⚡Crypto Alert : Altcoins are up 28% in just last month! Unlock gains and start trading now - Click Here

eth-usd

Forex and Commodities Week Ahead: Key Economic Events to Shape Market Trends

Arslan Butt•Sunday, March 31, 2024•2 min read

Last week, the Dollar Index closed at 104.486, marking a slight drop of 0.05%. This subtle change reflects the mixed economic signals from the U.S. and global markets.

Forex Economic Events Recap:

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

- On Monday, U.S. New Home Sales slightly missed expectations at 662K versus the forecasted 675K.

- Tuesday’s data showed a positive surprise in U.S. Core Durable Goods Orders, rising by 0.5% against the expected 0.4%, while overall Durable Goods Orders increased by 1.4%, rebounding from the previous -6.2% drop.

- The U.S. Consumer Confidence index on Tuesday slightly underperformed at 104.7 compared to the anticipated 106.9.

- Australian CPI on Wednesday aligned with expectations at 3.4% year-on-year, indicating steady inflationary pressures.

- In Europe, Spanish Flash CPI on Wednesday exceeded projections, reporting a 3.2% increase year-on-year.

- On Thursday, Australian Retail Sales showed a modest growth of 0.3%, and Canada’s GDP outperformed expectations at 0.6% month-on-month.

- The U.S. ended the week with its Core PCE Price Index meeting the 0.3% month-on-month forecast, reflecting ongoing inflation concerns.

Forex Economic Events Ahead

Monday, April 1

- Japan’s Final Manufacturing PMI is expected at 48.2. A higher figure could strengthen the JPY, affecting JPY forex pairs and possibly influencing commodity markets like precious metals.

- China’s Caixin Manufacturing PMI, forecasted at 51.0, will impact the CNY and commodity currencies, given China’s significant role in global trade.

Tuesday, April 2

- Australia’s RBA Meeting Minutes and ANZ Job Advertisements might sway the AUD, especially in commodities like gold and iron ore.

- Canada’s Manufacturing PMI (previous 49.7) and U.S. ISM Manufacturing PMI (expected at 48.5) will be key for USD/CAD pairs and could influence oil prices.

Wednesday, April 3

- China’s Caixin Services PMI (expected at 52.7) will provide insights into the service sector, potentially affecting the Asian markets and commodities like copper.

Thursday, April 4

- Europe’s Services PMIs will impact EUR pairs. Notable figures include Spain’s Services PMI expected at 55.5 and Italy’s at 53.0.

- U.S. ADP Non-Farm Employment Change (forecasted at 149K) and ISM Services PMI (expected at 52.7) will be critical for USD and gold price movements.

Friday, April 5

- U.S. Non-Farm Employment Change is anticipated at 205K, with the Unemployment Rate holding at 3.9%. These figures will likely have a significant impact on the USD and consequently affect metals and commodities pricing.

Expected Market Movements:

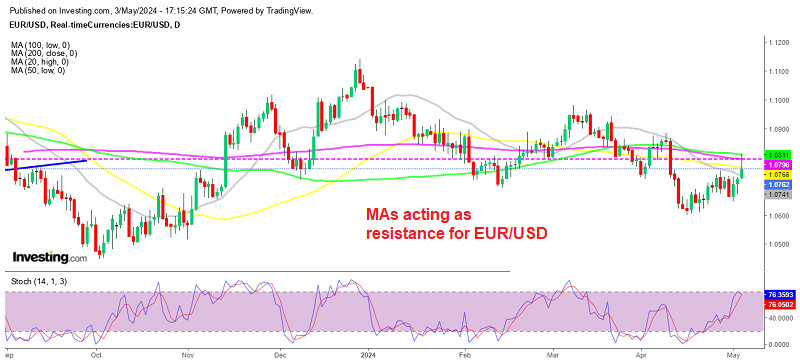

- Forex: Significant fluctuations are expected across major currency pairs, especially those involving the USD, EUR, AUD, and CAD, around the data release times.

- Metals: Gold and silver prices might react to the U.S. employment data and any unexpected shifts in manufacturing PMIs, as these affect the USD’s value.

- Commodities: Oil markets could be influenced by manufacturing data and geopolitical events, with natural gas storage data (expected change of -36B) also in focus.

In summary, the first week of April brings a series of pivotal economic events that could sway forex, metal, and commodity markets. Traders should prepare for volatility and potential opportunities arising from these data releases and their broader economic implications.

Check out our free forex signals

Follow the top economic events on FX Leaders economic calendar

Trade better, discover more Forex Trading Strategies

Arslan Butt

Index & Commodity Analyst

Arslan Butt serves as the Lead Commodities and Indices Analyst, bringing a wealth of expertise to the field. With an MBA in Behavioral Finance and active progress towards a Ph.D., Arslan possesses a deep understanding of market dynamics.His professional journey includes a significant role as a senior analyst at a leading brokerage firm, complementing his extensive experience as a market analyst and day trader. Adept in educating others, Arslan has a commendable track record as an instructor and public speaker.His incisive analyses, particularly within the realms of cryptocurrency and forex markets, are showcased across esteemed financial publications such as ForexCrunch, InsideBitcoins, and EconomyWatch, solidifying his reputation in the financial community.

Related Articles

Top

FX

Crypto

Commodities

Indices

Start Trading

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |