PU Prime Review

- Trading with PuPrime - Immediate Advantages and Disadvantages

- Overview

- PU Prime Visual, Video Overview

- PU Prime Stands Out in the Competitive Forex Crowd

- Minimum Deposit and Account Types

- Risk-Free Demo Account

- Islamic Account

- How to Open a PU Prime Account

- Safety and Security

- Bonus Offers and Promotions

- Partnership Programs

- Markets Available for Trade

- Fees and Spreads

- Margin and Leverage

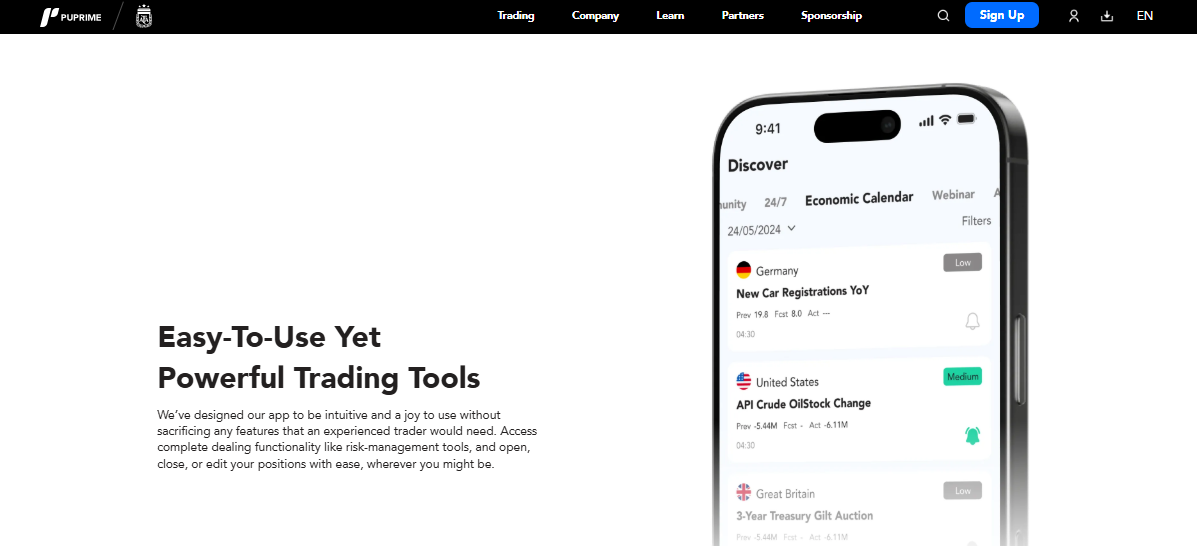

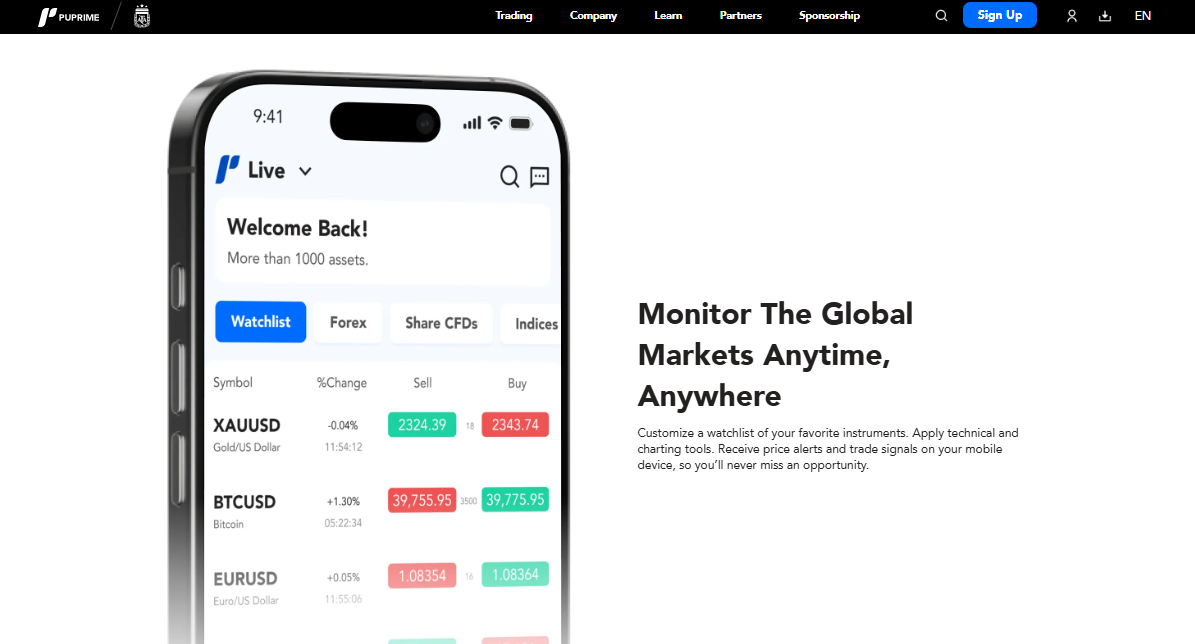

- Trading Platforms and Apps

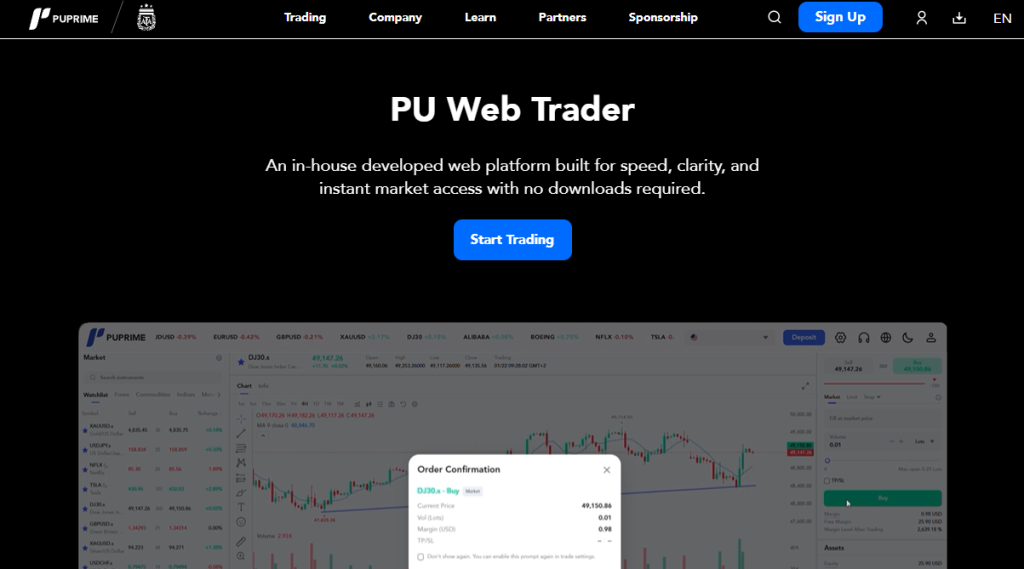

- PU Web Trader

- Trading Research and Tools

- Deposits and Withdrawals

- Education and Resources

- Trading Hours

- Customer Support Options and Contact Details

- Insights from Real Traders

- Trust Scores and Reviews

- PU Prime vs IG vs FBS

- Pros and Cons

- In Conclusion

Established in 2015, PU Prime is a globally recognised Forex and CFD broker. Regulated by 🇸🇨 FSA, 🇲🇺 FSC, 🇦🇺 ASIC, and 🇿🇦 FSCA, the broker offers access to over 1,000 CFD instruments, including Forex, commodities, indices, stocks, ETFs, and bonds. Traders benefit from leverage of up to 1:1000, multiple account options, and innovative trading platforms suitable for both beginners and experienced professionals. PU Prime is distinguished by its award-winning platform, multilingual support, and client-focused approach.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Trading with PuPrime – Immediate Advantages and Disadvantages

| ✓ Pros | ✕ Cons |

| Regulated by top-tier authorities in multiple jurisdictions. | U.S. traders are not accepted. |

| Low minimum deposit from $1 to start trading. | Limited product range compared to some brokers. |

| Offers competitive spreads and low trading fees. | Social/copy trading options are limited. |

| Provides MT4 and MT5 platforms with full functionality. | Islamic accounts have fewer features. |

| Fast deposits and withdrawals with multiple payment options. | Inactivity fees may apply. |

| Strong educational resources and market analysis. | Bonus promotions vary by region and conditions. |

Overview

PU Prime has grown into a globally known fintech brand, delivering advanced trading solutions across various asset classes. Operating in multiple regions with 90+ Forex-specific global awards, it maintains a client-first approach that consistently enhances the online trading experience through innovation, reliability, and excellent support.

Frequently Asked Questions

Is PU Prime a regulated and trustworthy broker?

PU Prime is a licensed broker with an expanding international reach. The company has built a reputation for reliability and transparency, backed by 90+ Forex-specific global awards and its dedication to client-focused service and advanced trading solutions.

What is the minimum deposit requirement at PU Prime?

PU Prime offers a competitive minimum deposit requirement, making live accounts accessible to both new and experienced traders. Funding is straightforward, with support for multiple currencies and instant processing on most payment methods.

Our Insights

PU Prime shines in 2025 as a reliable and versatile broker. Its award-winning platform, user-focused tools, and transparent trading environment attract traders who want innovation and global market access, ensuring a dependable and forward-thinking trading experience.

PU Prime Visual, Video Overview

Take a moment to explore PU Prime’s features, trading tools, and worldwide reach through this short video overview, which provides a clear visual introduction to what the platform offers traders around the globe.

PU Prime Stands Out in the Competitive Forex Crowd

PU Prime sets itself apart in the crowded forex market by focusing on innovation, transparency, and client-first values. Its award-winning platform, quick execution, wide asset access, and multilingual support demonstrate a broker committed to global standards and helping traders succeed at every level.

| Feature | PU Prime Strength |

| Execution Speed | Fast, stable, and globally optimized |

| Multilingual Support | Available in over 15 languages |

| Copy Trading Tools | Award-winning and beginner-friendly |

| Recognition | 90+ Forex-specific global awards |

Frequently Asked Questions

What makes PU Prime different from other forex brokers?

PU Prime provides more than competitive spreads, offering advanced trading tools, multilingual support, solid regulatory oversight, and award-winning features. This combination makes it a strong choice for both new and experienced traders worldwide.

