Yen to USD Rate Volatility Continues After BOJ Intervention

The rate of Yen to USD has seen dramatic volatility today. USD/JPY surged above 160 early, but the BOJ intervened, sending it 600 pips down.

The rate of Yen to USD has seen dramatic volatility today. USD/JPY surged above 160 at the Tokyo open, but the BOJ intervened, sending it down. There was a 300 pip bounce but the price has returned back down, so the immense volatility continues to drive this forex pair.

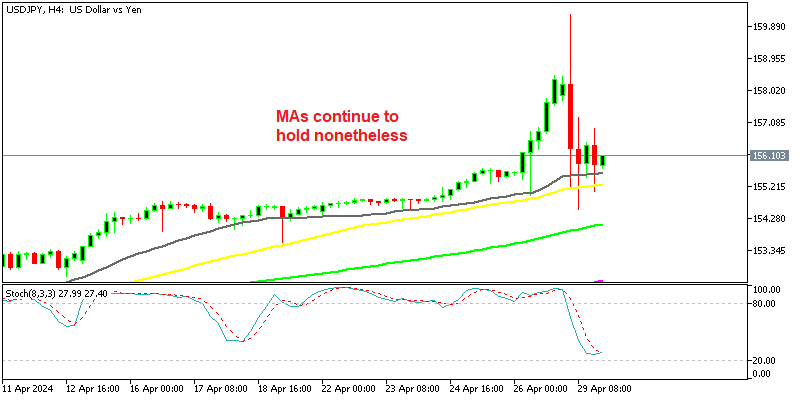

USD/JPY Chart H4 – MAs Continue to Hold Nonetheless

The focus at the beginning of the new week is on the JPY, as the Bank of Japan (BOJ) has finally intervened to push down JPY pairs, after a 200 pip surge art the start of the day. Early this morning, USD/JPY dropped from 160.22 as the decline gained momentum, reaching a low of 157.20, before plunging further to 155.05 in the first move.

This led to significant currency fluctuations, with USD/JPY bouncing back up to 157.18 before falling back to 154.53 a few hours later. However, the decline was temporary, as the pair bounced again to 156.90. Despite the second recovery, USD/JPY went through another decline in the last 2 h0uors and is still down 2.4% for the day, with the USD also feeling week due to this and currently sitting near 400 pips lower than the highs seen in Asia.

Initially, the 20 Moving Average (gray) was broken but the 50 SMA (yellow) halted the decline on the H4 chart following intervention earlier today. However, it was breached on the second attempt, gathering momentum and dropping to the day’s low of 154.53. So USD/JPY sellers made another attempt to break below the 50 SMA MA but they failed and the price rebounded higher. The 50-hour MA is being closely monitored as a result, which currently sits at 155.25.

If sellers intend to sell on the downside, the MA serves as a level to lean against and must be maintained below. But in the current situation of post-intervention volatility, where JPY traders are in a state of panic, resulting in abrupt up and down movements, a bounce off the 50 SMA could trigger further short covering and push the price back toward 160 perhaps, as traders react to the volatile swings.

USD/JPY Live Chart

- Check out our free forex signals

- Follow the top economic events on FX Leaders economic calendar

- Trade better, discover more Forex Trading Strategies

- Open a FREE Trading Account