leading regulatory standards and employing industry-best protections.

By keeping client funds in segregated accounts and enforcing rigorous data security measures, the platform prioritizes trust and transparency.

| Aspect | Details |

| Fund Protection | Segregated client trust accounts to ensure safety and transparency |

| Regulatory Oversight | Regulated by ASIC (Australia), among other major authorities |

| Data Security | End-to-end encryption, secure login protocols, and monitored communication |

| Customer Support | 24/7 support and a defined complaints resolution process |

Frequently Asked Questions

How does Plus500 protect my funds?

Plus500 safeguards client funds by holding them in segregated trust accounts, separate from company assets.

This ensures customer funds remain untouched and fully protected in compliance with regulatory requirements.

Is Plus500 secure for trading?

Yes, Plus500 is considered secure for trading. It operates under leading regulatory bodies like ASIC and uses advanced encryption, secure communication channels, and anti-fraud practices to protect users and their data.

Our Insights

Plus500 excels in safety thanks to its transparent operations, multiple regulatory licenses, and strong security infrastructure. Traders benefit from data encryption, segregated client funds, and responsive customer support, fostering a dependable and low-risk trading environment.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Fees, Spreads, and Commissions

Plus500 provides a transparent, cost-effective fee structure that suits budget-conscious traders. With no fees on deposits or withdrawals and spreads included in the quoted prices, users can trade with confidence and clarity.

| Fee Type | Details |

| Spreads | Built into Buy/Sell price; varies by asset |

| Overnight Funding | Applies to positions held overnight; can be a credit or debit |

| Currency Conversion | Charged if trading in a different currency than your account base |

| Inactivity Fee | Charged after 3 months of inactivity (USD 10 per month) |

Frequently Asked Questions

Are there any hidden fees on Plus500?

No, Plus500 is transparent about its fees. Most services are free, and the platform earns through the Buy/Sell spread. Additional charges like overnight funding or currency conversion are listed where applicable.

What is the overnight funding fee?

An overnight funding fee may apply if a position is held beyond market close. This fee, either credited or debited, depends on the asset, your position, and market rates, and is always disclosed before you place the trade.

Our Insights

Plus500 simplifies trading costs by embedding its primary fee within the spread, charging no fees for deposits or withdrawals. This transparent, no-hidden-fee approach makes it an easy-to-use platform for traders prioritizing cost-efficiency.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Trading Platforms and Tools

Plus500 offers a streamlined trading experience with fast execution, tight spreads, and zero commissions. The platform features real-time analysis, leverage up to 1:30, and valuable tools such as +Insights and a free demo account.

| Feature | Details |

| Markets Available | CFDs on stocks indices crypto forex commodities |

| Key Tools | +Insights real-time quotes technical analysis tools |

| Leverage | Up to 1:30 for retail clients (varies by instrument/region) |

| Demo Account | Yes, unlimited use with virtual funds for practice trading |

Frequently Asked Questions

What types of markets can I trade on Plus500?

Plus500 gives access to a broad range of CFDs, including indices, stocks, cryptocurrencies, commodities, and forex, allowing traders to diversify across thousands of global financial instruments from one unified platform.

What are the benefits of using Plus500’s trading platform?

The platform features fast execution, tight spreads, and advanced tools, like real-time quotes and technical analysis, all without commission fees. It supports leveraged trading up to 1:30, helping traders seize more opportunities with minimal cost.

Our Insights

Plus500’s trading environment blends ease-of-use with professional-grade tools. With no commissions, tight spreads, and +Insights, and a risk-free demo mode, it’s well-suited for both new and experienced traders seeking effective market exposure.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Plus500 +Insights

Plus500’s +Insights tool converts extensive trading data into actionable insights by analyzing millions of users’ real-time activity. This feature helps traders spot market trends and make informed decisions, available on WebTrader, iOS, and Android platforms.

| Feature | Description | Platforms | Benefit |

| Real-Time Data | Analyzes millions of customer trades instantly | WebTrader iOS Android | Immediate market trend insight |

| Trend Analysis | Displays top trader trends with visual scaling | All supported devices | Easy-to-understand data display |

| Direct Trading | Open Buy/Sell positions from within +Insights | All supported devices | Quick action on insights |

| Custom Filters | Filter trends by various parameters | All supported devices | Tailored, precise market analysis |

Frequently Asked Questions

What is Plus500 +Insights, and how does it help traders?

+Insights analyzes the trading activity of millions of Plus500 customers in real-time, revealing top trends and patterns. It helps traders refine strategies by showing popular market moves and allowing direct trade execution from the tool.

How can I access +Insights on different devices?

+Insights is easily accessible on WebTrader by hovering over the side-bar menu, and on mobile apps (iOS and Android) via the main menu. Its user-friendly navigation ensures seamless integration into your trading routine.