Does PU Prime offer any tools or features for trader success?

PU Prime gives traders access to copy trading, market insights, and an intuitive platform interface. Its mobile applications and client-focused design add convenience, while reliable execution and transparent pricing support a secure trading environment.

Expert Insight

PU Prime’s edge in the forex space comes from more than just market access. It excels by blending innovation, service, and reliability into a professional trading environment that helps traders grow. It’s a broker that delivers where many others fall short.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

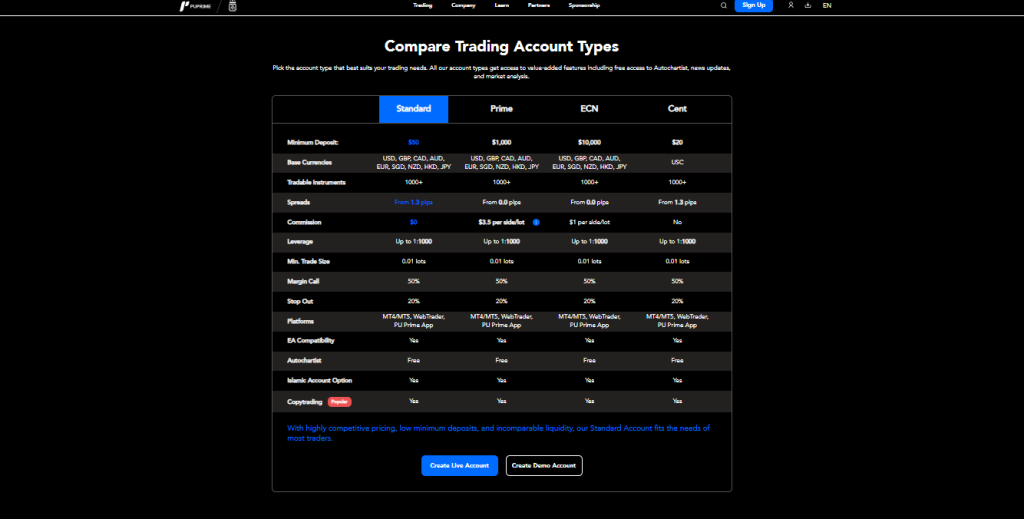

Minimum Deposit and Account Types

PU Prime provides a flexible and inclusive account structure tailored to a broad spectrum of traders. Whether you’re a beginner testing strategies or a pro demanding institutional-grade execution, PU Prime’s four account types offer adjustable spreads, competitive commissions, high leverage, and Islamic (swap-free) options for wider accessibility.

| Account Type | Open an Account | Minimum Deposit | Spreads |

| Cent | 20 USD | From 1.3 pips | |

| Standard | 50 USD | From 1.3 pips | |

| Prime | 1,000 USD | From 0.0 pips | |

| ECN | 10,000 USD | From 0.0 pips |

Frequently Asked Questions

What types of accounts does PU Prime offer, and who are they for?

PU Prime provides Cent, Standard, Prime, and ECN accounts, each tailored to different trading needs. Options range from accessible accounts for beginners to advanced choices designed for traders seeking tighter spreads and faster execution.

What is the minimum deposit for PU Prime accounts?

Minimum deposit requirements differ across account types. The ECN account requires $10,000, reflecting its professional-grade setup, while Cent, Standard, and Prime accounts have significantly lower deposit thresholds, making them suitable for small to mid-level traders.

Broker Assessment

PU Prime’s account lineup shines by providing flexible trading models suited to all skill levels. Whether you’re starting with micro lots or trading high volumes with tight spreads, you’ll find an account that matches your capital and strategy, while Islamic account options add further inclusivity.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Risk-Free Demo Account

PU Prime’s demo account offers traders a no-risk opportunity to experience live market pricing in a simulated environment. Ideal for both beginners and experienced users, it provides 60-day access to platforms like MT4, MT5, and PU Prime’s app, allowing full strategy testing without any financial exposure.

| Feature | Details |

| Duration | 60 days (renewable through Client Portal) |

| Market Data | Real-time pricing (no slippage or dividends) |

| Platforms | MT4 MT5 PU Prime App |

| Risk Level | Zero risk, demo funds only |

Frequently Asked Questions

What is the PU Prime demo account, and who should use it?

The demo account provides a risk-free environment where traders can simulate real-time trading without using actual funds. It is well-suited for beginners familiarizing themselves with the platform and for experienced traders testing new strategies.

How long is the PU Prime demo account valid, and what happens after?

PU Prime’s demo account remains active for 60 days. After expiration, users need to reapply through the Client Portal to continue using the demo environment, ensuring access stays secure and regularly updated.

Trader Perspective

The PU Prime demo account balances realism with easy access, offering real-time data and full platform features for an authentic trading experience. While it doesn’t perfectly replicate live markets, it remains a valuable tool for practicing and developing strategies without any financial risk.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Islamic Account

PU Prime’s Islamic Account is designed for traders who follow Islamic finance principles, removing overnight interest charges (swaps) in favor of a fixed administration fee. With eligibility on Cent, Standard, and Prime accounts, it offers flexibility while aligning with religious financial obligations across a wide range of assets.

| Feature | Details |

| Swap Charges | None |

| Eligible Accounts | Cent Standard Prime |

| Weekend Fees | No fees charged on weekends |

| Open an Account |

Frequently Asked Questions

What is a PU Prime Islamic account, and who should consider it?

