NZD/USD Remains Subdued as Data Supports RBNZ Rate Decision

The NZD to USD ratio remained below 0.61 yesterday, with NZD/USD trading in a 30 pip range, but the pressure remains to the downside, as the economic data shows that the New Zealand economy remains in a difficult position. Building permits posted an 8.8% decline in January, however consumer confidence improved last month. The previous day though, we saw that the business confidence indicator deteriorated by 2 full points.

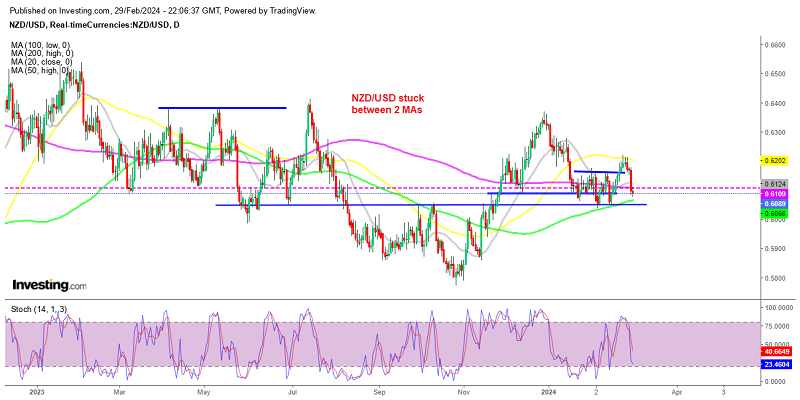

NZD/USD Daily Chart – The Retrace Ended at 50 SMA

These recent reports support the decision by the RBNZ to stop interest rate hikes. The decision by the Reserve Bank of New Zealand (RBNZ) to maintain the cash rate at 5.5% exerted downward pressure on the NZD/USD exchange rate. Market expectations were for another rate hike by the RBNZ, so the central bank’s decision has led to a significant decline in the New Zealand dollar against major currencies. This reaction resulted in a 100-pip drop in NZD/USD on Wednesday while yesterday the range stretched further but only marginally, by 10 pips.

New Zealand January Building Permits

- New Zealand building permits came at -8.8% MoM in January

- December building permits increased by 3.7%

- The building consents were -28.3%

- New Zealand Year-to-date Statistics: “Fewer new homes were consented in January 2024 than in each of the previous five January months”

ANZ Consumer Confidence Index

- In January, New Zealand consumer sentiment reached 94.5 points

- Previous consumer sentiment was 93.6 points

- ANZ responds to the inflation expectations question in this survey: “Household inflation expectations are substantially below their highs, but given the volatility, it is unclear whether they will continue to fall. They’re clearly still too high.

In January, building permits in New Zealand experienced a significant decline of 8.8% month-over-month, following a previous increase of 3.7%. Year-over-year, building consents plummeted by 28.3%. According to Stats NZ, January 2024 saw fewer new homes consented compared to the last five January months.

Additionally, the ANZ Consumer Confidence Index for New Zealand indicated a slight improvement in consumer sentiment, rising to 94.5 points in January from 93.6 points previously. However, ANZ commented on the inflation expectations question in the survey, noting that household inflation expectations have decreased from their highs but remain elevated, posing a challenge despite recent volatility.

Yestserday the Reserve Bank of New Zealand Deputy Governor Hawkesby also popped up, emphasizing the necessity of maintaining a restrictive monetary policy to ensure that inflation expectations are anchored at 2%. He indicated that the current policy stance, aimed at restraining inflationary pressures, will continue for the foreseeable future. This reaffirms the central bank’s commitment to its mandate of price stability and suggests a cautious approach towards any potential easing of monetary policy measures.

NZD/USD Live Chart

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |