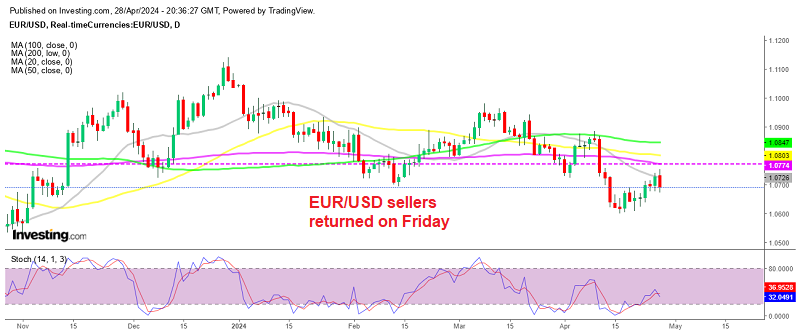

The rate of EUR to USD was moving higher for about 2 weeks after the fall stopped at 1.06. But, on Friday we saw a strong bearish reversal, which erased Thursday’s gains and engulfed the daily candlestick from the previous day, suggesting the continuation of the larger downtrend, with nothing in sight to save the Euro.

EUR/USD Chart Daily – A Bearish Engulfing Pattern Formed on Friday

EUR/USD reversed exactly at 1.06 two weeks ago and last week it broke above the crucial 1.07 resistance level, indicating potential bullish momentum. However, the rejection at the 1,0750 level and the 20-day moving average (gray) suggest that there is some strong resistance up there. Sellers seem to be entering the market with defined risk levels above the Fibonacci line, indicating a bearish outlook and potential for a plunge to new lows. However, we now have to break below the 1.07 level again.

Fundamentals Keeping the USD Bullish

There’s been a bit of a mixed bag in the US economic indicators lately. The underperformance of manufacturing and services PMIs, along with weaker inflationary pressures and higher layoffs, likely contributed to the initial fall of the US dollar. However, despite the unexpected underperformance of Q1 GDP, certain key components suggested the economy remains robust.

The rise in the GDP price index is a positive sign, indicating potential strength in the Personal Consumption Expenditures (PCE) report. However, the surprise increase in Core PCE might delay anticipated Federal Reserve interest rate decreases since it suggests stronger inflationary pressures than expected.

The ECB Is All About Lowering Interest Rates

The European Central Bank’s decision to maintain interest rates unchanged aligns with expectations, but the hint of a rate decrease in June suggests a potential shift in monetary policy. The statements from ECB members further reinforce this possibility, indicating a growing consensus within the bank.

The Eurozone’s CPI falling short of predictions provides additional justification for the ECB to consider cutting interest rates sooner rather than later. Lower-than-expected inflation can signal economic weakness and may prompt central banks to implement accommodative monetary measures to stimulate growth and inflation.

EUR/USD Live Chart

EUR/USD