The Islamic account is designed for traders seeking to avoid interest-based transactions. Rather than overnight swap fees, it charges a clear administration fee, ensuring compliance with Sharia finance principles while maintaining access to major trading instruments.

Which PU Prime accounts qualify for Islamic status?

Islamic status is available for Cent, Standard, and Prime accounts, but not for the ECN account. Once a qualifying account is opened, users can request the swap-free version through PU Prime’s support team for approval.

Independent View

PU Prime’s Islamic account provides an ethical, Sharia-compliant alternative to standard trading accounts. It features fair administration fees and avoids weekend charges, ensuring traders maintain full platform functionality and access to diverse assets while meeting religious requirements.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

How to Open a PU Prime Account

Here are a few easy steps to get your account set started and finalized on PU Prime:

1. Step 1: Submit Personal Information

Visit the PU Prime registration page and complete the application form. Select a trading platform (MT4/MT5), account currency, and account type. Click Confirm to proceed to verification.

2. Step 2: Verify Identity

Upload a valid government-issued ID (passport, national ID, or driver’s license). Documents must be clear, unedited, and in color. PU Prime will review the submission before issuing account login details.

3. Step 3: Verify Proof of Address

Submit a utility bill, bank statement, or lease agreement issued within the last six months. This step is mandatory for withdrawals. If the proof of address is not verified, you can still deposit and trade, but you can’t withdraw funds.

4. Step 4: Account Approval and Activation

Once all documents are approved, you will receive your MT4/MT5 login details via email. Remember, you can deposit before your address verification is completed.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Safety and Security

PU Prime operates under multiple regulators, including the Seychelles FSA, Mauritius FSC, Australia ASIC, and South Africa’s FSCA. The broker follows strict fund segregation practices, partners with the Financial Commission for EU protection, and holds client money in AA-rated banks, building a strong case for trader safety and trust.

| Measure | Details |

| Segregated Accounts | Client funds held separately in AA-rated trust bank accounts |

| Insolvency Handling | Regulatory reserves and €20,000 Financial Commission coverage |

| Regulatory Compliance | Licensed by FSA, FSC, ASIC, and FSCA with financial reporting standards |

| Banking Partnerships | Works with high credit-rated financial institutions |

Frequently Asked Questions

Under which regulators does PU Prime operate?

PU Prime is regulated by multiple financial authorities, including the Seychelles Financial Services Authority (SD050), the Mauritius Financial Services Commission (GB23202672), and South Africa’s Financial Sector Conduct Authority (FSP 52218). This multi-jurisdictional regulation ensures broad compliance and strengthens global oversight.

How does PU Prime protect client funds?

PU Prime holds client funds in segregated trust accounts with AA-rated banks, separate from its own operational accounts. This arrangement protects client deposits from company liabilities. The broker also maintains financial reserves in accordance with Seychelles FSA guidelines to ensure solvency protection.

Market Take

PU Prime demonstrates its dedication to security by following strict regulatory standards and adding extra protection through the Financial Commission. It uses segregated accounts and reputable banking partners, ensuring traders who prioritize safety and oversight can trust their funds are well safeguarded.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Bonus Offers and Promotions

PU Prime combines trading incentives with community engagement, offering a wide mix of promotions – from bonus credits and rebates to sports-themed giveaways and VPS access. These limited-time campaigns aim to reward both new signups and active traders. Each offer includes terms, so eligibility and volume conditions apply.

| Promotion | Key Benefit | Requirement |

| First Deposit Bonus | Up to 50% in trading credits | Deposit + bonus activation |

| Rebate Bonus | $1.50 per lot traded | Ongoing trading volume |

| VPS Access | Free VPS for smoother execution | Meet volume or deposit criteria |

| AFA Jersey Giveaway | Win signed jersey | Deposit and trade during promo window |

| NFP Prediction | Win up to $150 | Submit closest forecast |

| Refer-A-Friend | $150 referral reward | Complete KYC + trading by both users |

| First Deposit Cashback | 20% bonus converted to cash | Hit 35% trading volume of bonus value |

| “Trade Like Champions” Game | Compete for $4,000 prize pool | Complete missions + leaderboard rank |

Frequently Asked Questions

What types of promotions does PU Prime offer traders?

PU Prime provides various incentives, including deposit bonuses, cashback rebates, referral rewards, VPS access, and trading competitions such as the NFP Challenge and AFA Jersey Giveaway. Most rewards are contingent on qualifying deposits or trading volumes, so traders should review the terms to ensure eligibility for withdrawals.

How can I qualify for PU Prime’s promotional rewards?

Traders typically need to meet minimum deposit and trading volume requirements to qualify. For instance, cashback rewards are calculated per lot traded, while competitions may involve trade-based challenges or predictions. All promotions are time-limited and governed by detailed terms available in the Client Portal.