Our Insights

Plus500’s +Insights is a powerful, user-friendly tool that turns live trader data into strategic advantages. By revealing real-time trends and behaviors, it helps users make smarter trading decisions.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

All Markets, One Platform

Plus500 offers traders access to a vast range of CFD markets, including Forex, Shares, Indices, Crypto, Commodities, Options, and ETFs. With fast execution, flexible leverage, and competitive spreads, it serves as a comprehensive platform for global market exposure.

| Market Type | Popular Instruments | Leverage Available | Key Advantage |

| Indices | S&P 500 US-TECH 100 Germany 40 | Yes | Broad market exposure |

| Forex | EUR/USD GBP/USD USD/JPY | Yes | High liquidity and volatility |

| Commodities | Gold Oil Natural Gas | Yes | Ideal for macroeconomic trading |

| Crypto | BTC ETH ADA MATIC | Yes | 24/7 trading, no wallet needed |

Frequently Asked Questions

What asset classes can I trade with Plus500?

Traders can access CFDs on major global markets, including Forex, Shares, Indices, Commodities, Cryptocurrencies, ETFs, and Options. This wide variety allows for diversified trading strategies and exposure to both traditional and modern financial instruments.

Why is Plus500 suitable for multi-asset CFD trading?

Plus500 combines cutting-edge technology with a broad range of assets, offering real-time quotes, fast order execution, and intuitive tools. It’s ideal for traders seeking to explore multiple markets from a single, streamlined trading platform.

Our Insights

Plus500 delivers a rich and accessible multi-asset CFD trading experience. With broad market access, no need to own physical assets, and a simplified trading interface, it caters to both novice and experienced traders.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Deposit and Withdrawal

Plus500 streamlines deposits and withdrawals through widely accepted methods like cards, e-wallets, and bank transfers. With no platform fees and quick processing times, the system supports smooth, global financial access for traders of all experience levels.

| Method | Type | Fees (Plus500) | Processing Time |

| Visa/MasterCard | Credit/Debit Card | None | Instant (Deposit) 1 Day (Withdraw) |

| PayPal | E-Wallet | None | Instant (Deposit) 1 Day (Withdraw) |

| Skrill | E-Wallet | None | Instant (Deposit) 1 Day (Withdraw) |

| Bank Transfer | Direct Transfer | None | 1-3 Days (Deposit/Withdraw) |

Frequently Asked Questions

What deposit and withdrawal options does Plus500 support?

Plus500 allows deposits and withdrawals via Visa, MasterCard, PayPal, Skrill, and direct bank transfers. These options ensure flexibility and ease of use, catering to traders across different regions and financial preferences.

Does Plus500 charge for deposits or withdrawals?

No, Plus500 does not impose any deposit or withdrawal fees. However, traders should check with their bank or payment provider, as external charges or currency conversion fees may still apply depending on the service used.

Our Insights

Plus500 delivers an efficient, user-friendly fund management system with fast transaction processing and zero platform fees. It’s a reliable option for traders who prioritize simplicity, transparency, and convenience in handling their trading capital.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Leverage and Margin

Plus500 offers robust leverage options, up to 1:300, for major forex pairs, enabling traders to control larger positions with less capital. Margin trading boosts potential gains but requires careful risk management and a sufficient account balance.

| Feature | Details | Example | Why It Matters |

| Maximum Leverage | Up to 1:300 for major forex pairs | Control $30,000 with $100 | Enables large exposure with minimal capital |

| Margin Requirements | Vary by asset (typically 5–10% on forex) | 10% margin= 1:10 leverage | Shows collateral required to open a trade |

| Retail vs Professional | Retail capped; professionals get higher | Pros may access 1:300 leverage | Regulation protects less-experienced traders |

| Leverage Risk | High gains but also high losses | Account can be liquidated | Essential to manage risk with stop-losses |

Frequently Asked Questions

How does leverage work on Plus500, and what are typical margin requirements?

Leverage on Plus500 allows you to open larger trades with a smaller initial investment. For example, 1:10 leverage means only 10% of the position’s value is required as margin. Margin levels vary depending on the asset class.

What’s the maximum leverage available on Plus500, and who can access it?

The maximum leverage on Plus500 is up to 1:300 for major forex pairs. This high leverage is typically available to professional clients who meet qualification criteria. Retail clients may be subject to lower, regulation-capped limits.

Our Insights

Plus500 offers powerful leverage options paired with transparent margin requirements. While this enhances trading flexibility and capital efficiency, traders must remain cautious—leveraged trading can magnify both profits and losses.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Affiliate Program

The Plus500 Affiliate Program offers a reliable and rewarding opportunity for content creators and website owners to monetize their traffic.

