Forex Signals Brief April 9: Another Quiet Day Before the RBNZ and BOC

Despite a weak economic calendar, the NY Fed’s inflation predictions saw some changes, with three-year expectations increasing while one-year expectations remained constant. The announcement had minimal influence on the foreign exchange (FX) market, but US rates remained elevated throughout the day.

| Broker | Review | Regulators | Min Deposit | Website | |

|---|---|---|---|---|---|

| 🥇 |  | Read Review | ASIC, FSA, CBI, BVI, FSCA, FRSA, CySEC, ISA, JFSA | USD 100 | Visit Broker >> |

| 🥈 |  | Read Review | FMA, FSA | USD 50 | Visit Broker >> |

| 🥉 |  | Read Review | FSCA, CySEC, DFSA, FSA, CMA | USD 0 | Visit Broker >> |

| 4 |  | Read Review | SFSA, FSCA, CySec* | USD 5 | Visit Broker >> |

| 5 |  | Read Review | FCA, CySEC, FSCA, SCB | USD 100 | Visit Broker >> |

| 6 |  | Read Review | FCA, FINMA, FSA, ASIC | USD 0 | Visit Broker >> |

| 7 |  | Read Review | CySEC, FCA, FSA, FSCA, Labuan FSA | USD 100 | Visit Broker >> |

| 8 |  | Read Review | Not Regulated | 0.001 BTC | Visit Broker >> |

| 9 |  | Read Review | ASIC, CySEC, FSCA, CMA | USD 100 | Visit Broker >> |

| 10 |  | Read Review | CySEC,MISA, FSCA | USD 20 | Visit Broker >> |

Treasury yields across the curve increased, with the short end experiencing the most significant gains, particularly the 2-year yield trading near session highs. However, the 30-year yield approached session lows, while the 10-year yield reached a fresh high for 2024.

As the US session ended, the Australian dollar (AUD) emerged as the strongest currency, while the Swiss franc (CHF) was the weakest. The US dollar closed the day slightly weaker overall. Additionally, gold prices traded higher, setting a new record at $2353 per ounce.

Today’s Market Expectations

This morning the British Retail Consortium (BRC) reported that total retail sales in March increased by 3.5% year-on-year, marking the most significant uplift since August. Like-for-like sales also saw a notable increase, rising by 3.2% compared to February’s 1.0% growth. However, BRC mentioned that these figures are not seasonally adjusted and were influenced by Easter falling earlier in March compared to the previous year. BRC Chief Executive Helen Dickinson highlighted that the improvement in retail sales was largely driven by Easter falling unusually early, leading to increased food sales in the week preceding the long weekend. Meanwhile, Barclays UK reported a 1.9% year-on-year increase in consumer spending for March, consistent with the previous month’s growth. This marks the joint-smallest increase since September 2022.

The New Zealand Quarterly Survey of Business Opinion (QSBO) from the New Zealand Institute of Economic Research (NZIER) which was also released last night, revealed a decline in business confidence to -25% in the March quarter, compared to -2% in the previous quarter. Capacity utilization also decreased to 90.2% from 91.4% previously. According to NZIER, the post-election bounce in business confidence and activity seen in the final quarter of last year was short-lived. Furthermore, the survey indicated that a net 24 percent of businesses expect a deterioration in the general economic outlook over the coming months on a seasonally adjusted basis. Additionally, a net 23% of firms reported a decline in activity over the March quarter.

Yesterday the US Dollar continued to retreat after Friday’s bearish reversal, however, the price action was slow in the forex market, so the decline was limited. Gold made new record highs, while crude Oil reversed higher after opening with a bearish gap lower. We closed manually two trading signals in indices.

Gold Closes the Week at the Top

The bullish momentum in Gold has been remarkable in 2024, reflecting strong positive momentum in the precious metal market as global uncertainties remain elevated. Breaking through the $2,300 mark and aiming for $2,500 underscores the confidence and resilience of buyers in the gold market. This behavior highlights gold’s role as a safe-haven asset, particularly during periods of economic turbulence. The rise to a record high of $2,330 further solidifies the bullish sentiment surrounding gold, indicating sustained demand and investor interest. With ongoing global tensions and economic uncertainty, gold continues to attract investors seeking to hedge against potential risks and safeguard their wealth.

XAU/USD – 240 minute chart

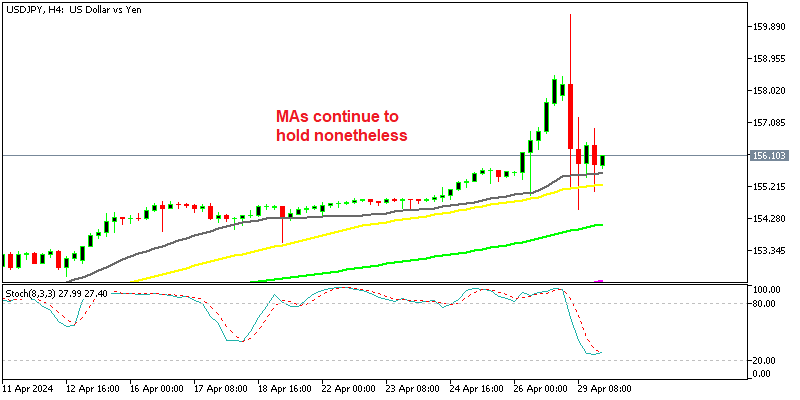

EUR/JPY Remains Supported by MAs

USD/CHF has displayed a bullish trend throughout this year, with a notable increase of more than 5 cents, maintaining levels above 0.90. Yesterday’s unexpected rise in the February unemployment rate, from an expected 2.2% to 2.3%, contributed to a 50-pip surge in USD/CHF, approaching the 0.9050 level during European trading hours.

USD/CHF – H4 Chart

Cryptocurrency Update

Bitcoin Stays Close to $70K

The struggle to sustain Bitcoin below $70,000 signifies strong buying momentum for BTC and the broader cryptocurrency market. This level serves as a critical resistance, indicating a potentially weakening bullish momentum. If buyers fail to sustain prices above this threshold, it may signal a decrease in demand and a shift in market sentiment. Moreover, the presence of a bearish reversal pattern on the daily chart supports the possibility of a price reversal. Such patterns often precede transitions from bullish to bearish sentiment, typically leading to further price declines. However, despite these challenges, the price managed to hold above $65,000 and bounced off the 50-day Simple Moving Average (SMA), returning to the $70,000 level again. This resilience suggests that buyers remain active and are willing to defend key support levels, potentially indicating ongoing bullish strength in the market.

BTC/USD – Daily chart

Ethereum Consolidate Above $3,000

The 50-period Simple Moving Average (SMA) has emerged as a significant support level for Ethereum, highlighting its importance in predicting price movements. As Ethereum’s price approaches the 50-period SMA, the bounce observed from this level indicates the willingness of buyers to participate in the market and uphold the price. However, Ethereum has faced resistance near the 20-period SMA, impeding further upward momentum. The 20-period SMA acts as a barrier to higher price advancement, suggesting the presence of either selling pressure or insufficient bullish momentum to push Ethereum’s price beyond this threshold. Additionally, a negative reversal occurred on Tuesday, causing the price to approach $3,000 but ultimately halting above the March lows. These technical dynamics depict a tug-of-war between buyers and sellers in the Ethereum market, with the 50-period SMA providing support while the 20-period SMA presents resistance. We are closely monitoring these moving averages and price levels for potential shifts in market sentiment and direction, especially since we are already long on ETH/USD.

ETH/USD – Daily chart

🏆 7 Best Forex Brokers

| Broker | Website | |

|---|---|---|

| 🥇 |  | Visit Broker >> |

| 🥈 |  | Visit Broker >> |

| 🥉 |  | Visit Broker >> |

| 4 |  | Visit Broker >> |

| 5 |  | Visit Broker >> |

| 6 |  | Visit Broker >> |

| 7 |  | Visit Broker >> |