Professional Opinion

PU Prime offers promotions that extend beyond standard deposit bonuses, including sports tie-ins, prediction games, and performance rewards. These incentives attract active and engaged traders. However, all offers come with terms and conditions, so make sure to read the details before participating.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Partnership Programs

PU Prime offers a comprehensive set of partnership models tailored to marketers, educators, and institutions. With rebate-based IBs, CPA payouts, hybrid programs, and white-label solutions, the broker supports scalable affiliate earnings backed by marketing tools, analytics, and multi-platform infrastructure.

| Program Type | Payment Structure | Ideal For | Max Potential |

| IB Program | Rebates per lot | Analysts educators managers | Volume-based tiers |

| CPA Affiliate | One-time payout + bonuses | Marketers bloggers publishers | $850/client + $10,000/mo |

| Hybrid Program | CPA + Rebates | Mixed-model affiliates | $8,000/month + rebates |

| White Label Services | Branded brokerage access | Institutions fintech businesses | Fully customizable |

Frequently Asked Questions

What partnership programs does PU Prime offer?

PU Prime offers four primary partnership programs: Introducing Broker (IB), CPA Affiliate, Hybrid Model, and White Label Solutions. Each is designed to meet different objectives, from earning per-lot rebates to establishing a branded trading business using PU Prime’s infrastructure and liquidity.

How do CPA Affiliates and IBs earn commissions?

CPA Affiliates can earn one-time payments of up to $850 per qualified referral, along with bonuses of up to $10,000. Introducing Brokers (IBs) receive rebates based on trading volume, with payouts increasing as referred clients trade more lots. This structure is well-suited for educators, signal providers, and strategy managers.

Critical Analysis

PU Prime’s partnership programs provide diverse monetization opportunities for individuals and businesses. With high-paying CPA deals, recurring IB commissions, and institutional white-label services, partners enjoy robust infrastructure and marketing support, making PU Prime a strong option for growing referral income effectively.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Markets Available for Trade

PU Prime provides access to more than 1,000 CFD instruments across six asset classes—forex, indices, commodities, shares, ETFs, and bonds. You can trade them through both proprietary and third-party platforms, using flexible leverage and dynamic market conditions tailored to each instrument.

| Asset Class | Instruments | Key Features | Platform Support |

| Forex | 54 Pairs | Tight spreads high leverage | MT4 MT5 PU Prime App |

| Indices | 29 Global Markets | Macro exposure flexible margins | All platforms |

| Commodities | 23 Assets | Gold oil natural gas | All platforms |

| Shares/ETFs | 800+ Stocks sector ETFs | US EU Asia shares lower leverage | Desktop Mobile |

Frequently Asked Questions

What markets can I trade with PU Prime?

PU Prime provides CFDs in six key categories: forex, indices, commodities, shares, ETFs, and bonds. These instruments are accessible through MT4, MT5, and the PU Prime platform on desktop, web, or mobile, offering flexible leverage and a variety of trading conditions.

What makes PU Prime’s forex and indices offering unique?

PU Prime offers 54 forex pairs and 29 global indices, providing tight spreads and high leverage. Popular pairs such as EUR/USD feature low spreads, while major indices present strategic opportunities for macro trading, each with its respective margin requirements.

Bottom Line

PU Prime offers a wide and diverse trading suite covering global asset classes. It supports forex, commodities, ETFs, and bonds, allowing traders to use flexible strategies and manage various risk levels – all within one broker’s comprehensive ecosystem.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Fees and Spreads

PU Prime offers a clear fee model that adjusts by account type. From spread-only Cent accounts to commission-based Prime and ECN tiers, traders can align pricing with their strategy. With no inactivity or maintenance charges, it’s appealing for both short-term and long-term account holders.

| Account Type | Spread From | Commission (Per Lot) | Swap-Free Option |

| Cent | 1.3 pips | None | None |

| Standard | 1.3 pips | ETFs: $12 per trade | None |

| Prime | 0.0 pips | $3.5 per side (FX, metals, indices) | None |

| ECN | 0.0 pips | $1 per side (lower cost) | None |

Frequently Asked Questions

What are PU Prime’s main trading fees?

Trading costs vary by account type. Cent and Standard accounts rely on spreads (starting at 1.3 pips), while Prime and ECN accounts offer 0.0 pip spreads plus commissions ($3.5 or $1 per side, respectively). ETFs incur extra commission on Standard accounts.

Does PU Prime charge overnight or swap fees?

PU Prime charges swap fees on most instruments, with the exception of Islamic accounts. Fees vary depending on the asset and trade direction. Triple swaps are applied on Wednesdays for forex and metals, and on Fridays for commodities and indices, to account for weekend rollovers.

Real Trader Experience

PU Prime provides a competitive cost structure for both retail and professional traders. Commission-based accounts feature ultra-tight spreads, and the lack of inactivity or maintenance fees enhances long-term value. However, traders should consider overnight swaps, futures rollovers, and currency conversion margins when crafting their strategies.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Margin and Leverage

PU Prime provides leverage up to 1:1000, with adjustable settings based on your account type and equity. Its built-in margin rules and asset-specific limits help balance opportunity and risk, making it a well-rounded option for traders across experience levels.

| Asset Class | Leverage Limit | Special Conditions | Affected by Account Leverage |

| Forex (Majors) | Up to 1:1000 | Drops to 1:500 if equity > $20,000 | Yes |

| Exotic Pairs (e.g. USDZAR) | 1:10–1:20 | Fixed caps regardless of account settings | None |

| Gold (XAUUSD, etc.) | Up to 1:1000 | Follows account leverage | Yes |

| Shares ETFs Bonds | Fixed | Margin requirements predefined | None |

| Indices Commodities | Fixed | Not affected by leverage settings | None |

Frequently Asked Questions

What is the maximum leverage available on PU Prime?