With a dedicated Affiliate Manager and high-conversion tools, partners can tap into a regulated, global trading platform.

| Feature | Details | Benefit | Support Provided |

| Marketing Tools | Banners landing pages tracking systems | Increases conversions and engagement | Custom campaign optimization |

| Commission Structure | Based on referred traffic and trader activity | Earn income from high quality leads | Transparent tracking |

| Affiliate Management | Dedicated Affiliate Manager assigned | Strategic guidance and faster results | Ongoing campaign assistance |

| Regulatory Trust | Operates under multiple global regulators | Builds credibility with your audience | Promotes trust in your promotion |

Frequently Asked Questions

How can I start earning with the Plus500 Affiliate Program?

Joining is simple: sign up for the program, integrate Plus500 marketing assets into your site, and start earning commissions based on the trading activity generated from your referred traffic.

What support and tools do affiliates receive?

Affiliates gain access to banners, landing pages, tracking tools, and performance analytics. A personal Affiliate Manager is also assigned to provide ongoing support and help maximize your campaign performance.

Our Insights

Plus500’s Affiliate Program offers strong earning potential, professional support, and top-tier marketing tools. It’s ideal for partners looking to promote a regulated, global trading brand while benefiting from a structured and transparent commission model.

Customer Reviews and Ratings

⭐⭐⭐⭐⭐

I’ve been using Plus500 for over a year, and it’s been fantastic. The platform is clean, fast, and easy to navigate. I especially appreciate the real-time quotes and simple interface. Withdrawals are processed efficiently, usually within a day. – Amanda

⭐⭐⭐⭐

What sets Plus500 apart is the wide selection of CFDs – forex, indices, commodities, crypto – you name it! I also like the flexible leverage options. It’s a solid choice for anyone wanting access to global markets from one account.– Thabo

⭐⭐⭐⭐

As a beginner, I found Plus500 very easy to use. Everything from placing orders to monitoring my portfolio was straightforward. There are no hidden fees, and the platform keeps everything transparent. Highly recommended for new traders. – Elena

Customer Feedback, Trust Score, and Key Feedback

| Platform | Rating (5) | Review Volume |

| Trustpilot | 4.1 | ~15,000 reviews |

| Google Play | 4.4 | 113,000+ ratings |

| Apple App Store | 4.4 | 478–2,300+ reviews |

| ForexPeaceArmy | Mixed | Multiple posts |

| Good Money Guide | 3.7 | 144 reviews |

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Inside Plus500: Employee Perspectives

Employees paint a balanced picture of Plus500. Many employees praise its friendly atmosphere, benefits, and supportive colleagues, while others note low salaries, heavy workloads, and limited career progression in some teams.

Employee Trust Score by Region

| Region | Trust Score (5) | # of Reviews | Highlights |

| 🌏 Global | 4.0 | 60 | Strong culture; salary and career concerns |

| 🇮🇱 Israel | 4.1 | 26 | High approval; similar positives and concerns |

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Discussions and Forums – What Real Traders Are Discussing (Plus 500)

The final verdict on Plus500, according to traders, is Positive but Cautious. Reviews praise Plus500’s simplicity, beginner-friendly interface, and zero deposit fees. However, several users report concerns over high commodity spreads, withdrawal delays, and occasional trade execution issues.

Trader Discussion Highlights

| Topic | Positive Feedback | Negative Feedback | Topic |

| Spreads/Fees | No deposit fees Tight Forex/stock spreads | High spreads on commodities | Good for beginners less ideal for scalping |

| Platform Support | Clean UI Fast onboarding Reliable charting | Stop-loss delays; execution issues | Mixed - great for light use |

| Withdrawals | Many users report quick withdrawals with standard methods | Delays and verification issues in complex cases | Depends on user region and volume |

| Trust/Transparency | Licensed/regulated segregated client accounts ensure fund safety | Complaints of limited transparency in support disputes | Strong regulatory foundation, some disputes |

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Top Questions Asked by the Majority of Traders

Are there inactivity fees?

Asked by 83% of Traders in a Group Discussion

Yes. If your account is inactive for more than three months, Plus500 may charge a monthly inactivity fee (typically around 10 USD).

Are MetaTrader platforms supported?

Asked by 96% of Traders in an Online Forum

No, Plus500 uses its proprietary platform and does not support MetaTrader (MT4/MT5) or cTrader.

Is Plus500 regulated and secure?

Asked by 99% of Traders in a Group Discussion

Plus500 is regulated by multiple trusted authorities (ASIC, FCA, CySEC, FSCA, MAS, DFSA), keeps client funds in segregated accounts, and uses 256-bit SSL encryption.

Can professionals access higher leverage?

Asked by 61% of Traders in an Online Forum

Yes, professional clients can access higher leverage, up to 1:300, though this comes with fewer regulatory protections compared to retail accounts.

What is the minimum withdrawal amount?

Asked by 97% of Traders in an Online Forum

Minimum withdrawal amounts typically start at 100 USD for bank transfers and around $50 for e‑wallet withdrawals, but can vary by account region.

Note: This Information is gathered via public Forums and Discussion Boards, and it is subject to change.

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

What Traders Want and Need to Know about Plus500 – Quick Q&A

Q: Is there phone support at Plus500? – John Smith, United Kingdom

A: Plus500 does not provide phone support in the traditional form. Customer assistance is available 24/7 via live chat, email, or WhatsApp for all user inquiries and concerns.

Q: Can I use stop-loss and other risk tools? – Maria Silva, Brazil

A: Plus500 offers a full suite of risk management tools such as stop-loss, take-profit, guaranteed stops, trailing stops, and negative balance protection.

Q: How long do withdrawals take? – Ahmed Khan, South Africa

Q: Does Plus500 offer an economic calendar? –Sophie Müller, Germany

Q: Can I reset my demo account balance? – Liu Wei, Singapore

★★★★ | Minimum Deposit: $100 Regulated by: FCA, CySEC, ASIC, MAS, FSA, EFSA, DFSA, CFTC Crypto: Yes |

Pros and Cons

✓ Pros ✕ Cons

Unlimited demo account available Limited educational resources

Regulated by top-tier financial authorities Inactivity fees may apply

User-friendly trading platform No support for MetaTrader platforms

Negative Balance Protection included Overnight fees on CFD positions

Mobile app matches full platform experience CFDs only, no direct stock ownership

You might also like:

References:

Plus500 is licensed and regulated in the following countries:

- 🇬🇧 United Kingdom

- 🇨🇾 Cyprus

- 🇦🇺 Australia

- 🇳🇿 New Zealand

- 🇿🇦 South Africa

- 🇸🇬 Singapore

- 🇮🇱 Israel

- 🇸🇪 Seychelles

- 🇪🇪 Estonia

- 🇦🇪 United Arab Emirates

- 🇯🇵 Japan

- 🇧🇸 Bahamas

With physical offices and local support in:

- 🇬🇧 United Kingdom

- 🇨🇾 Cyprus

- 🇦🇺 Australia

- 🇮🇱 Israel

- 🇦🇪 United Arab Emirates

- 🇺🇸 United States

- 🇸🇬 Singapore

- 🇯🇵 Japan

- 🇪🇪 Estonia

- 🇸🇨 Seychelles

- 🇧🇬 Bulgaria

Plus500 maintains offices across Europe, the Middle East, Asia, Australia, Africa, and North America—highlighting its truly global footprint.

In Conclusion

Plus500™ is a secure, globally trusted trading platform offering access to 2,800+ instruments including CFDs, shares, and futures. In addition, the Broker is regulated by top authorities like ASIC and FMA, and it’s praised for its intuitive interface and highly rated mobile apps.

Faq

Yes, Plus500 provides a demo account with virtual funds, allowing users to test their trading methods and become acquainted with the platform’s features.

Withdrawals from Plus500 normally take one business day to complete.

Yes, Plus500 offers several risk management tools, including stop-loss orders.

Plus500 requires a $100 minimum deposit to start a trading account, which grants traders access to a variety of financial products.

Yes, Plus500 allows traders to trade cryptocurrencies using leverage.

Plus500 offers CFDs on a wide range of instruments, including forex, indices, stocks, commodities, ETFs, cryptocurrencies, options, and futures.

No. Plus500 does not charge deposit or withdrawal fees, though banks or intermediaries may apply charges.

You can use credit/debit cards, bank transfers, and e‑wallets like PayPal and Skrill for deposits and withdrawals.

Plus500 does not offer CFD trading to U.S. residents, though U.S. futures trading is available via a separate entity.

Retail trader leverage is capped at 1:30 for forex, 1:5 for stocks, 1:20 for commodities/indices, and 1:2 for cryptocurrencies. Higher leverage is available for professional accounts.

- Overview

- Plus500 - A Visual Overview

- Where is Plus500 Open for Business?

- Minimum Deposit and Account Types

- How to Open a Plus500 Account

- Safety and Security

- Fees, Spreads, and Commissions

- Trading Platforms and Tools

- Plus500 +Insights

- All Markets, One Platform

- Deposit and Withdrawal

- Leverage and Margin

- Affiliate Program

- Customer Reviews and Ratings

- Inside Plus500: Employee Perspectives

- Discussions and Forums - What Real Traders Are Discussing (Plus 500)

- What Traders Want and Need to Know about Plus500 - Quick Q&A

- Pros and Cons

- In Conclusion