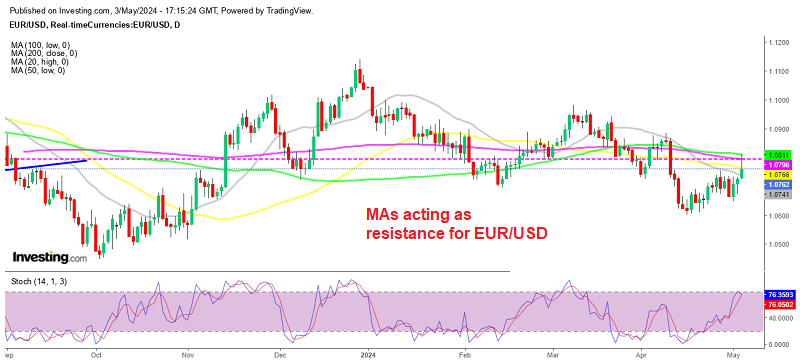

Is the Climb in EUR/USD Over After the Rejection at the 200 SMA?

The rate of EUR to USD has climbed more than 2 cents higher since mid-April, but the climb in EUR/USD might have reached its limits.

The rate of EUR to USD has climbed more than 2 cents higher since mid-April, but the climb in EUR/USD might have reached its limits. The upside picked up momentum on Friday, particularly after the release of the US non-farm payrolls (NFP) report which came in weaker than expected, however, the 200 SMA rejected EUR/USD and the price fell around 50-60 pips lower.

EUR/USD Chart H4 – Stochastic is Overbought

EUR/USD hit a low of 1.06 approximately three weeks ago, then reversed and has been on an upward trajectory since. It surpassed the 1.07 barrier, signaling potential positive momentum. However, frequent rejection at the 1.0750 level indicates strong resistance in that area. Last week, the upward movement intensified, and on Friday, EUR/USD climbed above 1.08 in response to disappointing NFP news. However, buyers were unable to breach the 200 SMA (purple), and after briefly surpassing it, the price reversed downward, indicating a rejection.

German Final Services PMI for March

On Tuesday, April 23, the focus was on the German economy. Preliminary private sector PMIs for April, which account for over 70% of the German economy, attracted market attention amidst growing expectations for an ECB rate cut in June. In April, the German Services PMI increased from 50.1 to 53.3 points. Additionally, the German HCOB Composite PMI climbed from 47.7 to a 10-month high of 50.5 points, surpassing the forecasted 48.6.

According to the final Services PMI survey:

- New business within the services sector increased for the first time in ten months.

- Workforce numbers grew at a more significant rate across the services sector.

- Wage hikes led to higher operating expenses across the services sector.

- Output prices also rose within the services sector as firms transferred rising costs to their customers.

- Optimism within the services sector retreated from a 25-month high observed in March.

EUR/USD Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account