Traders can choose leverage of up to 1:1000 on Cent, Standard, Prime, and Islamic accounts. However, if account equity exceeds $20,000, leverage is automatically reduced to 1:500 to ensure responsible risk management.

Do all instruments follow the same leverage rules?

Forex and gold follow the leverage set for your account. However, exotic currency pairs such as USDZAR (1:10) and USDTRY (1:20), along with instruments like stocks, ETFs, and indices, have fixed margin requirements that do not change with account leverage.

Key Takeaways

PU Prime offers high leverage alongside strong safety measures like equity-based auto-adjustments and strict stop-out rules. Additionally, by setting margin requirements per instrument it encourages disciplined trading while maintaining flexibility for experienced traders.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Trading Platforms and Apps

PU Prime provides a full suite of trading platforms, ranging from MT4 and MT5 to mobile, web, and social trading apps. Whether you’re a hands-on trader or prefer copying professionals, these tools cater to every trading style and experience level.

| Platform | Best For | Key Features | Device Type |

| MetaTrader 4 | Automated forex trading | EAs, proven stability | Desktop |

| MetaTrader 5 | Advanced technical analysis | DOM more indicators wider asset coverage | Desktop Mobile |

| WebTrader | Quick browser access | No downloads full access | Web Browser |

| PU Prime Mobile App | On-the-go traders | Alerts trade execution account tools | iOS Android |

| PU Social | Beginners social trading fans | Copy leaders adjust risk view signals | Mobile |

| Copy Trading | Passive investors | Mirror trades from pros | Platform-integrated |

Frequently Asked Questions

Which trading platforms does PU Prime offer?

PU Prime supports MetaTrader 4 (MT4), MetaTrader 5 (MT5), WebTrader, the PU Prime Mobile App, PU Social, Copy Trading tools, and API/Bridge connections. These platforms provide flexibility for manual, automated, and social trading strategies.

How is MT5 different from MT4 at PU Prime?

MT4 enables automated trading through Expert Advisors (EAs) and is well-suited for traditional forex strategies. MT5 builds on this by offering enhanced charting tools, additional order types, and Depth of Market (DOM) data, providing greater visibility and control over order flow.

Broker Scorecard

PU Prime provides a versatile platform mix designed for beginners, professionals, and institutions. Its combination of MT4, MT5, copy trading, mobile apps, and APIs lets traders use their preferred strategies across devices, offering complete flexibility in how and where they trade.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

PU Web Trader

PU Web Trader delivers a fast, browser-based trading experience designed for clarity and efficiency. The platform removes downloads, combines analysis and execution in one view, and supports advanced charting. As a result, traders gain instant access, smooth navigation, and reliable execution across devices.

| Feature | Description | Benefit |

| Platform Type | In-house web-based trader | No downloads required |

| Login System | Single login access | Saves time and effort |

| Charting Tools | 100 plus indicators | Deeper technical analysis |

| Order Execution | Optimised engine | Fast confirmations |

| Device Support | Desktop, tablet, mobile | Trade anywhere |

Frequently Asked Questions

What makes PU Web Trader different from other web platforms?

PU Web Trader focuses on speed, simplicity, and consolidation. Traders use one login for platform and portal access, view charts and orders on a single screen, and execute trades quickly. Therefore, it suits active traders who value efficiency and clean workflows.

Can beginners and experienced traders both use PU Web Trader effectively?

PU Web Trader supports both skill levels through an intuitive layout and advanced tools. Beginners benefit from clear navigation and instant access, while experienced traders rely on professional indicators, drawing tools, and smart position controls to manage risk confidently.

Our Findings

PU Web Trader stands out as a practical web-based solution for traders who want speed without complexity. The platform blends advanced charting, fast execution, and device flexibility into one interface. Overall, it suits traders seeking efficient market access without installing additional software.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Trading Research and Tools

PU Prime arms traders with a robust toolkit for technical and fundamental research. From Autochartist’s pattern detection to economic calendars and real-time market reports, the broker helps traders make informed decisions. Some advanced features require account verification, but core tools are free to access.

| Tool | Type | Purpose | Access Level |

| Autochartist | Technical Analysis | Pattern recognition and volatility analysis | Verified App |

| Economic Calendar | Fundamental Analysis | Track major financial events | Free |

| Trading Calculators | Technical Utility | Position sizing, stop loss, pivot points | Free |

| Currency Heatmap | Technical Snapshot | Visual currency strength meter | Free |

| Daily Market Reports | Market Commentary | Updates on forex, stocks, and commodities | Free |

| Forex News/Insights | News Feed | Real-time financial and currency updates | Free |

| Market Scanner | Signal Tool | Finds setups from your watchlist | Verified Accounts |

| Research Portal | Analytics Hub | Central access to market insights | Verified Accounts |

Frequently Asked Questions

What research tools does PU Prime provide to traders?

PU Prime provides tools such as Autochartist, trading calculators, currency heatmaps, daily market reports, an economic calendar, and a research portal. While most tools are available for free, advanced features like the Market Scanner and full research portal are accessible only to verified users.

How does Autochartist help with technical analysis?

Autochartist detects key market patterns, Fibonacci setups, and volatility changes. It is available as a Windows plugin and through the PU Prime mobile app, while Mac users may need third-party solutions to access the platform.

What You Need to Know

PU Prime equips traders with professional research tools covering technical and macroeconomic analysis. Verified users access enhanced insights, while standard users still receive ample analytical resources to strengthen their trading decisions and improve performance.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Deposits and Withdrawals

PU Prime supports a variety of payment methods, including bank wires, cards, e-wallets, and crypto, offering traders fast and fee-friendly account funding. While there are no internal fees, traders should check for third-party charges. Withdrawals require at least $40 and follow AML-compliant methods.

| Method | Processing Time | Limits /Notes | Fees |

| Bank Transfer | 2–5 Business Days | 1 free withdrawal/month, $20 thereafter | PU Prime: Free Banks: Varies |

| Credit/Debit Cards | Instant | Max $10,000 per transaction | PU Prime: Free |

| E-Wallets | Instant | Skrill Neteller Perfect Money | PU Prime: Free |

| Cryptocurrency | Instant | Fast blockchain-based processing | PU Prime: Free |

| Local Bank Transfer | Instant (Regions Vary) | Available in supported countries | PU Prime: Free |

Frequently Asked Questions

Does PU Prime accept Mobile Money?

PU Prime accepts mobile money in select regions through local bank transfers or supported e-wallet services.

What deposit options does PU Prime offer, and are there any fees?

PU Prime supports a variety of funding methods, including bank transfers, credit/debit cards, e-wallets, and cryptocurrencies. While the broker does not charge deposit fees, traders should verify whether any third-party providers apply their own charges.

In Practice

PU Prime offers fast, low-cost funding options and a clear withdrawal process. Supporting cryptocurrencies and e-wallets, it meets modern traders’ needs. However, users should check for third-party fees and ensure withdrawals meet the $40 minimum to prevent any processing delays.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Education and Resources

PU Prime delivers a structured, user-friendly education system suited for all trader levels. From basic video tutorials to advanced strategy webinars, it offers dynamic learning paths. Whether you’re starting or seeking to fine-tune your edge, PU Prime’s resources guide your development every step of the way.

| Resource Type | Description | Level | Format |

| Video Tutorials | Covers basics strategies copy trading | Beginner+ | Pre-recorded |

| PU Academy | Divided into beginner, intermediate, advanced | All Levels | Self-paced |

| Webinars | Weekly live market sessions | Intermediate+ | Live (mostly) |

| E-Books | Topics like psychology, risk, and patterns | Beginner+ | Downloadable |

| Trading Quizzes | Interactive tests on core trading topics | All Levels | Online |

Frequently Asked Questions

What types of learning materials are available at PU Prime?

PU Prime’s educational resources include video tutorials, e-books, weekly live webinars, trading quizzes, and structured courses through the PU Academy. Covering basic trading concepts, advanced strategies, and real-time market analysis, these materials cater to traders of all experience levels.

Are PU Prime’s educational tools beginner-friendly and interactive?

PU Prime categorizes its educational content into beginner, intermediate, and advanced levels. Interactive features such as quizzes, live webinars, and strategy walkthroughs provide an engaging learning experience tailored to each trader’s skill level, from newcomers to experienced participants.

Final Assessment

PU Prime provides tiered, practical education tailored to traders of all levels. Through interactive quizzes, live webinars, and structured courses, it offers a comprehensive platform for mastering trading basics or enhancing advanced strategies effectively.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Trading Hours

PU Prime’s trading hours are tailored to each asset type. Forex runs non-stop during the workweek, while commodities, indices, and shares follow global exchange schedules. For around-the-clock traders, crypto CFDs remain open 24/7. PU Prime updates holiday closures in advance to keep clients informed.

Frequently Asked Questions

What are PU Prime’s Forex and crypto trading hours?

Forex can be traded 24 hours a day, five days a week—from Monday 00:00 to Friday 24:00 (GMT+2/GMT+3 during DST). Crypto CFDs are available around the clock, including weekends and holidays, providing traders with full flexibility.

How do market hours work for stocks, indices, and commodities?

Stocks and ETFs adhere to the trading hours of their respective exchanges, usually closing overnight. Indices operate according to their native exchange schedules, while commodities like oil and metals follow US market hours, often including pauses between sessions.

Key Takeaways

PU Prime provides flexible market access, offering continuous forex trading during weekdays and round-the-clock crypto trading. Asset-specific schedules align with global markets, but traders should stay informed about public holidays that may cause session breaks and reduced liquidity.

Customer Support Options and Contact Details

PU Prime delivers 24/7 customer support through live chat, email, phone, online forms, and social media. Whether you’re facing technical issues, account concerns, or platform queries, you can expect consistent assistance. Live chat remains the fastest route, while email and phone support handle complex concerns.

Frequently Asked Questions

Is PU Prime’s customer service 24/7?

PU Prime provides 24/7 support through various channels, including live chat, email, and contact forms. Traders can reach out at any time, during trading hours or on weekends, and can expect timely responses depending on the chosen method.

What’s the best way to get quick help from PU Prime?

The live chat feature is the quickest way to contact PU Prime. Initial interactions are handled by a chatbot for basic inquiries, with escalation to a live agent when necessary. For more complex issues, email support provides a reliable and effective channel.

Bottom Line

PU Prime delivers reliable, 24/7 customer support through multiple channels. Live chat offers fast assistance, while phone and email handle more complex or technical questions. Their quick responsiveness creates a trader-friendly experience that ensures all inquiries receive proper attention.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Insights from Real Traders

⭐⭐⭐⭐

I started using PU Prime, and I must say their services are amazing. I placed a withdrawal and I got my money in less than 48 hrs. My relationship manager, Daniel, is very supportive and responds promptly. Highly recommend PU Prime!

Sulaimon Oluwaseun, Trustpilot user

⭐⭐⭐⭐⭐

Never had a problem with PUPRIME ever. Highly recommended 👌

Sam Emms, Android App review

⭐⭐⭐

Started trading 2 months ago and was clueless. But my account manager, Hafeez, really helped me get started without pressure. Loving the journey so far.

William Lim Yi Yong, Trustpilot user

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Trust Scores and Reviews

| Platform | Rating | Highlights |

| Trustpilot | 4.3 | 77% 5-star; praised for customer support and timely withdrawals |

| Google Play | 4.9 | 14 reviews; users highlight fast withdrawals and platform reliability |

| FX Empire | 4.3 | Good platform options, low fees, extensive research and education |

| myfxbook.com | 4.6 | Recognized with 12 trading industry awards |

| Investing.com | 4.8 | Excellent for all levels, tight spreads, fast execution |

| WikiFX | 4.3 | Regulated, beginner-friendly, strong educational offerings |

| Fazzaco | 4.4 | Low spreads, fast execution, helpful support team |

| Forex Peace Army | 1.8 | Complaints include delayed withdrawals and alleged profit removal |

| TradingFinder | Mixed | Notes both strengths and concerns, including fee transparency |

| BrokersView | 8.7 (out of 10) | Strong mobile platform, user-friendly and intuitive |

Criticisms and Considerations

Some traders on Forex Peace Army allege blocked withdrawals and profit reversals. Reddit users mention aggressive marketing and concerns about fee structures. Moreover, independent reviewers point out possible slippage and lack of tier-1 regulation.

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

PU Prime vs IG vs FBS

★★★★★ | Minimum Deposit: 20 USD (Cent) Regulated by: FSA, FSC, FSCA, ASIC Crypto: Yes |

Pros and Cons

| ✓ Pros | ✕ Cons |

| No fees on most deposits and withdrawals | ECN account needs $10,000 minimum deposit |

| 24/7 support via chat, email, and phone | Some forex pairs capped at lower leverage |

| Spreads from 0.0 pips on Prime and ECN accounts | Islamic accounts charge admin fees instead of swaps |

| Supports MT4, MT5, WebTrader, and PU Prime apps | Demo accounts expire after 60 days |

References:

In Conclusion

PU Prime offers a robust trading experience with account options suited for all trading styles. The broker operates through licensed entities in multiple jurisdictions, with key offices in:

- 🇸🇨 Seychelles

- 🇲🇺 Mauritius

- 🇿🇦 South Africa

- 🇦🇺 Australia

- 🇨🇾 Cyprus

- 🇻🇨 St. Vincent & the Grenadines

Its global support network extends across:

- 🇬🇧 United Kingdom

- 🇩🇪 Germany

- 🇫🇷 France

- 🇺🇸 United States (support only)

- 🇸🇬 Singapore (support only)

- 🇨🇳 China (information only)

- 🇮🇳 India

- 🇭🇰 Hong Kong

- 🇹🇭 Thailand

- 🇮🇩 Indonesia

- 🇰🇷 South Korea

While PU Prime does not allow trading account registration in the US, Singapore, Australia, China, or FATF-sanctioned regions, traders can still access support and information from these areas. This global structure ensures broad market coverage, local support, and secure trading for a diverse international client base.

Faq

Yes, PU Prime is a regulated broker authorized by several financial authorities, including the Seychelles Financial Services Authority (FSA). Its regulatory oversight ensures compliance with international standards and provides traders with transparency and security.

Yes, PU Prime supports copy trading, enabling clients to replicate the strategies of experienced traders. This feature is especially useful for beginners who want to learn from top performers while gradually building their own trading confidence.

PU Prime accepts multiple payment methods, including bank transfers, credit and debit cards, and e-wallets. Processing times vary by method, but most deposits are instant, while withdrawals are usually processed within one to three business days.

Yes, PU Prime provides extensive educational support, including webinars, video tutorials, trading guides, and market analysis. These resources help traders of all levels improve their strategies and make more informed trading decisions.

- Trading with PuPrime - Immediate Advantages and Disadvantages

- Overview

- PU Prime Visual, Video Overview

- PU Prime Stands Out in the Competitive Forex Crowd

- Minimum Deposit and Account Types

- Risk-Free Demo Account

- Islamic Account

- How to Open a PU Prime Account

- Safety and Security

- Bonus Offers and Promotions

- Partnership Programs

- Markets Available for Trade

- Fees and Spreads

- Margin and Leverage

- Trading Platforms and Apps

- PU Web Trader

- Trading Research and Tools

- Deposits and Withdrawals

- Education and Resources

- Trading Hours

- Customer Support Options and Contact Details

- Insights from Real Traders

- Trust Scores and Reviews

- PU Prime vs IG vs FBS

- Pros and Cons

- In Conclusion